Even though the S&P 500 is up significantly this year, not every part of the market is doing well. One of the worst performing aspects of the market is undoubtedly the banking sector. Driven by concerns about a wave of bank failures that began in March of this year, the industry has been flooded by pessimism. The good news is that this pessimism is slowly fading away. That has left open the opportunity for the companies that have survived up to this point to stage a recovery. One of the firms that has done precisely this, but that is still trading meaningfully lower than where it traded at prior to the crisis, is S&T Bancorp (NASDAQ:STBA). With a market capitalization of $1.18 billion, this regional bank is quite small. The bank certainly has some attributes about it that make it look appealing. But when you put everything in context, I do believe that it’s cheap for a reason.

An interesting bank

According to the management team at S&T Bancorp, the company serves as a bank holding company that traces its roots back to 1956. Management considers the company to be a full-service bank that has operations throughout Pennsylvania and Ohio. Through the locations that it has set up, the firm provides its customers with a wide range of services such as commercial and small business banking activities, commercial and consumer loans, brokerage services, trust services, and more. It also provides wealth management services for individuals and institutions through its own RIA that manages $2.2 billion.

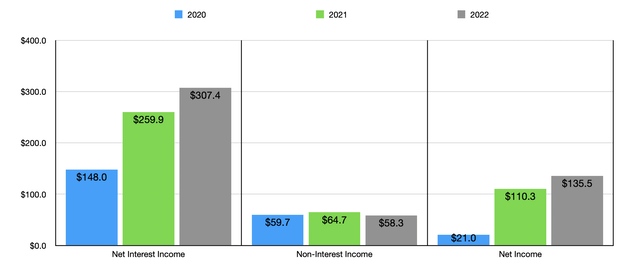

Author – SEC EDGAR Data

Over the past few years, the financial condition of the company has been interesting. Let’s start with a look at its income statement. From 2020 through 2022, net interest income for the company expanded from $148 million to $307.4 million. Given this massive growth, you might think that the overall assets of the company have grown tremendously. But that is not what happened. Actual loans on the company’s books actually dipped slightly during this time from $7.23 billion to $7.18 billion. After seeing deposits climb from $7.42 billion in 2020 to $8 billion in 2021, they then fell to $7.22 billion last year. The increase in net interest income also was not the result of the firm’s net interest margin expanding materially. Instead, it was the result of a plunge in the provision for credit losses from $131.4 million to only $8.4 million. If you look at only interest and dividend income over this three-year window, growth was more modest, with the metric climbing from $320.5 million to $340.8 million.

Similar to gross interest and dividend income, non-interest income for the company didn’t change all that much. In fact, it actually dipped from $59.7 million in 2020 to $58.3 million in 2022. Net income for the firm shot up however, soaring from $21 million to $135.5 million over the same window of time. But again, a lot of that change was driven by the massive provision for credit losses that negatively affected the enterprise back in 2020.

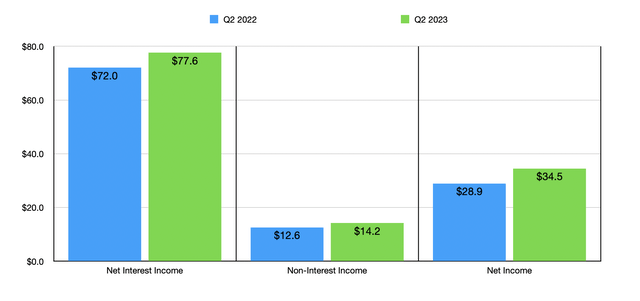

Even though the past is important to focus on, what’s more important is an emphasis on what has happened recently. The banking crisis that began in March severely affected the industry and I can’t say that I have seen any company that is outside of the major firms come out of this unscathed. The good news for shareholders is that S&T Bancorp managed to weather the storm quite well. Focusing again on the income statement, net interest income in the second quarter of the 2023 fiscal year came in at $77.6 million. That’s up from the $72 million reported one year earlier. Non-interest income grew from $12.6 million to $14.2 million, while net income for the business jumped from $28.9 million to $34.5 million.

