Welcome to the July 2023 edition of the ‘junior’ lithium miner news. We have categorized those lithium miners that won’t likely be in production before 2024 as the juniors. Investors are reminded that many of the lithium juniors will most likely be needed in the mid and late 2020’s to supply the booming electric vehicle [EV] and energy storage markets. This means investing in these companies requires a higher risk tolerance and a longer time frame.

July saw another very busy month with plenty of good news from the lithium juniors. Some easing of the Canadian bush fires was also good to hear.

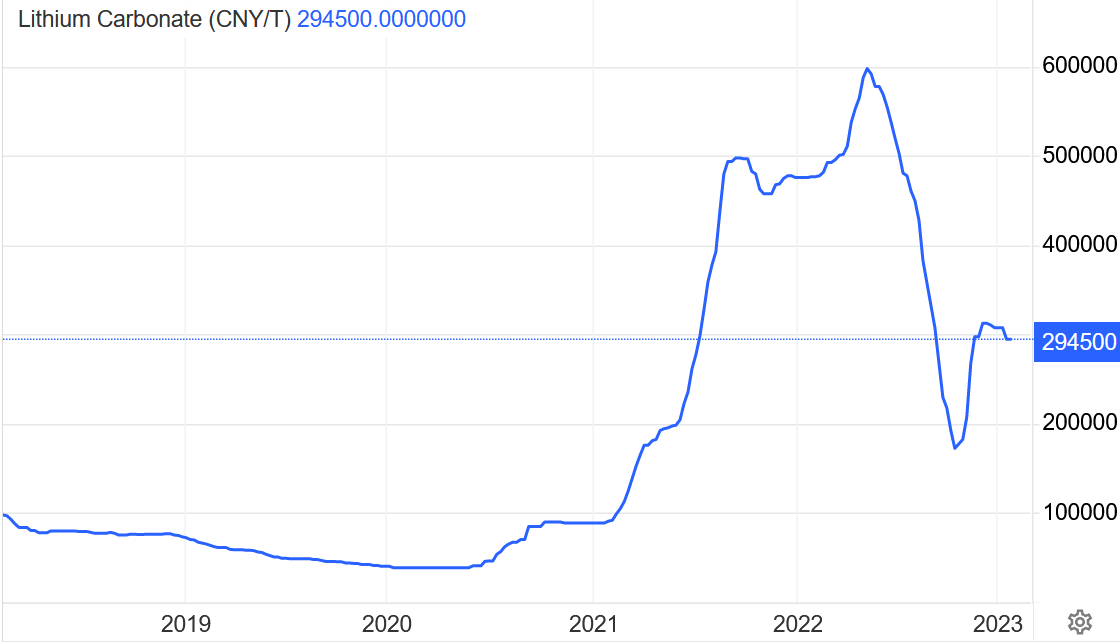

Lithium price news

Asian Metal reported during the past 30 days, the 99.5% China delivered lithium carbonate (99% min.) spot price was down 6.27% and the China lithium hydroxide (56.5% min.) price was down 8.23%. The Lithium Iron Phosphate (3.9% min) price was down 2.39%. The Spodumene (6% min) price was down 0.62% over the past 30 days.

Metal.com reported lithium spodumene concentrate (6%, CIF China) average price of USD 3,485/t, as of July 25, 2023.

China lithium carbonate spot price 5 year chart – CNY 294,500 (~USD 41,122) (source)

Trading Economics

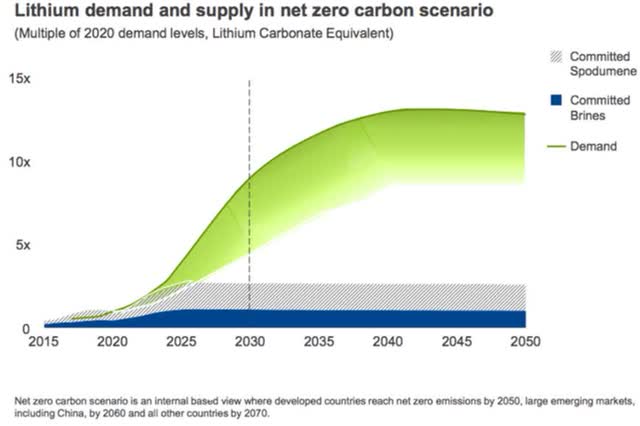

Rio Tinto forecasts lithium emerging supply gap (chart from 2021) – 60 new mines the size of Jadar needed

Rio Tinto

Lithium market news

For a summary of the latest lithium market news and the “major” lithium company’s news, investors can read: “Lithium Miners News For The Month Of July 2023” article. Highlights include:

- U.S DoE: Lithium & nickel are the two ‘high importance to energy’ critical materials in the mid term (2025-2035).

- BMI: Financing the battery arms race: The $514 billion cost of bridging the global EV supply chain divide.

- The future is lithium: Investing in the essential metal for tech and energy progress.

- Exxon Mobil expands lithium bet with Tetra Technologies deal.

- UK set to begin lithium mining (in 2028) as France’s Imerys agrees deal with British Lithium.

- Argentina’s Y-TEC (a unit of Argentine state oil firm YPF) to begin lithium battery production in Sept. 2023 with lithium supplied by Livent.

- China jumps ahead in the rush to secure lithium from Africa.

- Australia forecasts brutal lithium price correction as output surges.

- CATL touts breakthrough in cold-weather EV charging.

- Battery cathode prices rise for first time this year as lithium costs increase.

- Freyr Battery awarded a €100M ($112M) grant from the EU to support the development of its Giga Arctic project in Norway.

- China’s first-ever lithium futures tumble on trading debut. “Sentiment is now tempered by an anticipated surplus for lithium products in 2024.”

Junior lithium miners company news

Wesfarmers [ASX:WES] (OTCPK:WFAFY) (took over Kidman Resources)

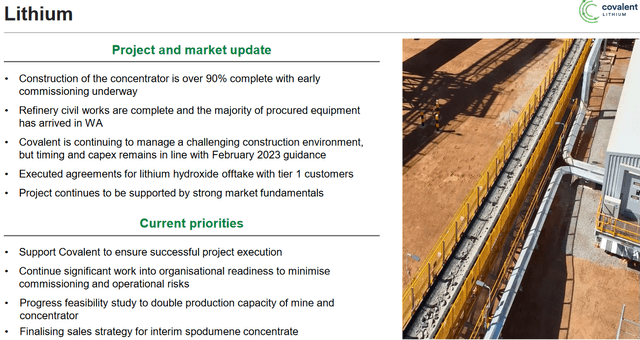

The Mt Holland Lithium Project is a 50/50 JV (“Covalent Lithium”) between Wesfarmers [ASX:WES] (OTCPK:WFAFF) and SQM (SQM), located in Western Australia. There is also a proposal for a refinery located in WA. More details here at: Progress at the Mt Holland lithium project.

No lithium related news for the month.

Mt Holland Project update May 30, 2023 (source – page 84)

Wesfarmers

You can view the latest company presentation here.

Upcoming catalysts include:

- Late 2023 – Mt Holland spodumene production.

- H1, 2025 – Kwinana LiOH refinery planned to begin and ramp to 45-50ktpa LiOH.

Liontown Resources [ASX:LTR] (OTCPK:LINRF)

Liontown Resources 100% own the Kathleen Valley Lithium spodumene project in Western Australia. Mostly funded to production.

On July 19 Liontown Resources announced:

Liontown awards Spodumene Concentrate haulage contract… Following an extensive tender process, Qube has secured the five-year contract, which involves loading spodumene concentrate at Kathleen Valley; haulage of the concentrate to the Port of Geraldton; storage and stockpile management at the port and the outload to port infrastructure for shipment to Liontown customers… The contract is due to commence in mid-2024 in line with process plant ramp-up…

You can view the company’s latest presentation here.

Upcoming catalysts include:

- 2023-24: Kathleen Valley Project construction

- Q1, 2024: Commissioning with production set to begin mid 2024

Leo Lithium Limited [ASX:LLL]

Leo Lithium is developing the Goulamina Lithium Project (50/50 JV with Ganfeng Lithium) in Mali with a total Resource of 211 Mt @ 1.37% Li2O, targeting a production start in mid 2024.

