Introduction

My thesis is that there is no chip manufacturer more important for the smartphone industry than TSMC (NYSE:TSM). Apple’s (AAPL) iPhone can’t exist without TSMC chips. Other major smartphone industry companies like Qualcomm (QCOM) and Huawei have a deep history with TSMC. Smartphones require small leading edge chips for optimal battery life and the FT reports that the only 5 companies in the world using ASML’s EUV machines for leading edge chips are TSMC, Samsung (OTCPK:SSNLF), SK Hynix (OTC:HXSCF), Intel (INTC) and Micron (MU).

As my May 2022 article says, TSMC has a bright future as they are still well positioned with small chips that are key for the power efficiency of mobile devices. Unlike Samsung, they don’t compete with their customers by making smartphones.

TSMC financials use New Taiwan dollars which go by the TWD code, the NT$ symbol and the NTD abbreviation. At the time of this writing, TWD 1,000 is equivalent to about $32. In other words, we can multiply the TWD figures by 0.032.

The Numbers

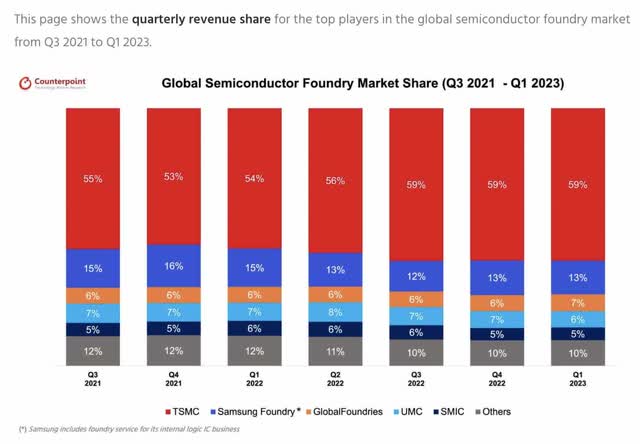

Per Counterpoint, no one comes close to TSMC for foundry revenue:

Foundry market share (Counterpoint)

The Chip War book by Chris Miller explains that TSMC is the only company on the planet capable of fulfilling Apple’s needs:

Apple’s iPhone processors are fabricated exclusively in Taiwan. Today, no company besides TSMC has the skill or the production capacity to build the chips Apple needs. So the text etched onto the back of each iPhone – “Designed by Apple in California. Assembled in China” – is highly misleading. The iPhone’s most irreplaceable components are indeed designed in California and assembled in China. But they can only be made in Taiwan.

[Kindle Book Location: 3,020]

We see from annual reports that smartphone companies such as Apple, Qualcomm and Huawei (HiSilicon) have historically been TSMC’s largest customers:

