Introduction

Since 2014 I’ve been a huge fan of visiting Las Vegas. I’ve made it my business to visit the popular destination a minimum of once a year. For the last 9 years I’ve probably been more than 30 times. My friends and family often make fun of me and seem to think I’m a huge gambler. And even though I am a Caesar’s and MGM Rewards member, I barely hit the poker tables. I recently wrote a piece on VICI here earlier this month explaining why I thought they were a buy then (still do) and why I think they will continue to outperform. In recent years, I’ve looked for things that provide more personal value to me while in Vegas. For example, instead of staying at any cheap hotel I now choose the one that provides that personal touch or has a particular pool/bar that I have been wanting to check out. I’m actually in town now for the upcoming boxing match this Saturday so I felt compelled to write another piece on one of my favorite REITs. The average temperature has been over 100 degrees but the strip is packed with tourists from all over the globe. With inflation starting to cool, it seems like foot-traffic has picked up again and I expect VICI Properties (NYSE:VICI) to continue down its path of rapid growth and rewarding shareholders with a long-term outlook.

Continued Expansion Outside The Las Vegas Strip

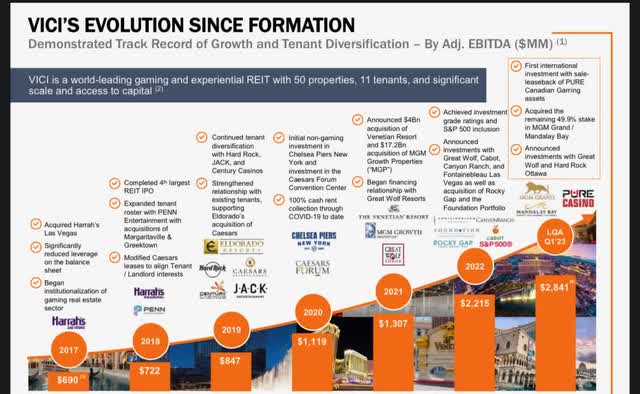

When VICI first burst onto the scene in 2018 who knew they would become one of the fastest REITs to go from IPO to S&P inclusion? They did this in a little under 5 years as stated by their CEO Edward Pitoniak. Although I’m a huge fan of Vegas, I know many people who are not. They either talk about how crowded it is, how hot it is, or normally how it’s too expensive. All these things are true but that doesn’t stop tourists from traveling there year after year seeking the “Vegas” experience and to spend their hard-earned money .

VICI investor presentation

Las Vegas is one of the top 30 most visited cities in the world by American tourists and top 10 for most visited cities in the United States beating out popular destinations like Honolulu and Miami. The REIT recently formed a partnership to support the growth of Health & Wellness Resort Canyon Ranch. Some investors might ask who are they and why does VICI have an interest?

Who Is Canyon Ranch?

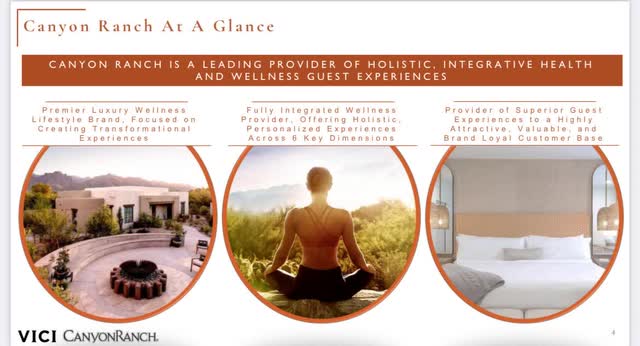

Canyon Ranch is a premier luxury wellness lifestyle brand, focused on creating transformational experiences with over 40+ years of experience providing guests to pursue a lifetime of wellbeing. The first one opened in 1979 in Tucson and was created by Mel Zuckerman. They currently have resorts in Las Vegas, NV, Tucson, AZ, Lenox, MA, and Woodside, CA. With three Texas locations expected to open soon. Fort Worth this year, Houston in 24′ and Austin in 2025-2026. They’re also expected to continue expanding and I think there’s no better candidate to help them with that besides VICI. The brand has won several awards and was named one of the 10 best Health Spa Resorts in the U.S. With this deal VICI is expected to provide the luxurious health and wellness brand with $150 million of mortgage financing for an initial lease term of 2 years with three one-year extensions. VICI also has a preferred equity term of 10 years; optional redemption at any time, subject to a redemption premium in the first three years. Additionally, the luxury spa’s high-revenue operating model had an 2022 average revenue per occupied room of $1,720 and I believe this will provide VICI with attractive capital and operating economics for the long-term.

VICI Canyon Ranch presentation

In short, Canyon Ranch is supposed to address all six dimensions of the wellness: Better Health, Better Fitness, Better Nutrition, Better Appearance, Better Sleep, and Better Mindfulness. Over the last decade or so it seems people have taken a vested interest into better health and wellness; whether this includes better eating, habits, exercising more regularly, etc. And this multi-trillion industry is expected to continue growing at a CAGR of 5%-10%. Before this deal, I had never heard of Canyon Ranch but I must say I will make a visit there soon, maybe as a retirement gift to myself.