On June 30 The West Australian reported: “West Perth-based Leo Lithium shares rise after producing direct shipped ore at Goulamina in West Africa.”

On June 30 Leo Lithium Limited announced: “Leo Lithium produces first DSO, offtake process set to commence.” Highlights include:

- “Mining of DSO commences at Goulamina, with crushing equipment at the starter pit performing efficiently.

- Trucking contractors for DSO set to be appointed imminently.

- Early revenue from DSO remains on track for Q4 2023, targeting the export of 185 kt prior to first spodumene concentrate production in H1 2024.”

On July 14 Leo Lithium Limited announced: “Goulamina mining services contract awarded to specialist West African Operator.”

On July 20 Leo Lithium Limited announced:

Leo Lithium Limited (ASX: LLL) – Suspension from quotation. The securities of Leo Lithium Limited (‘LLL’) will be suspended from quotation immediately under Listing Rule 17.2, at the request of LLL, pending the release of an announcement regarding correspondence from the government of Mali.

You can view the company presentation here.

Upcoming catalysts include:

- Q4, 2023: DSO targeted to begin.

- Q2, 2024: Commissioning targeted to begin for Goulamina.

Investors can read the recent Trend Investing article on Leo Lithium here.

Eramet [FR:ERA] (OTCPK:ERMAY) (OTCPK:ERMAF) – ‘Targets DLE production by early 2024’

Eramet is in a JV ‘Eramine Sudamerica’ (50.1% Eramet, 49.9% Tsingshan) which owns the Centenario-Ratones Lithium Project in Argentina. Eramet targets to start DLE production by Q2 2024.

On June 30 Bloomberg reported:

Glencore in talks to back Argentina Lithium plant for future supply… The commodity giant will sign an offtake agreement in exchange for helping to fund the lithium processing plant that Eramet is building with China’s Tsingshan Holding Group Co., according to people familiar with the matter, who asked not to be identified because the information is private… Eramet is building the 24,000-ton-a-year lithium processing plant with China’s Tsingshan, which is the world’s biggest producer of nickel and stainless steel. The project has an estimated cost of more than €700 million ($763 million) and is due to start production in the second quarter of next year, with a full ramp-up by mid-2025, Eramet said in a presentation in May. The French company and its Chinese partner plan to decide later this year whether to triple the plant’s capacity.

On July 3, Eramet announced: “Eramet: Closing of the divestment of Erasteel, the final step in Eramet’s repositioning in its Mining and Metals activities…”

Investors can read the recent Trend Investing article on Eramet here.

POSCO [KRX:005490] (PKX)

POSCO owns the northern Sal de Vida (Hombre Muerto salar, Argentina) tenements bought from Galaxy Resources (now Allkem). POSCO targets to start DLE production by H1, 2024.

On July 3 Market Screener reported:

South Korea’s POSCO plans $93 billion of investment by 2030. South Korean steelmaking and materials conglomerate POSCO Group, headed by POSCO Holdings, said on Monday it plans to invest 121 trillion won ($93 billion) by 2030 for growth in core businesses such as steel, battery materials and hydrogen.

On July 11 Market Screener reported: “Posco Group sets up Battery Recycling Ecosystem in South Korea’s South Jeolla Province…”

On July 23 Bloomberg reported: “Posco jumps most ever on bumper profits and EV battery bets.” Highlights include:

- “Stock also gets boost as short sellers cover bearish wagers.

- Shares surge as much as 24%, extending monthly gain to 76%.”

Upcoming catalysts include:

- Late 2023 – Plan to commission production of POSCO/Pilbara Minerals JV LiOH facility in Korea.

- H1, 2024 – Target to commence production at Hombre Muerto and ramp to 25ktpa LiOH.

Atlantic Lithium Limited [LSE:ALL] [ASX:A11] (OTCQX:ALLIF)

Atlantic Lithium is progressing its Ewoyaa Project in Ghana towards production. Piedmont Lithium has a 50% project earn-in share.

On June 29, Atlantic Lithium Limited announced: “Ewoyaa Definitive Feasibility Study” Highlights include:

- “3.6 million tonnes (“Mt”) spodumene concentrate production over 12-year Life of Mine (“LOM”).

- Exceptional Project economics: Post-tax Net Present Value (“NPV8“) of US$1.5bn with free cash flow of US$2.4bn from LOM revenues of US$6.6bn, Average LOM EBITDA of US$316 million per annum, Internal Rate of Return (“IRR”) of 105% and short payback of 19 months.

- C1 cash operating costs of US$377/t of concentrate Free-On-Board (“FOB”) Ghana Port, after by-product credits from conventional open cut mining operation; All in Sustaining Cost (“AISC”) of US$610/t.

- Modest capital cost estimate of US$185 million.

- Incorporates Modular DMS units to generate early cash flow and increased throughput from 2Mtpa to 2.7Mtpa: Modular DMS cash flow reduces mine build peak funding requirement; capex paid back prior to full completion of plant build; and DFS maintains low capital intensity of US$64/t of annualised throughput.

- Throughput increased by 35% following significant uplift in Ore Reserves to 25.6Mt @ 1.22% Li2O…

- DFS incorporates Mineral Resource Estimate1 (“MRE”) of 35.3Mt @ 1.25 Li2O and conservative LOM concentrate pricing of US$1,587/t, FOB Ghana Port.

- Project benefits from close proximity to operational infrastructure, low energy and water-intensity process flow sheet, proximity to potential off-takers and skilled Ghanaian workforce within surrounding communities; over 800 direct jobs to be created.”

Upcoming catalysts include:

- 2024 – Production targeted to begin.

ioneer Ltd [ASX:INR] [GR:4G1] (OTCPK:GSCCF) (IONR)

ioneer ltd. announced in September 2021 the sale of 50% of its flagship lithium boron project to Sibanye Stillwater for US$490m.

On July 24 ioneer Ltd announced: “Quarterly activities report for the period ending 30 June 2023.” Highlights include:

- “Rhyolite Ridge South Basin Mineral Resource increases by 168% to 3.4 Mt lithium carbonate equivalent (LCE) and 14.1 Mt of boric acid equivalent.

- Ioneer and Dragonfly Energy Partnership to strengthen U.S. lithium battery and storage supply chain.

- Federal permitting process [NEPA] continues to advance with completion of the first public scoping period and progress towards publication of a draft EIS.

- Detailed engineering and procurement activities advancing in preparation for commencement of construction in H1 2024.

- Growth studies (North and South Basins) progressing well with an update on metallurgical testwork expected in August 2023.”

Upcoming catalysts include:

- 2023 – Possible permitting approval.

- H1, 2023 – Commencement of construction of the Rhyolite Ridge Lithium Boron Project.

Vulcan Energy Resources [ASX: VUL] (OTCPK:VULNF)

Vulcan Energy Resources state that they have “the largest lithium resource in Europe” with a total of 15.85mt LCE, at an average lithium grade of 181 mg/L. The Company is in the development stage developing a geothermal lithium brine operation (geothermal energy plus lithium extraction plants) in the Upper Rhine Valley of Germany.

On July 13, Vulcan Energy Resources announced: “Positive local development and permitting progress towards delivery of Phase One of Vulcan’s Zero Carbon Lithium™ Project…”

Upcoming catalysts include:

- End 2026 – Target to commence commercial production at the Zero Carbon Lithium™ Project in Germany, then ramp to 40,000tpa.

Critical Elements Lithium Corp. [TSXV:CRE] [GR:F12] (OTCQX:CRECF)

No significant news for the month.

Investors can view the company’s latest presentation here.

Upcoming catalysts include:

- 2023 – Possible off-take or project financing announcements.

You can read the latest Trend Investing Critical Elements Lithium article here.

Standard Lithium [TSXV:SLI] (SLI)

No significant news for the month.

AVZ Minerals [ASX:AVZ] (OTC:AZZVF)

AVZ Minerals owns 51% of its Manono Lithium & Tin Project in the DRC, after selling 24% of it to Suzhou CATH Energy Technologies for US240m. DRC-owned firm Cominiere has a 25% share.