|

Year |

Apple |

Qualcomm |

Huawei |

AMD |

|

2013 |

1% |

22% |

||

|

2014 |

9% |

21% |

||

|

2015 |

16% |

16% |

||

|

2016 |

17% |

11% |

||

|

2017 |

23% |

7% |

5% |

|

|

2018 |

22% |

6% |

8% |

|

|

2019 |

23% |

14% |

||

|

2020 |

25% |

12% |

||

|

2021 |

26% |

10% |

||

|

2022 |

23% |

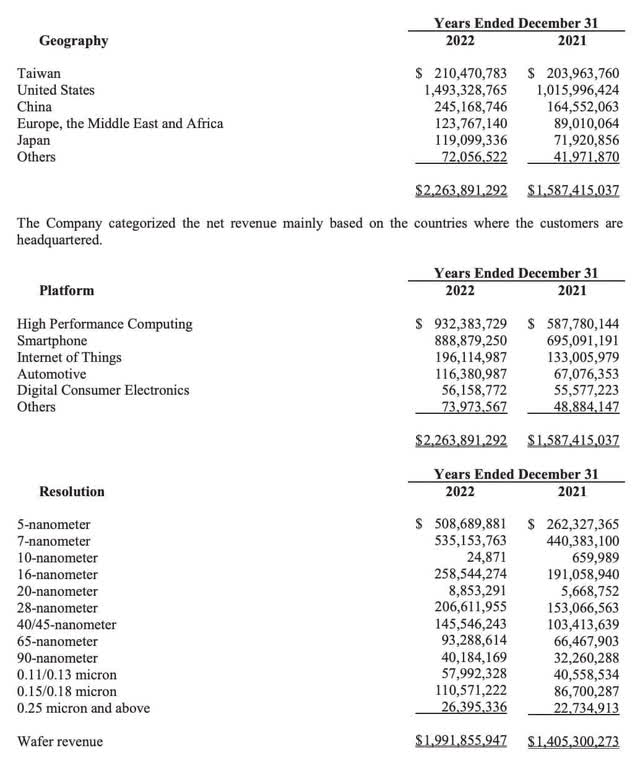

TSMC’s 2022 annual report shows revenue of NT$ 2,263,891,292 thousand composed of NT$ 1,991,855,947 thousand in wafer revenue plus NT$ 272,035,345 thousand in other revenue. NT$ 888,879,250 thousand of this was smartphone revenue. Converting into USD, that’s about $28.4 billion in smartphone revenue for 2022:

Smartphone revenue (2022 annual report)

Small Chips Preserve Smartphone Batteries

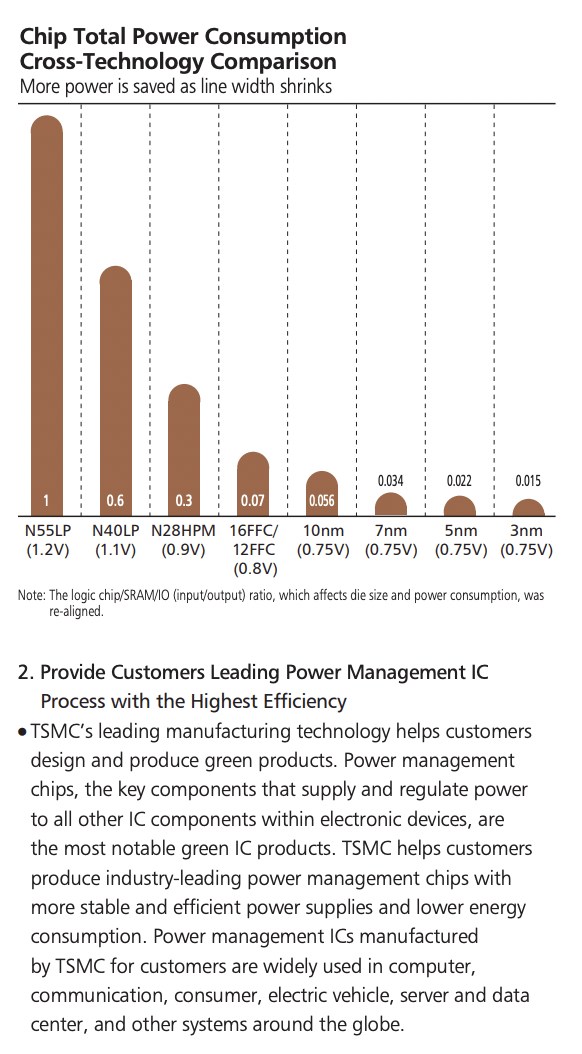

Chips with leading nodes from TSMC are crucial for the battery life of smartphones:

Power efficiency (2022 annual report)

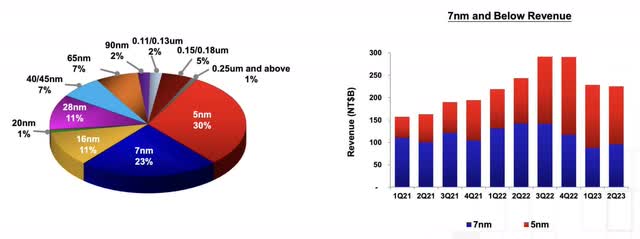

The 2Q23 presentation shows a year-over-year (“YoY”) increase in 5 nm revenue and a YoY decrease in 7 nm revenue:

7nm and below (2Q23 presentation)

