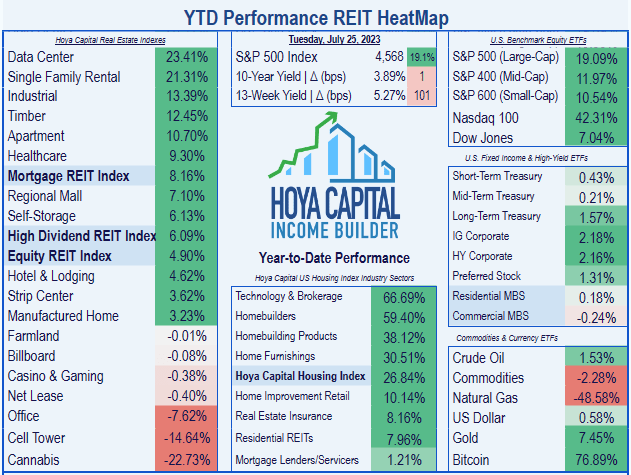

Hotel REITs took a ferocious beating during the pandemic, but they are making a steady comeback. As of this writing, Hotel REITs are up 4.62% in 2023, good for a middle-of-the-pack 9th-place standing among REIT sectors, and just slightly off the 4.90% pace set by the average REIT. Meanwhile, REITs as a whole are lagging the NASDAQ and the S&P indexes, and left in the dust by the NASDAQ.

