Dear Baron Health Care Fund Shareholder:

Performance

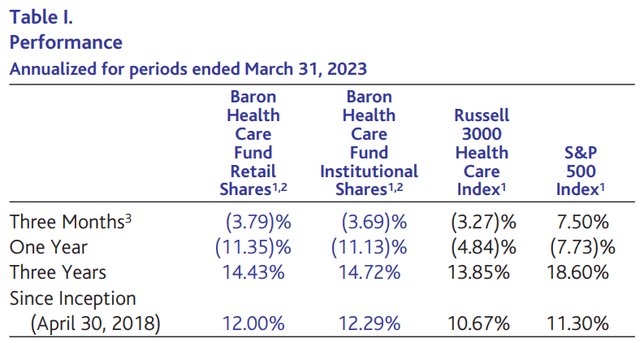

In the quarter ended March 31, 2023, Baron Health Care Fund® (the Fund) declined 3.69% (Institutional Shares), compared with the 3.27% decline for the Russell 3000 Health Care Index (the Benchmark) and the 7.50% gain for the S&P 500 Index. Since inception (April 30, 2018), the Fund increased 12.29% on an annualized basis compared with the 10.67% gain for the Benchmark and the 11.30% gain for the S&P 500 Index.

Performance listed in the above table is net of annual operating expenses. Annual expense ratio for the Retail Shares and Institutional Shares as of December 31, 2022 was 1.21% and 0.90%, respectively, but the net annual expense ratio was 1.10% and 0.85% (net of the Adviser’s fee waivers), respectively. The performance data quoted represents past performance. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate; an investor’s shares, when redeemed, may be worth more or less than their original cost. The Adviser reimburses certain Fund expenses pursuant to a contract expiring on August 29, 2033, unless renewed for another 11-year term and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. Current performance may be lower or higher than the performance data quoted. For performance information current to the most recent month end, visit www.BaronFunds.com or call 1-800-99BARON.

In a difficult quarter during which the Health Care sector failed to participate in the broader market rally, Baron Health Care Fund modestly trailed the Benchmark by 42 basis points, as disappointing stock selection overshadowed favorable impacts from differences in sub-industry weights and cash exposure.

Biotechnology and health care equipment investments accounted for most of the underperformance during the quarter. Weakness in biotechnology was broad based, led by double-digit declines from gene therapy specialist Rocket Pharmaceuticals, Inc. (RCKT) and mRNA-based vaccines and therapeutics leader Moderna, Inc. (MRNA) Rocket is currently focused on developing gene therapies for several rare diseases, including Danon disease, Fanconi’s anemia, lysosomal acid lipase deficiency, and Pyruvate kinase disorder. We believe the first three drugs should all launch commercially by 2025, generating substantial revenue for the company. In the near term, Rocket’s shares detracted given a lack of news flow catalysts amid a risk-off environment for biotechnology stocks in general. Moderna’s stock underperformed due to increasing uncertainty around what a booster market could look like as COVID shifts away from pandemic status and becomes an increasingly commercial market rather than government funded. That said, looking beyond COVID, we think Moderna has the potential to disrupt the biopharmaceutical industry from infectious disease vaccines to oncology. Lower exposure to benchmark heavyweight AbbVie Inc. (ABBV) and declines in Cytokinetics, Incorporated (CYTK), Ascendis Pharma A/S (ASND), and Inhibrx, Inc. (INBX) also weighed on performance in the sub-industry.

Within health care equipment, lower exposure to this better performing sub-industry coupled with share price weakness from fiber optic sensors manufacturer Opsens Inc. (OTCQX:OPSSF) and sleep apnea treatment leader Inspire Medical Systems, Inc. (INSP) hampered performance. We are unclear why Opsens underperformed in the first quarter. Although the company raised equity in December, which caused dilution, the company reported solid financial results in January, and is progressing well with the launch of Savvywire, the company’s newly approved guidewire for use in transcatheter aortic valve replacement procedures. The product is the only guidewire capable of delivering a transcatheter valve while enabling continuous pressure measurement and left ventricular pacing. We think Savvywire can drive significant growth and margin expansion for the company over the next few years. Regarding Inspire Medical, we believe the stock was down due to concerns about emerging competition. We think these concerns are unfounded and we used recent weakness to add to our position given our conviction that the company has a long runway for growth with its treatment for people with moderate to severe sleep apnea.

