Investment Rundown

There seems to have been a slight correction upward for the share price of Sylvamo Corporation (NYSE:SLVM). In the last twelve months, the price is up just over 30% but the p/e still sits very low at just 5.7 on a forward basis. Much of the reason for the low multiple seems to be from the fact that growth isn’t looking that impressive going forward, only around 6 – 8% for the EPS. Nonetheless, the company doesn’t seem like a steal because of this, and the low multiple could get an improvement if SLVM managed to exhilarate growth.

The company operates in the materials sectors but is niched towards paper products like uncoated freesheet and offset paper. The company has been in operation for over 100 years and has a market cap nearing $2 billion right now. But as some obvious challenges like more and more digitalization, they might face muted demand. I think stronger growth is necessary to justify a buy right now, and will instead view SLVM as a hold.

Company Segments

Back in 1898 Sylvamo was founded and has been focused on making paper products. The company has set up an international presence and dividends the business segments into the various regions it serves. These are as follows, Europe, Latin America, and lastly the North American segment. Several challenges are seemingly arising from many of the markets they are in. SLVM constantly has to face challenges like destocking and volatile demand levels.

Given that paper products like offset paper and uncoated free sheet are being phased out for more cost-efficient digital solutions, SLVM is forced to adapt with other products. Just quickly to emphasize the importance of diversifying their product offerings, the CAGR of paper products is only 1.5% from now and up until 2030. I think that sort of slow growth deserves a lower multiple, which is what SLVM is receiving right now.

The various segments all have different focus areas, like the European segment that makes colored laser printing paper. The Latin American segment is where the mills are located, and the North American segment offers imaging and commercial printings too.

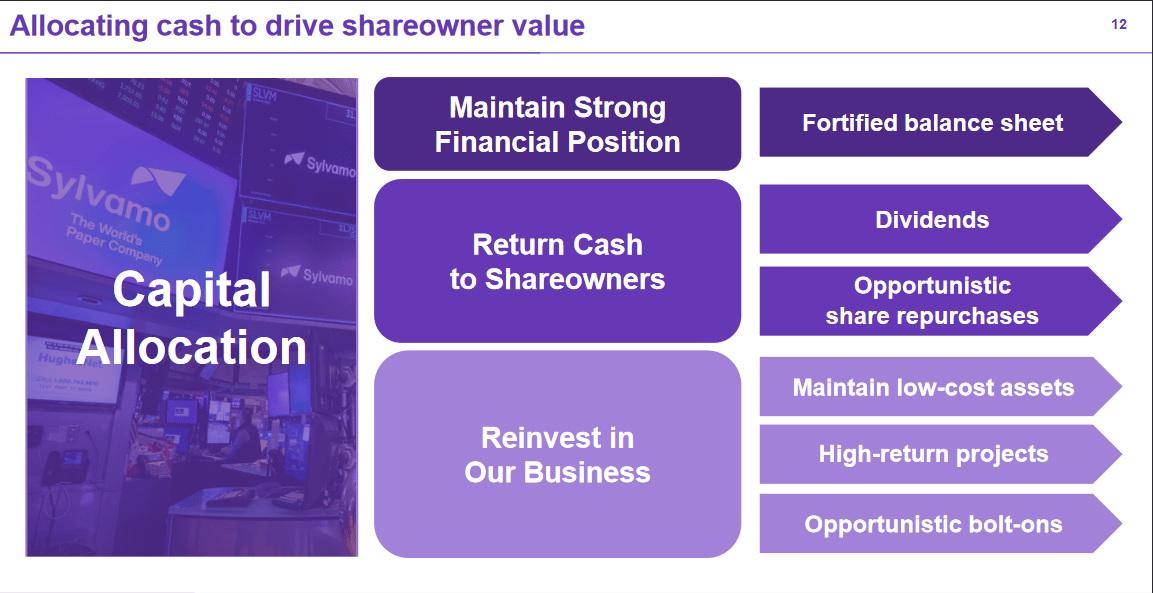

Capital Allocations (Earnings Presentation)

Because of the lack of growth in the market, it seems that a lot of the earnings are going toward shareholders instead of bulking and adding to the balance sheet where it seems necessary to me. The company has been buying back shares a little bit in recent years and also distributes a dividend. However, they aren’t enough to make a buy case. The dividend for example not above 1% and the shares outstanding have only really between 2022 and 2023 been reduced.

Earnings Highlights

On August 9 SLVM is announcing their next earnings report for the second quarter of 2023. I don’t expect to see any significant news released that would switch my rating of the company. It seems that EPS estimates are quite pessimistic, sitting at $1.19. That would QoQ represent an over 50% reduction in the EPS. It seems that struggling quarters are likely on the rise as commodity prices shift and trend downwards. More and more people are adopting digital solutions rather than paper, and the market that SLVM serves becomes limited. Even in emerging markets, using digital solutions is more appealing as it creates more growth opportunities.

