Presently, 2-year treasuries are being offered at a yield to maturity (YTM) of 4.9%, whereas 10-year treasuries are enticing investors with a YTM of 3.96%. These YTM figures are very attractive, in my opinion, especially when compared to the yields offered a few years ago (temporal comparison) and when compared to the yield currently offered by income-focused equities (cross-asset comparison).

Especially with regards to the latter perspective, the cross-asset comparison, I have recently advocated for rotation out of dividend equities and into fixed income assets. It is my conviction that if an investor can get equity-like returns from fixed income securities, shifting towards fixed income is the smart move, given matching returns at considerably lower risk.

The 10-year treasury yield is now trading above 4%, and has thus topped the ∼3.6% dividend benchmark that investors expect from investing in Schwab U.S. Dividend Equity ETF (NYSEARCA:SCHD). The key question now is: Why should investors take the equity/ volatility risk on stocks when the U.S. government is offering a higher-yielding, “risk-free” alternative? Or formulated differently, should investors dump dividend stocks and pile into treasuries instead?

The short answer is yes. And the reasoning is in the question: If a risk-free bond security is yielding a higher income than an income-focused equity portfolio (higher yield and lower risk), than arguably only fools would not rotate their asset allocation.

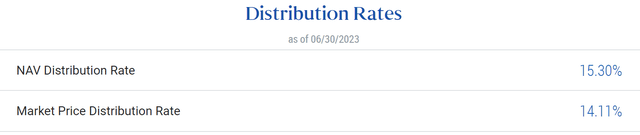

Drawing on this perspective, a 2-year 4.9% “risk-free” yield is quite something — especially when considering the (still-present) probability of a hard-landing. If, however, an investor believes in the Soft Landing narrative, as advocated by Fed chair Jay Powell, and more recently by the media, then the ~14% fixed-income yield offered by PIMCO’s Dynamic Income Fund (NYSE:PDI) is something else entirely.

About PIMCO’s Dynamic Income Fund

PIMCO’s Dynamic Income Fund is a closed end mutual fund actively managed by portfolio manager’s Joshua Anderson and Alfred T. Murata. The fund invests and manages a diversified fixed income portfolio with the primary goal to provide investors with a high level of current/ distributable income, while maintaining the potential for capital appreciation as a secondary priority.

With that frame of reference, PIMCO has historically paid a $0.2205 monthly dividend, as well as a special dividend of $0.86, $1.3091, $1.8362, $0.99, $1.45, $0.50, $0.42, $0.65 in 2012, 2013, 2014, 2015, 2016, 2018, 2019, and 2022, respectively. Modelling, PDI’s historical payout to the funds current market price of ~$19 suggests that investors may enjoy a ~14% annual dividend yield.

PDI Fund Prospectus

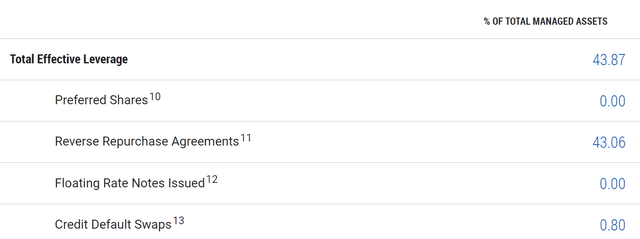

Now, it is true that PDI may and does use leverage, meaning that PDI portfolio managers borrow funds to invest and enhance potential returns, with the risk of higher losses on the downside. Currently, PDI has assumed ~44% leverage on NAV benchmark, mostly through reverse REPOS.

PDI Fund Prospectus

However, reflecting on PDI’s diversified portfolio allocation, the ~44% leverage shouldn’t give any reason for concern. PDI invests in a diverse range of fixed income securities, including but not limited to government and corporate bonds, mortgage-backed securities, asset-backed securities, and other debt instruments. In that context, PDI also has the flexibility to invest across various fixed income sectors, which allows the fund managers to seek opportunities in different parts of the bond market, balancing factor exposure in line with the portfolio manager’s view on the economy and financial market.

PDI Fund Prospectus PDI Fund Prospectus

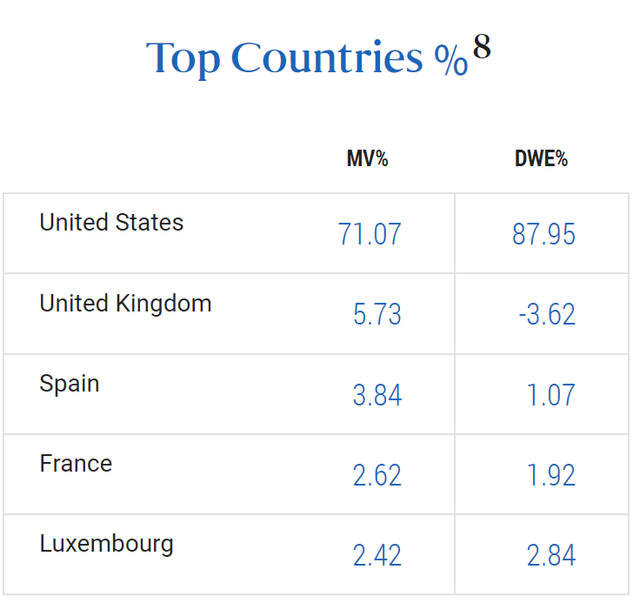

According to the PDI fund prospectus, PDI has currently allocated ~71% of the funds’ market value to the U.S., with UK bringing the second largest exposure (~6%).