These negative effects were somewhat offset by favorable stock selection in pharmaceuticals and life sciences tools & services, where performance was led by global animal health company Zoetis Inc. (ZTS) and weighing instruments provider Mettler-Toledo International, Inc., respectively. Zoetis reported a quarterly revenue beat and issued upbeat guidance for fiscal year 2023, despite higher R&D spending on investments in late-stage pipeline products and increased manufacturing to support future growth. Mettler’s shares outperformed in response to strong financial results, driven by broad-based strength across geographies and product categories. Additionally, management raised EPS guidance for fiscal year 2023 to account for less adverse foreign currency impacts versus the prior forecast. The Fund also benefited from its lack of exposure to select large-cap pharmaceutical companies, namely Pfizer Inc. and Johnson & Johnson, whose shares were down double digits for the quarter.

Our strategy is to identify competitively advantaged growth companies that we can own for years. Similar to the other Baron Funds, we remain focused on finding businesses that we believe have significant secular growth opportunities, durable competitive advantages, and strong management teams. We conduct independent research and take a long-term perspective. We are particularly focused on businesses that solve problems in health care, whether by reducing costs, enhancing efficiency, and/or improving patient outcomes.

We continue to think the Health Care sector will offer attractive investment opportunities over the next decade and beyond. Health Care is one of the largest and most complex sectors in the U.S. economy, accounting for approximately 18% of GDP in 2021 and encompassing a diverse array of sub-industries. Health Care is also a dynamic industry undergoing changes driven by legislation, regulation, and advances in science and technology. We think navigating these changes requires investment experience and sector expertise, which makes the Health Care sector particularly well suited for active management.

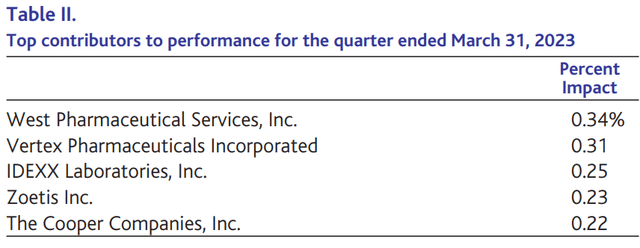

West Pharmaceutical Services, Inc. (WST) manufactures components and systems for the packaging and delivery of injectable drugs such as rubber stoppers for vials and plungers for prefilled syringes. Shares increased after the company reported financial results that beat analyst expectations and provided solid 2023 guidance. Excluding COVID-related product revenue, organic sales growth was 14% in the fourth quarter, and management expects mid-teens base business organic growth in 2023, well above its long-term target. West’s competitive pricing and favorable product mix, including products used with anti-obesity medicines, should help drive future demand. We continue to believe West operates a competitively advantaged business that is well positioned for long-term growth.

Vertex Pharmaceuticals Incorporated (VRTX) is a leader in the treatment of cystic fibrosis (CF). Vertex has three approved and marketed drugs, each for treatment of differing subsets of CF. These drugs represent paradigm shifts for CF patients hoping to extend their lives beyond their 30s or 40s. Shares increased primarily due to underlying business fundamentals, including strong free cash flow generation that is largely unmatched in the biopharmaceutical universe. In addition to its core treatment program for CF, Vertex has a robust pipeline of drugs that is starting to become value inflecting. We are looking to Vertex’s APOL1 kidney disease program and updates on its treatment for Type 1 diabetes, in particular, to drive future upside.

Shares of veterinary diagnostics leader IDEXX Laboratories, Inc. (IDXX) contributed to performance for the quarter, helped by financial results that beat consensus and multiple expansion. The post-pandemic rate of decline of veterinary visits seems to have stabilized and is poised to return to advancement by the end of 2023. IDEXX’s competitive trends are outstanding, and we expect new proprietary innovations and field sales force expansion to be meaningful contributors to growth. We see increasing evidence that secular trends around pet ownership and pet care spending have been structurally accelerated, which should help support IDEXX’s long- term growth rate.