Hoya Capital Income Builder

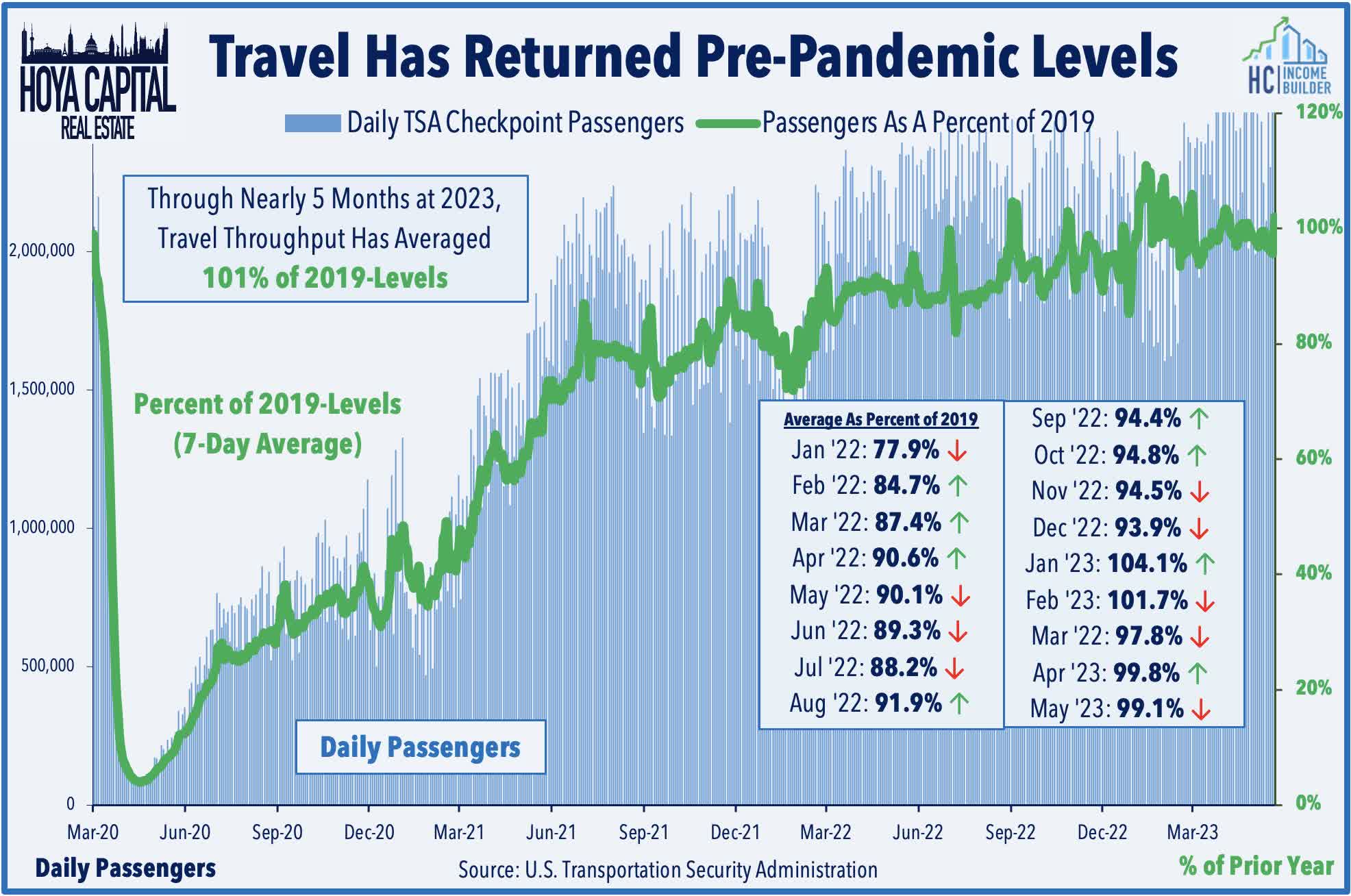

Airline travel, which is highly correlated to hotel demand, has returned to pre-pandemic levels.

Hoya Capital Income Builder

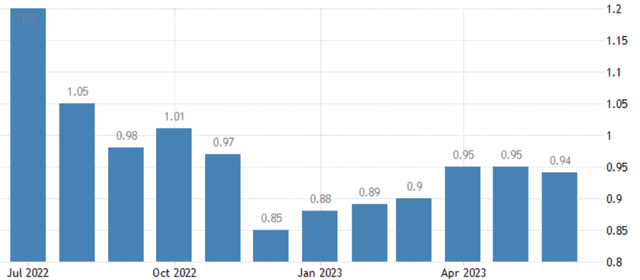

Gasoline prices are down more than 20% from a year ago, providing another summer travel tailwind.

TradingView.com

Hoya Capital’s latest sector report on Hotel REITs reads, in part:

Hotel REITs are pacing for a second-straight year of outperformance after punishing early-pandemic declines, buoyed by steady post-pandemic operating improvement and the long-awaited return of dividends.

According to the International Air Transport Association (“IATA”),

International traffic climbed 68.9% versus March 2022 with all markets recording healthy growth, led once again by carriers in the Asia-Pacific region. International RPKs reached 81.6% of March 2019 levels while the load factor at 81.3% exceeded the March 2019 level by 10.1 percentage points.

The final pandemic-era travel restrictions were lifted in May, so further recovery is likely over the coming months.

