SoFi Technologies (NASDAQ:SOFI) will report fiscal second-quarter earnings before the market opening bell on Monday. Going by SOFI stock reaction to quarterly earnings in the last few quarters, it is reasonable to expect a major move on July 31. In my opinion, the magnitude of the move will largely be determined by the management’s discussion about the potential impact of the resumption of student loan repayments. Almost two months ago, I thought the company was lacking a key earnings catalyst despite the improving business conditions, and the stock has continued its ascend by surging 40% higher since my previous article. On the back of the recent gains, I believe SoFi is no longer attractively valued. I am downgrading my rating for SOFI stock to sell from hold.

SOFI Stock Is Set For A Big Move

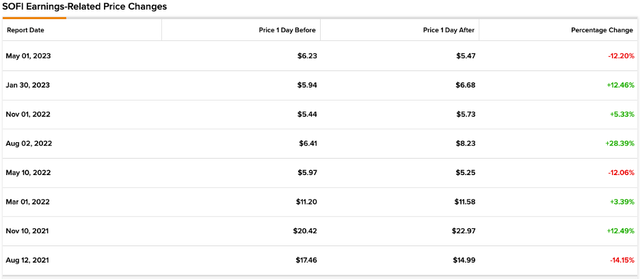

In 6 of the last 8 quarters, SoFi stock registered double-digit moves following the release of earnings reports.

Exhibit 1: SOFI earnings-related price changes

TipRanks

Based on a couple of reasons, I believe a platform is set for SOFI to react strongly to the upcoming earnings report as well.

First, SoFi stock has surged more than 110% this year, erasing some of the losses recorded in the last couple of years. Many investors accumulated shares at a deep discount to the current market price not so long ago, which gives them the opportunity to book gains following the earnings report. This may create substantial downward pressure on SOFI stock – most likely a temporary one – following the earnings report.

Second, Wall Street analysts covering SoFi has not been actively engaging in discussions about the impact of the resumption of student loan repayments ever since the passing of the debt ceiling deal. However, I believe this is about to change with the upcoming earnings call as the management will give color on their expectations alongside the most recent data for the student loan refinance business. Depending on the commentary of Wall Street analysts, SoFi stock may move strongly in either direction following earnings. I expect analysts to strike a cautious stance on SoFi given the recent run-up in stock prices. Last month, Piper Sandler, Oppenheimer, and BoFA Global Research downgraded SoFi stock based on valuation despite projecting stellar growth. As illustrated below, for the first time since 2021, SOFI stock is trading above the consensus price target, which is another reason to believe that analysts will be cautious going forward.

Exhibit 2: Price target vs stock price

Seeking Alpha

Based on these reasons and the historical market performance following earnings announcements, I expect the second-quarter earnings report to lead to notable volatility in SOFI stock tomorrow.

The Outlook Is Promising But Not As Rosy As It Sounds

Several long-term tailwinds are working in favor of SoFi, including the increasing popularity of online banking services, the company’s diversified portfolio of products, and the extensive operating history of the company going back 10 years which gives SoFi a know-how advantage over its peers and access to invaluable data. I expect these tailwinds to help SoFi turn profitable in the coming years, and the company may benefit from an expansion in valuation multiples as well given that Fintech companies that thrive are likely to be valued similarly to profitable tech companies – not financial services companies – in the long run. All this said, I believe there is a disconnect between the economic reality facing SoFi and its market value today.

As I discussed in my previous article, the increasing number of student loan borrowers who are already finding it difficult to keep up with repayments of other debt accumulated over the past couple of years is a threat to the thesis that SoFi will be a big winner of the expected resumption of student loan repayments. This is because the deterioration of their credit quality will make it difficult for SoFi to serve these clients. I will not dive deep into the data found by the New York Fed in this article as I presented the most important data points in my last article.