On June 30 AVZ Minerals announced: “Excellent results from Roche Dure extension drilling program.” Highlights include:

- “Results from the fifth and final consignment of 36 drillholes out of 53 resource drill holes from the Roche Dure extension drilling program: 927 samples returned values greater than 2% Li2O. 134 samples returned values greater than 3%. 14 samples returned values greater than 4% Li2O with the highest value being from hole MO22DD035 from 61.0 to 63.0 metres downhole grading 4.89% Li2O…

- Significant high-grade intersections include, for example, 341.6m @ 1.86% Li2O between 207.7m to 549.3m in hole MO22DD030 on section 7,900m north…”

On July 3 AVZ Minerals announced:

Continuation of transaction implementation agreement. AVZ Minerals Limited (ASX: AVZ, OTC: AZZVF) (“AVZ” or “Company”) refers to the Transaction Implementation Agreement (“TIA”) with Suzhou CATH Energy Technologies (“CATH”) as detailed in the Company’s ASX Announcements dated 27 September 2021 “Cornerstone investor secured for development of Manono Lithium and Tin Project”. The Company confirms that the parties to the TIA remain committed to the completion of the TIA. The TIA remains valid until either the completion or cancellation by the parties in accordance with the terms of the TIA.

Upcoming catalysts include:

- 2023 – Any further arbitration news in the Manono Project dispute with Zijin Mining Group.

Note: July 2022 – AVZ Minerals ‘confident’ despite Manono dispute remaining unresolved

Global Lithium Resources [ASX:GL1]

On July 26, Global Lithium Resources announced: “Manna Lithium Project Resource grows Manna Resource increases to 36.0Mt @ 1.13% Li2O.” Highlights include:

- “24.1% increase in total contained Li 2O from 327,000 tonnes to 406,000 tonnes Li 2O.

- 13% increase in the Manna Lithium Project Mineral Resource grade to 1.13% Li 2O.

- 10% increase in the Manna Lithium Project Mineral Resource tonnes to 36.0Mt.

- Manna demonstrates significant scope for further growth in mineral resources.

- ~50,000m of drilling to further expand Lithium Mineral Resource at Manna expected to commence August 2023.

- DFS studies concurrently running to progress Manna development in parallel with continued exploration.”

You can read a recent Trend Investing article on Global Lithium Resources here.

European Lithium Ltd [ASX:EUR] (OTCQB:EULIF)

On July 6, European Lithium Ltd. announced: “Critical Metals Corp. enters into share subscription facility for up to US$125.0M in transaction funding.” Highlights include:

- “Critical Metals has signed an agreement for a share subscription facility for up to US$125.0M in transaction funding from Global Emerging Markets [GEM].

- Critical Metals expects to provide an update on further equity funding in the near term.

- Funding will principally be used to accelerate the development of the Wolfsberg Lithium Project in Austria.”

On July 12, European Lithium Ltd. announced: “European Lithium to divest non-core asset.” Highlights include:

- “Sale of 100% interest in tenement E47/4144 located in North West Western Australia.

- The sale provides the Company with $1M of liquid assets (cash and/or shares in an ASX listed company).

- The sale of non-core Australian tenement aligns with the Company’s strategy to invest in and develop European assets supporting the green energy transition.”

Upcoming catalysts include:

- August 8, 2023 – Deadline to complete business combination to form Critical Metals Corp.

Savannah Resources [LSE:SAV] [GR:SAV] (OTCPK:SAVNF)

On July 3 Savannah Resources announced: “Upcoming Project milestones.” Highlights include:

- “…Savannah expects to complete the environmental licencing and DFS in the second half of 2024.

- Savannah has also initiated the process to licence a new 60KV connection and power line deviation to the Portuguese electrical grid network at the Project…

- The grid connection represents the longest lead time item among the secondary licences required for the Project, and the process is expected to be completed by mid-2025.

- Savannah has also initiated the procurement of services from a leading specialist engineering company to undertake the licencing requirements for the 17Km bypass road to the Project as per the DIA conditions.

- Other secondary licences, such as those required for construction and use of water, should be secured during 2024.”

On July 14 Savannah Resources announced:

Result of £6.1 million placing & subscription. Savannah Resources plc, the European lithium development company is pleased to announce that further to its announcement dated 13 July 2023 (the “Launch Announcement”), it has successfully completed the Placing, which has now closed…

On July 18 Savannah Resources announced: “Successful Primary Bid Offer increases total Fundraise to £6.5 million.”

Upcoming catalysts include:

- H2, 2024 – DFS due.

- Mid 2026 – Target to commence spodumene production at the Barroso Lithium Project.

You can read the recent Trend Investing article here at GBp 3.90 or the Blog (no paywall) here a month later at GBp 4.70. Quoted from the Blog – “Analyst rating is a ‘buy’ with a price target of GBP 22.60, representing 380% (4.8x) potential upside.”

European Metals Holdings [ASX:EMH] [AIM:EMH] [GR:E861] (OTCPK:ERPNF) (OTCQX:EMHLF)(OTCQX:EMHXY)

On July 21, European Metals Holdings announced: “European Bank for reconstruction and development €6m strategic investment.” Highlights include:

- “The European Bank for Reconstruction and Development (“EBRD”) has agreed to invest €6 million to support the Company’s development of the Cinovec Project in the Czech Republic.

- ERBD’s investment and expertise will be beneficial to the Company as the Cinovec Project moves through permitting, project financing, and completing its Definitive Feasibility Study (“DFS”).

- As part of its due diligence, EBRD engaged an independent, international mining consultancy to conduct a technical review of the Cinovec Project.

- EBRD is an International Financial Institution owned by the European Union, European Investment Bank and 71 countries, including the Czech Republic.

- The investment is to be implemented by way of a private placement of 12,315,213 shares of the Company to be issued to EBRD at a price of £0.423 per share (the “Placement”). This equates to AUD 0.803 per share.”

Upcoming catalysts include:

You can read a recent Trend Investing update article on EMH here.

Galan Lithium [ASX:GLN]

Galan is developing their flagship Hombre Muerto West (“HMW”) Lithium Project located on the west side edge of the high grade, low impurity Hombre Muerto salar in Argentina.

On June 26, Galan Lithium announced: “HMW Phase 1 development permits granted – works commenced.” Highlights include:

- “Initial Phase 1 HMW development permits granted last Friday, Argentina time.

- Top-soil removal for pond construction commenced.

- Permit includes all earthworks required for ground pond testing.

- Camp extension permit approved; most accommodation modules (for 250 personnel) on site.

- Full construction permits and commencement of Phase 1 pond construction expected during Q3 CY 2023.

- Phase 1 DFS results expected shortly.”

On July 3, Galan Lithium announced: “Phase 1 of Hombre Muerto West (HMW) DFS delivers compelling economic results for accelerated production.” Highlights include:

- “Phase 1 DFS delivers compelling economics from an initial 5.37ktpa LCE operation at HMW; targeting a high quality, 6% concentrated lithium chloride product (equivalent to 12.9% Li2O or 31.9% LCE) in H1, 2025.

- Phase 1 on its own delivers a post-tax NPV8% of US$460m, IRR of 36% and free cash flow of US$54m per year, facilitating Galan’s funding for further expansions.

- Capex before contingency of US$104m and opex of US$3,963/t of recoverable LCE contained in concentrated lithium chloride product; Phase 1 costing in the first half of world lithium cost curve.

- Approximate 2 year payback from commencement of production.

- Minimal fresh water and power required for lithium chloride production.

- Phase 1 provides an exceptional foundation for significant economic upside in the Phase 2 DFS (20ktpa LCE), due in September 2023; with Phase 2 production expected in 2026.

- Initial Phase 1 development permits granted; top-soil removal, camp expansion and other earthworks have commenced, allowing the project to maintain schedule for first production in H1 2025.

- Procurement of long lead construction items underway.”

On July 24, Galan Lithium announced: “Successful delivery of a premium quality, (6% Li) lithium chloride concentrate product from HMW Pilot Plant.” Highlights include:

- “HMW pilot plant confirms production of a premium quality, (6% Li) lithium chloride concentrate product (equivalent to 13% Li 20 or 31.9% LCE)…

- Phase 1 preparation works (new camp, top-soil removal etc) are on track for delivering lithium chloride production of 5.4ktpa LCE in 2025; main pond 1 clearing 80% complete.

