The Janus Henderson AAA CLO ETF (NYSEARCA:JAAA) and the Janus Henderson B-BBB CLO ETF (BATS:JBBB) are both actively-managed ETFs investing in senior loan CLO tranches. In simple terms, both funds invest in bundles of senior loans. JAAA focuses on those rated AAA, while JBBB on those rated BBB.

JAAA sports a growing 4.9% dividend yield, has extremely low interest rate and credit risk, and a strong performance track-record.

JBBB sports a growing 7.2% dividend yield, has extremely low interest rate risk, low credit risk, and a good performance track-record.

In my opinion, both funds are strong investment opportunities, with JAAA being generally more appropriate for more conservative investors, JBBB for more aggressive ones.

Strategy and Holdings Comparison

JAAA and JBBB are both actively-managed ETFs investing in senior secured CLO tranches. Let’s have a closer look at what this entails.

Senior secured loans are variable rate loans from banks to medium-sized, riskier companies. There are exceptions, but not too many. These loans are senior to other debt, and secured by company assets.

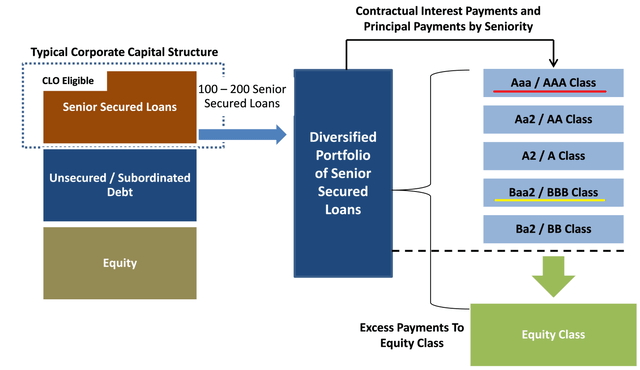

Senior loans are sometimes bundled together in CLOs. Each CLO, or bundle of senior loans, is divided into tranches. Income from the senior loans is used to make payments to all tranches. Senior tranches get paid first, junior tranches get paid last. Investors can buy into these tranches, and receive income from the bundle of senior loans. Quick graph of how these are structured

Stanford Chemist – Seeking Alpha

Both JAAA and JBBB invest in senior secured CLO tranches, meaning they both invest in bundles of senior loans, and receive income for doing so. Each fund focuses on a different tranche, however.

JAAA focuses AAA-rated CLO tranches, highlighted in red above.

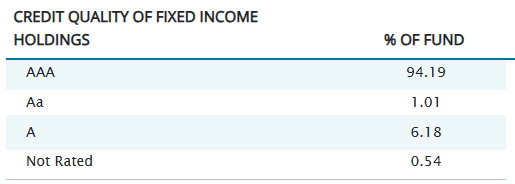

JAAA

JBBB focuses on BBB-rated CLO tranches, highlighted in yellow above.

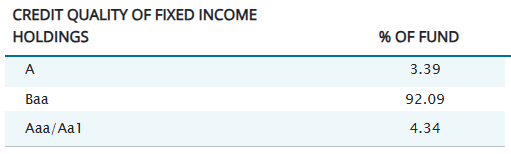

JBBB

Investing in different tranches has different implications for investors, which brings me to my next point.

Credit Risk Comparison – JAAA Clear Winner

As mentioned previously, senior CLO tranches get paid first. JAAA invests in AAA CLOs, the senior-most tranche, meaning the fund and its investors get paid first, before all other tranches, and before almost all investors (they get paid at the same time as other AAA investors). The securities backing these CLOs effectively always generate sufficient income for the AAA tranche, so investors in these effectively always get paid too. As per S&P, not a single AAA CLO has ever defaulted, and the product has existed for several decades.

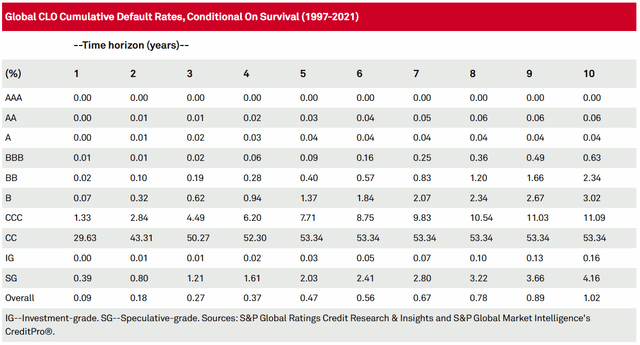

Corollary of the above, is that junior CLO tranches get paid last, while those in the middle get paid in the middle. JBBB focuses on BBB-rated tranches, and so gets paid somewhere in the middle out of all investors. Still, their overall credit risk is decisively below-average, as the vast majority of senior loans are paid back, in full, at maturity. Only around 3.0% – 4.0% of these default every year, although figures do vary depending on economic conditions. The other +95% get repaid without issue, and these almost always generate more than sufficient cash to pay back investment-grade CLO tranches, including BBB tranches. As per S&P, BBB CLOs have annual default rates of just 0.01%, effectively equivalent to zero.