Other Partnerships Outside The Gaming Space

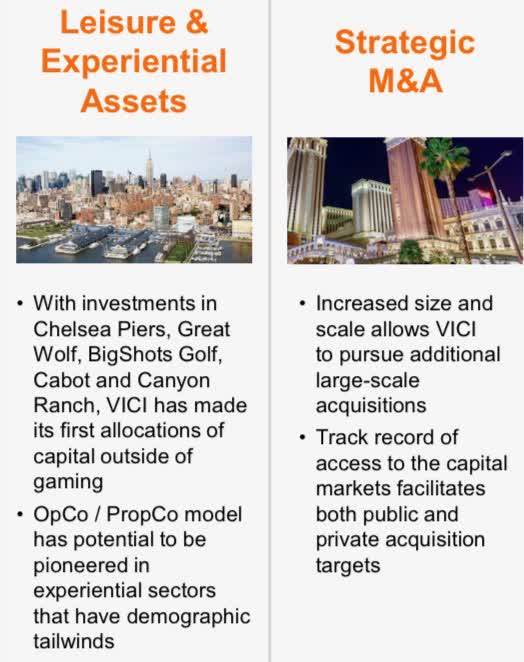

VICI also has long-term financing partnerships in high-quality real estate outside the casino space with Big Shots Golf, Cabot, Great Wolf Resorts, and Chelsea Piers New York. Then there’s also the possibility of VICI working with Six Flags (SIX) as the theme park giant has mentioned talks of trying to monetize its real estate assets but this remains to be seen. Although I see this as a real possibility for VICI to continue its expansion into the experiential realm.

VICIproperties.com

I like the fact that VICI is looking outside of the gaming area into leisure and experiential markets. People and times are changing, especially in the way they spend their time and money nowadays. And I think leisure and experience is the way to go. As I get older, I too tend to value more memorable experiences and not the traditional ones. Consumers prioritize creating memories and a study showed millennials would rather spend their money on experiences than material things. What better way for VICI to capture this than to invest in health & wellness spas, luxury golf courses, etc. From a business standpoint this is great move for the REIT.

Stellar FFO And Revenue Growth

During July 26th reported Q2 VICI slightly increased its guidance for 2023 FFO growth to $2.11-$2.14 from its prior range of $2.10-$2.13. They also beat on EPS by $0.07 and revenue by $23.31 million. Their strong quarter represented 12% AFFO growth and 36% revenue growth year-over-year and I believe this is because of the several accretive acquisitions VICI has made over the last year including: Four Canadian Casino Properties with Century Casinos in May and the acquisition of four PURE Canadian gaming assets in January. With all the economic uncertainty over the last year with inflation and the rapid rate hikes, VICI continued to outperform its peers and the S&P in the same period, further proving their resilience.

Expected Dividend Increase

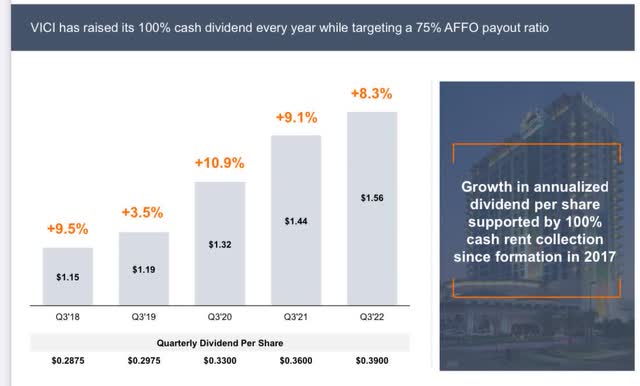

I expect VICI to announce a dividend increase in September for the scheduled October pay date. With their rapid growth year-over-year and beat on both FFO and revenue, I would not be surprised if they conducted a larger increase this quarter. VICI last increased the dividend by 8% from $0.36 to $0.39. The REIT raised the dividend by $0.03 in the last 3 raises but I’m expecting a $0.03-$0.05 raise this time. I believe VICI’s management team is being conservative and I expect them to exceed 2023 FFO guidance and come in between $2.15-$2.20.

VICI investor presentation

Even with an expected $0.44 dividend, this would put the payout ratio slightly below their target of 75%.

Valuation

Seeking Alpha gives VICI a valuation grade of B and I can say I agree with that as I see them continuing their stellar growth in these next few years. They currently trade at a FWD P/AFFO ratio of 15.46 in-line with the sector average of 15.48, suggesting to me that the REIT is reasonably valued. Even with this I think VICI is a buy at $33 & below and investors looking to start a position should dollar-cost-average in and to look for any share price weakness. We recently got a drop in early July close to their 52-week low and I took advantage adding a few shares on the dip. My goal is always to hold my stocks forever as I typically have a long-term outlook. I think that investors who view VICI as a long-term hold should consider adding at these prices.

Investor Takeaway

Although the S&P is up over 4% in the past month I believe VICI remains a buy. In my opinion this REIT is one of the best in the business and even with its short track record, will continue to reward shareholders with their investments in high-quality real estate for the long-term. If management does decide to conduct a larger dividend increase in the next few months this could be the catalyst the stock needs to break into that $36-$37 range.

Read the full article here