- Brine concentration process to continue through 2023 and into 2024.

- Phase 1 full construction permit and Phase 2 DFS advancing, both are expected in Q3 2023.”

Upcoming catalysts include:

- August 2023 – Phase 2 DFS (20ktpa LCE)

- 2025 – Target to ramp to 5.4ktpa LCE of lithium chloride production.

Frontier Lithium [TSXV:FL] (OTCQX:LITOF)

Frontier Lithium own the PAK Lithium (spodumene) Project comprising 26,774 hectares and located 175 kilometers north of Red Lake in northwestern Ontario. The PAK deposit is a lithium-cesium-tantalum [LCT] type pegmatite containing high-purity, technical-grade spodumene (below 0.1% iron oxide).

No news for the month.

Investors can read the Trend Investing article here and the recent CEO interview here.

Latin Resources Ltd [ASX:LRS] (OTC:LAXXF)

LRS’ flagship is the 100% owned Salinas Lithium Project in the pro-mining district of Minas Gerais, Brazil. The Salinas Project has a maiden Indicated & Inferred JORC Mineral Resource estimate of 45.2Mt @ 1.34% Li2O at the Colina deposit.

On June 28 Latin Resources announced: “District scale lithium corridor confirmed at Salinas. Multiple spodumene pegmatites intersected in reconnaissance drilling along strike SW of Colina Deposit…

- …Outcrop mapping 6 km to the southwest of the Colina Deposit, has identified a third new pegmatite occurrence within the Company’s interpreted prospective corridor.

- These latest drilling and mapping results confirm the presence of a ‘district scale’ lithium corridor within Latin’s tenements, extending up to 26 km to the southwest of the Company’s flagship 45 Mt Colina Deposit.

- Systematic step-out diamond drilling immediately along strike from Colina is ongoing, as are the regional drilling diamond drilling programs at both the south-west blind geophysical target and at the Fog’s Block tenement.”

On July 26 Latin Resources announced:

Quarterly activities report for the period ending 30 June 2023. 241% Increase for the Colina Mineral Resource JORC Mineral Resource Estimate total of 45.2Mt @ 1.32% Li 2O, including 30.2Mt @ 1.4% Li 2O Measured + Indicated. Colina JORC MRE now comprises 0.4Mt @ 1.3% Li 2O Measured + 29.7 Mt @ 1.4% Li 2O Indicated + 15.0Mt @ 1.2% Li 2O Inferred…

You can read the Trend Investing article that discusses Latin Resources here.

Patriot Battery Metals [TSXV:PMET][ASX:PMT] (OTCQX:PMETF)

Patriot Battery Metals own the Corvette Lithium Project in James Bay, Quebec. No resource yet but some great long length drill results.

On July 4 Patriot Battery Metals announced: “Patriot achieves 6% Li2O spodumene concentrate grade in preliminary HLS Metallurgical Testwork on the CV13 pegmatite indicating potential for joint processing with CV5.”

On July 10 Patriot Battery Metals announced: “Patriot announces final core assay results from its 2023 Winter Drill Program, including 108.0 m at 2.44% Li2O, at the CV5 Pegmatite, Corvette Property, Quebec, Canada.” Highlights include:

- “Additional high-grade intersections at the Nova Zone, which has been defined over a strike length of at least 1.1 km.

- 108.0 m at 2.44% Li2O (195.5 m to 303.5 m), including 37.5 m at 3.58% Li2O, or 16.0 m at 4.08% Li2O (CV23-181).

- 115.3 m at 1.81% Li2O (175.0 m to 290.3 m), including 89.6 m at 2.20% Li2O (CV23-177).

- Wide widths and strong grades in most westwardly drill hole completed to date at the CV5 Pegmatite – 78.9 m at 1.00% Li2O, including 34.8 m at 1.40% Li2O (CV23-184).

- Wide widths and strong grades in final drill hole completed during the 2023 winter drill program -139.2 m at 1.26% Li2O, including 36.2 m at 1.74% Li2O (CV23-190).

- Wide widths and strong grades returned in one of the most eastwardly drill holes completed to date at the CV5 Pegmatite, highlighting the strong potential of area – 36.0 m at 1.36% Li2O, including 17.0 m at 2.31% Li2O (CV23-165).

- All core sample assay results for drill holes completed during the 2023 drill winter program have now been reported.

- The Company is anticipating an announcement in a few weeks time for the initial mineral resource estimate at CV5, which will include all drill holes completed through April 17, 2023 (i.e., the recently completed winter drill program).”

On July 26 patriot Battery Metals reported:

…The ban on entry to the forest due to wildfires has been lifted for the area, including The Property. Due to some on-going road closures, the Company is remobilising personnel with materials to site using fixed wing aircraft. It is anticipated that the road closures will be lifted as the fires continue to be extinguished. The Company will have access to one helicopter, which will allow for the commencement of drilling and environmental baseline data collection at site by this weekend.

Investors can read the Trend Investing article here.

Azure Minerals Limited [ASX:AZS]

On June 30 Azure Minerals Limited announced:

More broad high-grade lithium intersections at Andover. 90.2m @ 1.23% Li20 in ANDD0214. 63.7m @ 1.15% Li20 in ANDD0210. 32.7m @ 1.32% Li20 in ANDD0217…

On July 5 Azure Minerals Limited announced: “Andover Project update.” Highlights include:

- “New Exploration Licence [EL] E47/4700 (10 blocks / 32km2) granted; adjoins existing Andover tenement currently being drilled (E47/2481).

- New EL hosts abundant pegmatites prospective for lithium mineralisation.

- Azure’s granted tenements now completely cover all identified pegmatites in the Andover district.

- Lithium-focused drilling continues with two diamond core rigs and three reverse circulation [RC] rigs in operation.

- Third diamond rig mobilising to site with the addition of extra rigs being assessed.

- Infill drilling to commence shortly for delineation of maiden Mineral Resource Estimate within the AP0009-AP0014 pegmatite area.

- Metallurgical testwork program for lithium extraction commenced.

- Four Miscellaneous Licence applications for groundwater search were submitted with grant expected in second half of 2023.

- All tenements granted or applied for are included in the Heritage Protection Agreement executed between Azure and the Ngarluma Aboriginal Corporation.

- Additional heritage surveys to commence shortly over the newly granted E47/4700.”

On July 14 Azure Minerals Limited announced:

More +100M lithium intersections returned at Andover. 101.3m @ 1.21% Li20 in ANDD0223 including high grade zone of 64.1m @ 1.63% Li20 and 100.2m @ 1.24% Li20 in ANDD0221 including high grade zone of 28.0m @ 1.86% Li20…

Century Lithium Corp. (TSXV:LCE) (OTCQX:CYDVF)(Formerly Cypress Development Corp.)

Century Lithium Corp. is focused on developing its Clayton Valley Lithium Project in west-central Nevada. Century Lithium is currently in the pilot stage of testing on material from its lithium-bearing claystone deposit at its Lithium Extraction Facility in Amargosa Valley, Nevada and progressing towards completing a Feasibility Study and permitting.

No significant news for the month.

Lake Resources NL [ASX:LKE] [GR:LK1] (OTCQB:LLKKF)

Lake Resources own the Kachi Lithium Brine Project in Argentina. Lake has been working with Lilac Solutions Technology (private, and backed by Bill Gates) for direct lithium extraction and rapid lithium processing.

No significant news for the month.

Lithium Power International [ASX:LPI] (OTCPK:LTHHF)

LPI owns 100% of the Maricunga Lithium Brine Project in Chile, plus plans to demerge its Australian assets into a new company called Western Lithium Ltd.

On July 3, Lithium Power International announced:

Cash sale completed for Western Lithium Ltd. As previously announced on 19 June 2023, the transaction involves the sale of 100% of WLI’s shares and comprises all cash-for-shares amounting to AUD$30,000,000 (thirty million Australian dollars), subject to a customary price adjustment to reflect WLI’s liabilities as at completion. Out of the total consideration, approximately AUD$29,000,000 has now been received. The balance is contingent on certain tenement applications being granted within 18 months of completion.

