Today’s article about The Bank of Nova Scotia (BNS), more commonly known as Scotiabank, outlines a few overlooked risk factors. Although a valuation model is embedded in the article, the analysis aims to add to market transparency by discussing micro factors instead of conducting a holistic analysis of The Bank of Nova Scotia’s stock.

Recoveries and Provisions

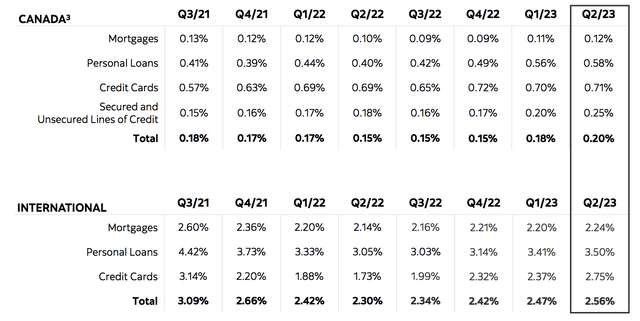

One of the primary identifiable risks that we want to highlight today is Scotiabank’s increasing uncollectible interest payments. The bank’s second-quarter results show a significant increase in retail interest payments that have not been collected within 90 days. Pairing this event with a $490 million year-over-year increase in loan provisions suggests a crunch on household loans within Canada and on an international scale.

Scotiabank

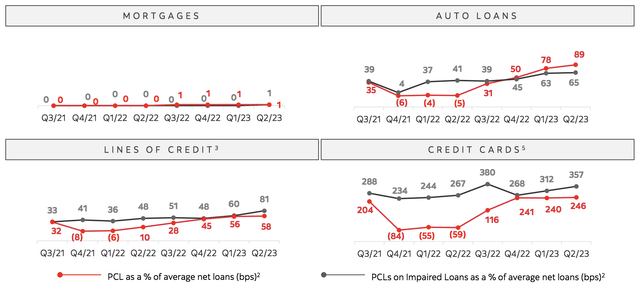

The diagram below shows a breakdown of Scotiabank’s retail loan provisions. The bank’s cyclical exposure to auto loans and short-term exposure to credit card debt has unsurprisingly resulted in an increase in provisions for loan losses. In our view, this is currently uniform across the banking industry; nevertheless, it presents a significant risk.

Approximately 73% of Scotiabank’s Canada mortgage portfolio is uninsured, and roughly 36% of the portfolio consists of variable-rate loans. We think these numbers add tremendous risk to the bank’s balance sheet amid a crunch within the Canadian real estate market.

Loans and Provisions (Scotiabank)

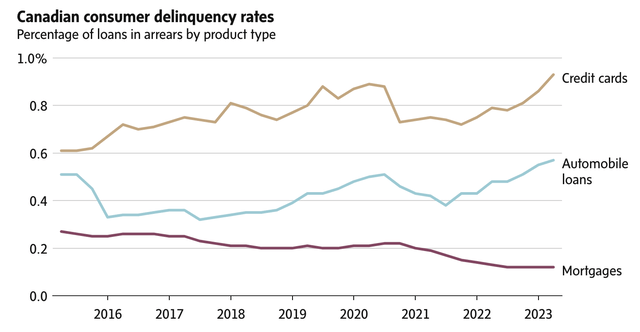

Furthermore, contributing to the data above, Canada’s credit card and automotive loans are also under pressure, with delinquencies rising significantly. Unfortunately, we see these rates sustaining unless automatic economic stabilizers kick in.

The Globe And Mail; Bank of Canada; RBC Capital

Commercial Real Estate Loans Portfolio

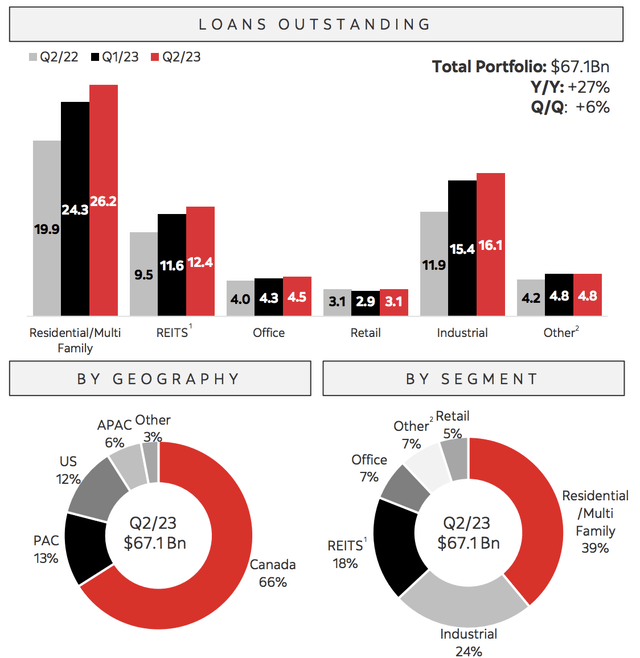

Scotiabank’s commercial real estate loan portfolio is worth approximately $67.1 billion, which is nearly negligible compared to the bank’s total asset base of $1.39 trillion. Moreover, the bank has low exposure to office buildings, which is something we believe is desirable in today’s day and age.

Although having stated the above, we think many neglect the risk attached to commercial real estate loans in today’s economy. In our opinion, risk premiums on commercial real estate are severely underscored at the moment as a credit crunch accompanied by significant counterparty risk seems on the horizon as pressure on corporate earnings continues to mount.

