Dividend-growth investing is an excellent time-tested way to build capital steadily over time. However, there are nuances on how to implement the method, what echelon to target, and what ingredients to consider in order to minimize losses in case a dividend thesis does not live up to expectations, etc.

On Seeking Alpha, I have covered a few dividend growth-centered vehicles, with new names added to the list periodically. My goal is to provide a deep analysis of these portfolios to examine what investors should realistically expect from such ETFs. And today, I would like to take a close look at the First Trust SMID Cap Rising Dividend Achievers ETF (NASDAQ:SDVY) to check whether this vehicle is a good choice in the current environment.

Regarding strategy, SDVY has a mandate similar to the one of the First Trust Rising Dividend Achievers ETF (RDVY) which I covered in July 2021. The principal difference is the echelon targeted. Tracking the Nasdaq US Small Mid Cap Rising Dividend Achievers Index, SDVY focuses on smaller companies, while RDVY favors heavyweights.

According to the First Trust website, for the selection universe, the Nasdaq US Mid Cap Index and the Nasdaq US Small Cap Index are amalgamated, then REITs are removed. The rules are relatively stringent as liquidity, market cap, growth, and quality screens are applied. The index has no interest in micro caps, so those valued at less than $500 million are shown the red light. The dividend growth stories are checked to find those stocks that “paid a dividend in the trailing twelve-month period greater than the dividend paid in the trailing twelve-month period three and five years prior.” EPS growth is also assessed. Cash must cover no less than a quarter of debt. The TTM payout ratio must not exceed 65%. Stocks that have all these characteristics “are ranked by a combined factor of dollar dividend increase over the previous five year period, current dividend yield, and payout ratio,” and 100 names with the lowest aggregate rank form the index, “subject to a maximum of 30% from any one sector and 75% from the mid cap or small cap size classification.” An equal weighting is applied; the index is reconstituted once a year and rebalanced quarterly.

Examining value, quality exposure, and dividend growth stories

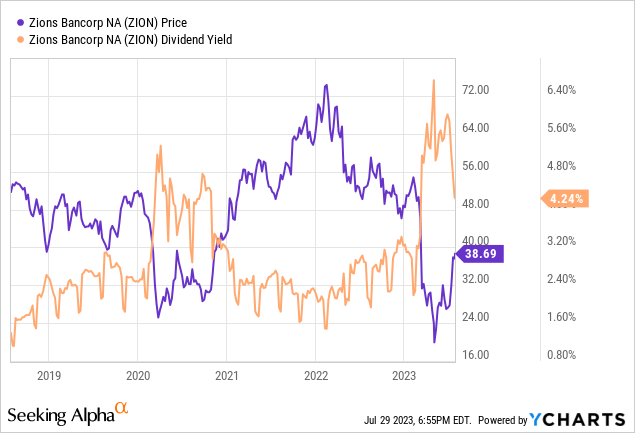

As of July 28, SDVY had a portfolio of 100 stocks, with the cohort of the major ten accounting for 11.6% thanks to the weighting schema. The key position with a 1.2% weight was Zions Bancorporation, National Association (ZION), a regional bank, offering a generous yield of 4.2% backed by a 10-year DPS growth story. It is worth noting that ZION’s relatively high yield is mostly the consequence of the share price losses inflicted by the (short-lived) banking crisis earlier this year; in the last 5 years, it was mostly below 3.2%, except for the coronavirus-torn 2020.

In my view, it makes sense to compare SDVY to another mid-cap equity echelon dividend vehicle ProShares S&P MidCap 400 Dividend Aristocrats ETF (REGL) regarding factor exposure; I previously reviewed REGL in May 2022, with a Hold rating. Let us look at my computations below:

| Metric | SDVY | REGL | Difference |

| Holdings | 100 | 49 | 51 |

| Market Cap | $7.05 billion | $7.46 billion | -$410 million |

| EY | 12.7% | 5.8% | 6.9% |

| DY | 2.4% | 2.5% | -10 bps |

| EPS Fwd | 4.7% | 7.8% | -3.1% |

| Revenue Fwd | 5.1% | 6.3% | -1.2% |

| Div Growth 3Y | 16% | 6.4% | 9.6% |

| Div Growth 5Y | 14.3% | 7% | 7.3% |

| Quant Valuation B- or higher | 46.9% | 24.3% | 22.6% |

| Quant Valuation D+ or lower | 24.8% | 46.3% | -21.5% |

| Quant Profitability B- or higher | 87.7% | 59.1% | 28.6% |

| Quant Profitability D+ or lower | None | 7.8% | -7.8% |

Created using data from Seeking Alpha and the fund

These vehicles might look similar as their weighted-average market capitalizations as well as dividend yields are almost on par, yet there are steep differences when it comes to valuation and dividend growth stories.

