Editor’s note: Seeking Alpha is proud to welcome Mark Denys as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Pool Corporation (NASDAQ:POOL) is a B2B distributor of swimming pool and outdoor living products. Its impressive track record over more than two decades, combined with booming financial markets and a strong COVID tailwind, resulted in a share price exceeding $577 in November 2021. In the course of the next year though, its share price nearly halved, hitting a low of $278 in October 2022. Today, it has rebounded substantially and analysts continue to recommend to buying or holding on to POOL.

I argue differently. The weakening outlook, the absence of a truly strong moat, poorly designed management incentives and a speculative possibility of having overpaid for a large acquisition in 2021 are suggesting me that it is time to get out of the POOL.

A rock-solid business model?

POOL sells its wares through 420 distribution centers across North America, Europe (5% of sales) and Australia (1% of sales) creating annual revenues of $6.2 billion and a net income margin of 12%. Roughly 80% of its customers are contractors who service private and commercial pool owners. POOL ensures that these contractors always have access to inventory, so that they can help pool owners at short notice.

Most of POOL’s business revolves around the installed base of pools, while renovations and upgrades are 20% of sales. New pool construction creates the remaining 20%. About 60% of sales is non-discretionary – i.e., maintenance products that pool owners cannot do without. Whilst this seems to be a strong foundation for its business model, I have identified four possible cracks.

Just another fashion trend?

The growing market for pool supplies and services is part of a trend towards ‘outdoor living’ and ‘lifestyle and wellness amenities’ in homes, hotels and resorts. However, as with any fashion trend, most trends change and few are durable.

Where’s the moat?

POOL has several competitive advantages (switching costs, economies of scale, recurring revenues), but when I look at these in isolation I conclude that none is very strong. POOL sells more than 200,000 national brand and private label products and consequently I believe there is no obvious competitive advantage from branding or intellectual property.

International expansion

In theory anyone can replicate POOL’s business model. Its industry is fragmented and has relatively low barriers to entry. However, one of the appealing characteristics of a fragmented market is that it is an ideal environment for a roll up company, such as POOL, that gradually acquires smaller competitors and typically dominates a local market. The USA is POOL’s local market and there seem to be enough opportunities for further acquisitions. However, in past years POOL has acquired businesses in Europe and Australia. Although expected market growth in these areas is slightly higher, its profitability in the US is still much better. In short, I believe that investors in POOL should not assume that POOL’s growth story can simply be extrapolated to other geographies.

Climate change

The increasing scarcity of fresh water, higher water costs, more regulation and the shift of seasons may all negatively affect POOL’s business. For example, the recent bad weather conditions in California and Arizona delayed the start of the pool season in those major states. This was the main reason for a downward adjustment of the full-year market outlook during the first quarterly earnings call in 2023. Legislation on water consumption becomes stricter and droughts have already led to bans on swimming pools.

To be sure, climate change can also provide a tailwind for POOL’s business in the form of an earlier start of the swimming pool season, increased use of swimming pools (increases chemical usage), increased sale of solar heating systems, pool covers, irrigation products, etc. Although the pool industry will benefit from some climate change consequences, others pose important threats. Their overall net impact on POOL is unknown at the moment.

Notes on Management

Peter D. Arvan (54) joined POOL as COO in 2017 and has served as the President and CEO since 2019. He currently owns over $20 million worth of shares, which is more than the required five times annual salary according company guidelines.

Since the other executives have also been promoted to the C-suite within the past years, I conclude that only a small part of POOL’s impressive track record can be attributed to current management. It was Manny Perez, POOL’s CEO from 2001-18, who was chiefly responsible for POOL’s past successes. By being vice-chairman of the board, he does remain part of POOL.

Incentive plan

POOL has both short- and medium-term incentive plans that are mainly paid in cash. The short-term plans are based on criteria that are related to growth, operating income and other non-disclosed criteria. One target concerns ROIC, which must be over 10%. Considering POOL’s track record this is an incredibly low threshold that is almost impossible not to meet. In fact, in the past 20 years it only happened once during the financial crisis in 2008.

