JD.com (NASDAQ:JD) has often been ignored by American investors. The company often seems like the not so famous cousin of (BABA). Typically, the stock has been a bargain though under $35. The last time we bought JD was in 2020 for around $34 and watched it make a huge run before selling in 2021 for a sizable gain.

Mark Twain

As Mark Twain once quipped, “History does not repeat itself but it does rhyme.” In one of Mark Twain’s famous stories, The Celebrated Jumping Frog of Calaveras County, a character named Jim Smiley is willing to bet on anything. He, like many current investors/speculators, loves to make bets which has contributed to the inflation of popular meme stocks and digital art.

I tend to think differently than the majority of investors. I only like investing money into opportunities in which the reward outweighs the risk. I like companies that have the potential to double within the year. (JD) is currently at an inflection point and appears poised to recapture its previous highs.

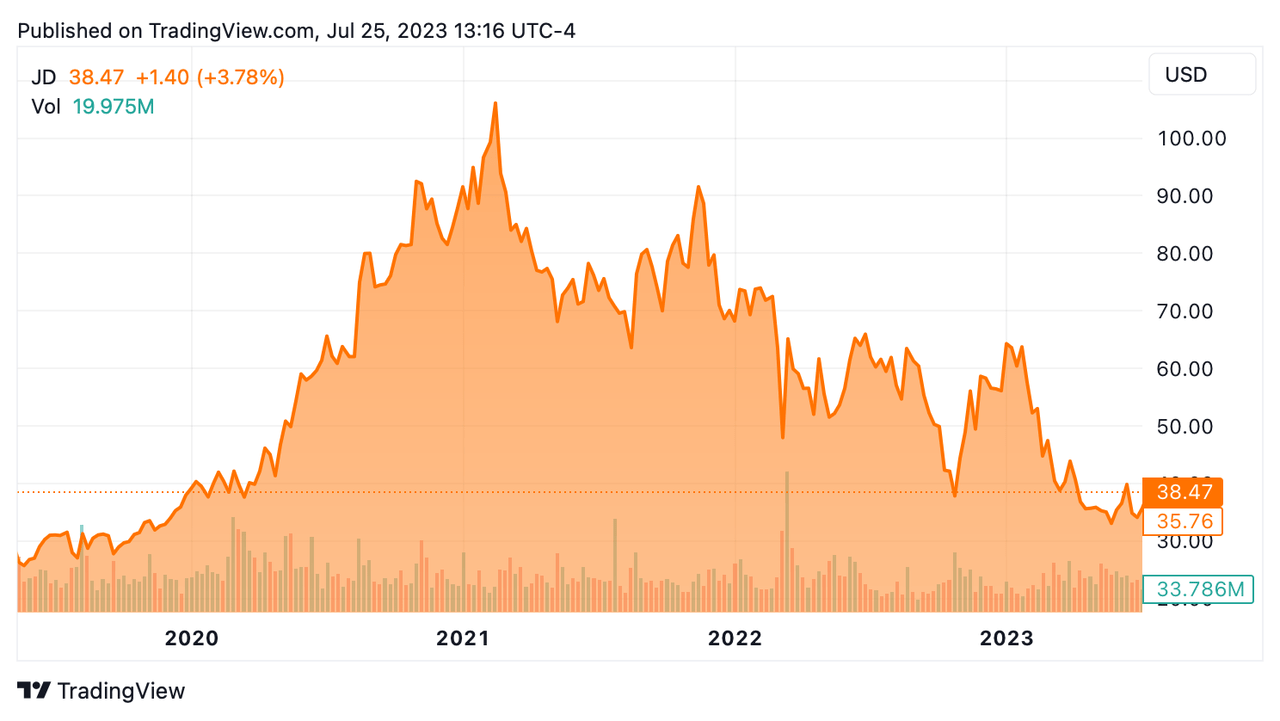

In regards to JD, there are some downside risks that we will discuss later but the stock has been firmly supported at around $35 since 2018 and has only traded below that level for short periods. The technical story can be told in three charts.

