Investors,

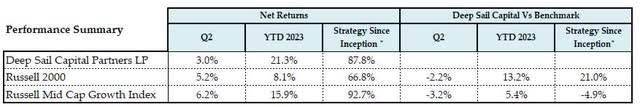

For the second quarter of 2023, Deep Sail Capital Partners (the “Fund”) returned 3% net of fees while averaging 78% net long exposure. Year-to-date through June, the fund returned 21.3% net of fees while averaging 76% net long exposure. Please consult your individual capital account statements for your individual net returns.

In the second quarter, the fund underperformed our benchmarks, the Russell 2000 index and the Russell Mid Cap Growth Index, by 2.2 and 3.2%, respectively. Year to date, we continue to outperform both benchmarks by a solid margin. The main driver of our underperformance in the second quarter was weak performance from the short portfolio. The long portfolio outpaced all our benchmarks in Q2, driven by the strong performance of two positions, Neogames (NGMS) and RCM Technologies (RCMT). The short portfolio saw weak performance in the second quarter, driven by what I describe below as a “mini rebubble” in low-quality long-duration equities.

Market Commentary

We have come so far in the last few months. We went from VCs begging for FDIC intervention in the Silicon Valley Bank failure in March to a “mini rebubble” in which low-quality, longduration equities caught fire again in June. Many of these companies are Moonshots, which are companies that have no revenues, high barriers to delivering a viable product, and require a significant amount of capital to fund. Alongside Moonshots, we saw several pump-and-dump companies emerge with an “AI” product in the second quarter. The markets clearly feel a bit like 2022 again, at least on the low-quality end of the market.

In reality, very little fundamentally has changed over the last 4 months. The yield curve is still inverted, the average 30-year fixed US mortgage rate has increased to over 7.5%, and the COVID savings surplus continues to drain. Forward indicators right now are mixed with no clear trend across them, so we are not flashing red yet, but structurally, all indications still suggest a coming recession.

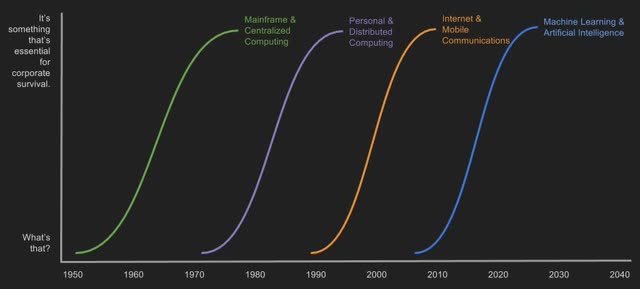

There was one bright spot in the second quarter, fundamentally. In March, it became clear that AI had found its first blockbuster application in ChatGPT, as it surpassed 1 billion users. I believe AI spending will kick off another important round of technology spending and development that will be a key driver of economic growth in OECD countries over the next 15 years. AI, like many transformative technology trends before it (Mainframes, PCs, Mobile, and Cloud), will require a multiple-year ramp-up in spending from a near-zero base.

Source: Xtrend AI

AI spending trends will continue to support the previous trends around corporate optimization and adoption of software applications to either improve insights or optimize workloads within their organizations. We continue to believe that infrastructure software has many years ahead of it of high growth as it continues to be embedded in the base software codes of new applications.

Overall, at this point in the cycle, the most likely outcome would be a mild recession, but with the mix of fundamental data, I believe we are in a wait-and-see environment right now.

I continue to believe now is a time to be cautious and avoid any companies that have significant debt or rely heavily on consumer debt to fuel their sales. I continue to position the fund’s short and long portfolios to support this cautious outlook on markets.

Long Portfolio Summary

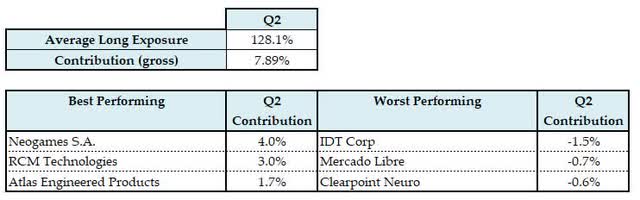

In the second quarter, the long portfolio had mixed performance across the board, with two positions providing the majority of the returns: Neogames S.A. and RCM Technologies. Neogames S.A. entered into a definitive agreement to be acquired by Aristocrat on May 14th for $29.50, roughly a 130% premium to the share price prior to the announcement. We exited our position in Neogames immediately upon the announcement of the acquisition. RCM Technologies was up 64% in the second quarter on the back of an improving outlook for employment and a continued share buyback by the company.