The medium-term plan is based on EPS growth of at least 5% on an annual basis, which results in a bonus that equals 50% of their base salary. This bonus increases to 200% when EPS growth is over 20%. During the past 20 years the average annual EPS growth was 18%. Even in the three years prior to the COVID pandemic the CAGR was already at 22%. Clearly, also this medium-term incentive plan is set at a low threshold and it may be adjusted for acquisitions, which could be a risky incentive.

POOL also has long-term equity awards in the form of restricted stock awards. Again, the performance vesting criterium (ROIC >10% for 3 years) is easy to meet given POOL’s track record.

In summary, POOL’s incentive schemes are aligned to shareholder interests, but its targets are not ambitious. The EPS growth target includes takeovers and may create an incentive for overpaying.

Acquisitions

POOL’s revenues have grown at a CAGR of 9.5% for the past 20 years. Several market research companies (Technavio, Verified Market Research and Allied Research) predict that organic growth will be in the lower single digits (2-4%) going forward. Similarly, the consumption of swimming pools chemicals and the sales for pool pumps are predicted to grow at 3-4% yearly. Clearly, POOL needs acquisitions to fuel its growth.

For a long time, POOL was a regular but not a very aggressive buyer and most of its acquisitions were rather small. In 2021 however POOL acquired Florida-based Porpoise Pool & Patio for $ 789 million net of cash. It was an acquisition at a size and valuation that was unseen before. At the top of the economic cycle, it caused a substantial increase in intangible assets, which could be suppressing the return on assets ratio going forward, as I will discuss later.

In addition, POOL’s May 2022 investor presentation unveiled its intention to spend only $25-50 million a year on acquisitions, which is similar to total capex at $50-60 million per year. It suggests that POOL may not be continuing many acquisitions in the coming years. If so, a very important driver of growth will be missing.

A look at POOL’s finances

A robust balance sheet

After compounding with an annual growth rate of 12.3% for the past two decades, POOL’s total assets were $3.6 billion at the end of 2022. This includes the acquisition of Porpoise Pool & Patio in 2021 that caused a steep change in goodwill and intangibles of 721 million. Despite its size, this acquisition did not change the risk profile of the balance sheet. Debt to Assets jumped by only 4% to 67% and was trimmed down to 65% in 2022.

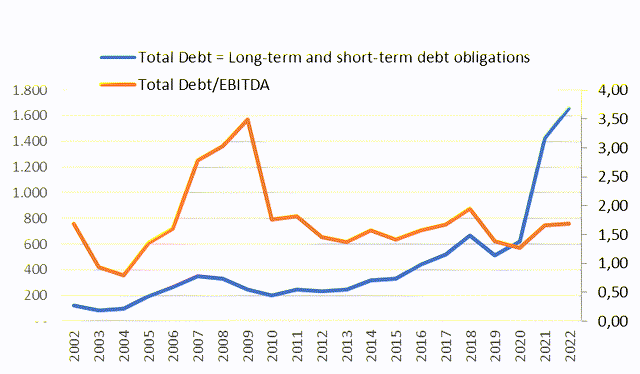

In 2022, POOL’s total debt grew by 16% to $1.67 billion, while its ratio of Total Debt/EBITDA hardly changed. At a level of 1.7, it indicates that POOL is well able to pay off its debt.

data from: www.roic.ai

Also, POOL’s gearing remains stable and prudent around 1.3. Given that 60% of its tangible assets are inventory and that POOL is well able to generate operating income, there should be no concern about its ability to meet financial obligations in case of an economic turmoil. Also in terms of liquidity POOL should be able to meet all its immediate liabilities.

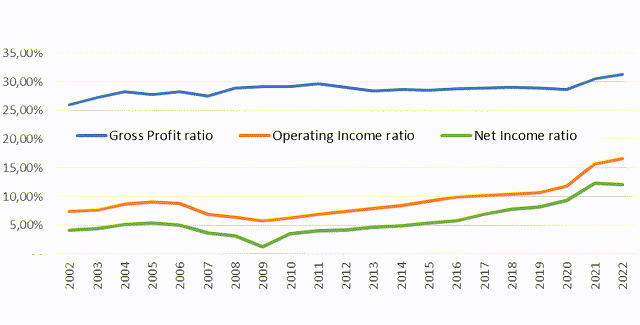

Strong margins, but a weakening trend

The past three years were quite eventful. First, COVID helped revenues to grow by 23% in 2020, which is roughly 16% in excess of its long-term trend. Revenues grew by 34.5% in 2021, a large part due to acquisitions, and finally in 2022 revenues grew at 16.7%, probably helped by the high level of inflation. However, when the annual price inflation in the US is subtracted, the resulting 10.2% is still clearly better than the annual revenue growth of 7.3% during the five years preceding COVID. For 2023, a drop in sales of ‘mid-single digits’ was announced after Q1, which was recently adjusted downward to -10% during the Q2 earnings call.

