Introduction

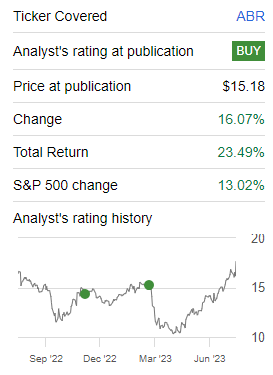

I have covered Arbor Realty Trust (NYSE:ABR) several times previously over the past few years, with my most recent article coming in March this year following the release of the company’s FY 2022 results.

Seeking Alpha

Since I last covered the company, its share price has been volatile to say the least. Sometime in March, there was the release of a short report on the company which caused the company’s shares to drop sharply, by over 25% in just a week. After reaching a bottom of just over $10 in April, the stock has gradually increased in price since, culminating in a close to 10% jump to its current price of $17.62 following the release of the Q2 earnings results on Friday. The short report has already been discussed at length by various authors and I will not be covering it in this article. Instead, the article shall focus on my takeaways regarding the company’s earnings for the 2nd quarter.

A Strong Quarter…

The company had an outstanding quarter, reporting distributable earnings of $0.57/share, a notable increase from the $0.52/share in Q2 2022 and a more than 25% increase compared to the $0.45/share in Q2 2021. During the quarter, the company’s Agency Business segment originated over $1.4 billion in loans, with its servicing portfolio growing by 2% to $29.45 billion. On the other hand, its Structured Business segment saw a slight decline in its portfolio (from $13.6 billion to $13.5 billion), though this was offset by an increase in yield, which rose from 8.83% to 9.07% due to rising LIBOR rates. The bulk of the company’s loans remain in the multifamily sector, an area which management has significant expertise in.

The company has been actively building up a strong liquidity position, having doubled its liquidity position from approximately $500 million as at Q3 2022 to the current $1 billion. CEO Ivan Kaufman emphasized the reasoning behind the company’s liquidity position during the earnings call:

In fact, unlike others in this space, we’ve been conducting ourselves as if we have been in a recession for over a year now. And as a result, one of our primary focus has been and continues to be preserving and building up a strong liquidity position. We are very pleased to report that we currently have approximately $1 billion in cash, which gives us a tremendous amount of flexibility to manage through this downturn and provide us with the unique ability to take advantage of the opportunities that will exist in this environment to generate superior returns on our capital.

This is consistent with the company’s approach over the previous quarters, when management mentioned the company was actively accumulating a “war chest” to deal with and take advantage of any challenging environments.

… Leads to Another Dividend Increase

The company’s impressive performance for the quarter led to an increase in the figure investors are most concerned about – the company’s dividends. The company raised its quarterly dividends to $0.43/share, its 12th increase in the past 13 quarters. Since 2020, the company has raised its dividends by an impressive 43%, a substantial growth from its previous dividend of $0.30/share.

What makes this dividend all the more remarkable is that the company has achieved this while maintaining one of the lowest, if not the lowest, dividend payout ratios in the industry. For Q2 2023, the dividend payout ratio was 75%. However, looking at the first half of 2023, the company’s dividend payout ratio actually decreased to 71% (total dividends of $0.85/share compared to distributable earnings of $1.19/share).

That being said, the company’s forward dividend yield remains an attractive 9.76%, based on the latest share price of $17.62. This high dividend yield, coupled with its low dividend payout ratio is certainly welcome news for investors as it shows the company is not overreaching to artificially boost its dividends. If anything, the company has room to increase its dividends by a further 20% and still have a payout ratio below 100%, reflecting the company’s prudent and responsible approach to dividend growth.

Cautious Times Ahead

Looking ahead, management anticipates that the next few quarters may not be as rosy as the recent quarter. During the earnings call, the CFO acknowledged that the company’s Q2 results had surpassed its own internal projections by a significant margin. When asked whether the Q2 earnings were close to recurring earnings or if the company had “over earned” for the quarter, the CFO stated that the figures for the next half of the year would likely be lower:

We have excessively high second quarter volume, given that rates rose to about 4% for a short period of time and have come back down. We see a little backlog in that business. We expect that business to be strong for the balance of the year, but I am projecting $1 billion, $1.1 billion versus $1.4 billion in the agency business in the third quarter and probably something stronger than that in the fourth quarter. So, I expect our agency business to come in for the year higher than we did last year, but I do expect a dip down in the third quarter and then a big rise in the fourth quarter. So, that gain on sale associated with those sales will change and likely end up with a reduction in gain on sale and a slightly less distributable earnings. Also, we are expecting the portfolio to continue to run down as there is no balance sheet lending and one-off has been naturally roll to our agency business.

However, he went on to add that the figures for the upcoming quarters would still be substantially higher than the company’s dividends. This should be of comfort to investors, as even in weaker quarters in the past, the company’s earnings were still able to comfortably cover its dividends. For instance, in Q2 and Q3 2021, when the company’s earnings were relatively lower at $0.45/share and $0.47/share, its earnings was still able to cover its dividends with room to spare. In fact, its current dividends can still be covered by those quarters, underscoring management’s conservative approach.

Final Thoughts

I have held Arbor Realty Trust for quite some time now. Each time I write about the company, I come to the conclusion that the company is a “Buy” and this time is no different. There is much to like about the company, and it starts from the management which have proven themselves many times over. The company has been consistently increasing its dividends, all while maintaining a low payout ratio.

There is, however, one point of consideration – the company has a current book value of $12.67/share, based on the latest earnings call. This means that the company is trading at a close to 40% premium over book value, its highest in a while. That being said, I view the current dividend as an attractive one, and would be alright with opening a position at the current prices, with a view towards adding to my position during any drop in share prices while continuing to collect my dividends.

Read the full article here