Main Thesis & Background

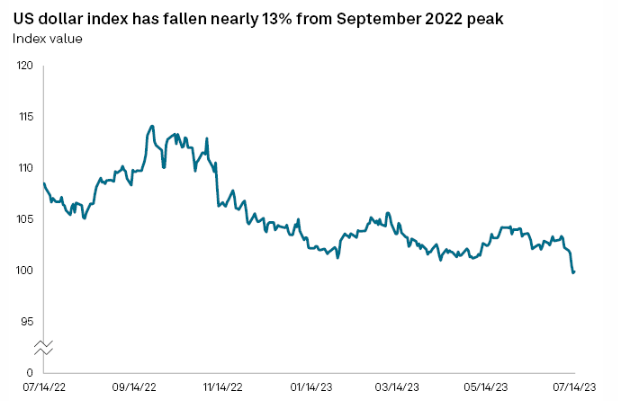

The purpose of this article is to evaluate the reasons behind the decline in the US dollar (USD), whether or not that trend will continue, and a few ways readers can approach this thesis with their investments. This has been an interesting topic, leading me to write an article on it, because the Federal Reserve here in the US has been aggressively hiking interest rates. This would typically cause the price of a currency to rise, yet we have seen some general weakness over the past 8 – 10 months from the USD against other major world currencies:

US Index (S&P Global)

If this seems surprising, I would surmise you are not alone with that sentiment. In this review I will focus on the why behind this development, the reasoning for my outlook that the USD will keep falling, and a few ways to capitalize on this trend if indeed it does continue.

Expectations Matter More Than Current Actions

The premise here is to understand why the USD is falling even as the Fed hikes interest rates. I think this is critical to understanding investing in general. The market cares more about what will happen in the future, as opposed to what is happening right now. That can be hard to reconcile at times, but we see it in equities, bonds, and even the value of the dollar.

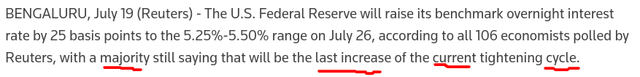

Case in point is the USD right now. The Fed has continued to increased interest rates throughout 2023 and even more recently hiked again this past week.

This was in-line with expectations, with many investors convinced this was the “final” rate hike from the Fed in this cycle, as a poll from Reuters illustrates:

Reuters Survey (Reuters)

Yet, as the prior paragraph showed, the USD is falling in value even as rates have increased. How can this happen? This is mostly due to where investors believe rates will ultimately end up over the next year. Despite rates being markedly higher and another (potential) hike on the way, economists and investors as a whole are of the belief this past July was it.

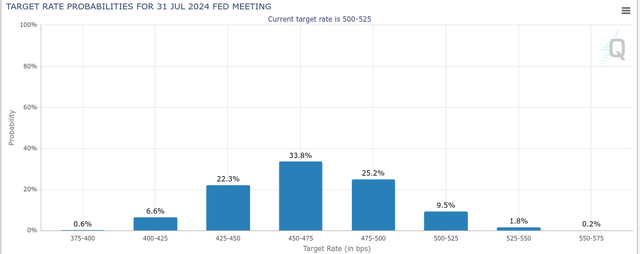

But this still doesn’t tell us the whole story. We can understand from this why the USD may not be rising. If the market has baked in the last of the Fed rate hikes, then it would stand to reason that the value of this currency would at least be stable. But the market has done more than that. It has started to anticipate cuts in 2024, as evidenced by the CME FedWatch Tool – which tracks investor sentiment on interest rate movements. The bottom-line is that this time next year the Fed’s benchmark rate is expected to be lower than it is right now:

CME Fed Watch (July 2024) (CME Group)

What we need to take away from this is that the “glory” days of the USD are expected to be coming to an end. After an aggressive rate hike cycle that began in 2022 that pushed the USD up in value markedly against currencies around the globe, times ahead suggest moderation. If the Fed really is “done” after the expected July hike and begins to slowly unwind this tightening cycle, there is not a strong catalyst for further gains in the USD.

While the recent decline may have been a bit too aggressive – setting up the possibility of a relief rally – the longer term trend should be to expect some sort of cooling off period for the USD. This would be in-line with historical norms and should probably be the base case unless we see some fundamental macro-changes.