Gross profits increased by 20% in the past year; a higher rate than revenues and much above the long-term trend of 11.4% each year since 2002. This is a relatively recent trend, because in the years before COVID the improvement in the gross profit margin seemed to be slowing. Are economies of scale running out of steam in the current business? Or is the recent improvement a sign that the long-term trend is still there?

In 2022 SGA costs were increasing in line with the total revenue growth. This is worse than the previous 10 years, which showed a steady decline in SGA costs as a percentage of revenues. It may indicate the synergies form the large acquisition in 2021 have not (yet) fully materialized.

data from: www.roic.ai

However, POOL’s growing Operating Income in absolute and relative terms continues to be impressive. Net Income grew by 15%, but the net margin did not improve due to higher taxes and other expenses. While we should not read too much into this single data point, it does represent a change in a long-standing upward trend since 2009. It remains to be seen whether synergies and increasing purchasing power from its growing size can, once more, accrue to the bottom line.

POOL’s management has a long-standing policy of buying back its shares at a rate of about 2% each year. Combined with strongly growing Net Income, its Earnings Per Share (diluted) have compounded by 18.9% since 2001.

In 2022 EPS grew by 16.9%, which is below the 21.3% during the 5 years preceding COVID. While EPS growth in 2022 is still impressive, the question is why the COVID tailwind did not continue to push up its EPS to similar growth levels as in the past.

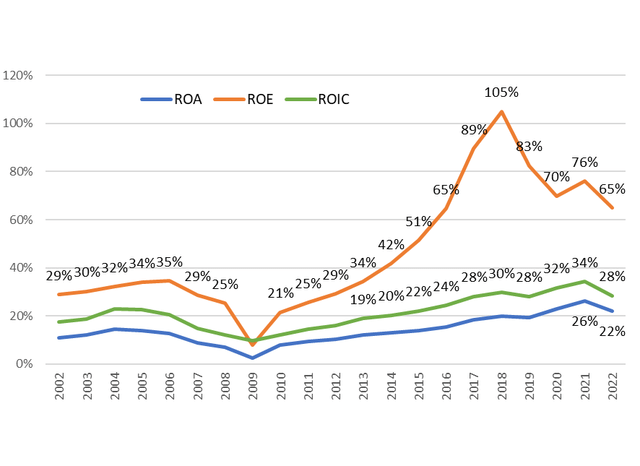

And similarly, while Return on Assets, Return on Equity and Return on Invested Capital all are very high in absolute terms, they are showing signs of a weakening trend in the past few years. Nevertheless, POOL’s WACC, which is estimated at 9.3%, is well below its ROIC. This indicates that POOL does continue to grow its business in a profitable manner.

data from: www.roic.ai

Future earnings at risk

During its Q4 2022 earnings call POOL’s management set out to give a cautious projection with expected revenues down by 0-3%. Yet, already after one quarter it had to adjust its revenues projection downward to ‘mid-single digits’. The recent Q2 earnings update showed that actual revenues were down -12% and management adjusted its full-year outlook to -10%. The main reasons were the extreme weather in some states, which resulted in deferred renovation projects and delayed pool openings, according to the CEO Mr. Arvan. Also the slowdown in the housing market, the general macroeconomic conditions and inflationary pressures were said to have an impact.

Whilst EPS was $18.7 in 2022 and the initial projection for 2023 was $16-17 EPS (Q4 2022). Each subsequent quarter has given a downward adjustment of the full-year EPS outlook from $14.62-16.12 at the end of Q1 to $13.14-14.14 at the end of Q2. During the Q1 update call, management was assuming ‘mild recessionary conditions’ for 2023. The 2008 financial crisis showed how its share price reacts to more severe recessionary conditions. At the time, POOL’s revenues dropped by -25% and for every -1% drop in revenues, its EPS dropped by -3%, while its share price more than halved. Currently, POOL is projecting 10% less revenues in 2023, which by comparison to 2008-2009 could result in 30% less EPS, which is towards the lower end of the most recent outlook.