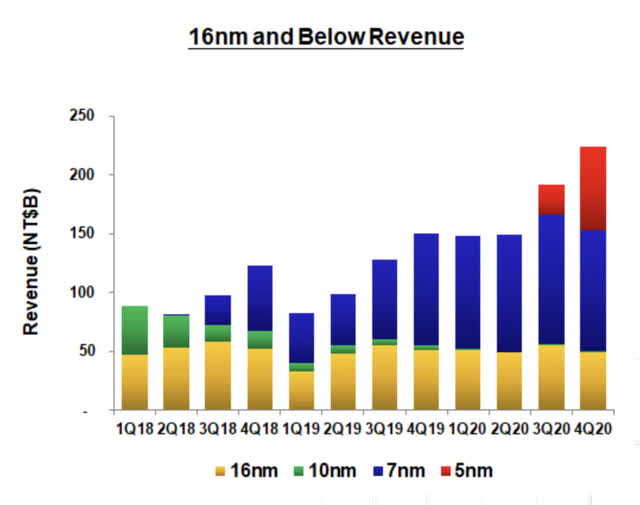

The 5 nm revenue above is especially impressive seeing as the 4Q20 presentation shows that 5 nm revenue didn’t begin until the 3Q20 period:

16nm and below (4Q20 presentation)

Valuation

Looking at the 2Q23 financial statements and the 2022 annual report, trailing twelve month (“TTM”) operating income was NTD 1,068,561 million or NTD 433,196 million + NTD 1,121,279 million – NTD 485,914 million. This came from TTM gross profit of NTD 1,306,384 million or NTD 546,700 million + NTD 1,348,355 million – NTD 588,671 million and TTM net revenue of NTD 2,228,148 million or NTD 989,474 million + NTD 2,263,891 million – NTD 1,025,217 million. Converting to USD, we have TTM operating income, gross profit and revenue of $34.2 billion, $41.8 billion and $71.3 billion, respectively.

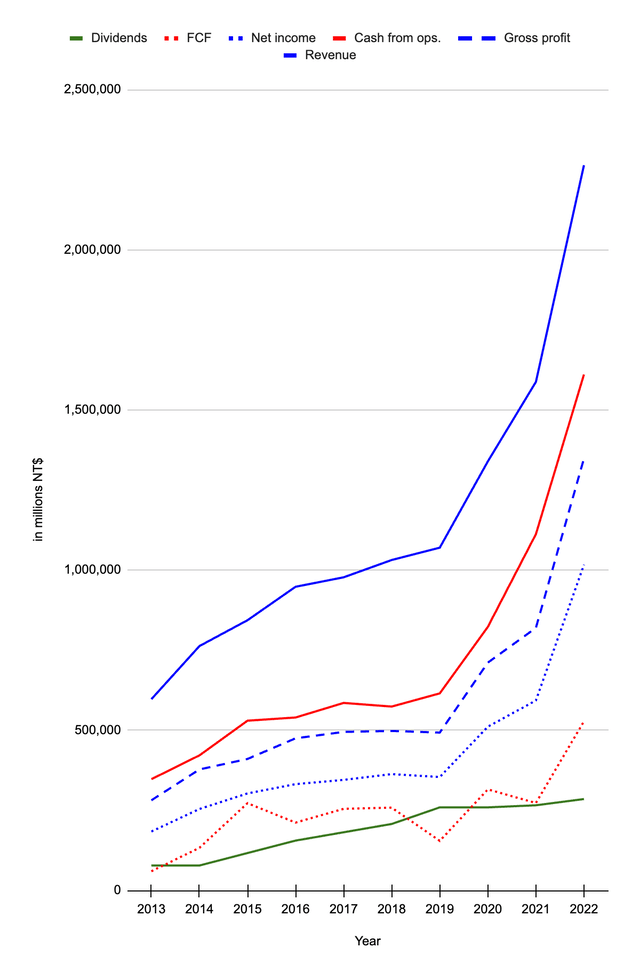

Net income is less than operating income under ordinary circumstances and we see below that free cash flow (“FCF”) can be as little as half of net income:

Historical financials (Author’s spreadsheet)

Given the fact that FCF is significantly less than operating income, I think a reasonable valuation range is 15 to 16x TTM operating income which comes out to $515 to $545 billion when rounded to the nearest $5 billion.

The 2Q23 financial statements show 25,929 million weighted average shares outstanding and a footnote says 1 ADR equals 5 ordinary shares. As such, the market cap is $520 billion based on the July 25th TSM ADR price of $100.32.

Seeing as the market cap is close to my valuation range, I see the stock as a long-term hold.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Read the full article here