- SDVY is offering a much more appealing valuation profile with a more than 2x higher EY and also with a substantially larger exposure to stocks with a Quant Valuation grade of B- or higher.

- Here, it would be pertinent to note that SDVY favors financials (over 30%) and industrials (24.3%), which have contributed most to its earnings yield and value exposure overall. This is also the case with REGL as it allocated 25.8% to financials. However, it has no exposure to energy, mostly because mid-size oil & gas names suffer from wild cyclical swings, and thus they are mostly unable to raise their dividends consistently amid tough capital allocation decisions they face, and an S&P 400 dividend aristocrat status (backed by 15 consecutive years of increases) is unachievable for them. At the same time, SDVY has an over 10% allocation. So this partly explains the 2.3x difference in their EYs.

- SDVY’s growth exposure is smaller as illustrated by the EPS and revenue forward growth rates. However, its weighted-average dividend growth rates are way higher.

- SDVY beats REGL when it comes to quality as there are no stocks with a D+ Profitability grade or lower in its basket, at all. Interestingly, all SDVY holdings are profitable, which is not the case with REGL as over 10% of its net assets are allocated to loss-making names.

Does that mean SDVY is superior to REGL? There is a nuance. The mid-cap dividend aristocrat ETF easily beats its peer regarding consistency. More specifically, only 45.4% of SDVY’s holdings have a B- Quant Consistency grade or higher, while REGL has over 83%. So for investors favoring steadiness and more predictable dividend growth, an aristocrat fund is obviously a better option to consider.

Performance: beating a few peers but not the market

Below, I would like to compare the key performance metrics of the ETF and its peers I selected:

- REGL

- RDVY

- ProShares Russell 2000 Dividend Growers ETF (SMDV)

- WisdomTree U.S. MidCap Dividend Fund ETF (DON)

The iShares Core S&P 500 ETF (IVV) and SPDR S&P MidCap 400 ETF Trust (MDY) were added for better context. The table covers the December 2017 – June 2023 period as SDVY was incepted in November 2017.

| Portfolio | SDVY | IVV | MDY | REGL | SMDV | DON | RDVY |

| Initial Balance | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 |

| Final Balance | $14,943 | $18,503 | $14,835 | $14,425 | $11,506 | $13,887 | $17,638 |

| CAGR | 7.46% | 11.65% | 7.32% | 6.78% | 2.54% | 6.06% | 10.70% |

| Stdev | 24.13% | 18.04% | 21.62% | 16.73% | 17.20% | 21.61% | 22.14% |

| Best Year | 29.11% | 31.25% | 25.78% | 19.39% | 18.14% | 30.24% | 37.70% |

| Worst Year | -15.26% | -18.16% | -13.28% | -3.26% | -5.88% | -8.24% | -13.28% |

| Max. Drawdown | -33.92% | -23.93% | -29.63% | -24.53% | -24.71% | -35.96% | -28.28% |

| Sharpe Ratio | 0.35 | 0.62 | 0.36 | 0.38 | 0.14 | 0.31 | 0.5 |

| Sortino Ratio | 0.53 | 0.92 | 0.52 | 0.55 | 0.2 | 0.42 | 0.76 |

| Market Correlation | 0.9 | 1 | 0.95 | 0.89 | 0.82 | 0.9 | 0.9 |

Created using data from Portfolio Visualizer

Over the period concerned, as illustrated by the annualized return, SDVY outperformed all the peers selected except for RDVY. Unfortunately, it failed to keep pace with the market. Besides, the highest standard deviation in the group is a disadvantage not to be overlooked.

Final thoughts

SDVY relies on a quality screening process to build a small/mid-cap dividend achievers portfolio. The ETF has demonstrated strong performance since its inception, beating MDY, DON, and SMDV. It has exposure to a plethora of appealing dividend stories. At this juncture, the factor story together with remarkable dividend growth characteristics beneath the surface makes SDVY a vehicle to consider. Importantly, liquidity is more than healthy. Nevertheless, the one downside I should mention is its burdensome expense ratio of 60 bps vs. REGL’s 40 bps. Investors should pay attention to it before buying into SDVY as expenses are the top detractors from the long-term total returns.

Read the full article here