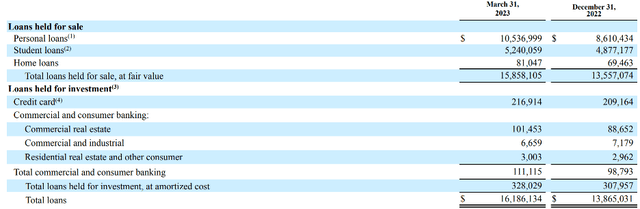

SoFi is likely to face a new challenge amid the continued slowdown in economic growth and rising interest rates. The company’s personal loan business has grown exponentially in the recent past. As illustrated below, personal loans account for the bulk of loans held by SoFi for sale. The company’s aggressive expansion into personal and other types of loan categories is an encouraging sign from a long-term perspective as a diversified product portfolio will help the company tap into new market opportunities. However, this is a business that may come under pressure in the coming months.

Exhibit 3: Loans held for sale as of March 31, 2023

Form 10-Q

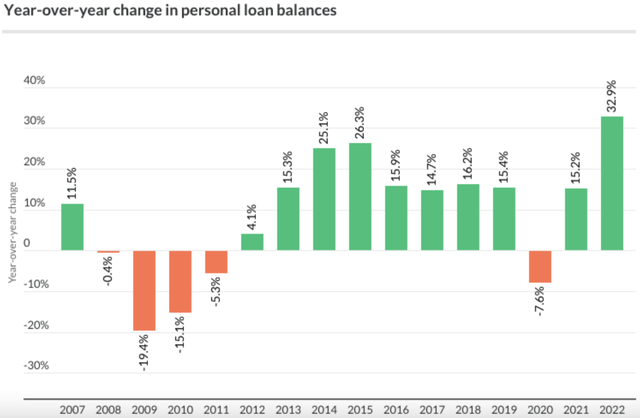

The demand for personal loan products has remained robust since 2021 with favorable credit conditions promoting this growth. After declining 7.6% in 2020, personal loan balances in the U.S. recovered sharply in 2021 and 2022. However, as illustrated below, America has seen notable declines in personal loan balances during difficult economic conditions.

Exhibit 4: YoY change in personal loan balances

LendingTree

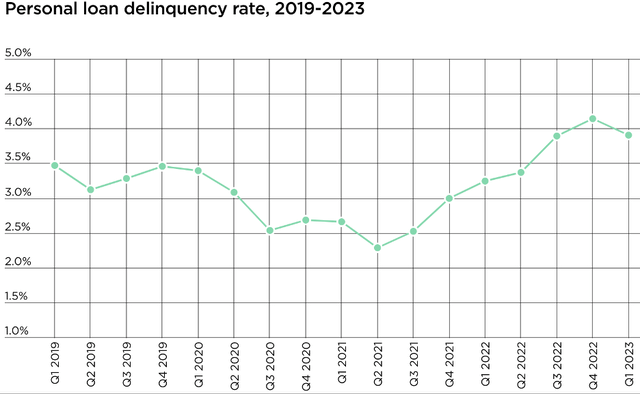

Although recession fears have taken a back seat this year amid the strong comeback of tech stocks, America is not out of the woods yet. With the Fed continuing its battle against inflation, persistently higher interest rates may lead to difficult economic growth conditions in the coming quarters. In such a situation, SoFi’s personal loan business may come under pressure. A notable increase in personal loan delinquency rates will prove as a major obstacle to the performance of SOFI stock as a deterioration in investor sentiment is a certainty amid such a development. As illustrated below, delinquency rates have trended higher since 2021, coinciding with interest rate hikes.

Exhibit 5: Personal loan delinquency rate

Nerd Wallet

If the personal loan business takes a hit in the coming quarters, it has the potential to negate some or most of the expected positive impact from the resumption of student loan repayments. This risk, in my opinion, is not accurately reflected in SoFi’s market value today.

In addition, earnings revisions are yet to meaningfully move higher, which poses a risk to the current momentum behind SOFI stock.

Takeaway

SoFi stock is likely to see a notable uptick in volatility when the company reports second-quarter earnings. Although I believe the company has a long runway to grow, I believe some of the main risks facing the company are not accurately reflected in the current valuation of the company. Given that the base-case long-term expectation is for SoFi to be as successful as a leading banking institution in the country, I do not find it rational to invest in the company at significantly elevated multiples compared to leading financial services companies. Taking into account this risk, the expected headwinds for the company’s personal loan business, and the overly optimistic expectations for the student loan business, I do not find SoFi’s valuation attractive today.

Read the full article here