Investment action

I recommended a buy rating for Pegasystems (NASDAQ:PEGA) when I wrote about it the last time, as I expected that once the transition is done, it should see a surge in activity similar to Pega Cloud’s explosive expansion. Based on my current outlook and analysis of PEGA, I reiterate a buy rating. I expect PEGA to achieve FY23 revenue guidance as cloud momentum continues. Importantly, I foresee the business generating sustainable FCF moving forward from here, which could act as a catalyst to drive further valuation upside.

Review

In their 2Q23 earnings report, PEGA showed mixed results, with total ACV growth of 13% excluding FX impact, slowing from 15% in the previous quarter. Lower license revenue in the quarter was mostly to blame for the overall revenue shortfall compared to estimates. Pega Cloud revenue also fell short of expectations, but still grew 23%, a minor improvement over 1Q’s 19% growth. However, cloud ACV growth was consistent at 23% excluding FX impact. Cloud gross margins also increased to 73% from 72% in the previous quarter.

The cash flow from PEGA is a bright spot in the 2Q23 report. Strong collections and sustained enhancements to operational efficiency led to a $46 million operating cash flow. The FCF margin for 2Q was 16%, and the FCF generated in 1H23, at $123 million, was more than two-thirds of the $180 million goal set by management for the full year. Despite the 1H’s success, management did not raise its FCF guidance for the year, therefore I expect the company to easily meet or exceed its $180M FCF target for the year in the coming quarters. I think investors are seeking for cash flow positive companies to invest in, thus this would be a major momentum driver for stock sentiment.

Management also remarked that the situational layer cake is the engine that drives the generative AI advantage, so there’s that to look forward to. Management is quite bullish on the prospects of generative AI and claims that it will bring about profound changes in the way their businesses operate within the next 12 to 24 months. In particular, PEGA’s management thinks the company has an edge over rivals in its ability to profit from Gen AI thanks to its situational layer cake-based design.

“It’s a proprietary capability that organizes all of an enterprise’s processes, rules, data models, and UI, into layers. So it supports building and reusing. Now, this layer cake is the perfect place to plug in GenAI. It creates a pace that after the GenAI contributes, people can see the model, touch it, understand it, and regenerate as needed. And it is this layer cake, this architecture, that is what Pega is uniquely able to provide our clients, a proprietary structural advantage at the heart of our products.”

– 2Q23 earnings call

Simply said, I believe that Generative AI will hasten PEGA’s acceptance by making it simpler, quicker, and cheaper to deploy, while enhancing the customer experience.

However, there are pitfalls to avoid. The management team saw no worsening in macro in 2Q23, but it still had an impact on ACV growth. The majority of the decline was due to weaker term licensing ACV, and I expect this to remain weak as transition goes on. Given the impending product enhancements that will be deployed to cloud clients later this year, however, I anticipate a rise in the number of customers looking to switch from license to cloud subscriptions. Despite my optimism that consumer engagement is on the upswing because of impending AI-related product advancements, I anticipate that macro headwinds will be more significant than AI-related tailwinds in the near term.

Valuation

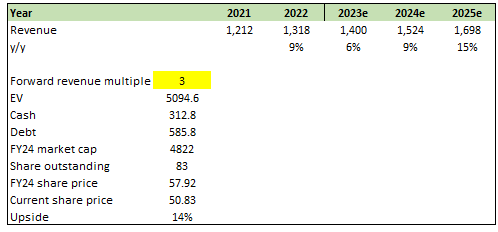

Author’s work

I continue to believe PEGA can hit FY23 management guidance and see acceleration in growth in the coming years as cloud adoption continues to gain traction. There might be some short-term blips due to the macro headwind, but I think the secular headwind is strong enough that the long-term growth trajectory remains intact.

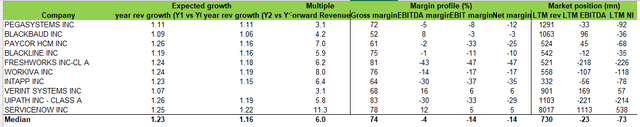

When we compare PEGA to other peers in the application software industry, it is clear that PEGA is not the fastest grower among the pack. It is also not producing positive profits yet. As such, I can understand why the stock is trading at a discount to the group (3x vs. 6x EV/forward revenue). For my model, I am assuming PEGA will continue trading at 3x forward revenue, which translates to a price target of $58 in FY24. However, I believe there is a chance for valuation to move closer towards peers’ median once PEGA shows that it can produce sustainable FCF (likely in FY24). An improvement in valuation multiples here would certainly add to the upside.

Author’s work

Final thoughts

I reiterate my buy rating for PEGA based on its strong cloud growth and the potential for sustainable FCF generation. Despite some mixed results in the 2Q23 earnings report, PEGA’s cash flow remains a bright spot, with a strong operating cash flow and promising FCF margins. The company’s focus on generative AI also presents an opportunity for growth and enhanced customer experience. While macro headwinds may pose challenges in the near term, I believe PEGA’s long-term growth trajectory remains intact. Although the stock currently trades at a discount to its peers, a potential improvement in valuation multiples once sustainable FCF is demonstrated could drive upside.

Read the full article here