Granite Point Mortgage Trust (NYSE:GPMT) is a mortgage REIT, which means that it’s essentially a capital provider for real estate projects. The way it works is as follows. GPMT provides a loan a to an office or multifamily property and the loan is secured by that property. GPMT collects interest on the loan and if the borrower defaults on the loan, GPMT gets to keep the property free of charge.

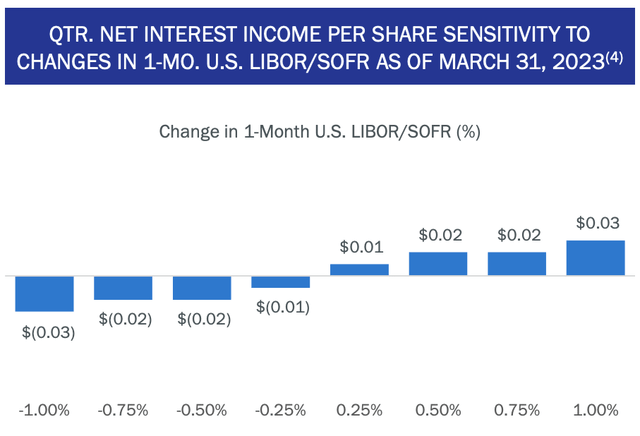

This is a pretty safe and predictable business under stable economic conditions, but when the economy weakens and interest rates increase, it becomes quite risky. This is because almost 100% of GPMT’s loans are floating rate. That means that as interest rates increase, GPMT gets to charge higher interest on their loan, temporarily boosting their interest income. This is nicely illustrated by the sensitivity below:

GPMT Presentation

I say temporarily, because high interest rates and weaker economic conditions also increase the risk that anyone of borrows will default. When that happens, the mREIT gets the foreclosed property, but its cash flow suffers because it no longer collects on that loan and it also may have to incur additional costs to make improvement to the distressed property to be able to sell it at a reasonable price.

Analyzing mREITs at this time is therefore all about determining how likely defaults are. In particular, because of the recent collapse of commercial real estate value, we especially care about risks associated to default of distressed buildings as those are likely to result in greater losses.

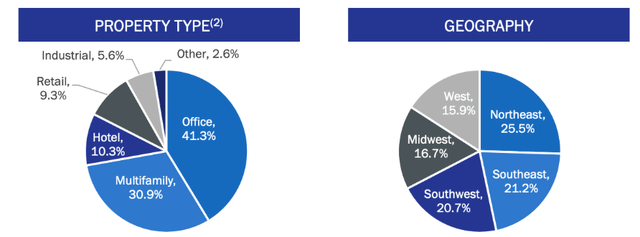

Granite Point Overview

First off, it’s important to note that Granite Point has a high office exposure of over 40%. This is by far the number one reason why the stock has sold off so much. Office is followed by much safer multifamily at 30% and hotels at 10%.

GPMT Presentation

By far, the best way to judge how risky a portfolio is to look at management’s action. Often, management knows that defaults are coming and tries to prepare by increasing their credit loss reserve. GPMT has been doing exactly that as they have increased their reserve from essentially zero a year and a half ago to $133 Million, representing almost 3% of their entire loan book. That may not seem like a lot but it’s $2.50 per share (which is almost half of the market cap since the stock trades at $6.0 per share).

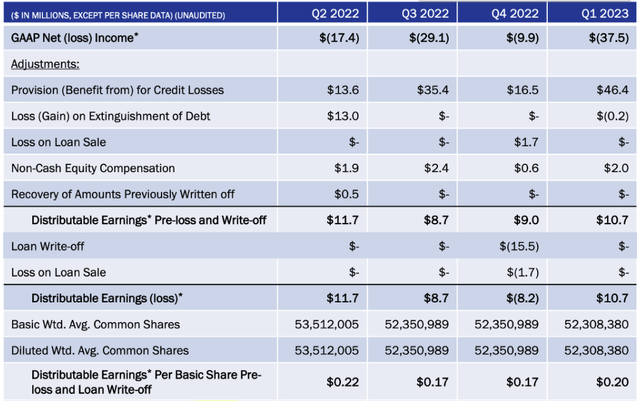

This tells me that management is worried that some loans will default and actually one default has already taken place in Q4 2022. As a result of a default on their $114 Million loan, the company took a $15.5 Million write-off in Q4 2022 as seen in the table below.

GPMT Presentation

And the thing is that the company isn’t even generating enough to cover its dividends. The dividend stood at $0.25 per share from Q1 2022 to Q3 2022 and was cut to $0.20 in Q4 2022. That totals $0.95 per share in total dividends throughout the year while distributable earnings pre write-off totalled just $0.80 per share. If we include write-offs distributable earnings totalled just $0.28 per share!

During Q1 2023, the picture improved slightly as distributable earnings came in at $0.20 per share, equal to the dividend paid. But I worry that a single loan default could again have a significant negative impact on distributable earnings and may lead to another dividend cut. As always, a dividend cut would most likely lead to a decrease in stock price.

And with 5 loans that are already 5-rated and many more 4-rated, it’s easy to imagine at least one of these loans will struggle, unless interest rates decrease fast and the commercial office market magically comes alive.

A potential dividend cut doesn’t automatically disqualify an investment but should be taken into account.

Valuation

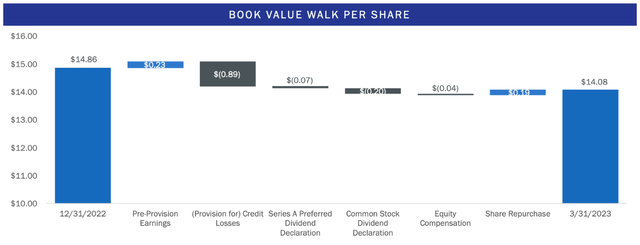

With regards to valuation, the stock is of course cheap and trades deeply below book value, which stands at $14.08 per share. The book value here is equal to the sum of all outstanding loans, minus the CECL reserve, minus any leverage that the company has.

GPMT Presentation

At $6.0 per share, the stock trades at 43% of book value. That sounds interesting, but the thing is that for that value to be unlocked we would need a series of catalysts. Most likely the Fed would have to cut interest rates soon, work from home would have to become a thing of the past and offices would have to make a strong comeback. That’s a lot of ifs.

Personally, I think it’s more likely that a couple of loans will default way before the bullish scenario above will materialize. I expect a dividend cut for Granite Point soon, perhaps as soon as Q2 2023 earnings next week, that’s why I rate the stock as a Hold for now. It’s already deeply discounted, which means a sell doesn’t make sense and the dividend cut risk is too high for a buy.

Things to watch for in earnings next week

Earnings which come out next week will give us much more clarity on the way forward. The dividend cut could come as soon as next week. If not, I’ll keep a close eye on the change to the CECL reserve which is a good proxy to management’s expectations of default and on the dividend coverage ratio. Any mention of downgrading of loans and/or a further increase to the CECL reserve will most likely lead to the recent rally fading.

Read the full article here