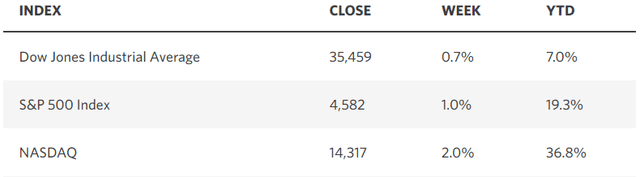

Last week was as good as it gets for the bullish narrative. With global central banks coming to the end of their tightening cycles, we have seen rates of inflation fall without interrupting the ongoing expansion, as economic growth remains resilient. As a result, long-term interest rates have been relatively stable, and the stock market rally is broadening beyond technology to more economically-sensitive sectors of the market. As recession fears fade, and consumer confidence lifts, valuations have become the punching bag for bears, but that is not a reasonable argument once we move past the largest and most influential names that dominate the major market averages. There is more bad news for ardent bears. According to Yahoo Finance, the last six times the S&P 500 rose five consecutive months through the end of July, the index was up for the balance of the year 100% of the time for an average gain of 8%. That is consistent with my outlook for new all-time highs in the coming 12-month period, and it will put to rest any speculation that what we have seen since last October is a bear market rally.

Edward Jones

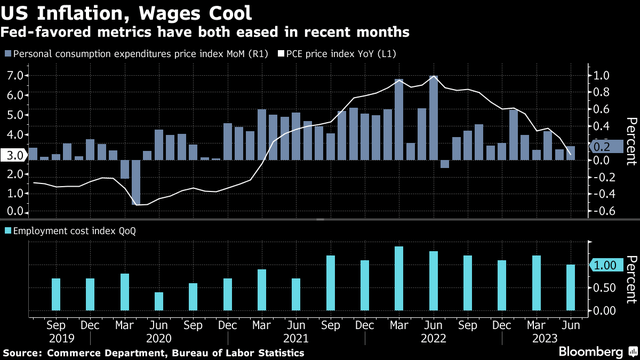

The Fed’s preferred measure of inflation, known as the personal consumption expenditures (PCE) price index, affirmed what we learned earlier from the Consumer Price Index (CPI). The disinflationary trend continues with the headline PCE falling from 3.8% to 3%, while the core rate that excludes food and energy fell from 4.6% to 4.1%. More importantly, the employment cost index, which is the broadest measure of labor costs, rose just 1% in the second quarter. The annualized rate fell from 5% in the first quarter to 4.6% in the one just ended. This has been the stickiest component of the inflation gauge, and its downtrend should be comforting to the Fed.

Bloomberg

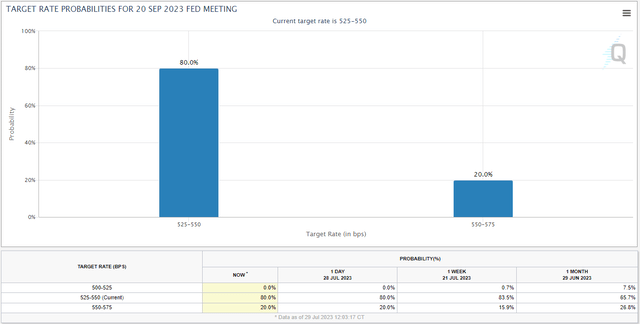

We have two job reports and two inflation reports before the Fed’s next meeting in September. As the moderation in housing and rental prices works its way into the annualized inflation gauges, and producer price deflation weighs on consumer prices, I think the disinflationary trend will be further entrenched. According to the Fed funds futures market, the consensus of investors sees the probability of another rate hike being just 20%. I think that percentage will fall after two more months of data. The Fed’s rate-hike cycle should be over.