Management would, however, have the flexibility to invest up to 40% of its total assets in securities from issuers with strong economic ties to emerging market countries.

The fund typically allocates a minimum of 25% of its total assets to privately issued mortgage-related securities, commonly referred to as “non-agency” securities.

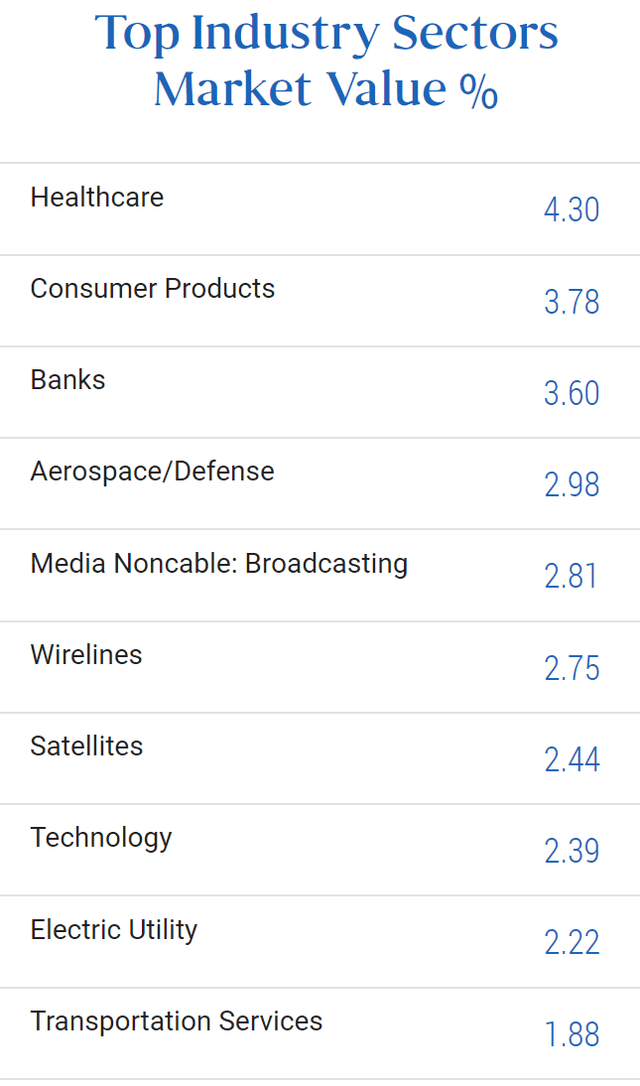

The fund’s industry exposure, mostly relating to corporate bonds, and other debt instruments, is well diversified — with no industry accounting for 5% of the fund’s market value.

To manage interest rate risk, the fund maintains an average portfolio maturity ranging from zero to eight years. This approach helps strike a balance between potential returns and sensitivity to changes in interest rates.

PDI Fund Prospectus

Currently, PDI’s effective maturity is around 6.7 years, which I personally see as the sweet spot of fixed-income investing, taking advantage of high rates for a considerable period of time, while not being overexposed to duration risk (long-dated fixed income securities are more sensitive to interest rate changes). PDI’s macaulay duration, which is a measure of the fund’s effective maturity, taking into account both the bond’s time to maturity and its present value of cash flows, is anchored around 3.8 years.

Playing The Soft Landing Narrative

Personally, I like the PDI as a bet to play what I see as Jay Powell’s “soft landing narrative”. There are a few reasons why: First, as I pointed out earlier in this article, I believe bonds are currently more attractive than equities, especially income-focused equities. Thus, I like PDI’s asset allocation composition. Second, within the fixed income argument, if the economy rebounds without a recession, those fixed-income securities that are economically sensitive should outperform “risk-free” government bonds. In that context, I would like to point out that PDI invests nothing in treasuries, but approximately ~30% in Mortgage securities, ~22% in high-yield credit, 16% in Non-US developed bonds, 11% in CMBS, ~6% in emerging markets. While the portfolio is clearly diversified and managed well, the exposure is still “risk-on” overall. Thus, as the economy delivers a soft landing, credit spreads in PDI’s securities should compress and the NAV should rise.

But how likely is a soft landing? Reflecting on this question, I would like to bring your attention to the recently published report by the Department of Commerce, which highlights that the U.S. economy expanded 2.4% in Q2, as compared to 2% in Q1 (growth is both positive as well as accelerating). And while consumer spending experienced a deceleration following a surprisingly strong start to the year, the setback was more than offset by a notable increase in business investment. Moreover, the economy continues to be supported by a strong labor market, the likely end of the interest rate hiking cycle, and, most notably, a moderation in inflation.

Conclusion

2-year treasuries offer a YTM of 4.9%, and 10-year treasuries offer a YTM of 3.96%, making govt. bonds attractive both compared to previous years and to income-focused equities. The 10-year treasury yield is now higher than the dividend benchmark for income-focused equities, suggesting investors should consider shifting to fixed income. In the world of fixed income, PIMCO’s Dynamic Income Fund offers a ~14% annual dividend yield, making it a highly appealing option for investors, especially if the economy rebounds without recession. That said, PDI is my pick for playing the soft landing narrative due to diversified risk-on exposure in fixed income markets, as I expect credit spread compression and NAV expansion.

Read the full article here