Real GDP grew at 2.4% in Q2, and that led the majority of forecasters to join the “soft-landing” camp. But we’re not buying it. As chronicled by Rosenberg Research, real GDP averages a 2%+ annual rate in the quarter in which the Recession begins, and that includes the Great Financial Crisis (in Q4 2007 GDP grew at +2.2% annual rate). In addition, and of great significance, it is widely known that monetary policy impacts the economy with a long and variable lag; most economists put this lag at 12 to 15 months. Yet despite the fact that much of this past year’s interest rate increases have yet to be felt, this Fed raised rates 25 basis points (.25 pct. points) at last week’s meeting (July 26).

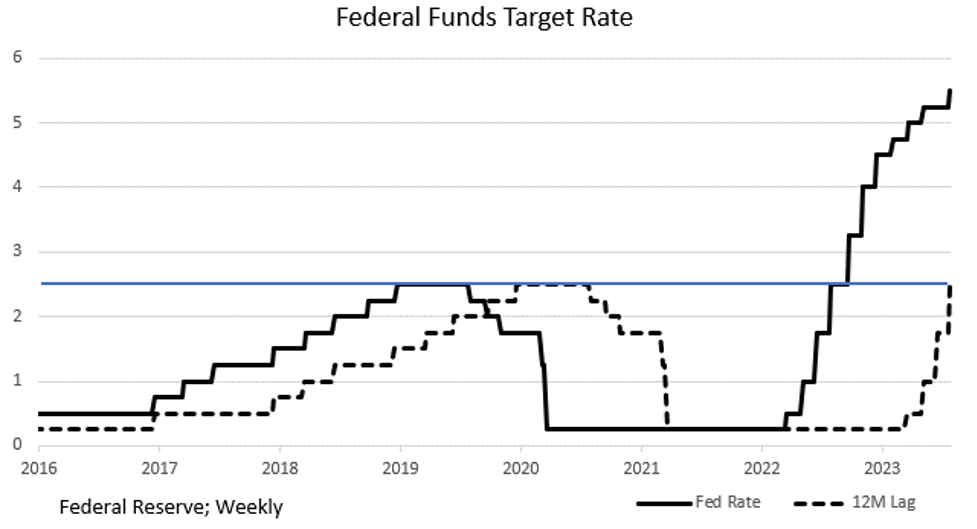

The chart at the top of this blog outlines what this means.

- The Fed has told us that the “neutral” Fed Funds interest rate, i.e., the rate that is neither “loose” nor “tight” and has no economic impact, is 2.50%. The blue line in the chart shows “neutral.” Rates above are restrictive, below are accommodative.

- The solid black line is the actual path of the Fed Funds rate since 2016.

- The dashed line shows the path of that Fed Funds rate with a 12-month lag.

The implication here is that, if monetary policy acts with a 12-month lag, then the dashed line represents monetary policy’s economic impact. Looking at the right-hand side of the chart, one can see that, until now, the effective (12-month lagged) rate has been below the 2.50% neutral rate since the hiking cycle began in March ’22. The Fed didn’t raise its Fed Funds rate above the 2.50% “neutral” rate until late September 2022. As a result, if the 12-month lag is accurate, policy has effectively remained accommodative and won’t turn restrictive until this upcoming September. Hence, the Q2 positive GDP growth shouldn’t come as a surprise. However, a look at the chart shows rapid and accelerating restriction beginning in Q4. Since there are already cracks appear in the economy, the implication is NO SOFT LANDING.

Dissecting GDP

The rise in GDP occurred for reasons other than what one would normally expect. Consumer spending only rose 1.6% in Q2 (vs. 4.2% in Q1). Food Services and Accommodation (restaurants and hotels) fell -2.9%, the worst reading since the opening days of the pandemic. Durable goods purchases were flat (0% growth). GDP growth was led by transportation services, i.e., the airlines (+9.8%) as pent-up demand for non-driving vacations was exercised. Thus, the rise in transportation services appears to be a one-time phenomenon.

One area of strength was non-residential construction (+9.7%). The souring international political climate has caused a onshoring of tech related production facilities, especially chip related. Such facilities are quite expensive to build. In addition, state and local governments increased their spending at a 3.6% annual rate in Q2, after a 4.4% rise in Q1. So, the growth in GDP was not caused by the usual suspect (the consumer).

Is the Fed Done? – Inflation Trends

We won’t know if the Fed is done raising until their September meeting, and that will likely be decided by the incoming inflation data (as frequently expressed by Chair Powell as the last press conference). Current trends are encouraging, but there are likely to be perception issues going forward. But, first the good news. The graph shows CPI inflation in core goods and services was almost non-existent in June. When asked at the post Fed-meeting press conference about the favorable CPI results, Powell quipped that it was “just one month of data.”

The Fed’s favorite inflation measure is the PCE (Personal Consumption Expenditures) core index which excludes food and energy. That rose +0.2% in June (+2.4% annual rate) from May. Using the backward-looking year over year view, in June this index was up +4.1%, down from May’s +4.6% rate. Our own view is that one month and three month (+3.4% annual rate) are better inflation trend indicators than the year over year concept to which this Fed has anchored itself. Relying on the 12-month look-back risks staying restrictive too long, especially with the long lags in monetary policy’s impact on the economy.

