Shares of Alnylam (NASDAQ:ALNY) declined slightly when the company announced a collaboration with Roche (OTCQX:RHHBY) that covers zilebesiran, a development candidate for the treatment of hypertension. I believe it is a win-win deal, but more so for Alnylam as it retains good economics in the most important market – the United States, significantly reduces the cost of zilebesiran’s development and commercialization and provides upside from other territories where Roche will be in charge of selling zilebesiran.

Nonetheless, the stock declined after the deal announcement, but I believe the reason is actually the company disclosing the very long timeline for zilebesiran to reach the market. The two companies will conduct a cardiovascular outcomes trial (‘CVOT’) before submitting for approval. I previously thought there was a path to registration based on blood pressure lowering that would get zilebesiran to market much faster.

On top of the need to conduct a CVOT, Alnylam plans to start a new KARDIA-3 phase 2 trial to further characterize zilebesiran’s efficacy and safety profile before starting the CVOT trial. I believe these changes add at least five years to zilebesiran’s market arrival and that we should not expect zilebesiran to hit the market before 2033.

But it appears this was going to happen even without this deal and in that sense, it is great that Alnylam gets the cash upfront and significantly reduced development costs going forward.

Zilebesiran overview and clinical data to date

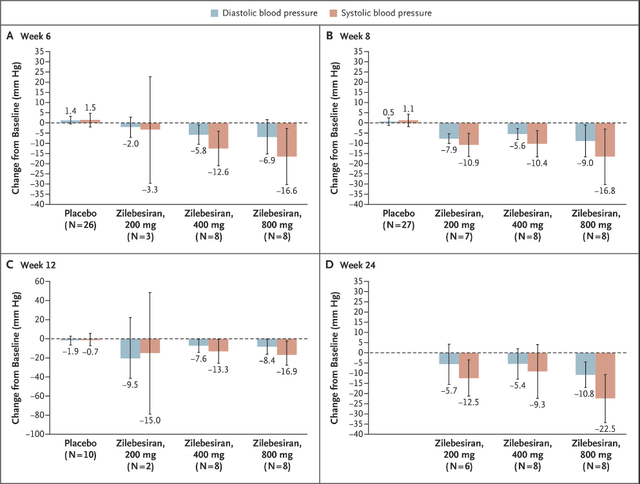

I liked zilebesiran (formerly ALN-AGT) from the first day I saw the preclinical data and those data have so far translated well to humans. This is a drug candidate in development for the treatment of hypertension and Alnylam has reported strong efficacy from the phase 1 trial, showing double-digit reductions in systolic blood pressure and near-double-digit reductions in diastolic blood pressure (and double-digit reductions in systolic BP at the highest 800mg dose).

The therapeutic hypothesis is that the liver-specific knockdown of angiotensinogen (‘AGT’) will reduce blood pressure (‘BP’).

The potential mechanistic advantages of zilebesiran are its liver-specific targeting that could improve renal safety versus ACE inhibitors and ARBs, and stable and durable silencing of AGT to address night-time BP, BP variability, and adherence problems.

In preclinical trials, AGT knockdown produced blood pressure reductions as monotherapy and in combination with ARBs (valsartan) and ACE inhibitors (captopril), and the same effects were observed to date in the phase 1 trial in hypertension patients. Reductions seem durable out to 24 weeks and show the potential for twice-yearly administration for consistent BP control. The 800mg dose was particularly impressive at week 24 (albeit in 8 patients) with 10.8mmHg and 22.5mmHg reductions in diastolic and systolic BP, respectively.

The New England Journal of Medicine

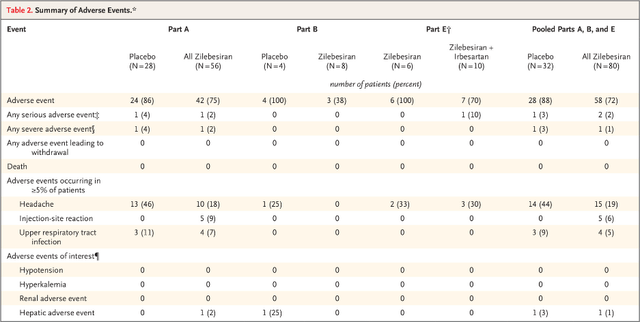

Safety so far looks good with headache, injection site reactions, and upper respiratory tract infections as the only frequent adverse events.

