Investment Thesis

Roku (NASDAQ: NASDAQ:ROKU) achieved a double-digit growth for the first time since 3Q FY2022, primarily driven by a gradual rebound in overall ad spending. We also saw both Google (GOOG) and META (META) reported better-than-expected ad revenue in their recent earnings, leading to an increase in their stock prices in the aftermarket.

Although Roku’s 2Q FY2023 earnings report suggests a potential growth inflection, I still don’t see a clear signal of margin expansion and profitability breakeven in the near term. However, looking at the macro perspective, Roku, which is perceived as a non-profitable growth stock, is likely to benefit from the soft-landing narrative and lower inflation.

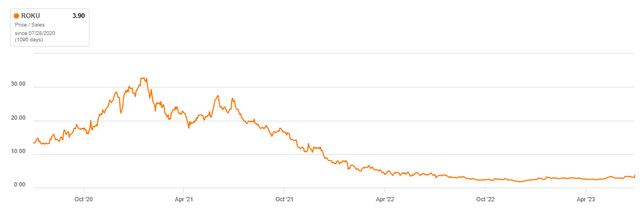

As long as Roku can maintain its growth acceleration momentum and achieve consistent double-digit revenue growth in the upcoming quarters, there is potential for an expansion in its valuation multiple. After a 30% post-earnings rally, its P/E TTM is still treading at 3.9x. Therefore, I still remain bullish on the stock.

2Q23 Takeaway

2Q23 Shareholder Letter

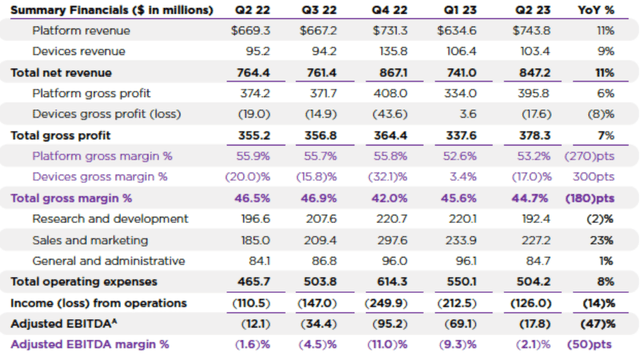

Roku shocked investors with a remarkable 30% rally after exceeding both revenue and GAAP EPS estimates. I think this positive price action stems from an impressive 11% revenue growth, which can be attributed to a 11% rebound in its platform revenue. This is a significant improvement as Roku’s platform revenue declined by 1% YoY in 1Q FY2023.

The double-digit growth reignited the growth optimism, reaffirming its status as a growth stock. However, we should be cautious that the company’s margins are still experiencing deterioration in this quarter.

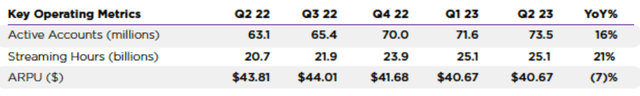

I believe that Roku’s primary focus lies in two areas: first, growing active accounts, and second, enhancing user engagement. In the near term, I think they are more important than prioritizing average revenue per user (ARPU) now. I will delve into more details in the following discussion.

2Q23 Shareholder Letter

According to past shareholder letters, Roku has consistently maintained at least 20% YoY growth on streaming hours and high teens YoY growth on active accounts. However, during the same period, this growth in key operating metrics didn’t directly translate into a substantial increase in revenue. This observation aligns with our earlier discussion, where the company prioritized growing active accounts and enhancing user engagement during the cyclical downturn in ad industry last year.

We saw Roku’s growth in ARPU started declining from 21% in 2Q FY2022 to -7% in 2Q FY2023, which negatively impacted revenue growth. I think this decline in ARPU is likely a result of intensified competition in ad market. Over the long term, Roku should effectively monetizing users to boost ARPU. I believe this will become a critical factor in driving up both top-line growth and valuation multiple.

In addition, regarding Roku’s guidance, the company forecasts a 7.1% YoY revenue growth in 3Q FY2023. However, they also see a -$50 million adjusted EBITDA, implying a -6% adjusted EBITDA margin. This indicates a further margin contraction despite the number being higher than the consensus. If the ad market continues to recover under the soft-landing narrative, it is possible that the company’s guidance is conservative and achievable.