Chart 1: The Four Year Chart of Growth and Pandemic

Seeking Alpha

The four year chart above shows the surprising growth from 2019-2021 prior to the pandemic and then it shows the direct impact of the Chinese economic slowdown during the Pandemic.

Seeking Alpha Seeking Alpha

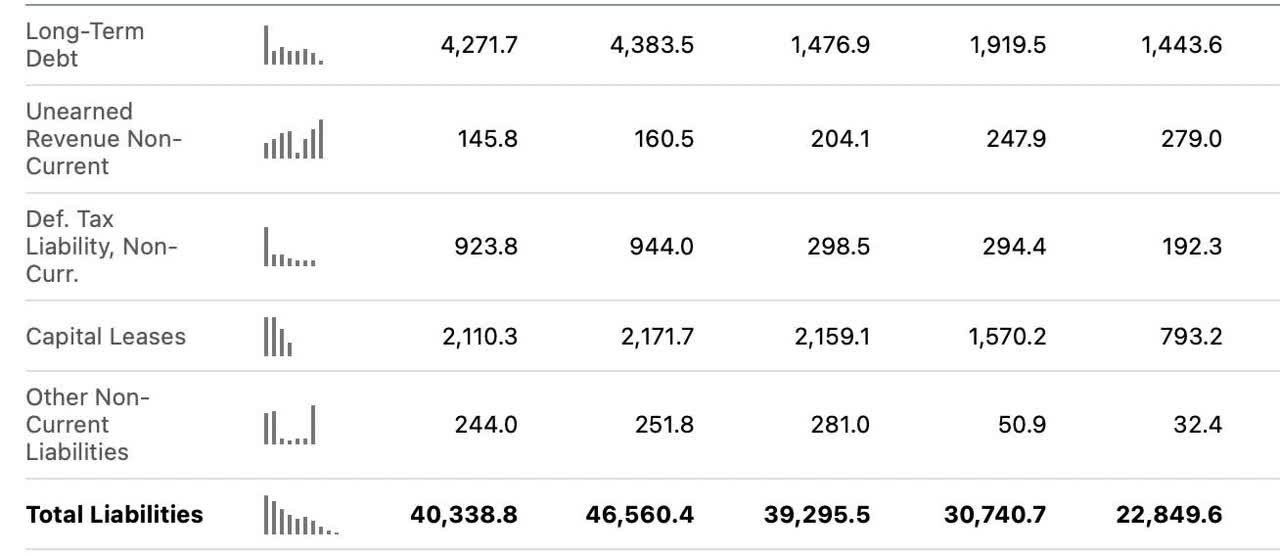

JD’s stock price might have suffered, but during this time JD grew its assets from $37 billion to $80 billion and only increased its liabilities from $22billion to $40 billion. Increasing the spread between assets and liabilities in each year as shown in their balance sheet.

Seeking Alpha

Not only did they manage to increase its assets, JD has also increased revenue and earnings as shown in its income statement. The company appears healthier than it ever has been and is poised to benefit from any growth or recovery in China directly. I would argue that even though the stock price has suffered. JD as a business is doing just fine.