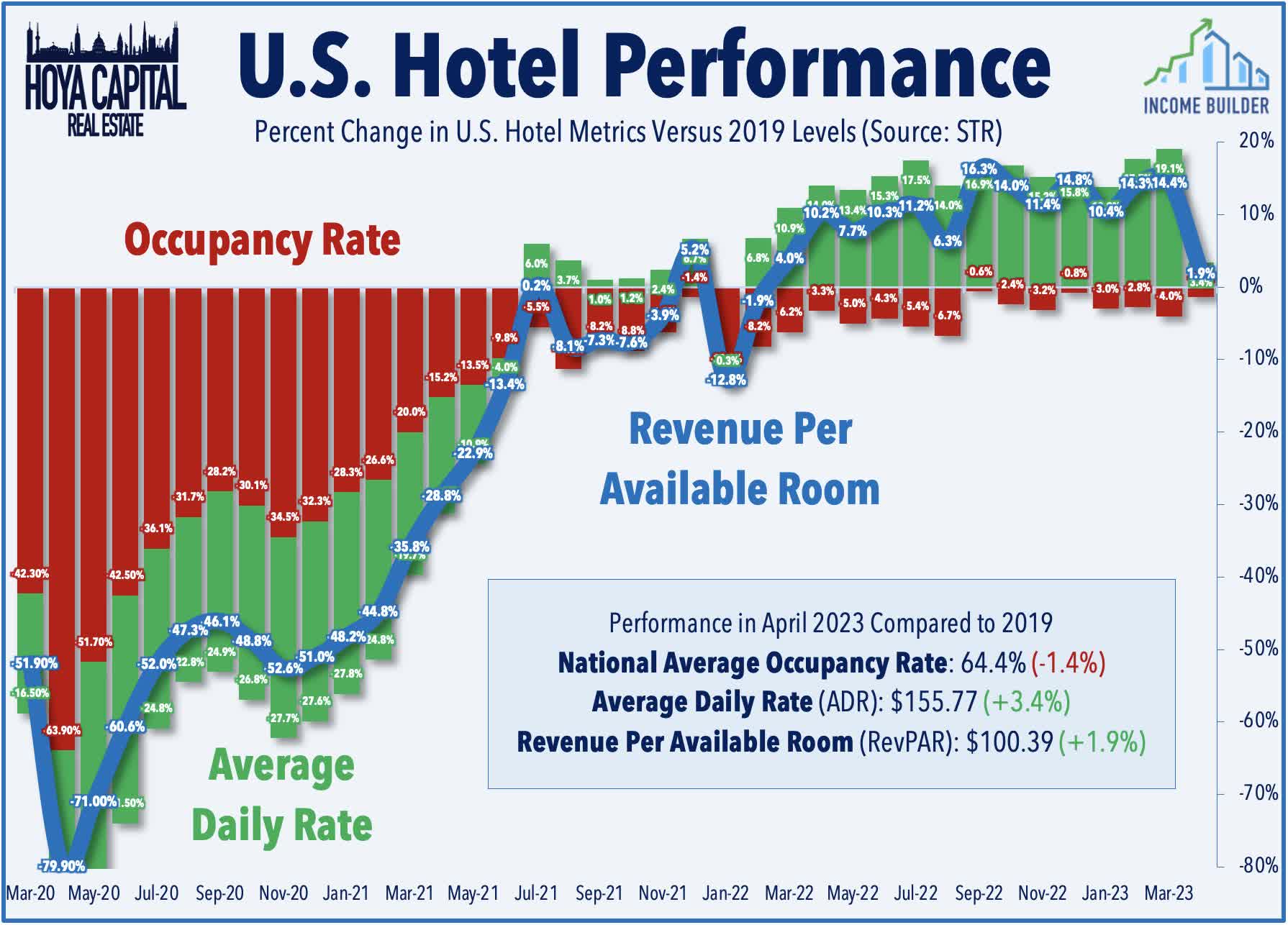

Meanwhile, hotel operating performance is sturdy. RevPAR (Revenue Per Available Room), occupancy, and ADR (Average Daily Rate) all remain at or above 2019 levels, after reaching all-time highs in 2022.

Hoya Capital Income Builder

CBRE (CBRE) forecasts RevPAR growth of 5.8% in 2023, driven by a 4.2% increase in ADR and an improvement in occupancy of roughly 100 basis points.

The forecast is best for Economy, Mid-Scale, and Upper-scale hotels, and markets in the southern half of the country.

CBRE Hotels Research

For investors who may want to increase exposure to Hotel REITs, this article examines growth, balance sheet, dividend, and valuation metrics for two companies well-positioned to take advantage of these tailwinds.