A quick table of cumulative default rates for CLOs.

S&P

As should be clear from the above, JAAA has almost no credit risk, while JBBB has very low credit risk. JBBB compares unfavorably to JAAA in this regard, although the fund is not all that risky on an absolute basis, or relative to other bond funds. JAAA should see minimal losses during downturns and recessions, JBBB should see low losses during these. As both funds are quite young, I can’t really gauge their performance during any period of market stress, but I’m reasonably confident of this assessment.

JAAA’s extremely low credit risk is a significant benefit for the fund and its shareholders, and its key advantage relative to JBBB. In my opinion, JAAA is the clear choice for more conservative investors wishing to minimize their credit risk.

Dividends Comparison – JBBB Clear Winner

JAAA and JBBB both indirectly invest in senior loans, income-generating securities, which results in reasonably good yields for both funds.

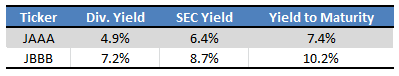

JAAA focuses on the relatively safe, low-yielding AAA CLO tranches of these securities. As these are the safest, senior-most tranches, yields are somewhat low, with the fund yielding 4.9%.

JBBB focuses on BBB CLO tranches of these securities. As these are in the middle of the pack based on seniority and safety, yields are moderately strong, with the fund yielding 7.2%. Yields would be much higher if the fund focused on the more junior tranches, but risks would be higher too.

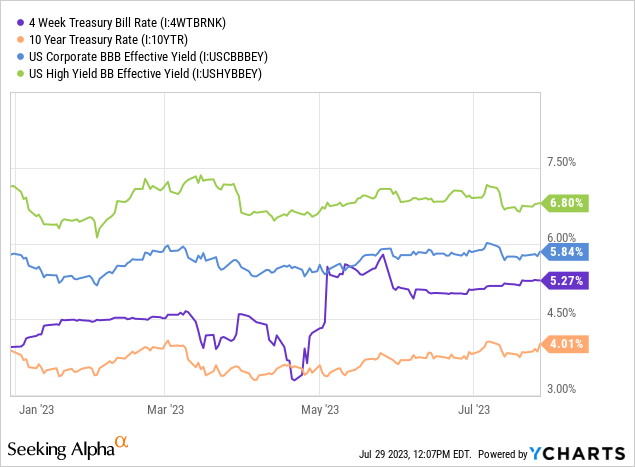

For reference, some benchmark interest rates.