The worst detractor in the second quarter was IDT Corp. (IDT), which reported earnings that were below analyst expectations in their traditional communications business as well as an overhang in regard to the outstanding lawsuit between IDT Corp. and shareholders for the sale of Straightpath Communications. Our long thesis on IDT is that the three small but fast-growing high-margin businesses within IDT (NRS, net2phone, and Boss Money) will slowly but surely become a much larger piece of the value of IDT Corp over the next few years and are materially undervalued within the larger IDT holding company. We believe that the risk of the litigation outcome, while still uncertain, is largely priced into the stock at these levels, and we continue to hold our position. Nevertheless, we have hedged our downside in IDT through the end of 2023 via put options in case of an extremely bad litigation outcome.

In Q2, we opened a new position in SDI Group (OTCPK:SDIIF), a serial acquirer in the digital imaging, sensors, and medical controls segments.

Current Position: RCM Technologies – Unrealized return 44%

RCM Technologies is a diversified talent services holding company. The company operates in three segments: healthcare, Life Sciences and Information Technology (LS&IT), and Engineering. The company has a strong history of high-quality capital allocation, including smart M&A and opportunistic share buybacks. Recent commentary from the Q1 earnings call suggests that their Engineering business has built a backlog for 2023 that will materialize in future quarters.

After their 4Q earnings back in March, they noted “Material Weaknesses in Internal Control

Over Financial Reporting” which caused the stock to drop 30%. I spoke with their CFO, Kevin Miller, about this after they submitted the filing. Kevin noted that the material weakness identified was related to their use of a third-party consultant to assist with the creation and ongoing development of their SAP accounting system. This work allowed those third-party consultants access to their accounting system, which is what caused the auditors to note a Material Weakness in Internal Controls. This came up during their most recent audit in 2022, and they are in the process of rectifying it in 2023, as they laid out in the 10-K. Currently, it is projected to be rectified in 2Q or 3Q of 2023. It seems highly unlikely that any material misstatements of their financials were made, and this material weakness should be resolved later this year with no impact on their financials.

Market Opportunity – Segments

RCM Technologies Healthcare segment is focused on providing nurses and other healthcare professionals with long-term and short-term staffing and placement services to hospitals, schools, and long-term care facilities. Since COVID, they have had success securing contracts with large school systems across the country in order to provide them with staffing for nurses, therapists, and other healthcare professionals at these schools. The Healthcare segment’s revenues have more than doubled since 2020, driven largely by the school segment. Recent weakness in their Healthcare business was driven by lapping some COVID-related demand spikes that are soon to be behind them. Overall, as COVID has become endemic, the school system’s demand for nurses and therapists has slowed, but I believe we have stabilized around Q1 levels, as suggested by management in the Q1 conference call. There is a huge opportunity in this space to expand to other School systems around the county, as they currently only service a small number of larger school systems. The total TAM of the school segment is likely 10-20x their current market share. On top of a large TAM in front of them, they have a huge opportunity to provide behavioral therapists to school systems, which are increasingly in demand by school systems to provide support to their students for behavioral and social issues. I believe we will see behavioral therapist demand outpace nurse demand in the future as more schools look to put in resources capable of supporting their students emotional health.

In the field of engineering, RCM Technologies offers a diverse range of services, including product design, development, and testing, as well as technical staffing and consulting. They assist clients in sectors such as aerospace, automotive, energy, manufacturing, and telecommunications. They have increasingly positioned their engineering business to be supportive of the shift to alternative energy. As new renewable energy resources and the shift to electric vehicles approach, there is a huge need for utilities to upgrade their transmission infrastructure. RCM Technologies Engineering Group has expertise in supporting a wide array of energy projects in the generation and transmission segments, including projects in solar, biofuels, fuel cells, batteries, substations, and transition upgrades. The engineering segment is well positioned in North America. Outside of that, RCM Technologies has recently launched an engineering office in Germany, which could be a launching pad for developing a business in Europe.

With regard to the Life Sciences and Information Technology (LS&IT) segment, RCM Technologies offers IT staffing, consulting, project management services, and life sciences support to assist businesses in various technology-related initiatives. They provide skilled IT professionals who can support clients in areas such as software development, data management, cybersecurity, and infrastructure management. This segment focuses on providing a full suite of IT services to middle-market companies within various industries. The LS&IT segment is the smallest of the three segments but has the highest gross margins at 34.5% (vs. 30% in Healthcare and 22% in Engineering). The segment has been an extremely reliable and consistent part of their business, generating roughly $3m / quarter of gross profit for RCM but growing only a few percent a year since 2020. In a way, you can think of the LS&IT segment as a cash cow that helps feed the faster-growing Healthcare and Engineering segments.