Apple Hospitality REIT

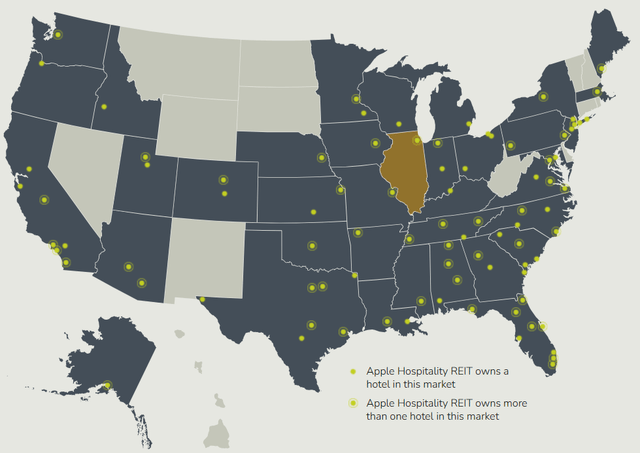

Apple Hospitality REIT (NYSE:APLE) is a 15-year-old company headquartered in Richmond, Virginia, with a market cap just below the sweet spot, at $3.47 billion. The company owns and operates a mostly upscale portfolio of 221 hotels, spread across 88 markets in 37 U.S. states. Nearly all these hotels (205 of the 221) are unencumbered as security for the company’s debts.

Apple Hospitality investor presentation

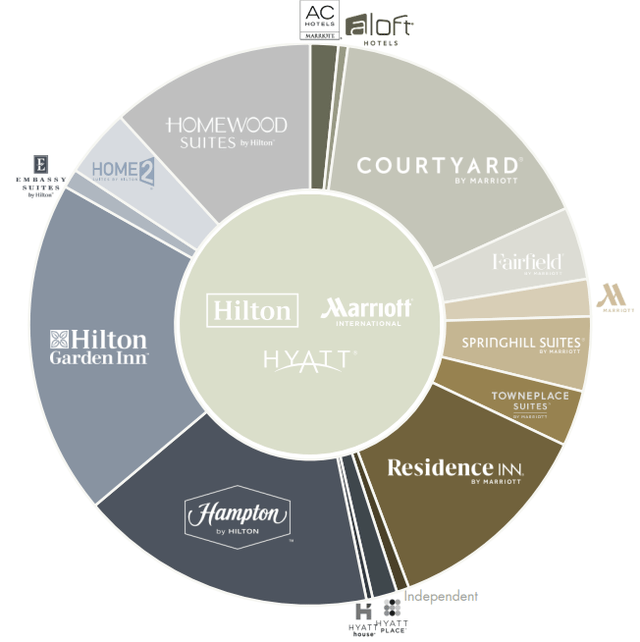

The average age of APLE’s buildings is just 5 years, which keeps capex to a minimum, and the hotels, which span 15 well-known brands, are popular with travelers, averaging satisfaction ratings of 4.3 out of 5 on TripAdvisor.