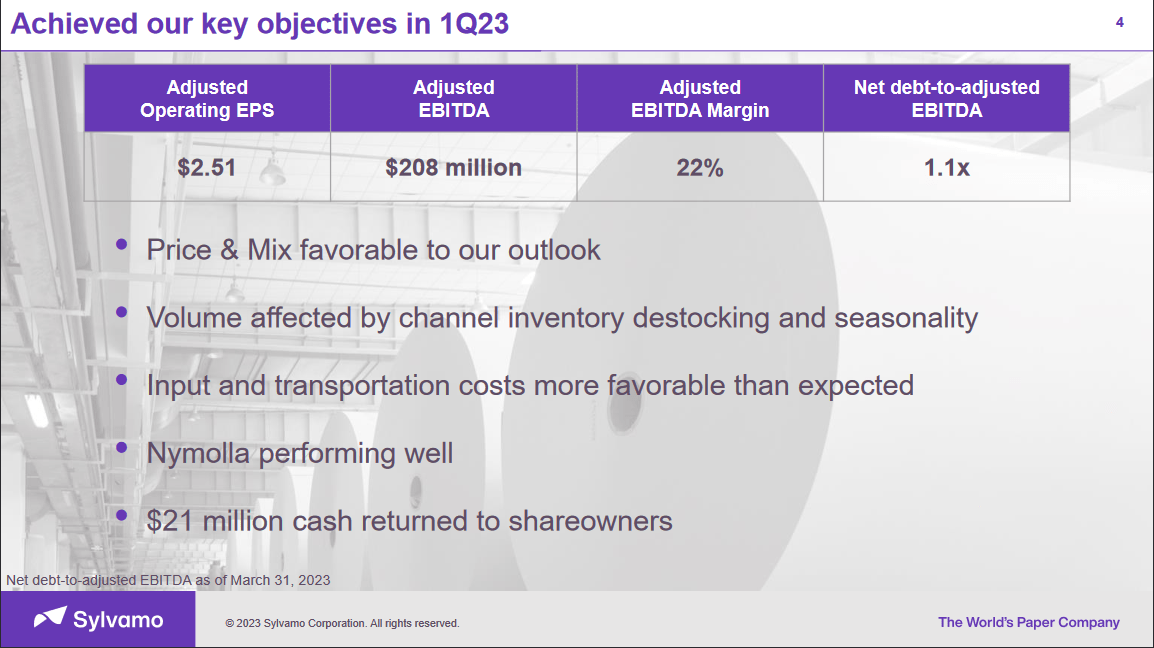

2023 Objectives (Earnings Presentation)

In terms of the last report from the company, it showed decent. EPS came in at $2.51 per share. This will significantly go down for the Q2 report as it seems there is less favorable pricing environment, as per the company’s admission in the last report. Helping offset some of this is higher importance and sales in the Latin American region. But still, this sort of inconsistency between quarters brings into question the long-term of the business.

Even though SLVM is generating quite strong EPS, in 2022 it was $7.84. SLVM doesn’t have a very high payout ratio, as most of the earnings are going toward paying down debt. In 2022 that meant $450 million in total for debt repayments. It still sits quite high at nearly $1 billion, or almost 50% of the market cap.

Risks

SLVM is currently facing a myriad of challenges that are affecting its operations and financial performance. Lower seasonal volume and rising seasonal costs are putting pressure on the company’s revenue and margins. Additionally, fluctuations in foreign exchange rates (Fx impact) are adding to the complexity of managing its international business.

Moreover, the rapid increase in the company’s share price might be unsustainable, especially if it is not fully supported by fundamental growth. The growth doesn’t seem justifiable given the results that SLVM has been posting. Rather, a correction to even lower multiples might be happening quite soon, reflecting this poor sentiment about future growth.

Financials

The financial state of SLVM right now is very solid, I think. The company has around 1.4x more assets than liabilities right now, and this means equity sits quite high at nearly $800 million. This has resulted in SLVM having a nearly 70% ROE.

Besides, the cash position sits quite high right now at $190 million. This isn’t perhaps enough to pay off even 50% of the $949 million long-term debts. But together with nearly $200 million in FCF, the company still sits safely in terms of paying back debts in my view. The TTM repayment of debts is $450 million, and it seems some of this has come from the cash position, which decreased from the highs in 2022 of $390 million. I don’t think this is bad, and the company is displaying a strong capacity of paying down debt and also repurchasing shares, spending $90 million on that.

Final Words

For investors that want to have exposure to the materials sector, I think there are far better options out there than SLVM right now. The company lacks strong growth and is in an industry facing significant challenges as more and more are digitalizing their operations to cut down on unnecessary expenses. For those that seek an investment in the sector, looking more towards mining companies or steel for example, I think will be yielding better returns.

The valuation right now with SLVM is very low, at a p/e of just 5.7 But that isn’t to justify it as a good buy right now. I don’t see there being any significant catalyst for the industry to make for a strong buy case. As for what I think is the “right” valuation for SLVM, somewhere around 10 – 12x earnings seems like a good area. This would put a price target of $89 per share. Leaving an upside of around 90%. Supporting my reasoning for this target is the fact the financials are solid and trading less below the sector than it currently does seem reasonable. Despite the upside, the rating remains a hold because of the low likelihood of this upswing happening in the short term, there need to be clear decreases in expenses for this to happen I think. Besides that though, the reason I have a hold rating though comes from the fact that perhaps short-term surprises in material costs could help soar margins, causing the share price to rise. However, what seems like a limited downside makes it a hold. If the balance sheet deteriorates along with margins, a sell rating could be made instead, as those are the supporting pillars of the business right now in my opinion.

Read the full article here