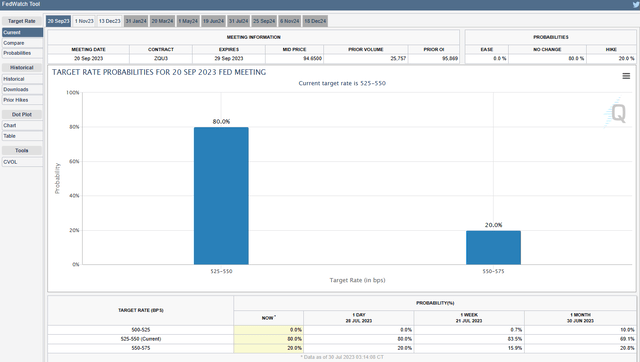

Additionally, while the management expects a modest growth in consumer spending, they remain concerned about a potential economic downturn despite some signs of recovery. The impact of the Fed’s 5% rate hikes last year could have significant impact on the U.S. economy. As I mentioned in my previous articles, the effects of monetary tightening typically manifest with long and variable lags, usually 6-24 months after the end of the hiking cycle. The market is currently priced in 80% of no further rate hike in the coming meeting. If inflation continues to trend downward, this could potentially signal the end of the current hiking cycle.

CME Group

What Could Go Wrong

In my opinion, the 30% post-earnings rally can be justified by three key conditions. Without these conditions, my bullish stance on Roku might face challenges, and this significant price reaction may not be reasonable.

Firstly, the market’s positive sentiment is largely based on the expectation of a soft-landing scenario in the economy. This means that there won’t be a severe recession in the near future, as economic data continues to show strength and resilience. In such an environment, there is potential for an acceleration in ad spending, which would benefit online streaming companies like Roku.

Secondly, the market has also factored in a less hawkish tone by the Fed, as headline inflation has been decreasing. The peak in interest rates can positively impact long-duration, non-profitable growth stocks like Roku. Given that Roku’s significant amount of FCF is expected to be generated over the long term, its valuation becomes highly sensitive to interest rates. If the market believes that the Fed won’t aggressively raise interest rates from current levels, stocks like Roku could have a relief rally.

Lastly, the market’s positive reaction might be influenced by a higher growth outlook for Roku. For example, the double-digit revenue growth seen in 2Q FY2023 is encouraging, and investors may expect a gradual and consistent growth reacceleration in the upcoming quarters, particularly in tandem with the recovery of the ad industry.

Valuation

Seeking Alpha

Roku’s near and mid-term outlooks indicate that the company is expected to remain unprofitable, with negative adjusted EPS and EBITDA. Furthermore, the company’s guidance suggests a breakeven in adjusted EBITDA by FY2024. Therefore, some valuation methods like P/E and EV/EBITDA are not suitable.

Let’s consider Roku’s P/S TTM. Although the stock was previously trading at a lofty valuation in FY2021, its valuation has significantly decreased from +30x since then due to a deteriorated growth outlook and substantial rate increases in 2022. Even after experiencing a 30% post-earnings rally, we can see the stock is currently trading at 3.9x P/S TTM, which is still 66% below its 5-year average. Therefore, I’m still optimistic about the stock’s upside momentum if the discussed conditions hold in the near term.

Conclusion

In sum, Roku’s remarkable 30% post-earnings rally, driven by a double-digit revenue growth due to ad recovery. This suggests a potential return to growth stock status, which created a positive market reaction. The company is on the right track to prioritize long-term growth by expanding active accounts and enhancing user engagement over ARPU. However, I still see challenges remain as Roku is expected to stay unprofitable in the near and mid-term with negative adjusted EPS and EBITDA. Roku’s P/S TTM is currently trading at 3.9x, still 66% below 5-year average. Lastly, I believe the stock’s upside momentum largely depends on a soft-landing scenario, Fed’s rate stance, and the company’s growth outlook. As long as these three conditions continue to hold, I maintain a bullish view on the stock.

Read the full article here