Apple Hospitality investor presentation

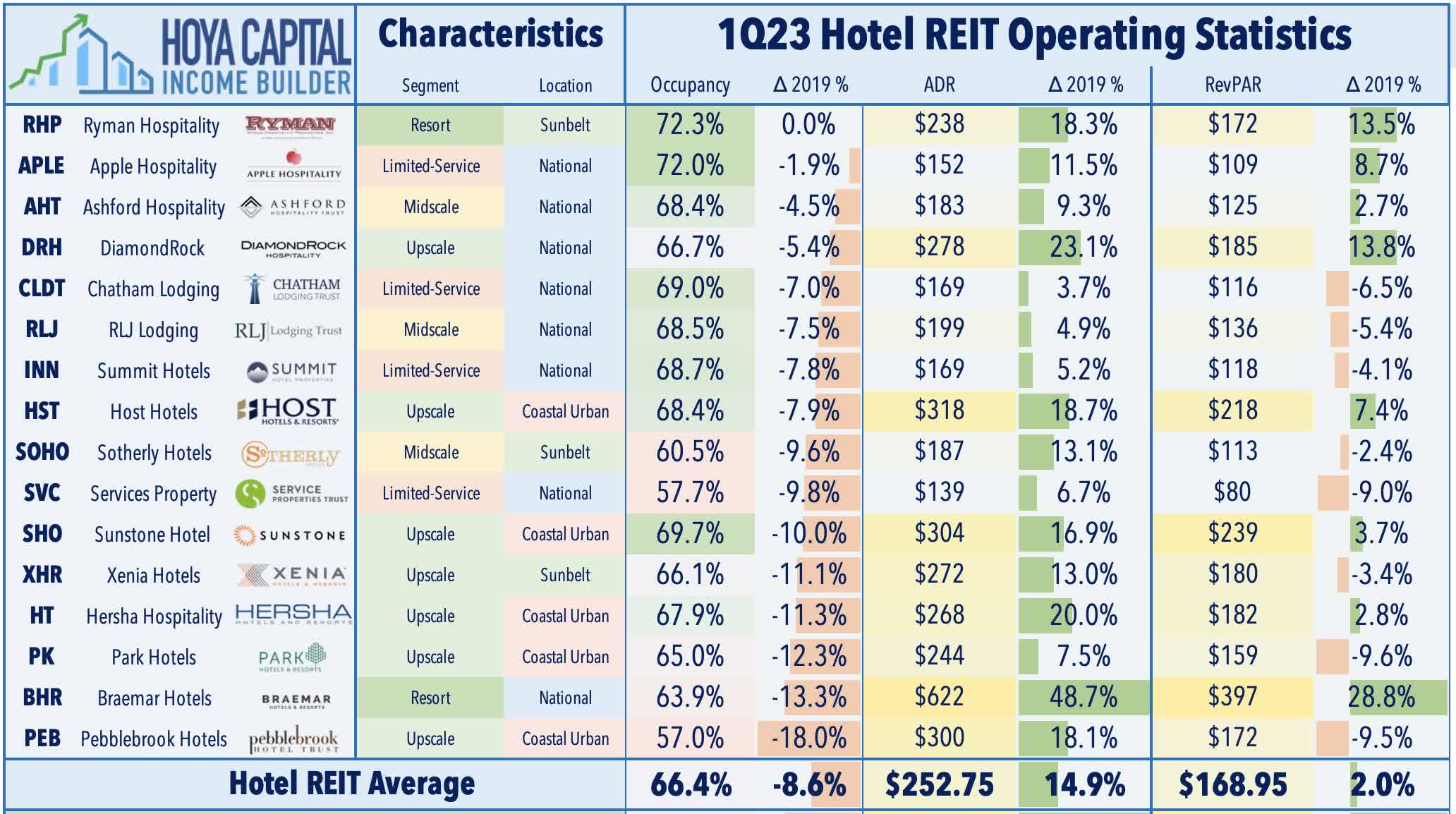

In 2022, APLE was the top-performing U.S. Hotel REIT, according to both the MSCI and Nareit indexes. Through Q1 2023, APLE’s ADR was up 11.5%, and RevPAR was up 8.7%.

Hoya Capital Income Builder

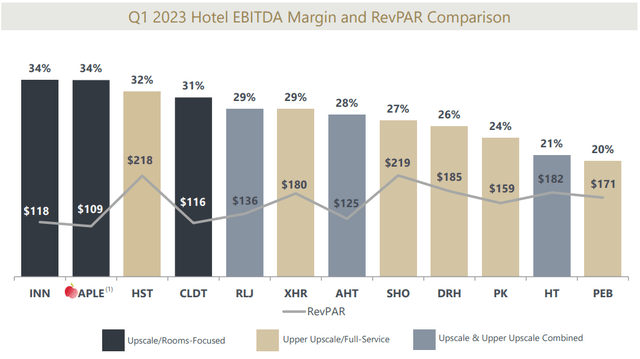

The company’s rooms-focused upscale strategy tends to result in higher margin than peers, as shown below.