On July 17, Lithium Power International announced: “Maricunga Lithium Brine Project status…”

American Lithium Corp. [TSXV: LI] (AMLI) (acquired Plateau Energy Metals Inc.)

On July 12, American Lithium Corp. announced:

American Lithium intersects highest grade lithium and cesium samples encountered to date at Falchani – Up to 5,645 ppm Lithium and up to 12,610 ppm Cesium…

On July 17, American Lithium Corp. announced: “American Lithium to accelerate development of Macusani Uranium internally – Elects to defer spin out…”

On July 19, American Lithium Corp. announced: “American Lithium announces financial and operating highlights for first quarter ended May 31, 2023.”

- “…Strategic Investment- invested C$5,380,000 in Surge Battery Metals (9.7% interest) to the support development of the Northern Nevada Claystone Project…”

Wealth Minerals [TSXV:WML] [GR:EJZN] (OTCQB:WMLLF)

Wealth Minerals has a portfolio of lithium assets in Chile, such as 46,200 Has at Atacama, 8,700 Has at Laguna Verde, 6,000 Has at Trinity, 10,500 Has at Five Salars. Also the right to acquire a 100% interest in the Ignace REE Lithium Property in Ontario, Canada.

On July 18 Wealth Minerals announced:

Wealth Minerals extends cooperation agreement with the Indigenous Quechua Community of Ollagüe for a second drilling campaign… The two parties have agreed that Wealth may drill up to twelve holes in the Ollagüe salar basin, designed to maximize information to improve and potentially increase the resource estimate for the Ollagüe Project (see press release January 17, 2023). The data collected, including from flow-test wells, will also allow the Company to advance towards a prefeasibility study proceeding from the pending preliminary economic assessment (“PEA”). Wealth management expects the PEA to be completed and announced by the end of Q3-2023.

Investors can view the company’s latest presentation here.

E3 Lithium Ltd. [TSXV:ETL] [FSE:OW3] (OTCQX:EEMMF) (Formerly E3 Metals)

E3 Lithium Ltd. is a lithium development company focused on commercializing its extraction technology and advancing the world’s 7th largest lithium resource with operations in Alberta. E3 has an Inferred Resource of 24.3mt LCE.

On June 27, E3 Lithium Ltd. announced:

E3 Lithium receives Alberta innovates progress payment. E3 LITHIUM LTD. (TSXV: ETL) (FSE: OW3) (OTCQX: EEMMF), “E3 Lithium” or “the Company,” Alberta’s leading lithium developer and extraction technology innovator, is pleased to announce it received a progress payment of $375,000 from Alberta Innovates and has claimed a total of $7.0M from all reimbursable and non-reimbursable grants to-date.

On July 13, E3 Lithium Ltd. announced: “E3 Lithium announces field pilot plant on track for August start as construction continues…”

You can read the company’s latest presentation here.

Nevada Lithium Corp. [CSE:NVLH] (OTCQB:NVLHF)

Nevada Lithium has an arrangement to own 100% of the Bonnie Claire Project in Nevada, USA; with an Inferred Resource of 18.68 million tonnes LCE.

On July 10 Nevada Lithium Corp. announced:

Nevada Lithium completes acquisition of 100% ownership of Bonnie Claire Lithium Project, Nevada USA with Robust PEA Economics of USD $1.5 billion NPV (After Tax) and receives proceeds from $11.3m concurrent financings…

Rio Tinto [ASX:RIO] [LN:RIO] (RIO)

On July 19 Rio Tinto announced:

Rio Tinto releases second quarter production results… At our Rincon lithium project in Argentina, our $140 million estimate and schedule to develop the starter plant remains under review in response to cost escalation…

Lithium South Development Corp. [TSXV:LIS] (OTCQB:LISMF)

On June 26 Lithium South Development Corp. announced:

Lithium South extraction technology update… Brine at the HMN Li Lithium Project is high-grade with low impurities. The newly completed resource expansion drill program at the Alba Sabrina and Natalia Maria Claim blocks has identified very good lithium grades up to 1176 milligrams per liter lithium. Magnesium, the main contaminant of concern in any lithium brine project, remains at a low ratio of 2.66 to 1. Test work is currently near completion regarding the production of industrial grade, and battery grade lithium carbonate from HMN Li brine. Results are expected in the near future. The Company remains committed to moving the HMN Li Project forward using the best suited technology for lithium extraction, balancing risk, and reward.

On July 13 Lithium South Development Corp. announced:

Production Well Program contracted. Lithium South Development Corporation (the “Company”) (TSX-V: LIS) (OTCQB: LISMF) (Frankfurt OGPQ), is pleased to announce it has contracted Well Drilling of Salta, Argentina, for the provision of three pumping wells for the HMN LI Project. The program is expected to be undertaken in the immediate future with rig availability in August.

You can view a recent Trend Investing Lithium South CEO interview here.

Alpha Lithium [NEO: ALLI] (formerly TSXV: ALLI) [GR:2P62] (OTCPK:APHLF)

On July 10 Alpha Lithium announced: “Alpha Lithium announces positive Preliminary Economic Assessment results for Tolillar Project in Argentina.” Highlights include:

- “US$1.5 billion (CDN$2.0 billion) after tax NPV8 with an IRR of 25.1%.

- US$5.3 billion (CDN$7.1 billion) of cumulative free cash flow over a 25-year mine life.

- 3.8-year after-tax payback period from start of production.

- Significant upside potential remains from recently drilled wells not yet included in this PEA.”

On July 14 Alpha Lithium announced: “Alpha Lithium Files Preliminary Economic Assessment for Tolillar Salar, Argentina…”

On July 17 Alpha Lithium announced:

Alpha Lithium significantly increases resource at Tolillar Salar, Argentina. Alpha Lithium Corporation (TSX.V: ALLI) (OTC: APHLF) (Germany WKN: A3CUW1) (“Alpha” or the “Company”) is pleased to report substantial increases to both indicated and inferred categories of lithium carbonate (“Li2CO3“) equivalent (“LCE”) resources in the Tolillar Salar in Salta, Argentina. The updated resource estimate includes 3,626,000 tonnes of indicated and 1,393,000 tonnes of inferred LCE. Alpha’s latest drilling campaign resulted in a 70% increase to the “indicated resource” category and a 20% increase to the “inferred resource” category.

Avalon Advanced Materials [TSX:AVL] [GR:OU5] (OTCQX:AVLNF)

Avalon has three projects in Ontario, Canada, and five in total throughout Canada. Avalon’s most advanced project is the Separation Rapids Lithium Project in Ontario with a M& I Petalite Zone Resource of 6.28mt grading 1.37% Li2O, plus an Inferred Resource of 0.94mt at 1.3%. Avalon also has a Partnership JV Agreement with Indian conglomerate Essar to establish Ontario’s first regional lithium battery materials refinery in Thunder Bay.

On July 10, Avalon Advanced Materials announced: “Avalon signs MOU with Metso, a World Leader in Critical Minerals Technology, to advance the development of Ontario’s First Lithium Processing Facility.” Highlights include:

The Non-Binding Memorandum of Understanding stipulates:

- “The pursuit of a definitive agreement to establish a lithium hydroxide processing facility in Thunder Bay, ON.

- Avalon to license Metso technology and solutions to produce lithium hydroxide cathode materials to serve the EV market.

- Allow Metso to conduct testing and engineering work across Avalon’s portfolio of critical-mineral projects, including the Company’s flagship deposit at Separation Rapids near Kenora, ON.

- The parties anticipate reaching a definitive agreement on or before Sept. 1, 2023.”

Snow Lake Lithium (LITM)

On June 30 Snow Lake Lithium announced: “Drilling delivers high-grade results at Snow Lake’s Grass River Project.”

- “First round of results from the recent winter drilling campaign at Grass River have now been received and interpreted.

- Best results include: 6.3M @ 1.97% Li20 from 31.7M including 1.49m @ 3.4% Li20 from 33.41M. 6.6M @ 1.59% Li20 from 47.6M including 1.5M @ 2.08 Li20 from 50M. 3.62M @ 2.36% Li20 from 62.27M. 4.53M @ 1.81% Li20 from 176.97M including 1.5M @ 2.74 Li20 from 178.47M.

