Oracle Corporation (NYSE:ORCL) is successfully harnessing the momentum of the rapidly growing cloud computing market. Its exceptional services and the high demand in this sector are fueling its prospects for a promising market forecast. Aided by the transformative impact of Artificial Intelligence (AI), Oracle is carving out a prominent position in this rapidly evolving sector, promising long-term gains. This piece provides a detailed technical analysis of Oracle’s stock price, aiming to discern its forthcoming trajectory and identify potential investment opportunities for long-term investors. Currently, the stock price is trading at the zenith of a long-term resistance zone, implying that any market downturn could represent a lucrative buying opportunity.

The Resurgence of Oracle in Cloud Computing and AI

Oracle’s cloud computing capabilities and the strong demand for this segment are primary factors that are contributing to its potential bullish market outlook in the long term. AI is reshaping investment trends, and Oracle’s growing prominence in this sector positions it as a strong contender for long-term gains. Despite having been known for underperformance, Oracle’s ERP software system has proven to be a mainstay, offering essential services for manufacturing businesses. However, the cloud segment, a less-recognized facet of the company, has seen substantial growth in recent years and appears to be the primary force pushing the company upwards.

Oracle’s clientele includes AI giant NVIDIA (NVDA), which employs Oracle’s products due to their high performance and cost-effectiveness in GPU cluster technology. The ability to host up to 32,000 GPUs in one cluster, is certainly a testament to Oracle’s strength and potential. The growth seen in cloud infrastructure, which saw a 76% rise in revenue year over year, while the total cloud sales grew by 54%, signals a strong potential for Oracle’s long-term performance. Such promising trends underline Oracle’s prowess in cloud technology, painting an optimistic picture for sustained growth and enhancing its attractiveness to long-term investors.

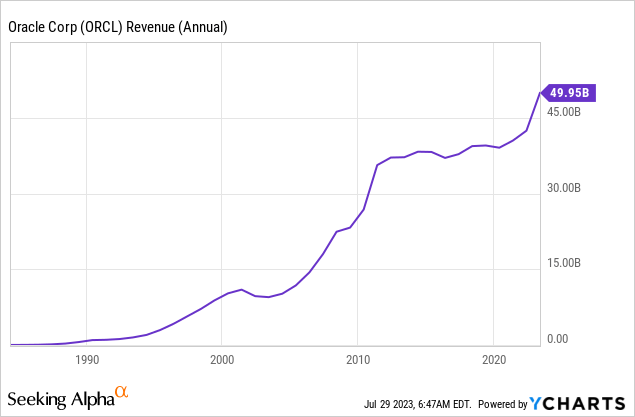

However, Oracle’s future success is reliant on its ability to continue innovating and leveraging its strong points, primarily the cloud segment, while addressing the slower growth in its other business segments. If Oracle can successfully navigate this, the company has the potential to surprise skeptics and make a bullish impact in the long term. Despite the challenges, Oracle’s stronghold in AI and cloud computing infrastructure should not be overlooked as these areas continue to expand and transform the tech industry landscape. As illustrated in the chart below, Oracle garnered a total revenue of $49.95 billion in 2023, indicating a solid foundation for future profitability.

Investment Opportunities Amidst Oracle’s Strong Resistance Phase

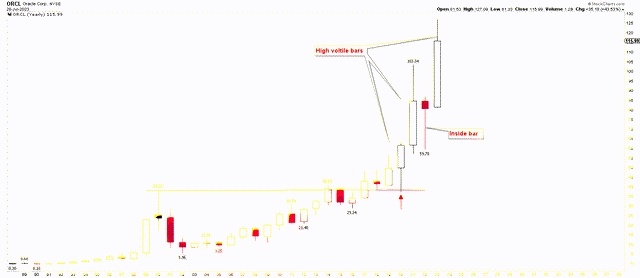

Oracle’s technical outlook presents a compelling bullish narrative, as the yearly chart below illustrates. The long-term red resistance line in the chart was overcome in 2017, sparking a consistent rise in value thereafter. A significant shift occurred when the price dipped in 2020, touching the once-resistance-now-support red line. This precision strike on the support line was met with a strong upward rebound, shaping a potently bullish hammer candlestick on the yearly chart. This 2020 hammer was the catalyst for a vigorous Oracle rally, yielding substantial price fluctuations in subsequent years.

Oracle Yearly Chart (StockCharts.com)

The correction in 2022 brought about an inside bar formation, when breached in 2023, incited a vigorous rally that reached an all-time high of $127.54. This 2022 inside candle breakout bore bullish implications, suggesting that the market is likely to sustain an upward trajectory in the long term. However, the pronounced volatility observed in 2021 and 2023 suggests potential fluctuations before the market continues its upward momentum. Nevertheless, any market correction will likely be perceived as a buying opportunity for long-term investors.