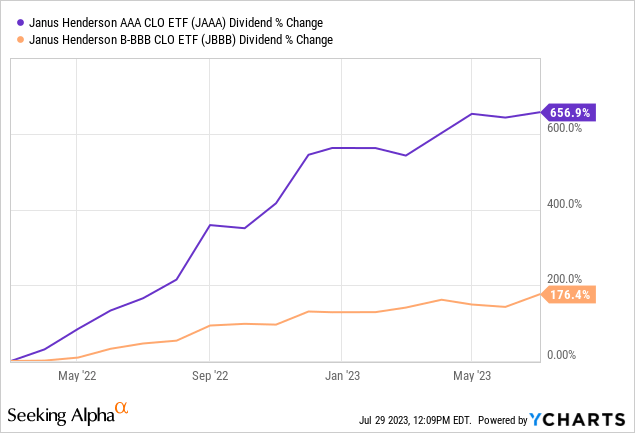

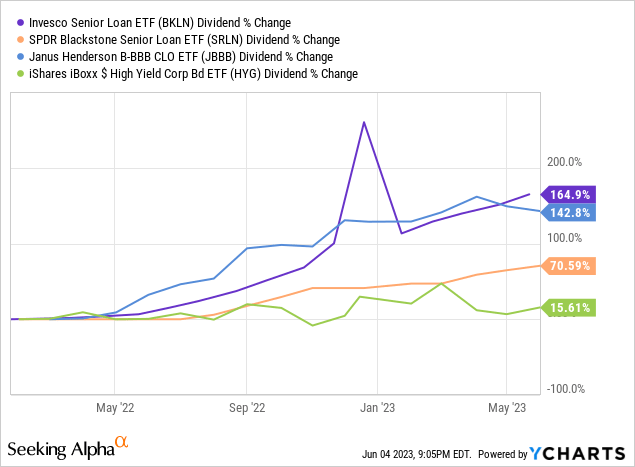

JAAA and JBBB both indirectly invest in senior loans, which see higher rates of interest as Federal Reserve funds rates increase (the situation is a bit more complicated, especially for CLOs, but that is the gist of it). As the Federal Reserve has aggressively hiked rates since early 2022 both funds should have seen strong dividend growth since, as has indeed been the case. JAAA’s growth has been greater in percentage terms, due to starting from a lower base / yield.

Both funds should see strong dividend growth moving forward, due to recent Federal Reserve hikes.

Both funds generate more in income than they distribute to shareholders, as evidenced by their SEC yields, a standardized measure of a fund’s underlying generation of income. Both funds have higher expected returns than their dividend yields, as evidenced by their yield to maturities. The dividends on both funds look quite good, across most relevant metrics.

Fund Filings – Chart by Author

JBBB’s comparatively strong, growing 7.2% dividend yield is a significant benefit for the fund and its shareholders, and its key advantage relative to JAAA. In my opinion, JBBB is the clear choice for more aggressive investors wishing to maximize their yield. Exact opposite situation relative to JAAA.

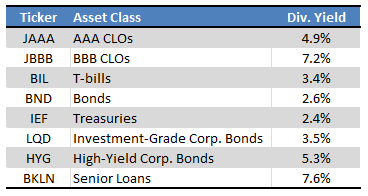

At the same time, the dividends on both JBBB and JAAA compare favorably to those of most bonds and bond sub-asset classes. JBBB yields more than, well, all broad-based bond index funds, while JAAA yields more than most of these.

Fund Filings – Chart by Author

The comparatively strong yields on these funds is due to (indirectly) investing in senior loans, which brings me to my next point.

Interest Rate Risk Comparison – Tie

JAAA and JBBB both indirectly invest in senior loans, which are variable rate loans with very low interest rate risk. Let’s have a look as to why, exactly, is this the case.

Simplifying things a bit, we can say that senior loans see higher interest rates when the Fed hikes rates, and vice versa. Senior loan rates are generally reset quarterly, so it generally takes one quarter for Fed hikes to result in higher senior loan rates. The situation is more complicated at the CLO / ETF level, but the overall logic and process remains.

Importantly, the above is not true for most bonds or fixed-income securities. Most of these have fixed coupon rates until maturity, and so do not see higher interest rates as the Fed hikes rates, at least not directly. In most cases, for investors to actually see higher rates they must wait until their existing portfolio of bonds matures, to be replaced with newer, higher-yielding alternatives. Bonds generally take years to mature, so this process can take years to play out.

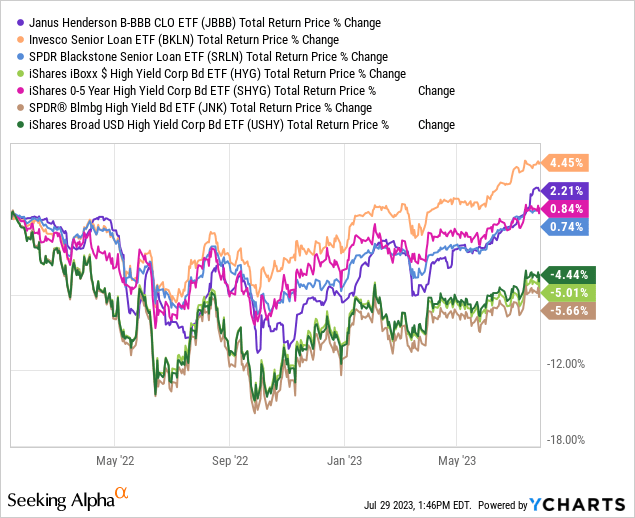

As should be clear from the above, senior loans and loan funds benefit from higher Fed rates much more swiftly than most bonds. Expect above-average dividend growth from senior loan funds when rates rise, as has been the case since early 2022. I’ve included JBBB and direct senior loan ETFs in the graph below, as well as high-yield corporate bonds, something of their closest analogue.