Apple Hospitality investor presentation

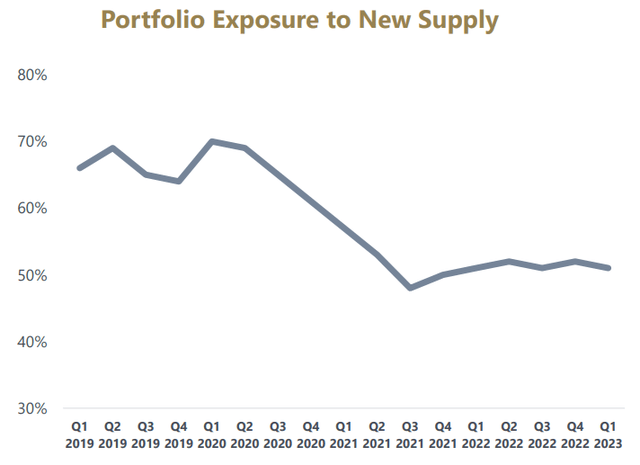

New construction starts of competing hotels have meaningfully decreased since the onset of the pandemic, with delays anticipated in completions. As a result, the proportion of APLE hotels exposed to new supply within a 5-mile radius has dropped sharply over the past 4 years. The 0.9% national supply growth anticipated over the next 4 quarters is 30% below the long-run average, according to the Hotel Horizons National Forecast Q1 2023 Edition from CBRE Hotels Research.

Apple Hospitality investor presentation

The company keeps capex low by opportunistically disposing of older buildings and buying younger ones (average age, 2 years) in markets expected to outperform over the next cycle and has been a net acquirer of hotels since the onset of the pandemic.

APLE Growth

Here are APLE’s 3-year growth figures for FFO (funds from operations) and TCFO (total cash from operations). Despite the body blow dealt by the pandemic, APLE’s FFO per share has fully recovered, and is expected to continue growing at a healthy pace, while TCFO and total FFO have recovered to 96% of pre-pandemic levels.

| Metric | 2019 | 2020 | 2021 | 2022 | 3-year CAGR |

| FFO (millions) | $361 | $13 | $205 | $348 | — |

| FFO Growth % | — | (-96.4) | 1477.0 | 69.8 | (-1.2)% |

| FFO per share | $1.62 | $0.09 | $1.53 | $1.63 | — |

| FFO per share growth % | — | (-94.4) | 1600.0 | 6.5 | 0.20% |

| TCFO (millions) | $382 | $27 | $218 | $368 | — |

| TCFO Growth % | — | (-92.9) | 707.4 | 68.8 | (-1.2)% |

Source: TD Ameritrade, CompaniesMarketCap.com, and author calculations

Meanwhile, here is how the stock price has done over the past 3 twelve-month periods, compared to the REIT average as represented by the Vanguard Real Estate ETF (VNQ).

| Metric | 2020 | 2021 | 2022 | 2023 | 3-yr CAGR |

| APLE share price July 24 | $8.82 | $14.60 | $15.76 | $15.15 | — |

| APLE share price Gain % | — | 65.5 | 7.9 | (-3.9) | 19.76% |

| VNQ share price July 24 | $77.92 | $105.82 | $94.02 | $86.89 | — |

| VNQ share price Gain % | — | 35.8 | (-11.2) | (-7.6) | 3.70% |

Source: MarketWatch.com and author calculations

APLE has outperformed the VNQ in each of the past 3 consecutive 12-month periods, including a 7.9% gain during last year’s carnage. If you bought APLE shares 3 years ago, in the gloomy depths of the pandemic, you are sitting on an average annual return of 19.8%, whereas the VNQ has returned only a 3.70% annual average during that time. Kudos to Seeking Alpha contributor Stephan Redlich for being the first to issue a Buy rating after the March 2020 crash.