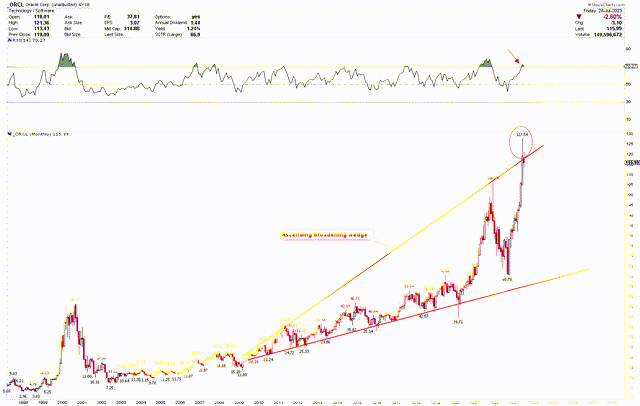

The monthly chart below for Oracle offers a closer look at the market situation. Currently, the market is trading at a strong resistance area delineated by ascending broadening wedge patterns—typically seen in highly volatile markets. Trading at the upper end of this range suggests an impending market correction. Interestingly, this resistance is also discernible in the RSI.

Oracle Monthly Chart (StockCharts.com)

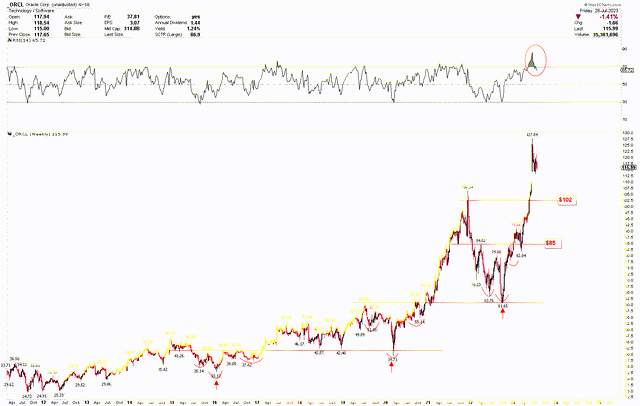

The weekly chart below emphasizes the significant levels where the market has consistently formed its base. It is noteworthy that Oracle forms inverted head and shoulder patterns before each new rally, and after each rally, the market retraces to the breakout point of the previous inverted head and shoulder pattern. This typically attracts new buyers and stimulates investment in Oracle.

Oracle Weekly Chart (StockCharts.com)

The above chart shows that the 2016 base formation was breached in 2017, triggering a sharp rally. After this rally, the market retracted to the $39.71 support during the Covid-19 pandemic—the breakout point of the previous rally. Yet again, an inverted head and shoulder pattern formed during 2020, which was breached in 2021, igniting another rally to reach $106.34. After touching this level, the market corrected downwards back to the breakout point at $61.65 in 2022, marking another base to reach an all-time high of $127.24. While the peak in Oracle is yet to be confirmed, and the market could still rally further, an optimal entry point would likely be during a market correction. The weekly chart suggests strong support around $102 and $85, where investors could potentially capitalize on Oracle stock for long-term investments.

Market Risk

The success of Oracle in the future is significantly hinged on its capacity to continuously innovate and optimize its strengths in the realm of cloud computing. Any faltering in its performance or a slowdown in growth within this key sector could present substantial threats to the overall progression of the company. Adding to these potential risk factors, Oracle’s stock has manifested considerable volatility during 2021 and 2023, indicating potential market instability that may arise before the market resuming its uptrend.

At present, Oracle’s market standing aligns with a strong resistance area as depicted in the monthly chart. Such resistance zones are commonplace within highly volatile markets and often serve as precursors to potential market corrections. Yet, given Oracle’s current market resilience, there’s potential for further advancement before any significant market correction eventuates.

Bottom Line

In conclusion, Oracle, with its growing prominence in the cloud computing and AI sectors, continues to demonstrate potential for long-term gains. Its continued innovation and the ability to leverage its strengths, primarily in cloud computing, coupled with consistent growth, underline its potential as a stable investment opportunity. The technical analysis further supports a positive forecast, suggesting a continued climb in performance, despite the likelihood of intermittent volatility and potential market adjustments. However, Oracle’s stock price is navigating a formidable resistance area, as highlighted by the ascending broadening wedge pattern. The yearly chart, representing yearly candles for 2021 and 2023, attests to this heightened volatility. Nevertheless, the long-term forecast remains optimistic, positioning any market correction from this stage as an advantageous purchasing opportunity for those with long-term investment plans. It’s crucial for investors to closely monitor this key area, as a breakthrough above $127.54 may suggest a further appreciation in Oracle’s value. Conversely, any market correction steering towards $102 and $85 should trigger serious contemplation among long-term buyers.

Read the full article here