Since its exit from the Grain Deal that ended July 17th, 2023, Russia has wasted no time in action or in words solidifying its position as the leading supplier of wheat to global export markets. But the logistics of global corn export markets will be even more affected by Ukraine’s lack of ability to export via the Black Sea, because Russia can’t make up the difference like it can with wheat.

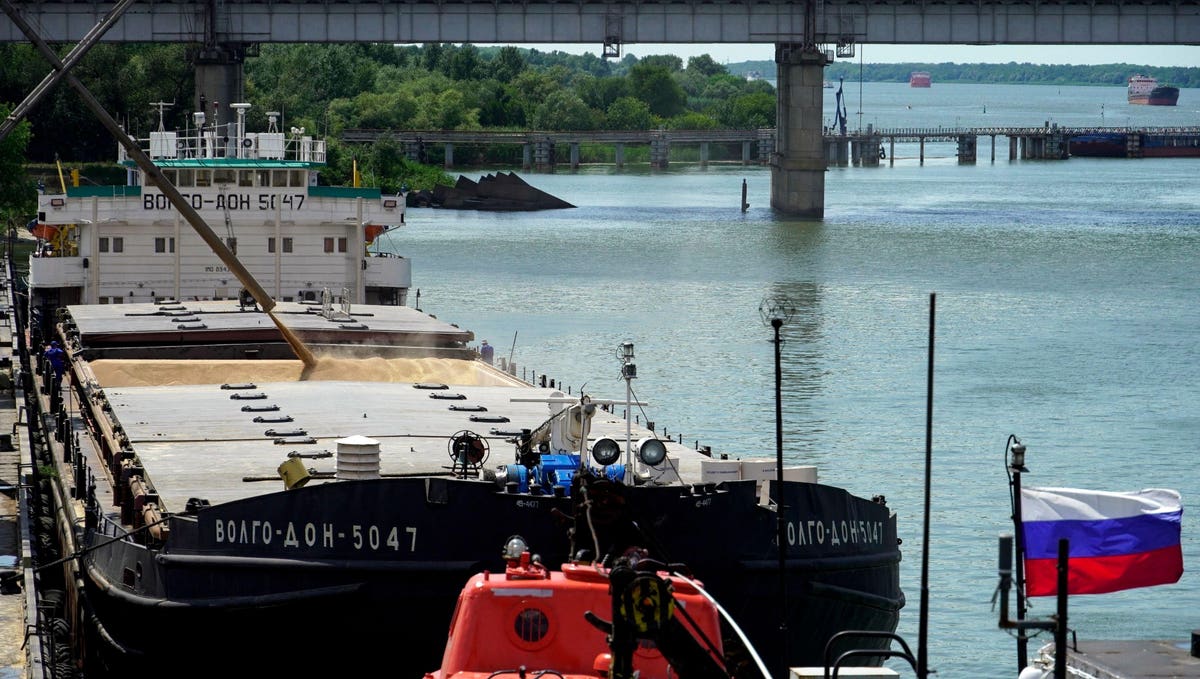

All is fair in war, as the saying goes, and Russia’s strategy is clear: degrade Ukraine’s grain export infrastructure with constant missile attacks while simultaneously warning the world that Ukraine is off-limits as a grain exporter.

According to the USDA’s most recent estimates, Ukraine was the world’s sixth largest wheat exporter in the just ended 2022/23 crop year, with an estimated 16.8 million metric tons (mmt) of wheat provided to global markets. By comparison, Russia is estimated to have exported 45.5 mmt in the 22/23 season, by far the highest export total of all the world’s major wheat grower/exporters.

For the 2023/24 wheat season, the same USDA report has Russia exporting 47.5 mmt of wheat and Ukraine exporting 10.5 mmt. In fact, Russia’s current pace of weekly wheat exports seems to be far ahead of the USDA’s 47.5 mmt estimate for the year, with some private analysts predicting Russia is currently on an annualized export pace nearing 60 mmt. Whatever number is actually realized is less important than knowing that Russia can make up the export deficit created by Ukraine’s anticipated lack of wheat exports; for now there is plenty of wheat in the world, and Russia is pretty much holding most of the exportable excess.

Wheat gets more attention, but Ukraine actually exports more corn than wheat, ranking third in the world (behind Brazil and the U.S.) with corn exports of 28 mmt in the 22/23 crop year and fourth in the world (behind Brazil, the U.S, and Argentina) in the 23/24 crop year with 19.5 mmt. By comparison, Russia’s corn exports are estimated at 5.1 mmt in 22/23 and 4.2 mmt in 23/24.

Clearly, Russia can’t make up the corn export supply deficit caused by Ukraine’s current inability to access Black Sea shipping lanes. To be sure, there is enough corn in the world for everyone, even without corn from Ukraine, but it’s in Brazil, the U.S., and Argentina. China, the largest buyer of corn from Ukraine, is already purchasing corn elsewhere, and USDA estimates, at least for now, show global corn inventories actually rising in the 23/24 crop year.

All of this is to say that even with disruptions caused by the Black Sea war, there is enough grain (wheat and corn) in the world right now, it is just a matter of where buyers will now have to source their purchases. Geographically, wheat export markets don’t change all that much; wheat can still be purchased from Russia which exports out of the Black Sea, just like Ukraine did until July 17, 2023. So long as there is no war related Black Swan event, wheat supplies will remain ample with Russia as the primary seller.

As for corn, Russia’s February 2022 attack on Ukraine and subsequent ruthlessness against all things Ukrainian, including Ukraine’s sea, river, and land based export facilities, will change things pretty dramatically for buyers, who will now have to look to North and South America for their corn instead of to the Black Sea.

Read the full article here