Author – SEC EDGAR Data

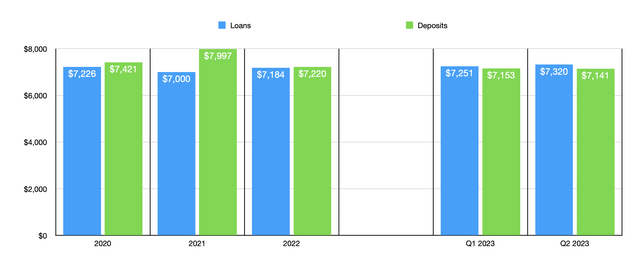

The company has also demonstrated that it has a rather solid balance sheet. Loans in the most recent quarter totaled $7.32 billion. In addition to being higher than what they were at as of the end of each of the past three fiscal years, they were also greater than the $7.25 billion the company had at the end of the first quarter. I do understand that one thing that investors are worried about right now when it comes to bank exposure is the amount of loans that are dedicated to office properties. Most banks have been providing details on that front. However, management has been quiet on the matter. We do know that commercial loans account for 71.4% of the firm’s overall loan portfolio. But beyond that, we have no idea how much might be dedicated to office properties. Overall commercial real estate is $3.22 billion, which translates to 44% of the firm’s overall loan portfolio. But it also has capital allocated toward commercial and industrial loans and a small amount attributable to commercial construction loans. Outside of the commercial side, the greatest exposure to the company is to residential mortgages. At $1.29 billion, these account for 17.6% of the firm’s overall loan portfolio.

Author – SEC EDGAR Data

While all of this is important, perhaps what’s more important when it comes to banks right now would be the deposit picture. After all, concerns over uninsured deposits are ultimately what caused the bank runs to begin with. At the end of 2022, the company had $7.22 billion in deposits on its books. This number dips slightly to $7.15 billion by the end of the first quarter. And by the end of the second quarter, deposits were down to $7.14 billion. That’s almost unchanged in the grand scheme of things and it is far better than what we have seen with other banks. But this is where more ambiguity comes into play. As of this writing, management has yet to say how much of its deposits are uninsured. This does create some risk for investors if fears begin to mount about the bank. But so far, remaining silent on the matter has proven to work in the company’s favor.

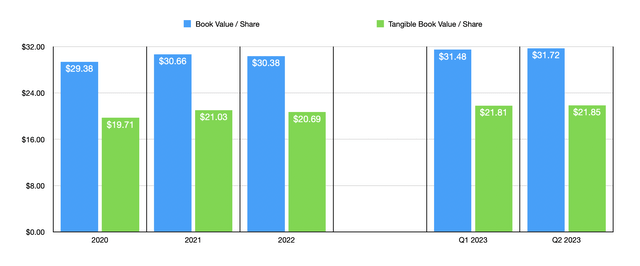

There are a couple of other tidbits that we should touch on. First, as you can see in the chart below, both the book value and tangible book value of the company per share has remained quite consistent over time. It would be better to see these numbers grow at an impressive pace. But stability is definitely better than a decline. And lastly, it’s imperative to state that the firm still has only a small amount of debt on its books. Even though borrowings increased since the end of 2022, they only grew from $439.2 million to $624 million. With $227.9 million in cash, as well as $970.4 million in securities that it could easily sell, the business is at no risk of not being able to pay this debt back.

Author – SEC EDGAR Data

Takeaway

When you look at S&T Bancorp in its totality, the stock looks quite cheap. Shares are trading at a price to earnings multiple of 8.7. And the stock is trading around the price of its book value per share. Compared to the pricing of some other firms in the space, I would normally reward the company with a ‘buy’ rating. This is especially true when you consider how stable its deposits have been and the fact that loans continue to grow. However, I don’t like the lack of transparency here. Management does not seem interested in letting investors know what the amount of uninsured deposits are and how that has changed. They also have not provided any real data regarding office property exposure. This lack of clarity could be why, even though the business has recovered significantly from the 33.1% plunge it experienced from the end of February until it bottomed out, the stock is still down 16.9% from that point. Until we get additional clarity, I’ve decided to rate the business a ‘hold’ instead

Read the full article here