Inflation Falling Faster Here Than Elsewhere

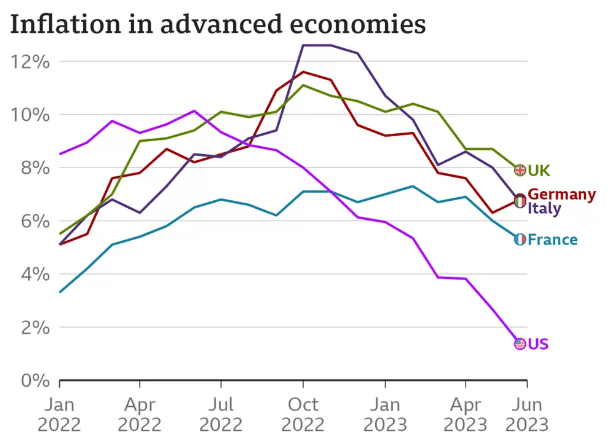

The prior paragraph touches on the background for why the USD may fall in isolation. But that again only touches on part of the story. We have to remember currencies are all about relative value. Can the USD buy more or less of another foreign currency. That is what drives the value. So the Fed’s movements, while critical, still must be put into perspective against what other central banks are doing.

This is again why we see the USD falling despite a current rate hiking cycle. It is not just about expectations here at home – but also about what other countries are going to be experiencing. In this light, we see an even stronger case for why the USD may have further to fall. This is because while inflation has been coming down in most corners of the world, it is actually declining faster in the United States. Other developed nations, especially in Europe, are experiencing stickier and more persistent inflation:

Harmonized ICP (EuroStat)

This suggests the ECB and other central banks like the Bank of England may have more work to do than the Fed does here at home. So, again, if the Fed is nearly done with its rate hiking cycle then that is quite dovish if other countries need to continue on a more aggressive path deeper into 2023 or even 2024. The net result is those nations are going to see their currencies rise as interest rates go up, pressuring the value of the USD which is expected to see end of its hiking cycle.

Of course, this is simply a prediction, not a guarantee. Nobody knows when a cycle will begin, end, or how it will ultimately compare to another country’s. There are many variables at play. But if we look to inflation as a guide, we see America is in a more fortunate spot. That suggests the Fed has more wiggle room and an excuse to be patient. While this may be good for the country and/or consumers overall, it is likely to put downward pressure on the dollar.

Despite (Or Because Of) Hikes, Outlook Weakens

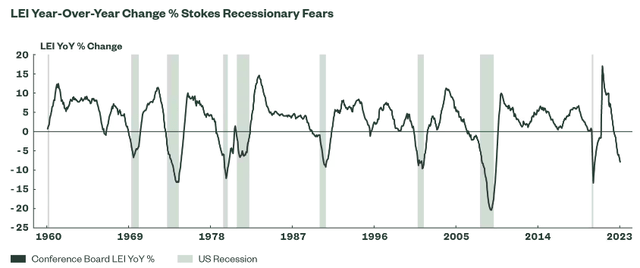

Another point to consider with respect to the USD is the outlook for future economic growth. While the Fed has embarked on a rate hiking plan to cool the economy (namely inflation), the net result may be too much cooling. As growth gets stifled, there has been a very real risk of a recession. This has been the mantra for a long time and the reality is the outlook for a recession keeps getting pushed back. But leading economic indicators keep projecting weakness despite an economy that has proved resilient over a difficult two-year stretch:

Leading Economic Indicators (Change) (Conference Board)

The simple reality is that the economy can only grow for so long. We eventually have to have some sort of pullback or recession. While economic indicators are not a perfect science, such large drops often act as precursors to a recession and this time around is probably not an exception.

This is relevant because if we do see a recession in the US it should have a two-pronged effect. Inflation will drop and the Fed will switch to a more dovish policy at a much quicker rate. Both of these conditions would result in a weaker USD, all other things being equal.

How To Play It – Part 1: Gold

Now that we understand the dollar’s drop, why it has been happening, and why it could continue, the next question is: “so, what?”. How does an investor make sense of this and, even more importantly, profit from it?

At this juncture I might again reiterate there is no crystal ball or “sure thing”. There are fundamental ways investors can profit from a declining USD and these are generally time-tested. But there are two key variables to always emphasize:

1) The USD may not decline in value and

2) Past performance is never a guarantee of future results.

Please keep these both in mind when performing portfolio allocation.

Those disclaimers notwithstanding, there are some strategies I would recommend with this backdrop. The first is to increase exposure to precious metals, with my favorite being gold. This is an asset that often serves as a potential safe-haven and it is a global strategy. If there is unrest, uncertainty, or volatility anywhere in the world – US included – that can often be a catalyst for demand. That is one key reason I generally like this metal over many others. It has a long history to support it, and it is not country-specific. Global investors and central banks often buy/demand it, and that is comforting to know.