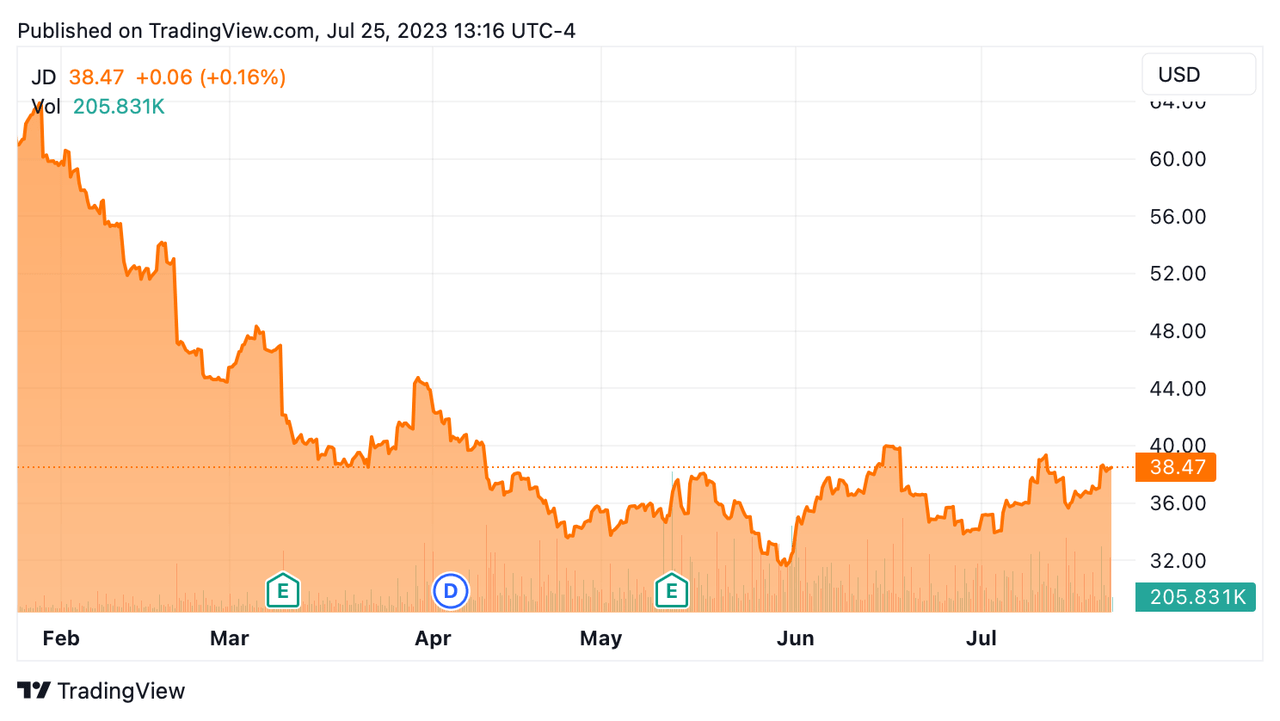

The Six Month Chart: The Fall and Economic Slowdown

Seeking Alpha

Over the last six months, the stock price has certainly suffered. Mainly this is due to the poor results of 2021 which can be attributed to the pandemic slow down. Meanwhile investors in most Chinese companies have felt like this.

Canva

When we examine the one month chart, we see rays of hope and we are reminded that the darkest hour is right before dawn. Fear and uncertainty also bring the best opportunities in the market. Right now people are uncertain what will happen in the Chinese economy and this uncertainty has made many companies appear cheap.