Commercial Real Estate Loans (Scotiabank)

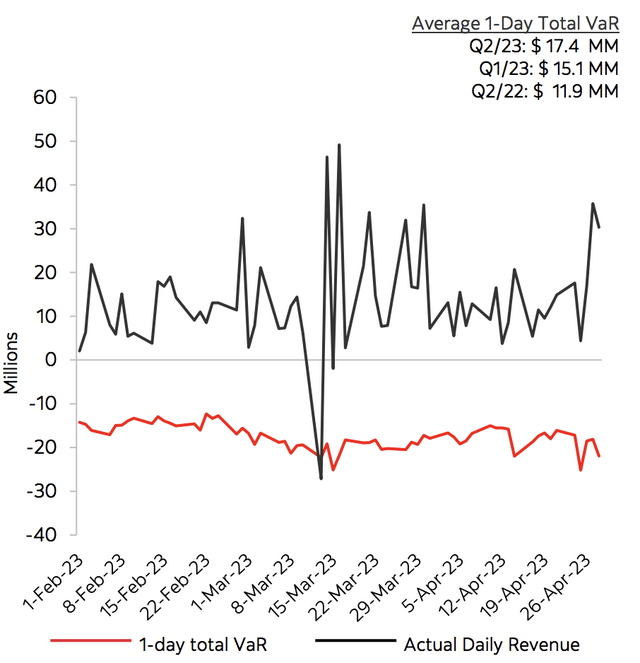

Trading VaR Increasing and Emerging Market Volatility

Another critical risk for Scotia is the ongoing levels of value-at-risk on trading revenues. With interest rates at the higher end and global yield curves struggling, we foresee ongoing market and credit volatility, leading to substantial VaR numbers, which could be deemed an unwanted risk by many investors.

Scotiabank

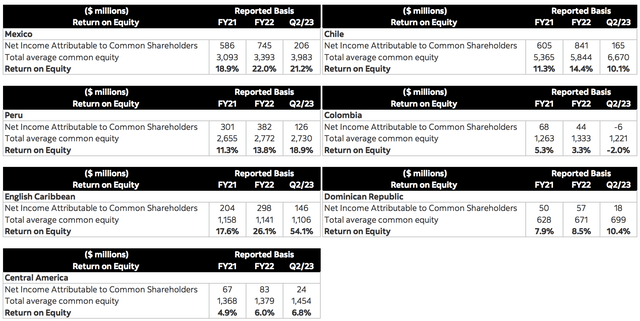

If you’ve been following Scotiabank for a while, you would probably know that it uses emerging market exposure as part of its growth strategy. Although this strategy makes sense to achieve long-term trend growth, it onboards volatility and might exhibit lackluster returns if the global economy continues tightening. The bank’s regional return-on-equity figures remain superb, but we do not expect this to sustain into 2024, with cyclical reasons at the base of our argument.

Emerging Market Exposure (Scotiabank)

Valuation Concerns

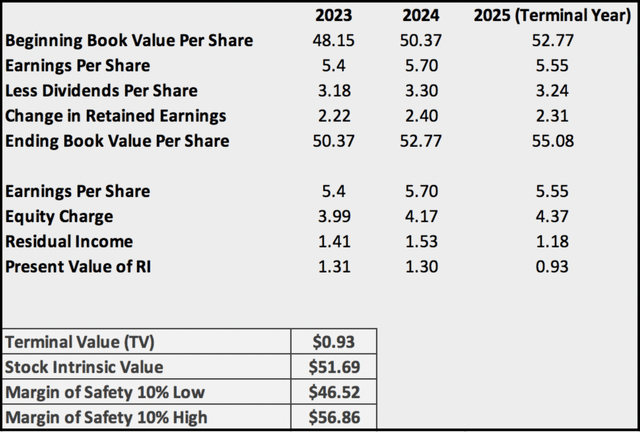

Continuous Residual Income Model

Investors often focus on price-to-book ratios when assessing bank stocks. As such, we decided to include our continuous residual income model’s results in today’s Seeking Alpha article.

According to our model, Scotiabank’s stock is in fair value territory (at the time of writing the article). Although not a substantial risk, a stock in fair value territory suggests its positives have already been realized by most investors.

Author’s Work

Model Inputs

Herewith are the inputs used to calculate the model.

- Scotiabank’s stock price was divided by its price-to-book ratio to establish a baseline book value per share.

- Seeking Alpha’s data bank was utilized to extract earnings and dividend forecasts. The terminal year values are normalized averages.

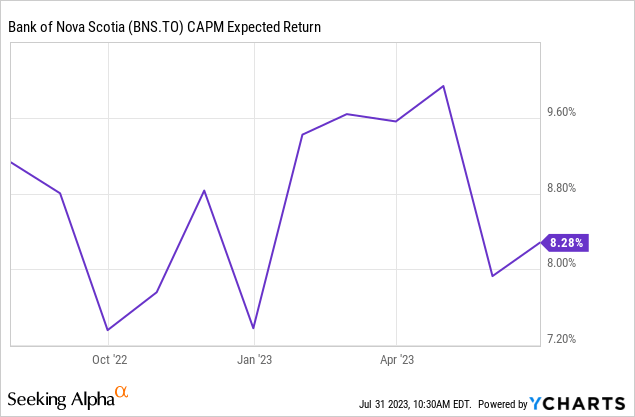

- The CAPM was used to determine Scotiabank stock’s expected return (equity charge), as displayed below.

Final Word

Although we are not bearish about Scotiabank’s prospects, we believe the market has yet to price numerous risk factors. In our opinion, extended payables on retail debt and exposure to commercial debt pose significant threats. Moreover, our valuation model suggests the stock is in fair value territory with little upside potential in store.

Read the full article here