Another piece of good news revolves around inflation expectations. This is something the Fed

worries about because high and rising expectations mean that the buying public won’t revolt against higher prices. On the other hand, low inflation expectations do result in consumers foregoing purchases of goods which have recently had price increases. The chart shows rapidly falling inflation expectations in Q2.

Caution – Base Effects

Unfortunately, there are some flies in this ointment. The table shows what year over year inflation will look like when the Fed meets again in September under four different monthly inflation scenarios, from +0.2%/month to -0.1%/month.

Note that under the most likely +0.2% and +0.1% scenarios, both showing favorable monthly changes, annual inflation (year over year) ticks up from the current 3.0% (June) level because of “base effects,” i.e., the change in the denominator as it moves from June 2022 to July and then August of 2022. Something in this range is what the Fed is likely to see at its September meeting showing no progress on a year over year basis from the June 3.0% level. Note that only if inflation is completely benign (0.0%) will the year over year number breach below 3% by August. If there is no progress in the year over year inflation number from June through August (i.e., the most likely +0.2% or +0.1% scenarios), we are likely to get another 25-basis point rate hike, as this Fed clearly doesn’t believe that monetary policy impacts the economy only after a fairly long lag.

Labor

The tight labor market is another Fed concern. We think they would like to see the U3 unemployment rate in the low to mid 4% area. But because there are demographic issues (baby boomers retiring but lack of labor to replace them), we see labor hoarding in the private sector, even at the expense of profit margins.

Note that labor productivity has been negative for five quarters in a row and six of the last seven. This is what happens when companies keep employees they don’t need. Negative productivity, by the way, has a large negative impact on profit margins.

The latest Employment Cost Index (ECI) showed up with a 1% growth rate in private sector wages/salaries (4.1% annual rate). This has been coming down, and 4% is a livable number. Looking back a year, the ECI was up +4.6% in Q2 2022 and +5.1% in Q1. So, while the downtrend is encouraging, given the Fed’s fear of a 1970’s style “wage/price spiral,” this is likely still too hot for them.

Housing

Existing home sales are crashing because, as noted in prior blogs, most homeowners have mortgage rates in the 3% area, the result of near zero Fed administered interest rates for more than a decade. So, moving, even sideways, results in a significant increase in that monthly payment. As a result, existing home inventories are scarce, and mortgage purchase applications are down -23% from year earlier levels. The result has been a move of buyers to the new home market where homebuilders have accommodated those buyers. One of those concessions is a lower price; the median price of a new home has fallen -4.0% from year earlier levels.

On a percentage basis, year over year home sales seem to be doing okay, but that’s because 2022 sales were so poor. Note that 2023 sales (blue bars) are still not stellar.

Other Data

- The freight industry is surely in Recession. That says a lot about the movement of goods. The chart shows a precipitous drop in freight billings beginning in 2022, but now accelerating. We caught a recent headline bemoaning a drop in the demand for cardboard, implying that on-line sales are starting to shrink.

- Leading Economic Indicators (Conference Board) have been negative for 15 months in a row. This many negative readings has always been accompanied by Recession. And Johnson Redbook’s same store sales have turned negative on a year over year basis.

- All the Fed Regional Manufacturing surveys have been in negative terrain for months. Thus, the manufacturing sector is clearly in Recession.

- Commercial bank credit has now turned negative on a year over year basis. The U.S. economy runs on credit! Economist David Rosenberg noted recently that we have had four months in a row of credit contraction which has, 100% of the time in the past, been associated with Recession. We’ve noted in past blogs rising credit card and auto loan delinquencies. Rosenberg says that, according to S&P, corporate defaults are at their fastest pace in more than a decade, even faster than in the 2020 lockdowns. They note 200 companies in severe financial stress. Per Rosenberg, the Fed says that 37% of publicly traded companies will struggle to roll over their debt and the knock-on effects could be “stronger than in most tightening episodes since the late 1970s.”

Final Thoughts

So, NO, despite the positive Q2 GDP number, we still don’t buy into the “soft-landing” scenario. As noted at the top of this blog, the impacts of tight monetary policy are just starting to kick in. Q4 will be interesting.

While the equity market is convinced that all is well and Recession has been avoided, there are still too many negative signposts including:

- 15 consecutive months of negative prints in the Conference Board’s Leading Economic Indicators;

- High and rising credit card and auto loan delinquencies;

- Rising bankruptcies and oncoming issues in debt rollovers at significantly higher interest rates;

- Stagnant retail sales as evident in Johnson Redbook’s same store sales data;

- Mounting Commercial Real Estate (CRE) problems at local and regional banks;

- Falling commercial and consumer lending at the nation’s banks;

- Consistent negative manufacturing readings from the Fed Regional Bank surveys.

Our view remains that inflation is on the wane, but we have the “base effects” in the computation of the indexes that could play on the Fed’s fears and cause yet another unnecessary rate hike come September. Overkill, we think. And we know the Fed isn’t looking at the chart at the top of this blog!

(Joshua Barone and Eugene Hoover contributed to this blog.)

Read the full article here