Zoetis Inc. (ZTS) is a global leader in the discovery, development, and manufacturing of companion and farm animal health medicines and vaccines, selling in more than 120 countries across eight core species. Shares rose after the company reported a fourth quarter revenue beat and issued 2023 guidance that met Street forecasts, calling for 6% to 8% operational growth and 7% to 9% adjusted net income growth despite higher R&D spend on late-stage pipeline products and manufacturing spend. Zoetis, which is growing 100 to 200 basis points above the industry’s 4% to 5% CAGR, should benefit from expanding demand for animal health products, driven by increasing consumption of animal proteins and the humanization of pets. Five key catalysts include products for osteoarthritis pain, parasiticides, dermatology, diagnostics, and emerging markets. Longer term, Zoetis should be able to achieve double-digit earnings growth on consistent revenue increases and an improving cost structure due to a more favorable product/species mix and manufacturing efficiencies. Strong operating cash flow helps facilitate capital deployment opportunities to supplement expansion.

The Cooper Companies, Inc. (COO) is a global medical device company operating under two business units: CooperVision, a leading manufacturer of a full range of specialty soft contact lenses and modalities; and CooperSurgical, targeting women’s health care and fertility. Shares rose on an across-the-board beat and raised fiscal year revenue/EPS guidance on a stronger outlook for organic growth, better operational efficiencies, and more favorable foreign exchange rates. CooperVision remains well positioned to participate in the multi-year shift to higher priced, higher margin daily and silicon hydrogel lenses. Its broad product portfolio and customer service focus position CooperSurgical to gain share in the $1 billion-plus global fertility market, which benefits from sustainable demographic tailwinds, including increasing maternal age, improving access to treatment, increased patient awareness, growth in number of fertility clinics, and expanding insurance coverage for infertility. Lastly, the company has the first mover advantage in the $5 billion-plus myopia management category, with potential for MiSight to become the standard of care.

Table III.

Top detractors from performance for the quarter ended March 31, 2023

|

Percent Impact |

|

|

UnitedHealth Group Incorporated |

-0.98% |

|

The Cigna Group |

-0.50 |

|

Moderna, Inc. |

-0.45 |

|

Elevance Health, Inc. |

-0.34 |

|

Rocket Pharmaceuticals, Inc. |

-0.34 |

UnitedHealth Group Incorporated (UNH) is the leading health care franchise in the U.S., with more than $350 billion in annual revenue. Following relatively strong performance in 2022, shares fell along with other managed care companies, primarily on sector rotation. Despite solid fourth quarter results and conservative initial 2023 guidance that fell within its 12% to 15% long- term earnings goal, investors stepped to the sidelines on concerns about proposed changes to the Medicare audit program, preliminary 2024 Medicare Advantage (MA) rates, and the impact of Medicaid recertification. We believe UnitedHealth is the best-positioned managed care player, with a leading franchise in MA, the market’s fastest growing segment. We expect continued strong growth and profitability, driven by positive demographic trends, effective cost management through leverage of size and scale, industry-leading technology investments, enhanced expertise in population health, and a growing portfolio of providers, all of which enables UnitedHealth to keep and effectively manage more of its health care spending in-house.

The Cigna Group (CI) is a leading provider of health care services and benefits. Like UnitedHealth, Cigna’s shares were down alongside other managed care companies during the quarter, primarily on sector rotation. Cigna reported a fourth quarter beat and inline 2023 guidance driven by strong enrollment across all products; continued growth in established business (60% of revenue); and outsized growth in Cigna’s accelerated segments comprised of specialty pharmacy, Evernorth Health Services, and its U.S. Government business. Despite these positive results, investors stepped to the sidelines on concerns about proposed changes to the Medicare audit program, preliminary 2024 Medicare Advantage rates, the impact of Medicaid recertification, and heightened scrutiny of pharmacy benefit managers. While we believe that, over the long term, Cigna is a well-run, well- positioned managed care player with solid growth opportunities, we reduced our position to lower overall exposure to the managed health care segment.

Moderna, Inc. (MRNA) is a leader in the emerging field of mRNA-based vaccines and therapeutics and was one of the three main producers of the COVID vaccine. Shares fell during the quarter. We believe as COVID shifts away from pandemic status and becomes an increasingly commercial market (rather than government funded), there is increasing investor uncertainty around what a booster market could look like, which is pressuring shares. Looking beyond COVID, we think Moderna has the potential to disrupt the biopharmaceutical industry, from infectious disease vaccines to oncology, and we remain shareholders.