The New England Journal of Medicine

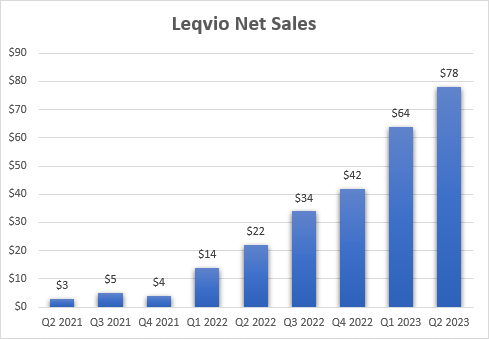

So far, so good, and it appears Roche definitely liked the data and the potential of the drug. I believe Alnylam has another Leqvio (inclisiran) on its hands but with much better economics. Novartis (NVS) owns the global commercial rights to Leqvio and Alnylam is entitled to receive royalties on global net sales of Leqvio of up to 20% but it sold half of the royalty rights to Blackstone back in 2020.

Deal terms and zilebesiran’s potential

Alnylam will receive $310 million upfront and is eligible to receive additional milestone payments for a total consideration of $2.8 billion. The companies will share profits equally in the U.S. where they will co-commercialize zilebesiran. Roche will be in charge of selling zilebesiran outside the U.S. and Alnylam is entitled to low double-digit royalties on net sales.

Alnylam will lead a joint clinical development plan for the first indication with Roche’s participation and the costs of development will be shared 40% by Alnylam and 60% by Roche and Roche may lead the development in additional indications in the future.

Uncontrolled hypertension is a huge market. Alnylam estimates there are more than 200 million patients in the top seven commercial markets and that approximately 80% of patients have uncontrolled hypertension. However, the primary targeted market with the mentioned CVOT trial will be 77 million patients with high cardiovascular risk with hypertension in the top seven markets.

With a price in the range of Leqvio ($6,500 per patient per year prior to rebates and discounts which likely drops down to a net price in the $4,000 per patient per year range), even low single-digit market penetration translates to billions in annual net sales. However, I would not exclude more affordable pricing to maximize market access.

Alnylam has previously characterized zilebesiran as an at least $4 billion a year opportunity in two distinct populations with $2 billion in uncontrolled hypertension and $2 billion in the above-mentioned high-risk population. With Roche as a partner and a much broader combined commercial infrastructure, I believe the peak sales potential could be well above $4 billion.

Leqvio’s uptake shows that while it will take longer to generate the CVOT data, it should be beneficial. Novartis has struggled to get Leqvio up and running due to the lack of CVOT data (results are expected in 2026 and should significantly improve uptake in the second half of the decade) and it is being sold only based on LDL cholesterol reductions it generated in the phase 3 trial. Sales have only recently picked up. I believe Leqvio’s uptake would have been much stronger if Novartis had the CVOT data to promote.

Novartis earnings reports

Of course, to reap the rewards, zilebesiran would need to be successful in the mentioned CVOT trial and show good data in three KARDIA trials without safety concerns. We should see the results from the KARDIA-1 trial where zilebesiran is being evaluated as monotherapy in mild to moderate hypertension in the following months and the results from the KARDIA-2 trial where zilebesiran is being evaluated in combination with the most common anti-hypertensive drugs (ARB, calcium channel blocker or diuretic) in the first half of 2024. Mind that Alnylam says “early 2024” but the way the company describes its timelines is that the “early” part of the year stretches out to June.

And while the follow-up in KARDIA trials is too short to de-risk the CVOT trial of zilebesiran, we should see data in hundreds of patients that should provide sufficient comfort in the efficacy and safety of the candidate.

Conclusion

Alnylam has sweetened the bad news on the development plan side for zilebesiran with a very positive deal with Roche that I believe is a win-win. Of course, more so for Alnylam given the respective sizes of the two companies, but Roche stands to benefit quite a bit considering the profit split in the U.S. and it getting most of the economics outside the U.S.

I believe this represents a cash flow swing of more than a billion for Alnylam this decade, and probably above $2 billion by the time zilebesiran reaches the market in 2033 or so due to the milestone payments and shared development costs. This deal should also bring Alnylam closer to the promised sustainable non-GAAP profitability by 2025.

What the newly revealed development plan does is basically eliminate zilebesiran as an upside driver for the stock despite the upcoming KARDIA readouts because the most important catalyst for this asset is now the CVOT trial and we will not see the results this decade.

The focus now turns back to Onpattro and the upcoming AdCom for ATTR amyloidosis cardiomyopathy and the eventual FDA decision on whether to approve it for this indication and more importantly, to the HELIOS-B outcomes trial of Amvuttra in the same patient population in the first half of 2024.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here