Piedmont Office Realty Trust (NYSE:PDM) turned in another strong quarter of leasing with positive cash spreads of 14%. They also made significant progress in the renewal of their largest tenant, U.S. Bank. But the real story is their recent refinancing activity and the subsequent decrease in the quarterly dividend. Some may relish in the cut. But in my view, focusing on the dividend distracts from the upside potential in the share price.

PDM Refinancing Activity

Piedmont has been quite active this year in the debt markets. In one sense, this can be viewed as a positive, as it shows the company continues to have readily available access to capital in a challenging funding environment. It helps that they carry investment-grade ratings from two of the three major rating agencies.

Their access to capital, however, is not without significant cost. During the first quarter, PDM settled a maturity that was due in June through a combination of a drawdown on their credit facility, as well as through the issuance of a new +$215M unsecured term loan.

For the term loan, it was priced at adjusted SOFR plus a spread anywhere between 0.85% to 1.70%. At June 30, the effective rate of the loan was 6.20%, which represents a spread of 280 basis points (“bps”) over the prior loan.

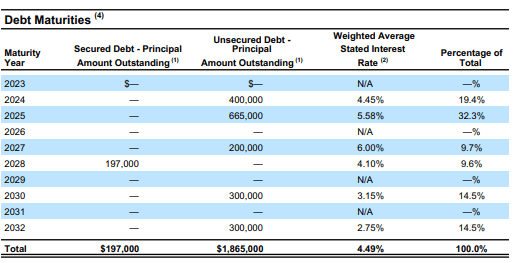

A 280bps increase in the interest rate is not ideal, but it’s not dramatic either. At the end of Q1, prior to the refinancing, the weighted average rate of their total debt balance was 4.13%. Following the rollover, the weighted rate was 4.49% at the end of Q2.

The surprise was what happened in the most recent quarter ended June 30. Looking at their debt ladder, PDM had +$400M coming due in March of 2024. The weighted rate on this was 4.45%, with an effective rate of 4.10%.

PDM Q2FY23 Investor Supplement – Debt Maturity Schedule

Last quarter, CFO, Bobby Bowers, noted that they were working with their investment bankers in evaluating their options. While the maturity was near-term, they still had a good amount of time to address it. After all, the previous debt due in June was settled in the same quarter.

PDM is targeting +$100M to +$200M in dispositions in the next six to 12 months. Arguably, they could have continued marketing the properties through the year. At the high end of the range, it could have brought in enough to cover 50% of the amount coming due.

Instead, they settled it in full via the issuance of a new five-year unsecured note bearing interest at a 9.25% interest rate. That represents a spread of approximately 500bps over the effective rate on the prior loan.

That is a significant repricing. By my estimates, the weighted rate on their debt portfolio is now likely up by about 100bps to 5.45%. And just looking at the spread on the debt, PDM is now going to incur +$20M more in interest expense per year. At the current share count, that’s $0.16/share off funds from operations (“FFO”) on an annual basis or $0.08/share for the second half of this year.

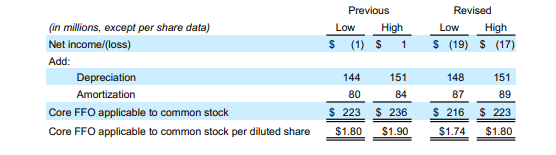

Hence the lowered FFO midpoint of $1.77/share compared to $1.85/share previously.

PDM Q2FY23 Investor Supplement – Summary Of FY23 FFO Guidance

PDM Dividend Cut

But is the lowered FFO guidance to blame for the dividend cut? In their decision to slash the quarterly payout by 41%, the Board highlighted higher interest expense. Others may also echo the notion the cut was related to the payout ratio.

It’s hard to argue against the Board. But in my view, the dividend wasn’t cut due to inadequate coverage. On the contrary, the payout appeared well covered, even with the lowered midpoint.

Consider the new midpoint of $1.85/share. At the former quarterly dividend rate of $0.21/share, the annualized payout ratio would have been just 45%. What about adjusted FFO? At the end of Q2, PDM reported approximately $0.09/share in adjustments. At the end of the same period last year, it was $0.10/share. Let’s be conservative at $0.15/share.

Even knocking $0.15/share off the new midpoint would still result in a payout ratio of less than 50%. That’s well below the sector average of about 70%.

And unlike others, PDM is not burdened with competing capital priorities. They have no joint venture exposure and no developments to fund. They are also in a strong liquidity position. The higher interest burden is a disappointment, but they are still well within their covenant requirements.

In my view, the dividend was cut because management doesn’t believe they will hit their disposition targets. And this would impact taxable income. Since the payout is very much based on this more than anything else, lower projections likely figured prominently into the Board’s decision.

In fact, in my last coverage on the stock on May 10, I referred to their taxable income and said, “The current dividend, therefore, is well in excess of their minimum. As such, I can foresee a cut in the periods ahead of about 50%. This would take the annual dividend to about $0.45/share.”

At $0.50/share, the payout is right around target levels. The cut, therefore, is not a surprise.

Is PDM Stock A Buy, Sell, Or Hold?

If there are doubts about the disposition market, is it telling of the underlying value of Piedmont’s properties? I argue that it’s not. It’s more likely attributable to the inability of buyers to secure financing at worthwhile rates. If an investment-grade issuer is priced at 9%+, imagine what would be quoted for a lower-rated participant. Constraints in the funding market, then, would naturally impede PDM’s disposition targets.

This is also likely why PDM accelerated the timetable on their recent debt issuance. Better to lock in the funding now, albeit at higher interest rates, than take the risk of waiting several more months, when banks could become even more reluctant to lend.

And realistically, it’s unlikely PDM will carry the debt for long. They could have mortgaged one of their properties in exchange for a lower rate, but they took the unsecured route instead. Why? Because for one it gives them the flexibility to avoid any penalties on prepayment.

For PDM not to take this route within the next two years would be a surprise, in my view. Sure, a higher interest burden will dilute their earnings potential in the meantime. But it doesn’t change my assessment that shares are still materially undervalued.

Consider one of their premier properties in the Midtown Atlanta market, 1180 Peachtree. This property was 96.1% leased at June 30 with in-place rents 25% below market. Similarly, rents at another one of their Midtown properties, 999 Peachtree, were 20% below market.

PDM also has about +$40M in cash revenues pending upon either lease commencements or free rent burn off. That equates to over $0.30/share in FFO.

And though funding constraints are currently impeding the disposition market, one could go back to 2022 to see what well-funded buyers were paying for their properties. It was certainly not a cap rate of 10%, which was the implied cap commanded by shares at June 30. Rather, the sales were completed at sub-5% cash cap rates.

Even a modest reassessment of the company’s portfolio would indicate outsized returns. At an implied cap of 8% on forward NOI of +$315M, the stock would trade in the ballpark of $15/share.

Remember, too, that their dispositions were completed at significantly higher valuations. An 8% cap, arguably, is still too high. Yet, the upside is still about double where shares currently trade.

There is a lot going on with PDM. But those willing to see past the recent noise may benefit through market-beating gains over the medium-long term.

Read the full article here