Elevance Health, Inc. (ELV) is a leading health benefits company in the U.S., serving more than 45 million members through its affiliated health plans under the Blue Cross/Blue Shield brand in 14 states. Shares fell along with those of other managed care companies on investor concerns over proposed lower 2024 Medicare Advantage (MA) rates and changes in risk assessment methodology. We believe Elevance has multiple growth drivers, including its MA business, its in-house pharmacy benefit management business, and its Diversified Business Group, which includes behavioral health, advanced analytics, and complex and chronic care services. Near term, medical cost trends remain low, Elevance has pricing power, and earnings should benefit from rising interest rates. Over the long term, management targets 12% to 15% annual EPS growth. We think Elevance is a high-quality growth company trading at a reasonable valuation.

Rocket Pharmaceuticals, Inc. (RCKT) is a biotechnology company specializing in gene therapies for rare genetic diseases outside of oncology, including Danon disease, Fanconi’s anemia, lysosomal acid lipase deficiency, and Pyruvate kinase disorder. As a biotechnology stock without near-term news flow in a risk-off market, the share price suffered as a result of this duration risk. We expect treatments for the first three diseases to be commercially launched by 2025, which should generate substantial revenue. Short-term investor focus is on a pivotal trial design for Danon disease, as it represents the largest commercial opportunity of the three. Given our estimation of the high probability of positive free-cash-flow generation in coming years, coupled with the life-saving nature of Rocket’s therapies and the high unmet need, we are comfortable managing through present investment risk.

Portfolio Structure

We build the portfolio from the bottom up, one stock at a time, using the Baron investment approach. We do not try to mimic an index, and we expect the Fund to look very different from the Benchmark. We loosely group the portfolio into three categories of stocks: earnings compounders, high-growth companies, and biotechnology companies. We define earnings compounders as companies that we believe can compound earnings at double-digit rates over the long term. We define high-growth stocks as companies we expect to generate mid-teens or better revenue growth. They may not be profitable today, but we believe they can be highly profitable in the future. We expect the portfolio to have a mix of earnings compounders, high-growth, and biotechnology companies.

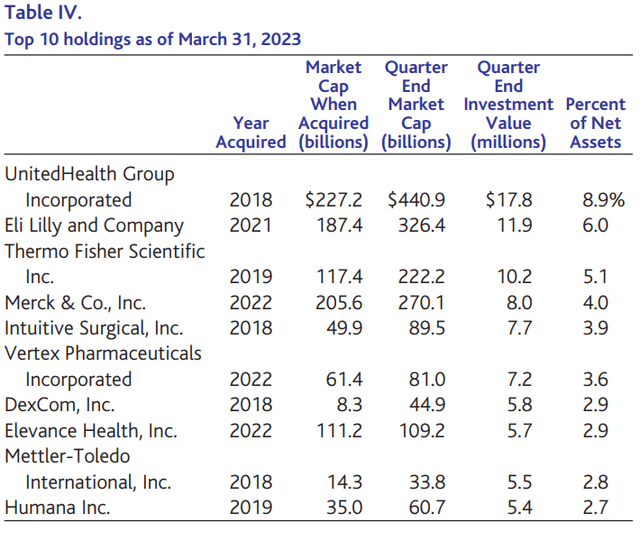

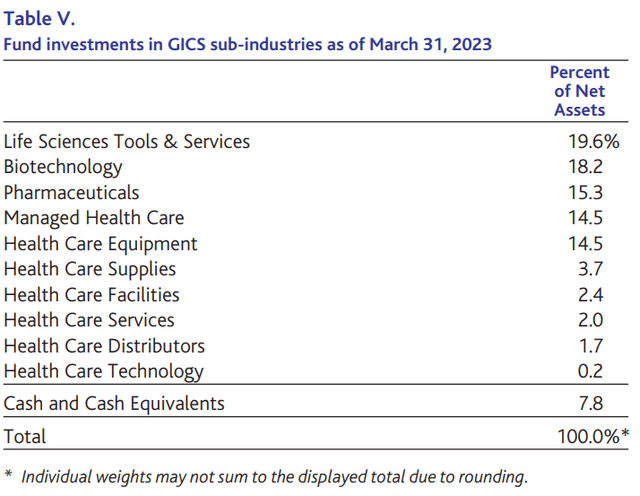

The Fund may hold in stocks of any market capitalization and may hold both domestic and international stocks. As of March 31, 2022, the Fund held 45 stocks. This compares with 486 stocks in the Benchmark. International stocks represented 12.2% of the Fund’s net assets. The Fund’s 10 largest holdings represented 42.7% of net assets. Compared with the Benchmark, the Fund was overweight in life sciences tools & services, health care supplies, managed health care, and health care distributors, and most underweight in pharmaceuticals, health care equipment, and biotechnology. The market cap range of the investments in the Fund was $136 million to $441 billion, with a weighted average market cap of $127 billion. This compared with the Benchmark’s weighted average market cap of $173 billion.

