Introduction

UroGen Pharma (NASDAQ:URGN) is a biotech company focused on developing innovative solutions for urothelial and specialty cancers. They’ve developed RTGel, a proprietary reverse-thermal hydrogel technology aimed at improving the effectiveness of existing drugs through prolonged exposure of urinary tract tissues. UroGen’s approved product Jelmyto and investigational candidate UGN-102 utilize this technology to treat several types of non-muscle invasive urothelial cancer. Their immuno-uro-oncology pipeline also includes UGN-301, an anti-CTLA-4 antibody, for combination therapy potential.

UroGen’s pipeline (UroGen 10-K)

Recent events: On Thursday, UroGen’s stock surged ~41% following successful trials of UGN-102, which significantly reduced recurrence, progression, or death in cancer patients. UroGen intends to submit a marketing application for UGN-102 next year and announced a $120M private placement deal with investors led by RA Capital Management and Great Point Partners.

The following article reviews UroGen in light of Phase 3 data.

Financial Performance

First reviewing financials: UroGen Pharma’s Q1 2023 revenue from Jelmyto was $17.2 million, up from $13.6 million in Q1 2022. Research and development expenses were $12.5 million, and selling, general, and administrative expenses were $24.5 million. There was a non-cash financing expense of $5.2 million related to the prepaid forward obligation to RTW Investments and a $3.6 million interest expense related to the term loan with Pharmakon Advisors. The net loss was $30.2 million, and cash, cash equivalents, and marketable securities totaled $75.2 million. For 2023, UroGen predicts Jelmyto revenues between $76-86 million and operating expenses between $135-145 million.

UGN-102: Administration & Clinical Development

UGN-102 is UroGen’s novel sustained-release formulation of mitomycin being developed for treating low-grade intermediate risk non-muscle invasive bladder cancer (NMIBC). It’s administered locally into the bladder via catheter, converting into a gel that gradually releases the active drug over several hours, despite urine flow. This process allows prolonged exposure of mitomycin to the tumor, potentially leading to the chemoablation of both visible and unseen tumors. UroGen’s Phase 2b OPTIMA II trial showed promising results, and they progressed with the Phase 3 ENVISION trial. They’re also exploring home administration of UGN-102, potentially improving patient access and quality of life.

ATLAS & ENVISION Trials: Top-Line Data

UroGen Pharma recently released positive topline data from its Phase 3 ATLAS and ENVISION trials for UGN-102, a treatment for low-grade, intermediate-risk non-muscle invasive bladder cancer (LG-IR-NMIBC). In the ATLAS trial, UGN-102 reduced the risk of recurrence, progression, or death by 55% and showed a 64.8% complete response rate at three months. In the ENVISION trial, patients treated with UGN-102 had a 79.2% rate of complete response at three months. The drug was generally well-tolerated in both trials.

LG-IR-NMIBC is a common form of bladder cancer with an estimated 80,000 patients in the U.S. Current standard treatment is transurethral resection of bladder tumor (TURBT), a surgical procedure which patients often undergo multiple times due to the recurrent nature of the disease. Such surgeries carry significant risks, especially for older patients. Furthermore, TURBTS are costly (ranging between $3000-$6000).

The data suggest that UGN-102, which allows for longer exposure of bladder tissue to the chemotherapy drug mitomycin, offers a potentially effective non-surgical treatment option. Notably, UGN-102 performed comparably to TURBT in terms of complete response rate. Furthermore, the side effect profile was similar to that observed in previous clinical trials.

If UGN-102 is approved by the FDA, which UroGen anticipates submitting for in 2024 given further positive findings, it could transform the standard of care for LG-IR-NMIBC. By offering a non-surgical, minimally invasive treatment option, UGN-102 could significantly improve patient outcomes and potentially drive growth for UroGen.

My Analysis & Recommendation

In conclusion, UroGen’s positive Phase 3 trials for UGN-102, coupled with their strong financial performance in Q1 2023, reflect the company’s growth potential. Given the promising results from the ATLAS and ENVISION trials, UGN-102 may significantly change the treatment landscape for patients with LG-IR-NMIBC, offering a non-surgical option that reduces recurrence, progression, or death.

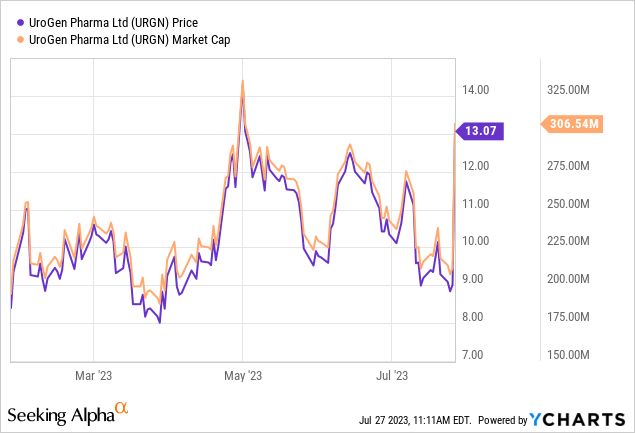

At writing, UroGen’s market cap has risen near $300 million, representing an impressive 40% intraday increase. The surge in stock value appears justified given the promising data from the ATLAS and ENVISION trials and the potential transformation of care for a large population of patients with LG-IR-NMIBC. With UGN-102’s approval and marketing, the company may see even further growth.

The anticipated submission of an NDA for UGN-102 in 2024, assuming further positive findings, may signal a breakthrough for patients and healthcare professionals in managing LG-IR-NMIBC. The potential shift from invasive surgeries to a minimally invasive treatment could represent a paradigm shift in patient care. Additionally, with Jelmyto’s growing revenue and the possibility of at-home administration of UGN-102, the company is poised for potential future success.

As an investor, I find these indicators encouraging. The company’s proven ability to innovate in the urothelial cancer space, coupled with its strong financial performance and the market potential for UGN-102, leads me to recommend a ‘Buy’ position for UroGen. Nonetheless, like any investment, it is crucial to continue monitoring the company’s progress, particularly the final data from the ENVISION trial and the outcome of the NDA submission for UGN-102.

Furthermore, it is essential for investors to be conscious of the risks linked to investing in microcaps. These stocks often exhibit higher volatility, reduced liquidity, and limited financial disclosure, posing challenges in accurately assessing the company’s financial well-being. Additionally, the regulatory oversight for microcaps may not be as stringent, leading to an increased potential for fraudulent activities. Consequently, it is prudent to regard microcap investments as speculative and high-risk endeavors.

Risks to Thesis

When the facts change, I change my mind.

While I stand by my ‘Buy’ recommendation for UroGen, it’s important to consider potential risks in the interest of balanced investment analysis.

Firstly, UGN-102’s final approval is not yet secured. The treatment is still under clinical trial and regulatory review, meaning there’s uncertainty around whether it will ultimately gain FDA approval. Regulatory decisions can be unpredictable and are subject to the rigorous evaluation of safety, efficacy, and risk-benefit profile of the drug.

Secondly, the biotechnology and pharmaceutical industry is fiercely competitive. Even with UGN-102’s approval, UroGen would need to secure a robust market position against potential competing treatments.

Thirdly, the implementation of at-home administration of UGN-102, while innovative, carries its own risk. There might be unexpected complications or low uptake by patients or healthcare professionals, which could affect anticipated revenue streams.

Lastly, the company’s financial health should be monitored continuously. While their Q1 2023 performance was strong, shifts in R&D expenses, revenue generation, or unexpected financial liabilities can impact the company’s financial stability.

Read the full article here