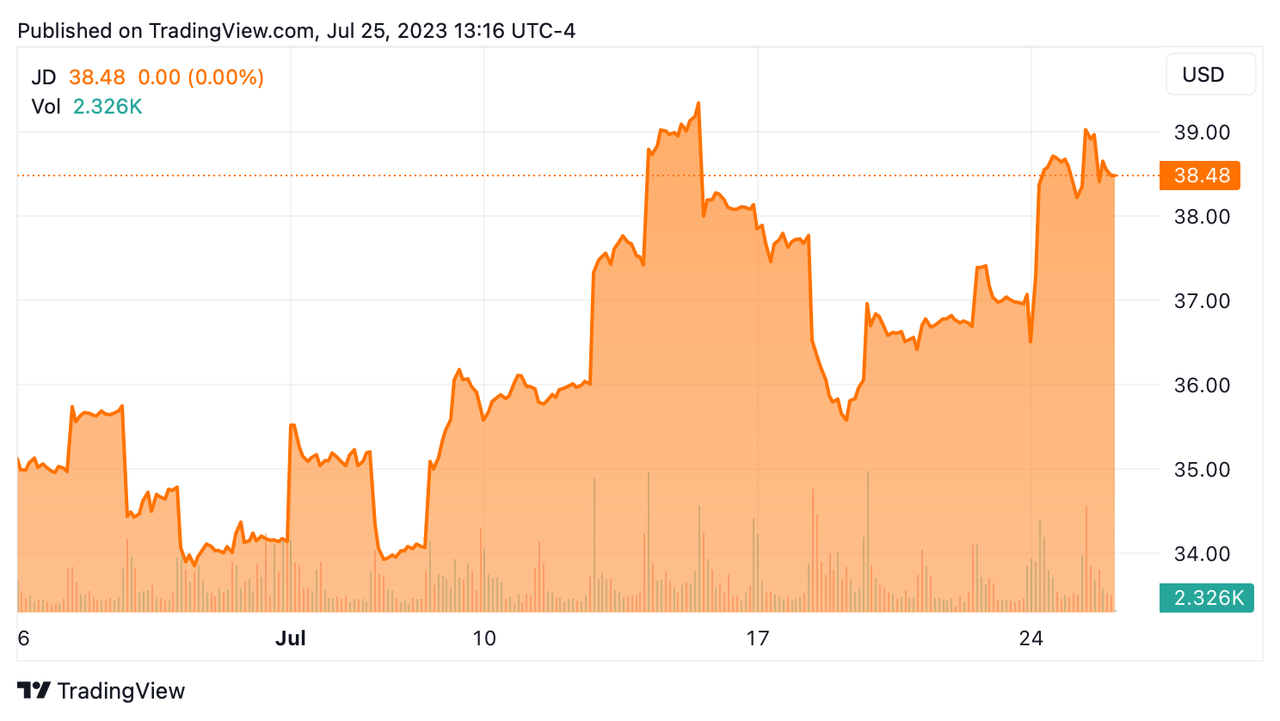

The 1 Month Chart: Signs of Hope and Life

Seeking Alpha

The one month chart shows the building hope of investors. The inflection point for the stock appears to be around $34. If JD continues to deliver results the stock price should reflect a more optimistic future. Since the stock market likes to look ahead, any positive results should act like a catapult for the stock price and it appears as if the move has already started.

Current Intrinsic Value:

Using our proprietary methodology we have JD’s current value at around $70 which presents a discount of 46%.

We arrive at this value by using both Qualitative and Quantitative analysis:

When evaluating stocks, I consider a comprehensive set of ten data points, encompassing both qualitative and quantitative aspects. I assess the company’s financial performance, looking at consistent revenue growth and positive earnings per share (EPS). Valuation ratios, including the price-to-earnings (P/E) ratio and price-to-book (P/B) ratio, offer insights into the stock’s pricing relative to its earnings and book value.

Examining JD’s industry position reveals its strong foothold in the competitive e-commerce sector, while assessing management and governance ensures effective leadership. The focus on product differentiation and customer satisfaction contributes to JD’s success. I analyze the company’s debt and liquidity management to understand its financial health. Considering regulatory and legal factors is crucial, particularly as JD operates in China, exposing it to geopolitical and regulatory risks. Macro-economic factors and China’s economic stability are taken into account. My final consideration ranks the current sentiment because as a behaviorist I believe sentiment is the most important factor at determining inflection points.

Currently, I believe that JD has just passed through a major inflection point based on a change in sentiment that started a month ago. Evaluating JD across these ten data points indicates its potential as an investment and puts its fair value somewhere between $65 and $90, but investors should still remain cautious of regulatory and macro-economic risks. Thorough research and monitoring are essential for informed decision-making.

Looking Forward

If JD has an exemplary quarter as outlined in this recent article here by Cavenagh Research, we expect the value to increase significantly. The main reason this opportunity exists is because current sentiment regarding Chinese companies is still very low even though it has recently shown signs that sentiment is improving.