We continue to invest in multiple secular growth themes in Health Care, such as genomics/genetic testing/genetic medicine, technology-enabled drug development/discovery, minimally invasive surgery, diabetes devices and therapeutics, anti-obesity medications, picks and shovels life sciences tools providers, the shift to lower cost sites of care, value-based health care, Medicare Advantage, and animal health, among others. To be clear, this list is not exhaustive: we own stocks in the portfolio that do not fit neatly into these themes and there are other themes not mentioned here that are in the portfolio. We evaluate each stock on its own merits.

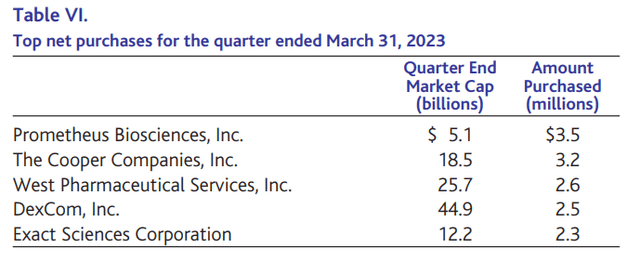

Recent Activity

During the first quarter, we established three new positions and exited five positions. Below we discuss some of our top net purchases and sales.

We added to our position in Prometheus Biosciences, Inc., (RXDX) a clinical stage biotechnology company. Prometheus’ lead product candidate, PRA023, is a monoclonal antibody that has been shown to block a target called TL1A that is associated with intestinal inflammation and fibrosis. In December 2022, the company reported promising Phase 2 clinical trial results, suggesting potential for PRA023 to be a novel treatment for ulcerative colitis and Crohn’s disease. The company plans to advance PRA023 into Phase 3 clinical trials for ulcerative colitis and Crohn’s disease in 2023. The company is also studying PRA023 as a treatment for Systemic-Sclerosis-associated Interstitial Lung Disease and plans to announce a fourth potential indication for PRA023 in 2023. We believe PRA023 has blockbuster potential. Prometheus also has a pipeline of earlier stage product candidates. On April 16, Merck issued a press release announcing its agreement to acquire Prometheus for $200 per share in cash.

We added to our position in The Cooper Companies, Inc., a medical device company that is a global leader in its two verticals, CooperVision (contact lenses) and CooperSurgical (women’s health/fertility products and services). On the contact lens side, the overall market is growing, driven by the increased incidence of myopia, and Cooper is enjoying above market growth driven by the company’s wide range of specialty lens offerings and the multi-year trend of users trading up to daily silicone hydrogel lenses where Cooper is under-indexed. The contact lens market is an oligopoly with high barriers to entry and long product cycles. Especially exciting is Cooper’s portfolio of products for the treatment of myopia, including MiSight, the first FDA approved contact lens for myopia in children, a huge and growing market. On the women’s health side, CooperSurgical has positioned itself, primarily through niche acquisitions, to be a one-stop shop for gynecologists and obstetricians and has built a strong and expanding franchise in the rapidly growing global fertility market. We believe Cooper is a high-quality, well-managed earnings compounder that is well positioned to achieve solid top-line growth and expanding margins. We also expect Cooper to achieve attractive returns from strategic acquisitions facilitated by the company’s strong free cash flow.

We added to our position in West Pharmaceutical Services, Inc., a leading supplier of components and systems for packaging and delivery of injectable drugs. West’s products include rubber stoppers that enclose drug vials, rubber syringe plungers, as well as drug delivery systems such as auto- injectors and electronic wearable injectors. West’s business is benefiting from a mix shift towards higher value products, including stoppers and syringe plungers that have been coated with proprietary material to prevent contamination, and products which have been washed, sterilized, and vision inspected. West has dominant market share in its primary product categories and long-term customer relationships with customers who trust West and rely on its quality products to package their drugs, which can cost hundreds of thousands of dollars. West’s products go through stability testing to make sure they do not affect the drug they contain. The FDA has a master file with West’s products and customers can reference the master file when applying for approvals. Substantial capital is required to build manufacturing facilities ahead of revenue. West manufactures globally and can serve its customers with technical and regulatory support around the world. West has pricing power and can raise price a few percentage points each year. West’s business has tailwinds from a new class of diabetes/ obesity drugs called GLP-1s (such as Ozempic, Wegovy, and Mounjaro). Management targets 7% to 9% revenue growth over the long term and 100 basis points of operating margin expansion per year.