Data by YCharts

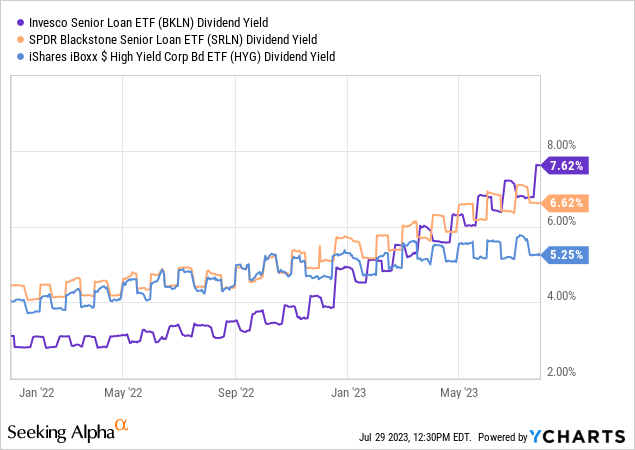

Senior loan dividend yields have also seen higher growth than comparable bond funds. I’ve excluded JBBB here, as the fund is quite young, and so dividend yields were not particularly informative in early 2022 (they still have grown though).

Bond prices tend to decline when the Fed hikes rates, as investors sell off their older, lower-yielding bonds to buy newer, higher-yielding alternatives. Senior loans prices, however, tend to be much more stable and resilient, as these securities see higher coupon rates as the Fed hikes. No need to sell your low-yield senior loan if the rate will increase next quarter.

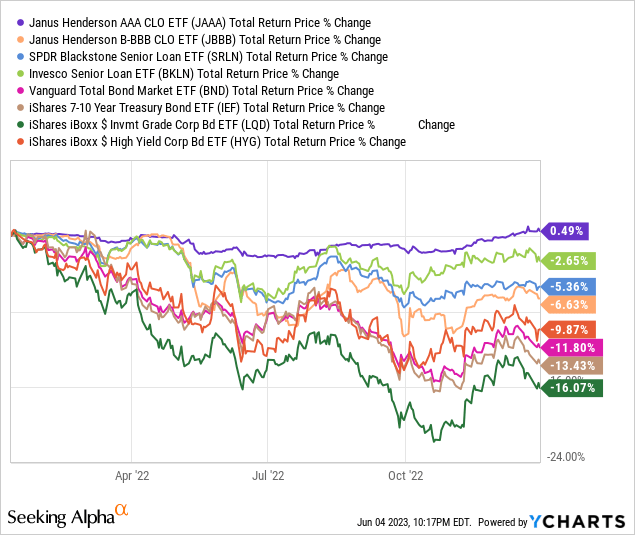

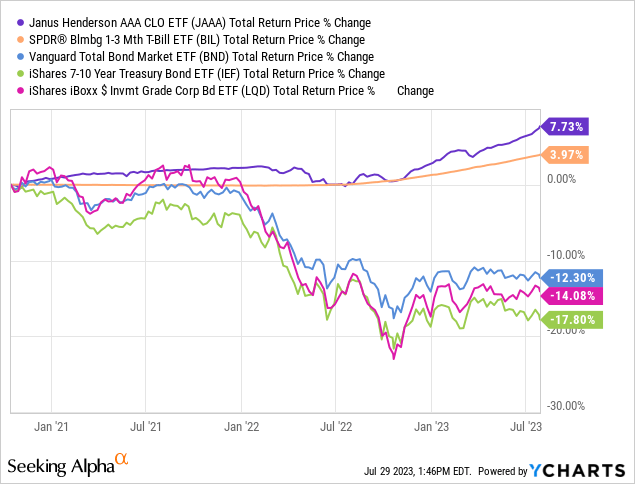

Due to the above, senior loans and senior loan funds tend to see lower capital losses when interest rates increase, leading to outperformance. Both JAAA and JBBB outperformed most other bonds and bond sub-asset classes during 2022, a period of rapidly rising rates. Other senior loan ETFs outperformed as well. JBBB’s performance was quite a bit weaker than that of JAAA, likely due to its higher credit risk combined with investor bearishness.

Data by YCharts

JAAA and JBBB both have very low interest rate risk, a significant benefit for themselves and their investors.

