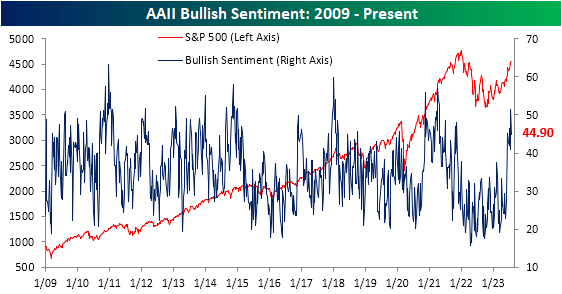

The S&P 500 has continued its rally, but sentiment has not exactly reflected that. The latest reading on investor sentiment from the AAII survey showed bullish sentiment dropped back below 50% this week. 44.5% of respondents reported as bullish in the past week, which is right in line with the average reading of the past two months.

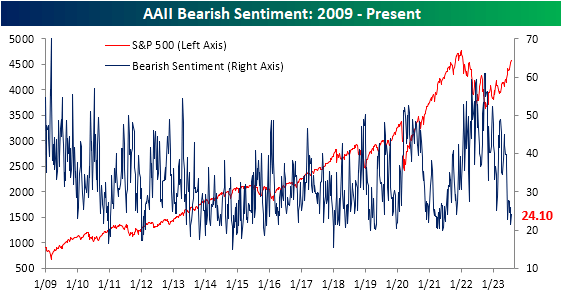

The 6.5-point decline in bulls was only partially picked up by bearish sentiment, which rose from 21.5% (the lowest level in over two years) to 24.1%. Albeit higher sequentially, that remains a muted reading.

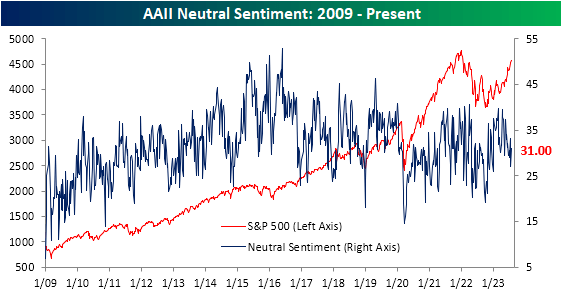

Neutral sentiment took home a larger share of the drop to bulls, with the reading rising to 31% from 27.1%. That is only the most elevated reading in two weeks, as neutral sentiment is the closest of any response to its respective historical average.

While the AAII survey showed some moderation in optimism this week, that was not the case for other surveys. In last Thursday’s Closer, we discussed how alongside the AAII survey, multiple other sentiment readings have tipped in favor of bulls recently.

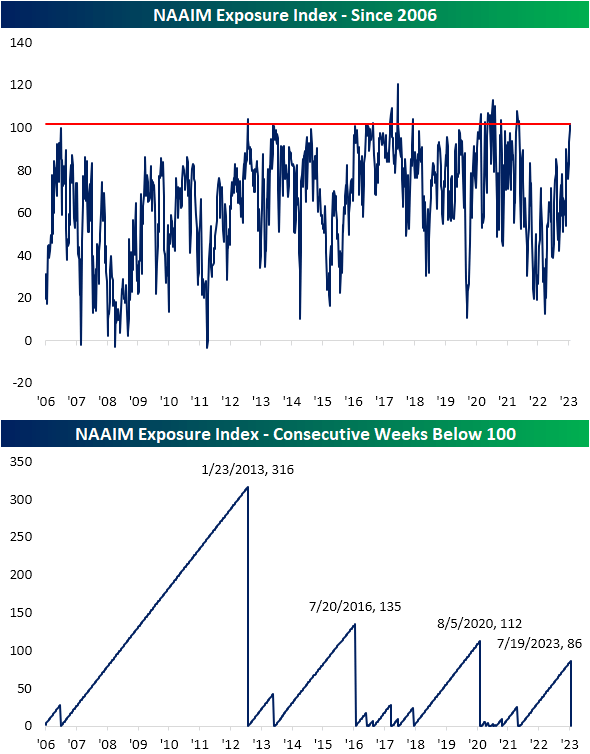

One such indicator that has continued to become more bullish is the NAAIM Exposure index which tracks the average equity exposure of active investment managers.

Readings range from -200 to +200. -200/+200 would imply on average money managers are leveraged short/long, readings of -100/+100 would be fully short/long, and a reading of zero would be market neutral.

This week, the index tipped above 100 for the first time since late November 2021. In other words, active money managers are now fully long for the first time in over a year and a half. That streak of readings below 100 also ends as the fourth longest in the survey’s history at 86 weeks in a row.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here