- Further results from the balance of the drilling program are anticipated in the coming weeks.

- Drilling program to be included in a future Mineral Resource Estimate (MRE) with the Company anticipating releasing a Maiden MRE for the Grass River Project together with the upcoming PEA in July…”

On July 17 Snow Lake Lithium announced:

Snow Lake Lithium announces appointment of Chief Executive Officer. Snow Lake Resources Ltd., (NASDAQ: LITM) d/b/a Snow Lake Lithium Ltd. (“Snow Lake” or the “Company”) is pleased to announce the appointment of Mr. Frank Wheatley as Chief Executive Officer (“CEO”) of the Company with immediate effect.

Essential Metals [ASX:ESS] (OTCPK:PIONF)

Essential Metals has 9 projects (lithium, gold, gold JV, and nickel JV) all in Western Australia. Their flagship Pioneer Dome Lithium (spodumene) Project has a JORC Compliant Total Resource of 11.2Mt at 1.16% Li2O.

On July 3 Essential Metals announced:

Develop and Essential Metals enter into binding Scheme Implementation Deed. Transaction delivers a significant premium to Essential shareholders while giving them ongoing exposure to the Pioneer Dome Lithium Project and future upside from the combined group, led by highly regarded mining executive Bill Beament… The Scheme Consideration is 1 new Develop share for every 6.18 Essential shares held, implying a fully diluted equity value for Essential of ~A$152.6 million and A$0.56 per share based on the closing price for Develop shares of A$3.46 per share on 30 June 2023. This represents a significant premium of: 34.9% to the closing Essential share price of A$0.415 per share on 30 June 2023. 30.8% to the 20-day Essential VWAP of A$0.428 per share up to and including 30 June 2023. 62.3% to the Essential share price prior to the pre-Tianqi Lithium Energy Australia (TLEA) Scheme price of A$0.345 per share on 6 January 2023 and 12.0% to the TLEA Scheme price of A$0.50 per share… Essential’s largest shareholder, Mineral Resources Limited (ASX: MIN) (MinRes), has agreed to vote its 19.55% shareholding in Essential in favour of the Scheme in the absence of a superior proposal and subject to the Independent Expert concluding that the Scheme is in the best interests of Essential shareholders. Upon implementation of the Scheme, Essential shareholders will hold 18.4%2 of the combined group, which is estimated to have a pro forma market capitalisation of A$771.3 million based on the Capital Raising price of A$3.20 per Develop share and cash of approximately A$81.7 million.

On July 17 Essential Metals announced: “Drilling completed at Pioneer Dome Lithium Project – Updated…”

On July 24 Essential Metals announced:

June 2023 quarterly report… Feasibility study activities continued with focus being on further metallurgical test work, native title heritage surveys and other permitting matters. A drill programme targeting three exploration targets commenced in June and was completed in July – assays are pending. The offtake-funding Expressions of Interest process was restarted in May, following termination of the TLEA Scheme Implementation Agreement, but was subsequently suspended on announcement of the Develop Scheme of Arrangement. Closing Cash of $8.0 million on hand as at 30 June 2023…”

Green Technology Metals [ASX: GT1]

Green Technology Metals [ASX:GT1] (“GT1”) has several very promising lithium projects near Thunder Bay in Ontario, Canada.

On June 26, Green Technology Metals announced: “Drilling and large-scale field exploration commenced across gt1’s lithium portfolio.” Highlights include:

- “Expansive field exploration season commenced, aimed at building upon our current 22.5Mt1 resource base within easy reach of GT1’s planned Converter in Thunder Bay.

- 22,000m extensional and infill drilling underway at the Root Bay Lithium Project.

- 19 new holes completed so far for 3,741m, with results expected from July 2023.

- Widespread field exploration commenced at Root Bay with immediate success identifying additional LCT pegmatite outcrop along strike 1.4km from drills.

- Additional geological resources mobilised to fast-track exploration…”

On July 14, Green Technology Metals announced: “Root Bay shaping as exceptional high grade lithium deposit.” Highlights include:

- “Assay results at Root Bay have been received and continue to demonstrate the consistency of high-grade mineralisation across the Root Bay deposit.

- Significant high-grade results include: RB-23-1013: 17.1m @ 1.77% Li2O from 71.0m. RB-23-1014: 17.2m @ 1.74% Li20 from 57.2m. RB-23-1009: 19.6m @ 1.50% Li20 from 26.9m. RB-23-1038: 16.0m @ 1.78% Li20 from 167.1m. RB-23-1020: 16.8m @ 1.69% Li20 from 82.5m. RB-23-1032: 16.8m @ 1.61% Li20 from 139.6m. RB-23-1025: 16.3m @ 1.62% Li20 from 131.4m…

- Drilling will continue over the next quarter to upgrade the tonnage and JORC confidence level of the maiden inferred mineral resource estimate of 8.1Mt @ 1.32% Li2O.”

Winsome Resources Limited [ASX:WR1] [FSE:4XJ] (OTCQB:WRSLF)

On July 20, Winsome Resources announced:

Update on Quebec Fire Situation. Lithium exploration and development company Winsome Resources (ASX:WR1; “Winsome” or “the Company”) announces that despite road access to the James Bay region still being blocked by government authorities, a small party from the Company conducted an initial reconnaissance of Adina, Cancet and Winsome’s Cargair Camp using an aircraft… It appears no Winsome equipment was damaged, and it is fortunate several drill rigs owned by the Company’s drilling contractor, RJLL, were yet to be mobilised to site and can thus be done so quickly once the government grants access to recommence operations.

On July 26, Winsome Resources announced: “Quarterly report period ending 30 June 2023…”

You can view the Aug. 2022 Trend Investing article on Winsome Resources here, when it was at A$0.26.

Atlas Lithium Corp. (ATLX)

On July 10 Atlas Lithium Corp announced: “Atlas Lithium intersects 3.34% Li2O over 7 meters and 1.82% Li2O over 25 meters at its Neves Project in Brazil’s Lithium Valley…”

On July 13 Atlas Lithium Corp announced:

Atlas Lithium hits a record milestone with high grade 5.23% lithium oxide intersect at only nine meters depth in its Lithium Project… Drill hole DHAB-185 yielded an intersect with 5.23% Li2O mineralization extending from 9.20 to 10.30 meters… In aggregate, DHAB-185 showed 21.75 meters at an average grade of 2.12% Li2O…

On July 24 Atlas Lithium Corp announced:

Atlas Lithium announces investments from strategic parties to advance its lithium project. Atlas Lithium Corporation (NASDAQ: ATLX) (“Atlas Lithium” or “Company”), a leading mineral exploration company, is pleased to announce that it has received an investment of US$ 10 million for restricted shares of the Company’s common stock from four investors with long-dated experience in the lithium industry. One of the investors is Mr. Martin Rowley, recently retired Chairman of Allkem Limited, a well-known lithium company with market capitalization of approximately US$ 7 billion. The capital raised will be utilized in advancing Atlas Lithium’s 100%-owned Neves Project in Brazil’s Lithium Valley, a well-regarded mining district for hard-rock lithium…

Lithium Ionic Corp. [TSXV:LTH] (OTCQB:LTHCF)

On June 27 Lithium Ionic Corp announced: “Lithium Ionic announces maiden Mineral Resource Estimate at its Itinga Project in Minas Gerais, Brazil; Drilling Program expanded with 13 rigs operating; PEA underway.” Highlights include:

- “M&I Resource estimate of 7.57Mt grading 1.40% Li2O and Inferred of 11.86Mt grading 1.44% Li2O. The MRE incorporates the Bandeira and Outro Lado (Galvani) deposits, using a cut-off grade of 0.5% Li2O for Bandeira Open Pit and 0.8% Li2O for Outro Lado and Bandeira Underground. Approximately 39% of the MRE is classified in the M&I categories.

- Rapid growth in a short timeframe. The MRE is based on 181 diamond drill holes and 28,204 metres of drilling.

- Significant expansion potential…

- Expanded drill program with 13 drills in operation. The drilling program for the remainder of 2023 has been expanded to 50,000 metres to increase the size of the MRE…

- Accelerated project engineering. A Preliminary Economic Assessment (PEA) is underway and expected to be completed in Q3 2023, with the objective of accelerating a Definitive Feasibility Study [DFS] targeted for completion by the end of 2023.