Even still, we should be mindful of the fact that this thesis is not new. Gold has had a strong 2023 already on the expectation the Fed will slow down (the recent “pause’ by the Fed at their last meeting reinforced this). Further, continuing unrest in Europe and elsewhere has proven there is merit to holding metals and other hedge assets. The net result has seen gold rise to within striking distance of its five-year high. That should solicit some caution:

Gold / US Dollar Spot (CNBC)

This is not meant to be contradictory. I will point-blank say I am a gold bull here and believe it has a strong investment thesis at this moment. But that does not mean there aren’t risks – and chief among those risks is the fact that gold has already been rising sharply. Investors may have “missed the boat” so to speak and that presents plenty of downside risk if the trends I discussed earlier in this review do not pan out. Gold could be due for a painful correction in that case and that amplifies the risk-reward proposition here.

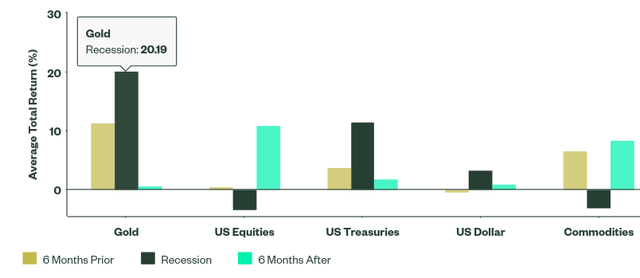

But I go back to my recession concern. If central banks do tighten to the point where economic growth contracts, gold is generally a good place to me. While equities and commodities tend to fall during recessions, sectors like metals and bonds often out-perform. In fact, if we look at gold’s average performance during a recession we see it vastly beats out many popular categories:

Sector Performance (Recessions) (Morningstar)

What this conveys to me is that gold is a time and battle-tested asset that is ripe for strong performance in exactly the type of environment I am anticipating over the next 12-18th months. While gold’s recent rise has been managing expectations to a degree, I still see a bull case going forward.

*I own the iShares Gold Trust ETF (IAU) and have owned the Sprott Physical Gold and Silver Trust (CEF) in the past. I would recommend that fund and/or the Sprott Physical Gold Trust (PHYS) as options for this idea.

How To Play It – Part 2: Quality/Dividends

For those who may not want gold, or simply want to diversify, there are thankfully other options for difficult markets. Equities as a rule can often benefit from falling inflation and a falling USD – especially those large-cap companies that earn some revenue overseas and in those local currencies. However, the caveat is that if inflation or the dollar fall too much and signal contract or recessions, equities can suffer. So these points are positive catalysts only to a point.

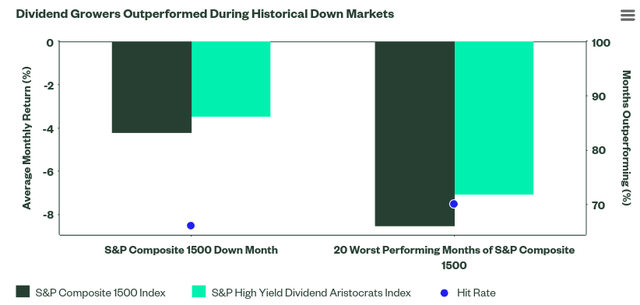

But we must also remember that not all “equities” are created equal. Stock investing can mean a plethora of things. For me it means mostly large-cap, U.S. investing, along with some developed world exposure. For others it could mean small-caps, growth, emerging markets, or any other strategy. The good news is that quality dividend players, my preferred investment strategy, often perform relatively well in weaker economic climates. This speaks to their resiliency, the need for income by investors, and their relative attractiveness compared to “weaker” companies.

The good news for me here is that my strategy of quality dividend is precisely the type of strategy that beats the equity market (as measured by the S&P 500) during periods of distress:

Dividend Growers Out-Performance (State Street)

My conclusion here is to continue to add to quality dividend-payers despite a weakening outlook for U.S. equities. There very well could be losses on the way but they should be minimized compared to other equity strategies. Of course this is not foolproof, but that is why I am considering adding to bonds (mostly munis) and assets like gold to complement this strategy in the second half of the year.

*For quality dividends, I own the Schwab U.S. Dividend Equity ETF (SCHD), the iShares Core Dividend Growth ETF (DGRO), and the SPDR S&P Dividend ETF (SDY) and would recommend all three.

Bottom-line

The point of this review was to articulate the performance of the USD, why it has been falling, why that could continue, and how investors could make that work to their advantage. I see a backdrop where the USD’s decline does continue compared to other major currencies. To that effect, I see a favorable environment both for quality dividend payers and precious metals – gold in particular. For those who already have enough exposure to these ideas, I say “well done”. But for those who are concerned about where the market may be headed in the second half of 2023, I think consideration of these strategies could serve you well at this time.

Read the full article here