LendingTree, Inc. (NASDAQ:TREE) stock fell even further after the online financial services company reported a larger-than-expected drop in first-quarter revenue and lowered its outlook for the rest of the year. However, following the recent price drop, TREE stock now appears to be in a buying zone for investors with a long-term investment horizon. TREE’s stock appears appealing because the price has already reflected the impact of negative events, and there is only limited downside remaining. Along with improving market dynamics, the company’s strategy of simplifying its business model and lowering its cost structure will aid in profit optimization in the coming years.

LendingTree Q1 Earnings Results and Outlook

Let’s quickly review LendingTree’s most recent financial performance and its outlook for 2023 before moving on to investment analysis. The earnings release highlights negative factors while also emphasizing elements that could be critical in regaining investor confidence.

The Negative Factors

TREE’s main issue is a revenue decline that started in 2022 and accelerated in the first quarter. Its first-quarter revenue of $200 million was down 29% year-on-year, marking the lowest level since the second quarter of 2020. The decline is attributed to tighter market conditions and a slower economic expansion. Revenues fell sharply in all three business segments, including home, consumer, and insurance. Its consumer segment revenue dropped 21%, insurance segment revenue fell 4%, and home segment revenue plunged 57% year-over-year.

The company expects revenue of $190 million in the second quarter, implying that the revenue decline will not be reversed anytime soon. Furthermore, the company’s projected revenue of $800 million for 2023 appears unimpressive, as it represents a $180 million decrease from the midpoint of its previous 2023 forecast. The lower revenue forecast reflects not only the impact of tightening conditions but also the impact of businesses that have been or will be exited in the coming quarters. The company’s intention to close its Ovation Credit Services division in the second quarter is the most significant contributor to the lower revenue forecast. The forecast also includes a decrease in insurance revenue because one of its largest partners has temporarily halted new policy acquisitions across multiple states.

The Positive Factors

Despite the fact that declining revenue has historically had a negative impact on TREE’s stock price, the Q1 earnings call had many positive aspects that may help investors feel more confident in future fundamentals. The two most important factors are decreasing costs and growing opportunities for higher earnings growth in the coming quarters and years. In the first quarter, for example, its total revenue cost fell 11.6% year over year to $13.7 million. Revenue costs are expected to fall even further in the coming quarters as a result of cost-cutting and simplification actions that have eliminated low-returning businesses. This strategy not only cuts costs but also allows the company to refocus on key priorities that will drive profitable growth. As a result, despite lowering its revenue forecast by $185 million, the company’s adjusted EBITDA guidance range has been reduced by only $5 million. When the revenue environment improves, this strategy will allow it to generate significant operating leverage on its lower fixed cost base.

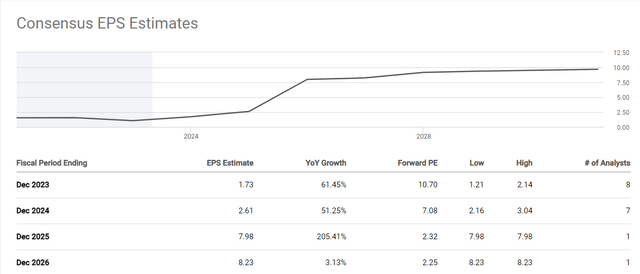

TREE’s Earnings Estimates (Seeking Alpha)

Analysts on Wall Street predict that the company’s earnings per share in 2023 will be close to $1.73, a 61% increase from this year. Earnings growth is likely to accelerate in the coming years, with 2024 expected to be another year of more than 50% growth. On the balance sheet, the company still has a sizable amount of excess cash. At the end of the first quarter, the company had $150 million in cash on hand, whereas it only requires $50 to $75 million to operate the business.

Market Trends Support Higher Earnings Expectations

Along with cost-cutting and simplification initiatives, market trends are likely to support higher earnings forecasts. A potential pause in the Fed’s rate hike policy is the main factor behind the market trends’ improvement. The Fed has raised interest rates ten times in the last twelve months, sending fund rates to levels not seen since the financial crisis. Following the most recent rate increase, Fed Chairman Powell stated that the bank is nearing or may have already reached its target level for rate hikes.