We believe with the sentiment shift JD shareholders will reap the benefits. We expect continued improvement in earnings and in book value over the coming year as the Chinese recovery starts to really take off. Another important factor to consider is the possibility of China using some forms of stimulus in order to jump start their economy before the end of the year. This could provide a significant tailwind for the Chinese stock market.

The integration of AI (Artificial Intelligence) into JD’s operations could also unleash a tidal wave of positive transformations. By harnessing the power of AI, JD can optimize its supply chain, offer personalized shopping experiences, and provide top-notch customer service with AI-powered chatbots. The strategic implementation of AI algorithms will enable JD to make data-driven decisions, enhance pricing strategies, and predict customer behavior accurately. With AI-driven product recommendations and efficient inventory management, JD can unlock hidden growth potential while delivering targeted marketing campaigns to the right audience. The future of JD holds exciting possibilities with AI’s potential to revolutionize delivery systems through autonomous vehicles and drones. Embracing AI integration positions JD to thrive amidst the dynamic landscape of e-commerce, propelling the company towards further growth and prosperity.

Current Risks

Investing in JD.com, amidst China’s dynamic landscape, entails specific risks that demand prudent consideration. Regulatory uncertainties in China’s evolving environment could impact JD.com’s prospects, while geopolitical tensions may create unpredictability in global markets. Investors should be vigilant about financial reporting and transparency issues surrounding Chinese companies, which might affect their ability to make informed choices. Additionally, currency risks, fierce competition in the e-commerce industry, and potential supply chain disruptions pose challenges for JD.com. Cybersecurity threats and macro-economic factors further add to the complexities of investing in this market. A comprehensive evaluation and understanding of these risks are essential for making informed decisions in the ever-changing Chinese investment landscape.

Of these risks the most important one is country risk. Investors globally are still shaken by what happened to investments in Russia and current global tensions make investing in China or any communist country a real risk. There is a real reason many companies in China are trading at a discount to their intrinsic value. Although China wants to promote growth, businesses are at risk if they do not serve at the interest of the people.

Current Tailwinds

JD.com, the Chinese e-commerce giant, can expect to benefit from several tailwinds in the Chinese economy. First and foremost, the country’s continued economic recovery post-COVID-19 bodes well for JD.com’s growth prospects. As consumer confidence returns and spending increases, the demand for online shopping and delivery services is likely to surge, playing right into JD.com’s strengths. Additionally, China’s ongoing urbanization and rising middle class provide a vast market for the company to tap into, with increasing disposable incomes driving higher consumer spending on goods and services. Furthermore, the Chinese government’s support for domestic consumption and digitalization efforts aligns with JD.com’s strategic focus, positioning the company favorably to capitalize on these favorable policies. JD.com’s expertise in technological innovation, logistics infrastructure, and customer-centric approach further enhances its ability to thrive in the evolving Chinese economy. As these tailwinds continue to gather strength, JD.com’s market presence and revenue growth are poised to benefit significantly in the foreseeable future.

Conclusion:

JD.com presents an intriguing investment opportunity amid the current market landscape. The company has experienced strong growth while the stock has languished. JD.com’s strong financial position, impressive revenue and earnings growth, and strategic focus on technological innovation position it favorably in the e-commerce industry. While there are risks to consider, such as regulatory uncertainties and geopolitical tensions, JD.com stands to benefit from tailwinds like China’s economic recovery, increasing consumer confidence, and government support for domestic consumption and digitalization efforts.

I believe JD presents a compelling opportunity since it has low risk and the potential. Although buying JD under $35 is a no brainer, we cannot guarantee that you will see the price dip back to that level. As Mark Twain said, “Prediction is difficult particularly when it involves the future.” Given the significant upside potential we would still be comfortable buying full or half positions at current levels. That does not mean buyers should underestimate the risk. Holding a small position in JD as part of a balanced portfolio could be a wise decision, but having too much exposure to China might not be prudent. As investors it is important to weigh the potential rewards and risks, and determine for yourself if it makes a suitable investment. Good luck investing and remember that having a great margin of safety is better than luck.

Read the full article here