- Permitting process underway. Environmental Impact Assessment (“EIA”) studies for both deposits are underway and expected to be complete within H2 2023, at which time the applications are expected to be submitted for the respective environmental and social licenses.”

On July 11 Lithium Ionic Corp announced: “Lithium Ionic drills 1.69% Li2O over 7.8m and 1.32% Li2O over 9.2m at Bandeira.” Highlights include:

- “1.69% Li2O over 7.79m (hole ITDD-23-109).

- 1.32% Li2O over 9.15m (hole ITDD-23-105).

- 1.39% Li2O over 8.41m (hole ITDD-23-119).

- 1.74% Li2O over 6.39m (hole ITDD-23-112).

- 1.55% Li2O over 7.01m (hole ITDD-23-102).

- 1.86% Li2O over 5.70m (hole ITDD-23-120).”

On July 13 Lithium Ionic Corp announced: “Lithium Ionic announces C$25 million Bought Deal Financing.”

On July 19 Lithium Ionic Corp announced:

Lithium Ionic signs MOU with local government authority Invest Minas; obtains priority status to facilitate acceleration of licensing and development for its Itinga and Salinas lithium projects, Brazil…

On July 20 Lithium Ionic Corp announced: “Lithium Ionic drills 1.89% Li2O over 10.2m and 1.92% Li2O over 6.4m at Bandeira.”

On July 25 Lithium Ionic Corp announced: “Lithium Ionic reports initial drill results from the Salinas Project; intersects 1.38% Li2O over 16m and 1.60% Li2O over 12m, Minas Gerais, Brazil.”

Lithium Energy Limited [ASX:LEL]

On June 29, Lithium Energy Limited announced: “Significant maiden JORC Lithium Resource of 3.3 Mt LCE at Solaroz Project in Argentina.” Highlights include:

- “…This maiden MRE confirms Solaroz as a highly strategic lithium asset being substantial in size and located directly adjacent to the Olaroz lithium brine production facilities owned by Allkem Limited (ASX:AKE).

- Within the 3.3Mt LCE Resource, there is a high-grade core of 1.34Mt of LCE with an average concentration of 405 mg/l Lithium (at a 350 mg/l Lithium cut-off grade).

- This initial 3.3Mt LCE Resource is within a 4,777 ha area identified by TEM geophysics as having elevated conductivity representing brine and encompassing the first 5 holes drilled at Solaroz to date.

- 3 drill rigs continue operating on site with further planned holes targeting upgrades to the MRE for the balance of the ~12,000 ha at Solaroz.

- Infill drilling is also planned to upgrade the Resource from an Inferred category, with test production wells to be installed in support of on-going engineering and other technical and feasibility studies relating to the commercial development (into production) of Solaroz.”

On July 13, Lithium Energy Limited announced: “Drilling commences at Hole 7 and Hole 6 intersects lithium-rich brines at Solaroz Lithium Project.”

Argentina Lithium & Energy Corp. [TSXV: LIT] (OTCQB:PNXLF)

No news for the month.

You can read a Trend Investing CEO interview here.

International Lithium Corp. [TSXV:ILC] [FSE: IAH] (OTCQB:ILHMF)

No news for the month.

Battery recycling, lithium processing and new cathode technologies

Rock Tech Lithium [CVE:RCK](OTCQX:RCKTF)

On July 4 Rock Tech Lithium announced:

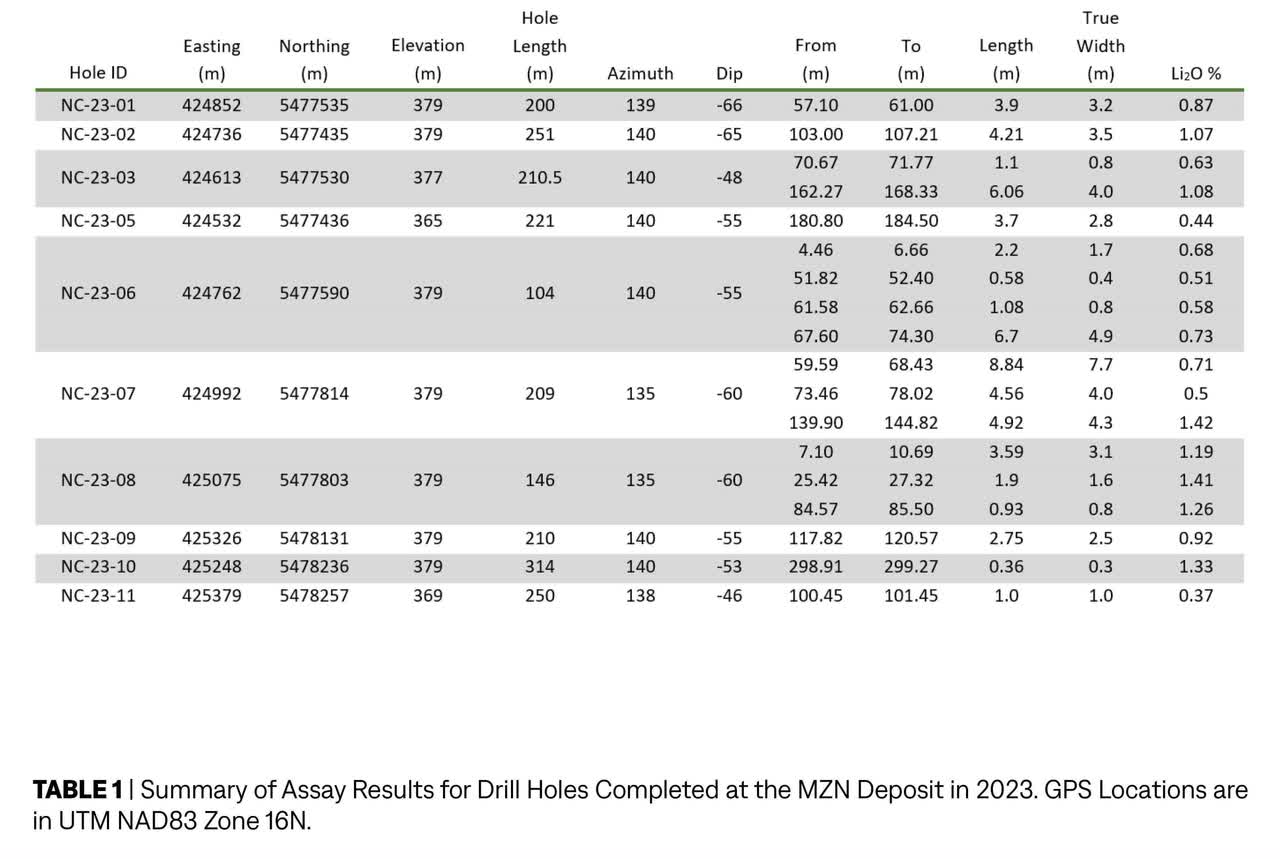

Assay results returned from step-out drill program. We have received positive assay results from our 2023 winter drill program. The completed step-out drilling aims to support the expansion of known pegmatite zones at its 100%-owned Georgia Lake Lithium project with successfully drilled 17 exploration holes for a total of 3,676 meters in the first months of 2023, at the Main Zone North [MZN] and McVittie deposits.

Summary of Assay Results for Drill Holes Completed at the MZN Deposit in 2023. GPS Locations are in UTM NAD83 Zone 16N. (source)

Rock Tech Lithium

Neometals (OTCPK:RRSSF) (OTCPK:RDRUY) [ASX:NMT]

No lithium news for the month.

Nano One Materials (TSX: NANO) (OTCPK:NNOMF)

On July 20 Nano one Materials announced: “Nano One advances its commercial LFP plans at Québec Facility, secures six new patents.” Highlights include:

- “…Commercial LFP evaluations to begin in Q4, leading to potential offtake and first revenues.

- Trials and engineering informing design and operation of first full scale LFP commercial plant.

- 6 new patents significantly extend IP protection, launching total to 33 globally.”

