The Cruise Liner Investment Thesis Has Sailed

We previously covered The Royal Caribbean Cruises (NYSE:RCL) in November 2022, suggesting the minimal margin of safety due to the overly optimistic stock recovery from the July bottom. We had believed that RCL might lose its recovery steam, as the labor market had been too robust for the Fed’s previously hawkish stance.

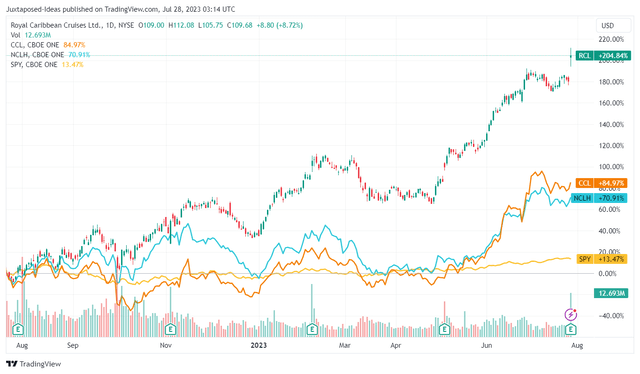

RCL 1Y Stock Prices

Trading View

For now, it appears that we have been proven wrong, with the cruise liner stocks outperforming the wider market and RCL leading the pack in recovery at +204.84% over the past year.

This is impressive indeed, with pent up demand remaining strong despite the rising interest rate environment, with the cruise liner’s FQ2’23 customer bookings and deposits still growing to $5.7B (+7.5% QoQ/ +35.7% YoY), well exceeding pre-pandemic FY2019 levels of $3.42B (+8.9% YoY).

Despite the raised prices, RCL’s load factor continues to improve to 105% (+3 points QoQ/ +23 YoY) by the latest quarter, nearing FY2019 levels of 108.1% (-0.8 points YoY), with the revenue per passenger cruise day also expanding by +16.6% above FY2019 levels.

Due to these optimistic developments, it is unsurprising that the cruise liner has recorded improved Net Yields of +12.9% compared to FQ2’19 levels and much improved EBITDA margins of 32.1% by the latest quarter (+10.3 points QoQ/ +26.5 YoY). The latter has well exceeded FY2019 levels of 30.3% (-0.4 points YoY), partly attributed to the moderating fuel costs.

With the RCL management continuously raising its FY2023 adj EPS projection to $6.10 at the midpoint, compared to FQ1’23 guidance of $4.60 and FQ4’22 guidance of $3.30, it is unsurprising that sentiments surrounding the stock has been euphoric, due to the massive improvement from FY2022 levels of -$7.50.

While its recovery remains a great distance away from the FY2019 levels of $9.54, we are not overly concerned yet, since it is entirely possible that we may see another raised guidance in the next quarter.

RCL’s Valuations Remain Lofty, With Its Execution Lagging Behind

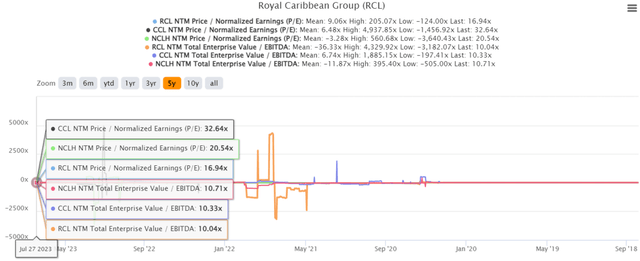

RCL 5Y EV/ EBITDA and P/E Valuations

S&P Capital IQ

However, RCL’s valuations remain somewhat inflated at NTM EV/ EBITDA of 10.04x and NTM P/E of 16.94x, compared to its pre-pandemic mean of 10.10x and 11.61x, respectively.

While the reopening cadence has been impressive, we are not that convinced yet, with the cruise liner peers’ valuations similarly elevated, including Norwegian Cruise Line Holdings (NCLH) and Carnival Corporation & plc (CCL).

For one, RCL is expected to record FY2025 revenues of $16.27B and adj EBITDA of $5.28B, suggesting the market analysts’ projection of a top and bottom line expansion at CAGR of +6.8% and +7.7% between FY2019 and FY2025, respectively.

These numbers only suggest a return to normalization instead of high-growth cadence, compared to its pre-pandemic levels of +8.8% and +12.5%, respectively.

On the one hand, investors must note RCL’s bloated long-term debts of $18.68B in the latest quarter (-2.1% QoQ/ +7.6% YoY). Its weighted average interest rate for total debt is also elevated at 7.16% (+0.81 points QoQ/ +1.07 YoY), naturally accelerating its annualized interest expenses to $1.42B (-1% QoQ/ +17.4% YoY).

Therefore, the expansion in the cruise liner’s EBITDA will be easily negated by the interest headwinds, resulting in impacted EPS performance, with the Fed still opting for a rate hike in the July FOMC meeting. Depending on when the Fed pivots and the banks follow suit, we may see the cruise liner’s prospects remain mixed, since 21% of its debts are exposed to variable rates.

On the other hand, only $3B of RCL’s debts will mature through FY2024, easily bolstered by the robust $3.7B in liquidity and $2.3B of annualized Free Cash Flow generated in the latest quarter.

For so long that the cruise liner remains operating cash flow positive, it appears that survival may not be an issue, especially due to the strength of the post-pandemic travel boom thus far.

However, investors may also want to temper their expectations, since we do not expect dividends and share repurchases to be reinstated anytime soon. The management has iterated its focus on deleveraging its balance sheet over the next two years, while increasing its expenses to prepare for China’s reopening from Q1’24 onwards.

So, Is RCL Stock A Buy, Sell, or Hold?

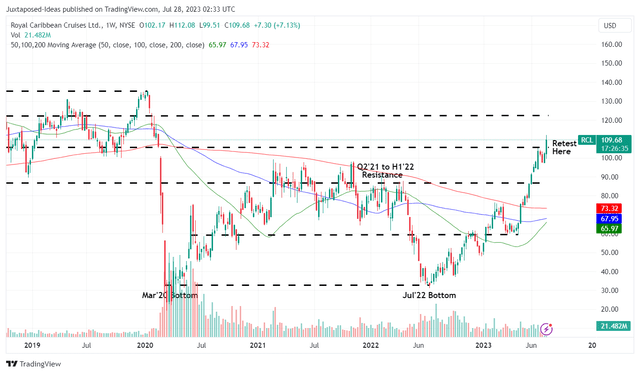

RCL 5Y Stock Price

Trading View

Assuming that this optimistic cadence continues, RCL investors may remain invested in the stock, since we expect these support levels to hold in the near term, with its financial performance likely to improve to pre-pandemic levels.

However, we do not recommend new investors to add here, due to the reduced margin of safety to our price target of $107, based on its normalized P/E valuations of 11.61x and the market analysts’ FY2025 EPS projection of $9.22.

With all of the growth already pulled forward, we prefer to rate the RCL stock as a Hold (Neutral) here.

Read the full article here