Priced for perfection?

As discussed, recently POOL’s CEO lowered 2023 guidance for the second time this year. With expected net income 25-30% lower than 2022, a key question for POOL’s valuation is whether POOL will return to its usual EPS growth in the coming years.

Below I will estimate POOL’s fair value using the following assumptions:

- POOL’s market is expected to grow by 2-4% per year for the coming decade.

- Through ongoing acquisitions, POOL can grow by the higher single digits: 7-10% per year.

- POOL’s Net Income has a tendency to grow roughly double that of revenues: 16-19% per year.

- Share-buyback of 2% per year results in POOL’s EPS growing by of 18-21% per year.

The table below shows the assumptions underlying a fair value estimate based on a discount rate of 10%. I assumed that the EPS in the first year is at the high, mid or low point of POOL’s updated guidance, while EPS growth in the next 4 years equals the 5-year pre-COVID CAGR of 21% (high case), the 20-year CAGR of 19% (medium case) or 15% (low case). The EPS growth in the five years thereafter is in each case 10% lower than the previous years.

|

EPS 2023 |

EPS growth 2024-27 |

EPS growth 2028-32 |

Terminal P/E 2032 |

Scenario Weight |

Fair value Business as usual |

Fair value Lower RoA |

|

|

High |

14.14 |

21% |

11% |

20 |

20% |

$429 |

$386 |

|

Medium |

13.64 |

19% |

9% |

18 |

60% |

$324 |

$294 |

|

Low |

13.14 |

15% |

5% |

15 |

20% |

$195 |

$181 |

|

Fair value estimate (DCF, 10% discount): |

$319 |

$290 |

|||||

This valuation assumes that after this year’s dip in earnings, EPS growth resumes to ‘business as usual’ growth rates. Under this scenario current share price (around $360-380) is more or less 10-20% overpriced compared to my estimated fair value ($319).

However, POOL’s main source of profits are its tangible assets such as distribution centers and inventory. Its quarterly Return on Assets (RoA) varied in a range of 10-17% pre-COVID and jumped to 17-25% in 2021-2022. The EPS growth in the ‘low’ scenario still assumes an annualized RoA of around 19%. This may still be considered relatively optimistic, given that currently RoA is trending down to about 14% (LTM).

Whilst much of the recent drop in RoA can be attributed to adverse weather conditions and higher interest rates, part of this drop might be explained by POOL overpaying for its acquisition Porpoise in 2021. It must be said that this is merely speculation, since POOL does not report data on the Porpoise acquisition separately. However, the acquisition did substantially raise the intangible assets on its balance sheet, increasing from 16% in 2020 to 31% in 2021. If we would assume that these 15% additional intangible assets do not create tangible returns, we may expect that its total assets generate 15% less returns in the coming years. Under this scenario I estimate POOL’s fair value around $290. Adding a 10% margin of safety would suggest a safe entry point for buying POOL around $250.

Wrapping up

Given its impressive track record in growth and shareholder return, POOL seems to be company that fits any shareholder with a buy-and-hold mentality. However, looking backward can be dangerous. In this article, I have argued that there are several risks related to its business model, its management and its share valuation. In the past, a considerable part of POOL total shareholders’ return was the result of multiple expansion. In 2022 this has reversed into a multiple contraction and, despite the jump in its share price this year, it is reasonable to expect that under present macroeconomic conditions it is unlikely that we will see such structural multiple expansion again soon.

My valuation analysis showed that POOL is priced for perfection. If POOL continues to face headwinds according to the current outlook, then we can expect its share price to drop by 10-20%. If it turns out that POOL did substantially overpay for its large acquisition in 2021, then its share price could drop below $300 until it reaches its fair value.

Taking all of the above on board, I consider POOL an attractive buy with a reasonable margin of safety when its share price is around $250 for an expected return of >10% annually. Given that most investors are looking backward at POOL’s impressive past, it is unlikely that its share price will drop that low very soon. However, if economic conditions continue to worsen, this may become reflected in its share price, providing an opportunity for the patient investor. For the current holder of this stock, I suggest it is time to get out of the POOL.

Read the full article here