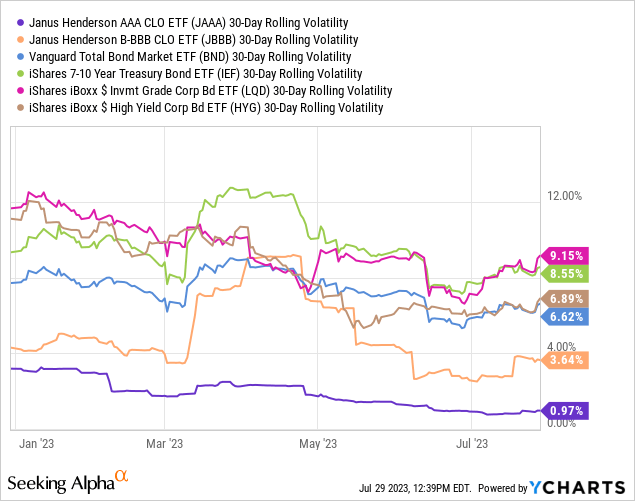

Overall Risk and Volatility – JAAA Clear Winner

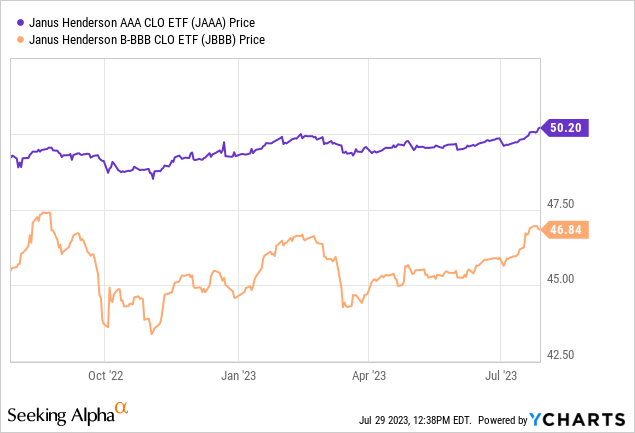

JAAA’s share price is more stable than that of JBBB, as the former has lower credit risk.

JAAA is much more stable than most other bond funds too, with JBBB being somewhat more stable than most as well.

JAAA’s lower overall risk and volatility is a significant benefit for the fund, and an important advantage relative to JBBB.

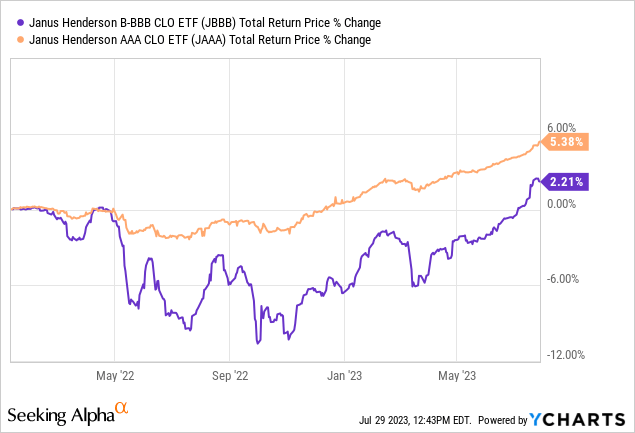

Performance Track-Record Comparison – JAAA Slight Winner

JBBB focuses on CLO tranches with weaker credit ratings and higher yields than JAAA. This should result in stronger long-term returns for JBBB. This has not been the case since inception, as both funds are young, and have really only existed during a prolonged bear market.

Notwithstanding the above, I’m pretty confident that JBBB should outperform JAAA long-term, as it yields more and has reasonably low credit risk.

Both funds have performed quite well relative to funds with comparable credit ratings. JAAA has outperformed other investment-grade bond index funds, including those focused on t-bills.

JBBB has outperformed most other non-investment grade corporate bond ETFs, although it has not outperformed relative to the Invesco Senior Loan ETF (BKLN), one of the largest senior loan ETFs in the market.

In general terms, the performance track-record of both funds is strong, more so for JAAA. On the other hand, JBBB should see stronger performance long-term moving forward.

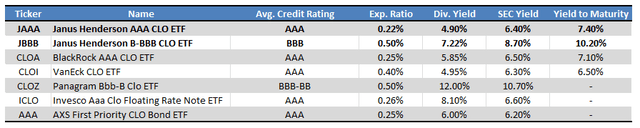

CLO ETFs

Finally, a quick table on some of the larger CLO ETFs in the market. Plan an article looking at these in the coming days, time permitting. For some of the younger funds, annualized the latest dividend payment to arrive at a dividend yield.

Fund Filings – Chart by Author

Conclusion

JAAA and JBBB are both actively-managed ETFs investing in senior loan CLO tranches.

JAAA focuses on AAA-rated tranches, JBBB on BBB-rated tranches.

JAAA sports a growing 4.9% dividend yield, has extremely low interest rate and credit risk, and has a strong performance track-record.

JBBB sports a growing 7.2% dividend yield, has very low interest rate risk, low credit risk, and good performance track-record.

Both are strong investment opportunities, with JAAA being generally more appropriate for more conservative investors, JBBB for more aggressive ones.

Read the full article here