Other lithium juniors

Other juniors include: 5E Advanced Materials Inc [ASX:5EA] (FEAM), ACME Lithium Inc. [CSE:ACME] (OTCQX:ACLHF), American Lithium Minerals Inc. (OTCPK:AMLM), Anson Resources [ASX:ASN] [GR:9MY], Ardiden [ASX:ADV], Arizona Lithium [ASX:AZL] (OTCQB:AZLAF), Atlantic Lithium [LON:ALL] (OTCQX:ALLIF), Azimut Exploration [TSXV:AZM] (OTCQX:OTCQX:AZMTF), Bastion Minerals [ASX:BMO], Battery Age Minerals [ASX:BM8], Bradda Head Lithium Limited [LON:BHL] (OTCQB:BHLIF) (OTCPK:CDCZF), Brunswick Exploration [TSXV:BRW] (OTCQB:BRWXF), Bryah Resources Ltd [ASX:BYH], Carnaby Resources Ltd [ASX:CNB], Champion Electric Metals Inc. [CSE:LTHM] [FSE:1QB1] (GLDRF), Charger Metals [ASX:CHR], CleanTech Lithium [AIM:CTL] (OTCQX:CTLHF), Compass Minerals International (CMP), Cosmos Exploration [ASX:C1X], Critical Resources [ASX:CRR], Cygnus Metals [ASX:CY5], Delta Lithium [ASX:DLI](formerly Red Dirt Metals), Electric Royalties [TSXV:ELEC], Eramet [FR: ERA] (OTCPK:ERMAF) (OTCPK:ERMAY), Foremost Lithium Resources & Technology [CSE:FAT] (OTCPK:FRRSF), Future Battery Minerals [ASX:FBM] (OTCPK:AOUMF), Greentech Metals [ASX:GRE], Greenwing Resources Limited [ASX:GW1] (OTCPK:BSSMF), Grounded Lithium [TSXV:GRD] (OTCQB:GRDAF), HeliosX Lithium & Technologies Corp. [TSXV:HX] (formely Dajin Lithium Corp. [TSXV:DJI]), Hannans Ltd [ASX:HNR], Infinity Lithium [ASX:INF], Infinity Stone Ventures (CSE:GEMS) (OTCQB:GEMSF), International Battery Metals [CSE: IBAT] (OTCPK:IBATF), Ion Energy [TSXV:ION], Jadar Resources Limited [ASX:JDR], Jindalee Resources [ASX:JRL] (OTCQX:JNDAF), Jourdan Resources [TSXV:JOR] (OTCQB:JORFF), Kodal Minerals (LSE-AIM:KOD), Larvotto Resources [ASX:LRV], Lepidico [ASX:LPD] (OTCPK:LPDNF), Liberty One Lithium Corp. [TSXV:LBY] (LRTTF), Li-FT Power [CSE:LIFT] [FSE:WS0] (OTCPK:LFTPF), Lithium Australia [ASX:LIT] (OTC:LMMFF), Lithium Chile Inc. [TSXV:LITH][GR:KC3] (OTCPK:LTMCF), Lithium Corp. (OTCQB:LTUM), Lithium Energi Exploration Inc. [TSXV:LEXI](OTCPK:LXENF), Lithium Plus Minerals [ASX:LPM], Lithium Springs Limited [ASX:LS1], Loyal Lithium [ASX:LLI], Megado Minerals [ASX:MEG], Metals Australia [ASX:MLS], MetalsTech [ASX:MTC], Midland Exploration [TSXV:MD] (OTCPK:OTCPK:MIDLF), MinRex Resources [ASX:MRR], MGX Minerals [CSE:XMG] (OTC:MGXMF), New Age Metals [TSXV:NAM] (OTCQB:NMTLF), Noram Lithium Corp. [TSXV:NRM] (OTCQB:NRVTF), Oceana Lithium [ASX:OCN], Omnia Metals Group [ASX:OM1], One World Lithium [CSE:OWLI] (OTC:OWRDF), Patriot Lithium [ASX:PAT], Portofino Resources Inc.[TSXV:POR] [GR:POT], Power Metals Corp. [TSXV:PWM] (OTCQB:PWRMF), Power Minerals [ASX:PNN], Prospect Resources [ASX:PSC], Pure Energy Minerals [TSXV:PE] (OTCQB:PEMIF), Pure Resources Limited [ASX:PR1], Q2 Metals [TSXV:QTWO], Quantum Minerals Corp. [TSXV:QMC] (OTCPK:QMCQF), Spearmint Resources Inc [CSE:SPMT] (OTCPK:SPMTF), Solis Minerals [ASX:SLM], Spod Lithium Corp. [CSE:SPOD] (EEEXF), Stria Lithium [TSXV:SRA] (OTCPK:SRCAF), Surge Battery Metals Inc. [TSXV:NILI] (OTCPK:NILIF), Tantalex Lithium Resources [CSE:TTX], [FSE:1T0], Tearlach Resources [TSXV:TEA] (OTCPK:TELHF), Tyranna Resources [ASX:TYX], Ultra Lithium Inc. [TSXV:ULI] (OTCQB:ULTXF), United Lithium Corp. [CSE:ULTH] [FWB:0UL] (OTCPK:ULTHF), Vision Lithium Inc. [TSXV:VLI] (OTCQB:ABEPF), Xantippe Resources [ASX:XTC], X-Terra Resources [TSXV:XTT] (OTCPK:XTRRF), Zinnwald Lithium [LN:ZNWD].

Conclusion

July saw lithium chemical spot prices and spodumene spot prices retrace lower.

Highlights for the month were:

- Leo Lithium produces first DSO, offtake process set to commence. Suspending from quotation pending the release of an announcement regarding correspondence from the government of Mali.

- Glencore in talks to back Argentina Lithium plant (50.1% Eramet, 49.9% Tsingshan) for future supply.

- POSCO jumps most ever on bumper profits and EV battery bets. Plans $93 billion of investment by 2030.

- Atlantic Lithium Ewoyaa Project DFS results in a post-tax NPV8% of US$1.5bn, IRR of 105%. CapEx of US$185m.

- AVZ Minerals drills 341.6m @ 1.86% Li2O.

- Global Lithium Resources Manna Lithium Project Resource grows Manna Resource increases to 36.0Mt @ 1.13% Li2O.

- European Lithium – Critical Metals Corp. enters into share subscription facility for up to US$125.0M in transaction funding.

- Galan Lithium HMW Phase 1 development permits granted, works commenced. Phase 1 DFS results in a post-tax NPV8% of US$460m, IRR of 36%.

- Latin Resources – District scale lithium corridor confirmed at Salinas, extending up to 26 km to the southwest of the 45 Mt Colina Deposit.

- Patriot Battery Metals drills 108.0 m at 2.44% Li2O at Corvette. The ban on entry to the forest due to wildfires has been lifted for the area, including The Property.

- Azure Minerals Andover Project drills 90.2m @ 1.23% Li20, 101.3m @ 1.21% Li20, & 100.2m @ 1.24% Li20.

- Nevada Lithium completes acquisition of 100% ownership of Bonnie Claire Lithium Project.

- Alpha Lithium announces positive PEA results for Tolillar Project – US$1.5 billion (CDN$2.0 billion) after tax NPV8 with an IRR of 25.1%.

- Avalon signs MOU with Metso to advance the development of Ontario’s First Lithium Processing Facility.

- Develop Global (backed by Mineral Resources) to acquire Essential Metals in a share-based deal worth A$152.6m (~US$101m).

- Green Technology Metals drills 17.1m @ 1.77% Li2O from 71.0m at Root Bay.

- Atlas Lithium intersects 3.34% Li2O over 7 meters and 1.82% Li2O over 25 meters at its Neves Project in Brazil.

- Lithium Ionic announces maiden Resource Estimate at its Itinga Project in Minas Gerais, Brazil – M&I Resource of 7.57Mt grading 1.40% Li2O and Inferred of 11.86Mt grading 1.44% Li2O.

- Lithium Energy Limited – Significant maiden JORC Lithium Resource of 3.3 Mt LCE at Solaroz Project in Argentina.

- Nano One advances its commercial LFP plans at Québec Facility, secures six new patents.

As usual all comments are welcome.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here