Overview

My recommendation for Schneider Electric (OTCPK:SBGSF) is a buy rating, as I expect valuation to stay at the current levels at least until FY23, as investors seeking exposure to this industry are likely to allocate to SBGSF as it is relatively better than peers. Note that I previously gave a hold rating to SBGSF due to the steep valuation that it was trading at after a 50% rally.

Recent results & updates

SBGSF reported organic revenue growth of 15.3% in 1H23 achieving EUR17.7 billion in revenues. Organic revenue growth was driven by acceleration in both segments, Energy Management and Industrial Automation, 15.2% and 11.5%, respectively. Strong revenue growth also led to a 14% increase in Adj. EBITA of EUR3.2 billion, or 18% adj EBITA margin.

Backlog and growth outlook

When it comes to organic sales growth in 2023, management is now projecting a range of 11-13%, up from the previous projections of 10%-13%. The adjusted EBITA growth guide was raised to 18-23% from the previous 16-21%. The new EBITA range suggested an organic margin increase of 120 bps to 150 bps, or 17.7-18%. Management also anticipated healthy free cash flow in the second half of FY23.

SBGSF’s growth in backlog during the second quarter of 2023 provides over six months of visibility by the end of the first half of the year, giving me more optimism about the company’s ability to meet its FY23 goals. Moreover, 2H23 earnings results were realized for nearly 2 full months, which indicates that management likely has visibility for the rest of the year already. Combined with the robust sales growth, the expanding backlog is unmistakably bullish, demonstrating the persistence of a robust demand backdrop. As the pricing component softens in 2H23 compared to the higher base of last year, I anticipate volume to be the primary contributor to organic sales growth. However, management noted that the price benefit will continue into 2023 as a result of the percentage price increase that has yet to be fully realized. So, this does provide an additional driver for growth. In addition, management was more optimistic than most regarding China, noting the slow start to the year but seeing signs of improvement and anticipating a recovery in the 2H. This leads me to have high hopes for the positive result of SBGSF in 2H23.

Valuation and risk

In my previous model, my valuation was isolated from SBGSF’s historical valuation, and as such, I expected the valuation to revert back to its average of 17x. Taking a fresh look at SBGSF valuation with my relative analysis against industry peers, I believe there is a possibility of a short-term “trade” as we move through FY23.

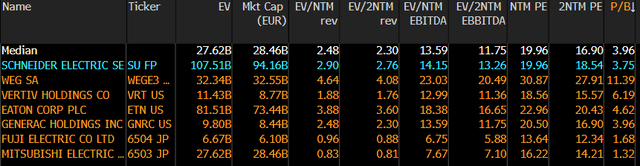

Bloomberg

When we look at SBGSF peers in the industry, they are currently trading at 20x forward PE, and they have historically traded at an average of 20x over the past 5 years. SBGSF trades in line with the industry historically. However, within the group, I believe SBGSF is the relatively stronger one in almost all aspects.

- Gross margin of 40% vs. group average of 29%; EBITDA margin of 18.8% vs. group average of 16.6%; EBIT margin of 14.4% vs. group average of 11.4%; net margin of 11.6% vs. group average of 8.9%

- SBGSF is expected to grow in the mid-single digits for the near term, which is modestly above the group average.

- SBGSF has a similar leverage profile.

- SBGSF is the largest player, ranked by revenue, among the group.

Also, as I have reviewed above, SBGSF has high visibility into FY23 earnings, which makes meeting FY23 consensus estimates very likely. In the current investing climate, where investors are risk averse, I believe SBGSF provides an attractive avenue for investors to allocate their capital, if they need exposure to this industry.

Hence, I have a view that SBGSF will be able to sustain its 20x forward PE valuation in the near term, providing investors with the opportunity to invest ahead of earnings in the next 2 quarters to make some returns.

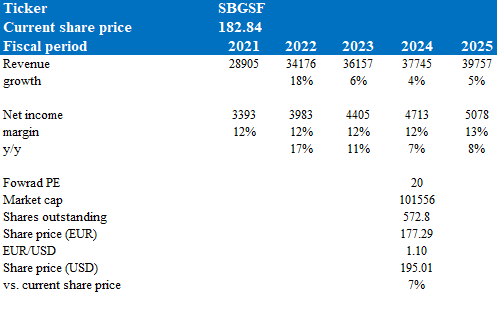

Author’s valuation model

According to my model, SBGSF is valued at $195 in FY24, representing an 7% increase. This target price is based on consensus estimates, which essentially follow management guidance and historical mid-single digit growth. While this is not a big upside as share prices dip due to volatility (or any other reasons), I think investors can take advantage of that and make small returns as valuation is likely to stay at the current level until the end of FY23 in my view.

Summary

I upgraded SBGSF to a buy rating. The company’s recent results have shown robust organic revenue growth and strong performance in both the Energy Management and Industrial Automation segments. The management’s improved projections for sales growth and adjusted EBITA further reinforce my optimism of the business. Additionally, the growing backlog provides good visibility into meeting the FY23 goals.

Considering SBGSF’s strengths compared to industry peers, its historical valuation, and the positive outlook for the company’s performance in the second half of FY23, I believe the current valuation of 20x forward PE is sustainable in the near term. This makes SBGSF an attractive investment option for risk-averse investors seeking exposure to this industry.

While the projected target price for FY24 indicates a modest increase, I anticipate opportunities for investors to capitalize on short-term fluctuations in share prices and potentially make small returns. In conclusion, the upgrade to a buy rating is based on the company’s solid fundamentals and its potential to maintain valuation levels until the end of FY23.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here