We added to our position in DexCom, Inc., (DXCM) a medical device company which sells continuous glucose monitoring (CGM) devices for people with diabetes. DexCom is in the early stages of the launch of its seventh- generation device called the G7, which offers many new features, including 60% smaller size, a disposable transmitter, and 30-minute sensor warmup, among other features. We think the G7 will drive revenue growth acceleration through continued penetration in the core insulin intensive diabetes population globally. In addition, Medicare recently decided to provide coverage of CGM for people with Type 2 diabetes who are basal insulin users, meaning people with diabetes who use insulin daily but don’t need to use insulin intensively at every meal or multiple times daily. This expanded coverage adds millions of people to DexCom’s addressable market. Over the long term, we believe DexCom will have an opportunity to expand into the even larger category of non-insulin users with Type 2 diabetes given the benefits of CGM in helping all people manage their diabetes.

We initiated a position in Exact Sciences Corporation (EXAS), a cancer diagnostics company whose flagship product is Cologuard, a stool-based DNA colon cancer screening test. Colon cancer is the second leading cause of cancer deaths in the U.S. Patients who are diagnosed early are more likely to have a complete recovery. Exact has a large opportunity to screen patients with Cologuard. There are roughly 110 million Americans between the ages of 45 and 85 who are at average risk for colon cancer. At a three-year screening interval and an average revenue per test of roughly $500, this represents a potential $18 billion annual revenue opportunity for Cologuard. Recently, the Cologuard business has exhibited strong momentum with several tailwinds driving growth, including demand from health systems, which are incentivized to comply with screening guidelines for enhanced payments, the American Cancer Society guideline change lowering the age of recommended screening from 50 to 45, increased adoption of electronic ordering, and a growing rescreening opportunity. Later this year, Exact expects to report clinical trial data on Cologuard 2.0, a second-generation screening test that management believes will have enhanced specificity and boost gross margins. Exact also plans to participate in the market for minimal residual disease testing and multi-cancer early detection, two large new market opportunities for the company. After many years of heavy investments in its laboratories, IT, and distribution, the company recently turned adjusted EBITDA positive and expects to turn free cash flow positive next year. Long term, management targets 80% gross margins and 40% adjusted EBITDA margins for the business.

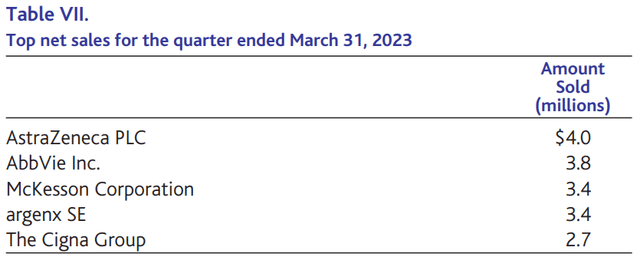

We reduced our position in AstraZeneca PLC (AZN) ahead of a clinical data read-out of a competitor drug that would compete with one of the company’s important drugs. We reduced our position in AbbVie Inc. (ABBV) due to our less optimistic view of the company’s pipeline and long-term growth profile. We trimmed our position in McKesson Corporation (MCK) on valuation concerns after strong performance in 2022. We reduced our position in argenx SE (ARGX) to de-risk ahead of a clinical data read-out. Lastly, we reduced our position in The Cigna Group to lower overall exposure to the managed health care segment.

Outlook

The XBI, the SPDR® S&P® Biotech ETF that is largely concentrated in small- and mid-cap biotechnology stocks, was down 8.18% in the first quarter. This poor performance was likely due to concerns about the impact of small bank failures on small biotechnology companies’ ability to access capital and the impact of the Medicare drug pricing provisions of the Inflation Reduction Act. We continue to focus on select small- and mid-cap biotechnology stocks that we believe have innovative products and are well funded and well positioned in a more difficult pricing environment. Examples include Rocket Pharmaceuticals, Inc., a developer of gene therapies for rare, undertreated diseases, and Prometheus Biosciences, Inc., which we discussed earlier.