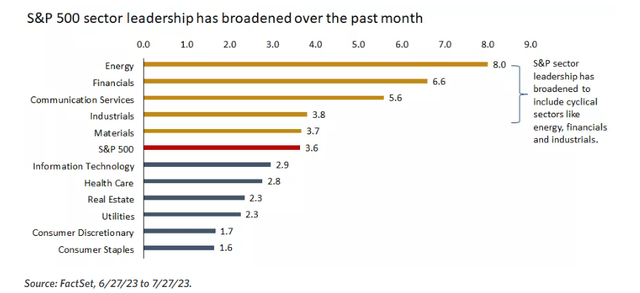

CME

Despite disinflation and the slower rates of economic growth that are supposed to come with it, corporate profits are surprising to the upside for the second quarter. According to FactSet, halfway through earnings season 80% of the companies in the S&P 500 are beating estimates, which is above the 5- and 10-year averages. As a result, the year-over-year decline in profits has narrowed from 9% to 7.2% over the past week. I expect that trend to continue this week. What is more encouraging is that the market rally over the past month has been led by cyclical sectors that are more sensitive to the economic cycle. This is a leading indicator for economic growth, and a positive one at that.

Edward Jones

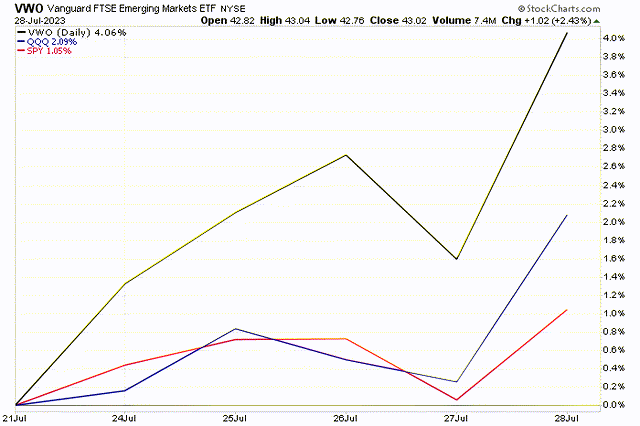

Two weeks ago, I surmised that we may start to see international markets outperform the US market based on a weakening dollar and more reasonable valuations. It is naturally becoming more difficult to find good growth opportunities on a risk-reward basis as the stock market appreciates. Last week was a good one for the Vanguard Emerging Markets ETF (VWO), which I highlighted two weeks ago, largely because of China’s outperformance on the tailcoats of new stimulus efforts by the central government.

StockCharts

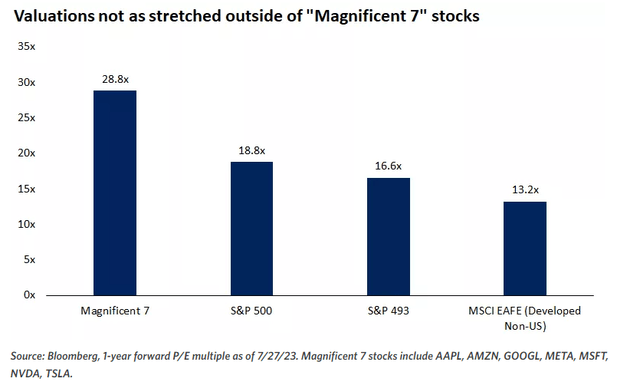

That said, our markets are not as expensive as advertised by the bear crowd if we exclude the seven largest technology-related companies in the index, which have been coined the “Magnificent 7.” When we exclude Apple (AAPL), Amazon (AMZN), Google (GOOGL), Meta Platforms (META), Microsoft (MSFT), Nvidia (NVDA), and Tesla (TSLA) the price-to-earnings multiple for the S&P 500 falls to 16.6 times earnings on a forward basis. I consider that to be a hair under fair value with an inflation rate of 3%. That multiple falls to 13 times when look at foreign developed markets. My point here is that while the easy money may have already been made, there are still plenty of opportunities for growth in this market, but investors need to be more surgical as the bull marches on.

Edward Jones

Read the full article here