APLE Balance sheet

APLE’s balance sheet is downright stellar, with liquidity, debt ratio, and Debt/EBITDA all considerably better than the REIT average, and head and shoulders above the Hotel REIT sector.

| Company | Liquidity Ratio | Debt Ratio | Debt/EBITDA | Bond Rating |

| APLE | 2.99 | 29% | 3.8 | — |

Source: Hoya Capital Income Builder, TD Ameritrade, and author calculations

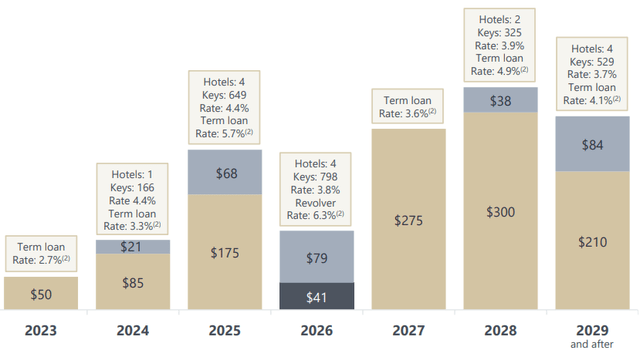

APLE has borrowing capacity of about $1.2 billion, and only 16 of the 221 hotels are encumbered as security against the company’s $1.48 billion debt. Near term maturities are favorable, with only $156 million (10.5%), due between now and the end of next year.

Apple Hospitality investor presentation

APLE Dividend

Apple Hospitality was the first Hotel REIT to restore its dividend after the pandemic. APLE currently pays a juicy 6.34% yield, and Seeking Alpha Premium rates it an A- for dividend safety. A little too safe if anything. All in all, a much stronger-than-average dividend payer.

| Company | Div. Yield | 3-yr Div. Growth | Payout | Div. Safety |

| APLE | 6.34% | 5.2% | 60% | A- |

Source: Hoya Capital Income Builder, TD Ameritrade, Seeking Alpha Premium

APLE Valuation

Despite its excellent track record of recovery from the pandemic, its strong balance sheet, and its tasty yield, APLE sells for just 8.8x FFO ’23, which is barely half of the REIT average of 17.2. The price is low, considering all you get with this stock.

| Company | Div. Yield | Price/FFO ’23 | Premium to NAV |

| APLE | 6.34% | 8.8 | (-20.5)% |

Source: Hoya Capital Income Builder, TD Ameritrade, and author calculations

I concur with Hoya Capital Income Builder’s assessment that APLE would be fairly valued at $23, so it is currently discounted from fair value by about 33%.

What could go wrong?

Hotel REITs are very sensitive to small changes in supply and demand conditions. Even in normal times, they operate with an adjusted NOI that is the lowest in REITdom. Thus, a reversal in the supply chain, or any event that hampers demand, could significantly impede all hotel REITs.

Additionally, hotel profitability is closely related to travel, so anything that restricts people’s willingness or ability to travel would adversely affect Apple Hospitality, along with other hotel stocks.

Hotels are labor-intensive, and personnel shortages or stoppages could adversely affect operating costs.

Hotels are not the only lodging option for travelers, and not necessarily the best option, either. Competition from innovative lodging companies like Airbnb (ABNB) and Vrbo cannot be ignored.

Bottom line: APLE

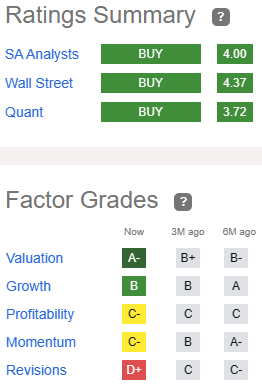

High and safe yield, low price, sterling balance sheet, and solid growth anticipated going forward, all add up to a solid investment. That’s not just my opinion. Seeking Alpha analysts, Wall Street analysts, and the Seeking Alpha Quant ratings all agree, as do The Street and TipRanks.

Seeking Alpha Premium

Six of the 8 Wall Street analysts covering APLE recommend Buying, with two advocating a Hold. The average price target is $18.43, implying 19.1% upside, for a total return north of 25%.

However, as always, the opinion that matters most is yours.

Read the full article here