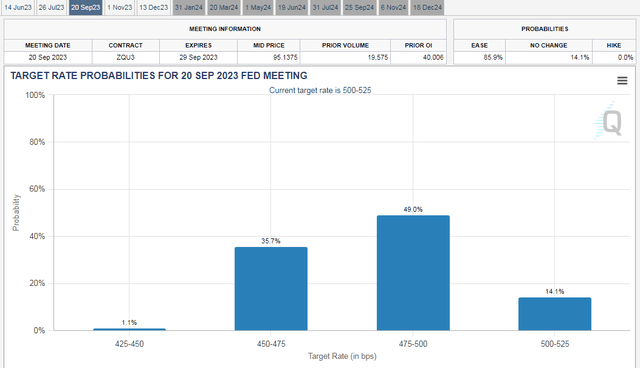

Fed Rate Cut Expectations in September (CMEGroup)

According to CME data, the market participant also believes that the Fed’s rate-hiking cycle has ended and that a rate cut is likely in the second half of 2023. Although it appears that keeping rates at a higher level for some time will help the Fed achieve its goal of lowering inflation sooner, developing stress in the banking sector may force the Fed to consider rate cuts in the second half. Several regional banks have already failed, and recent quarterly data show that banks are struggling to keep deposits and reduce credit losses. According to market analysts, bank stress would have a similar impact on the economy as the Fed’s quarter percentage point increase.

Why is LendingTree Stock Attractive Now?

LendingTree Stock Price (Seeking Alpha)

Buying when others are afraid has always been the most effective strategy for achieving exceptional returns. However, buying the dip makes sense when investors purchase a stock near the bottom of the selloff with improving fundamentals. Last year, I advised investors to stay away from TREE’s stock because of its deteriorating fundamentals. You can read my article ‘LendingTree: A Risky Play Despite 80% Stock Price Drop’ for more information. But it now seems that the impact of negative events has been fully reflected in the stock price. In fact, the recent selloff of about 25% that occurred after first-quarter earnings demonstrate that the impact of the lower 2023 guidance has also been felt. I believe LendingTree will gradually regain investor interest as a result of the strategies it has put in place to cut expenses and streamline its operations. Aside from that, demand for consumer finance, housing, and insurance is likely to return once the market stabilizes, which I predict will start happening in the second half of 2023.

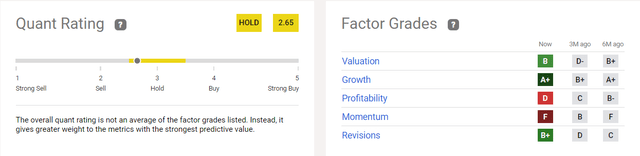

TREE Stock Quant Ratings

Quant Ratings (Seeking Alpha)

LendingTree received a hold rating from Seeking Alpha’s quant system, with a quant score of 2.65, owing to a low score on momentum and profitability. I believe the quant grade on momentum is likely to improve in the coming months as the stock price has absorbed the impact of recent negative events and there is limited downside left. Additionally, the business currently has a D grade for profitability because of losses over the previous few quarters. This factor is expected to improve, as the company has already returned to profitability, with forecasts indicating solid earnings growth in the coming quarters and years. A positive B on revisions also indicates that Wall Street analysts have begun to raise their earnings forecast for the company. With a B grade on valuations, TREE’s stock appears to be a good option for dip buyers. Its stock currently has a PEG ratio of 0.21 and a price-to-sales ratio of 0.25, both of which are lower than the sector averages of 1.01 and 2.16, respectively. The stock also looks significantly undervalued based on its forward P/E ratio of 10 compared to the broader market index of 17.

In Conclusion

For investors with a long investment horizon and the potential to bear volatility in the short term, LendingTree, Inc. seems like a good choice. Following a price drop of around 80% in the previous twelve months, TREE stock appears to have already priced in the impact of negative events. Furthermore, buying LendingTree, Inc. makes sense because future fundamentals are expected to improve in the second half of 2023 due to internal strategies and improvement in broader market conditions.

Read the full article here