RCM Technologies – 4 Pillars of an Exceptional Investment:

|

Pillar |

Rating |

Comments |

|

Pillar 1 – High Quality Business Model |

B- |

• The healthcare segment has a very strong niche in providing schools with nurses, which differentiates their revenue streams, has sticky contracts, and is very early in its expansion. |

|

• The engineering segment is driven largely by the development of new projects in oil & gas, energy, manufacturing, and telecommunications. |

||

|

• Talent Services (specifically the life sciences and healthcare segments) are highly exposed to the US employment market, which is a key watch point for the company. |

||

|

Pillar 2 – Outstanding Management |

A |

• Executive Chairman Brad Vizi has shown an aptitude for capital allocation, including some M&A, well-timed buybacks, and well-timed debt usage and repayment. |

|

• Brad and the CFO, Kevin Miller, have developed a strategy in which they “skate to where the puck is going” within each of their business segments. |

||

|

Pillar 3 – Substantial Long Term Growth Prospects |

B+ |

• The Engineering and Healthcare segments are well positioned to take advantage of trends in each of their segments: Engineering: biofuels, expansion of the electricity grid, and renewable energy Healthcare: expanded penetration of clinical therapists in schools. |

|

• Due to the high cash flow of the core businesses, there is a lot of optionality for management to pursue M&A or share buybacks. |

||

|

• The company has several small initiatives that will start adding to its core revenues and earnings, including expanding its Engineering into Europe and their TalentHerder acquisition completed in October 2022. |

||

|

Pillar 4 – Reasonable Valuation |

A- |

• Company has bought back 11% of shares in last 12 months (as of end of 1Q) |

|

• EV/EBITDA = 6.7 TTM. The stock is up 68% in Q2 and still relatively cheap but less so than earlier this year. |

||

|

• Engineering services will be back half of 2023 loaded. I expect some solid 3Q & 4Q revenue and EBITDA growth. |

Short Portfolio Summary

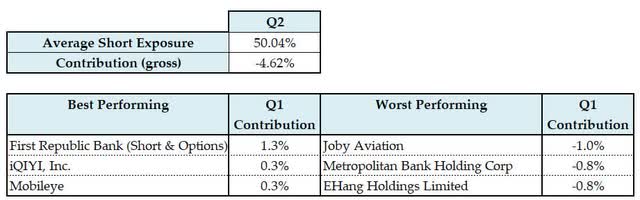

Low-quality, long-duration, and high-short-interest stocks saw a huge rally at the end of the first quarter off the lows they set in Q4. As described above in our Market Commentary section, there was a mini-rebubble that occurred starting in Q2. This mini-rebubble is centered around artificial intelligence (AI), electric vertical take-off and landing (eVTOL) aircraft, and some leftover SPAC pumps from the last cycle. We believe this mini-rebubble will burst just like all of the other bubbles that we have traded before (3D printing, Electric Vehicles, Cannabis, etc.). Eventually, it will deflate.

Our best-performing short position in the quarter was in First Republic Bank, as the company entered receivership in the second quarter, essentially zeroing out the equity value. Banks continue to be on shaky ground with the current interest rate landscape, but the banking crisis has likely passed. We continue to hold short positions in a few regional banks that we believe are still overvalued in light of the new lending and rate environment.

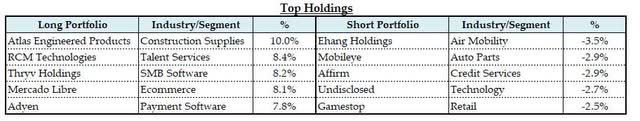

Top Holdings & Current Exposure

At the end of the second quarter the fund held 26 long positions and 32 short positions. The fund ended the quarter with an exposure of 134% long and 52% short or a 82% net long exposure.

Sincerely,

Sean

| Disclaimer: Deep Sail Capital LLC (“Deep Sail Capital”) is an investment adviser to funds that are in the business of buying and selling securities and other financial instruments. This information is provided for informational purposes only and does not constitute investment advice or an offer or solicitation to buy or sell an interest in a private fund or any other security. An offer or solicitation of an investment in a private fund will only be made to accredited investors pursuant to a private placement memorandum and associate subscription documents. Past performance is no guarantee of future results.

“Deep Sail Capital Partners” returns in this document are shown as net returns or gross returns where stated. Historical net returns assume a 1.5% and 15% management and performance fee, respectively. For Net Returns of fees and expenditures figures please reach out to the fund manager at the email [email protected]. “Deep Sail Capital LLC” name was changed on April 7th 2022 from the previous name “Organon Capital LLC”. “Deep Sail Capital Partners LP” name was changed on April 6th 2022 from the previous name “Westropp Funds LP”. * – “Strategy Since Inception” refers to the Strategy inception date of July 2016. Deep Sail Capital Partners LP’s predecessor incubator fund, “Westropp Funds LP” pivoted from a Value Investment style to a Growth at a Reasonable Price (GARP) style fund on that date. For more details on this transition or the calculation behind the “Strategy Since Inception” returns please reach out to the fund manager at [email protected]. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here