In pharmaceuticals, our largest investment continues to be in Eli Lilly and Company (LLY). Lilly’s new diabetes drug Mounjaro is likely to be approved for obesity in 2023. Lilly has two new obesity drugs advancing into Phase 3 trials. Lilly also has a drug in late-stage development for Alzheimer’s disease. Lilly is not facing any significant near-term patent expirations, and we think the company should be able to grow revenue and earnings at attractive rates through the end of the decade and beyond.

Following weak performance in 2022, life sciences tools stocks began the year on a positive note driven by fading COVID headwinds and solid fundamentals. We think the life sciences tools companies we own (such as Thermo Fisher Scientific Inc. (TMO), Mettler-Toledo International, Inc. (MTD), and West Pharmaceutical Services, Inc., among others) are good long-term investments because they have secular growth drivers, pricing power, recurring revenues, high margins, and low-capital intensity.

For medical device companies, COVID-related headwinds are mostly in the rearview mirror, and procedure volumes are improving. We continue to think medical device companies will see increasing demand driven by an aging global population and a higher disease burden from chronic diseases. We have investments in companies with innovative devices for sleep apnea and diabetes, among other areas. For the most part, our investments are in companies addressing non-elective procedures, which makes them less likely to be deferred in a recession.

Managed care companies have had a rough start to 2023 due to a variety of issues, including heightened regulatory scrutiny of the Medicare Advantage program and the Pharmacy Benefit Manager industry and less favorable Medicare Advantage rates for 2024. Despite these headwinds, we continue to think the long-term fundamentals of the managed care companies we own are strong, and the stocks are now trading at depressed valuations in our view, setting them up for attractive long-term returns.

Overall, our long-term outlook for Health Care remains bullish. Innovation in the sector and the themes in which we have been investing are very much intact. We believe the Fund includes competitively advantaged growth companies with pricing power, strong management, and excellent balance sheets.

As always, I would like to thank my colleague Josh Riegelhaupt, Assistant Portfolio Manager of Baron Health Care Fund, for his invaluable contributions to the Fund.

Thank you for investing in Baron Health Care Fund. I remain an investor in the Fund, alongside you.

Sincerely,

Neal Kaufman Portfolio Manager

1 The Russell 3000® Health Care Index is an unmanaged index representative of companies involved in medical services or health care in the Russell 3000 Index, which is comprised of the 3,000 largest U.S. companies as determined by total market capitalization. The S&P 500 Index measures the performance of 500 widely held large cap U.S. companies. All rights in the FTSE Russell Index (the “Index”) vest in the relevant LSE Group company which owns the Index. Russell® is a trademark of the relevant LSE Group company and is used by any other LSE Group company under license. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. The indexes and the Fund include reinvestment of dividends, net of withholding taxes, which positively impact the performance results. The indexes are unmanaged. Index performance is not Fund performance; one cannot invest directly into an index.

2 The performance data in the table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

3 Not annualized.

Investors should consider the investment objectives, risks, and charges and expenses of the investment carefully before investing. The prospectus and summary prospectus contains this and other information about the Funds. You may obtain them from the Funds’ distributor, Baron Capital, Inc., by calling 1-800-99BARON or visiting www.BaronFunds.com. Please read them carefully before investing.

Risks: In addition to general market conditions, the value of the Fund will be affected by investments in health care companies which are subject to a number of risks, including the adverse impact of legislative actions and government regulations. The Fund is non-diversified, which means it may have a greater percentage of its assets in a single issuer than a diversified fund. The Fund invests in small and medium sized companies whose securities may be thinly traded and more difficult to sell during market downturns. Portfolio holdings are subject to change. Current and future portfolio holdings are subject to risk.

The discussions of the companies herein are not intended as advice to any person regarding the advisability of investing in any particular security. The views expressed in this report reflect those of the respective portfolio manager only through the end of the period stated in this report. The portfolio manager’s views are not intended as recommendations or investment advice to any person reading this report and are subject to change at any time based on market and other conditions and Baron has no obligation to update them.

This report does not constitute an offer to sell or a solicitation of any offer to buy securities of Baron Health Care Fund by anyone in any jurisdiction where it would be unlawful under the laws of that jurisdiction to make such offer or solicitation.

BAMCO, Inc. is an investment adviser registered with the U.S. Securities and Exchange Commission (SEC). Baron Capital, Inc. is a broker-dealer registered with the SEC and member of the Financial Industry Regulatory Authority, Inc. (FINRA).

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here