Summary

Readers may find my previous coverage via this link. My previous rating was a buy, as I believed Dover Corp. (NYSE:DOV) would continue to see better-than-expected segment profit performance despite the backlog cancellation in DCST that impacted EPS guidance for 2Q23. I am reiterating my buy rating for DOV as I expected major headwinds like destocking to be over by FY24, and the business should start to see normalized growth rates. However, I would be cautious about sizing up any positions today as the near-term risk of missing guidance or consensus estimates is high given the required growth acceleration between 3Q23 and 4Q23.

Financials / Valuation

DOV reported Q2 revenue this week of $2.1 billion, a weak adj. segment EBIT that was primarily due to a disruption in the vehicle services group caused by an ERP system upgrade, and adj. EPS of $2.05. Management anticipates continued mix headwinds in DPPS and modest growth in 3Q23. As a result, this meant that FY23 projections imply a significant increase in the final quarter of the year. As for FY24, managers were optimistic, noting that bookings might turn around for the better in 4Q23. Given I see increased risk of meeting FY23 guidance as a steeper 4Q ramp is required, I am shifting to a more conservative mode for the near-term, but still remain cautiously optimistic as I believe destocking headwinds are matters of the past and management is upbeat on FY24.

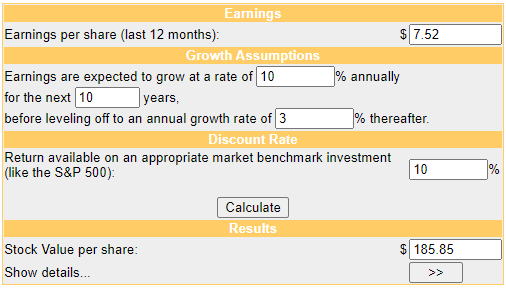

Based on my view of the business, DOV should be able to continue growing EPS at 10%, similar to its historical growth rate, supported by a growing topline and margin expansion. Discounting it back at 10%, which I think is a fair discount rate, I got a target price of $185, which is around 26% upside.

Moneychimp

Comments

Management has stated that the majority of the destocking headwinds are now behind them, leading me to believe that this key headwind is now a thing of the past. Demand from consumers and businesses remained strong through 2Q23, and with inflation down sharply from its peak, a gentle landing for the US economy appears likely to me. Management has also been showing signs of being less pessimistic (during the earnings call) as it prepares for a soft landing. I find it interesting that management is much less pessimistic than they were on the previous quarter’s earnings call. This indicates that management has noticed a trend toward steadier conditions. Management has indicated that, with a more optimistic 2H outlook, inventory levels should continue to fall thanks to normalizing lead times and robust shipments. As a result, I anticipate a decrease in working capital and an increase in free cash flow generation. While it may seem like bookings are down, I think that this is only because of destocking trends and not a fundamental change. However, I anticipate that order decreases associated with clearing the still-high backlog will persist in the near future, until they are completely out of the system.

Management has expressed optimism for FY24, arguing that the DOV secular growth exposures in heat exchangers, CO2 systems, clean energy, and thermal connectors will drive growth. When it comes to heat exchanges in particular, I believe that the fact that they are currently sold out and DOV needs to build out in order to ramp production and meet expected 2024 demand levels is a telling sign of underlying demand strength.

However, management is confident they can do so thanks to their optimistic EP outlook, which accounts for the back-end loaded timing of volume increases in waste handling and aero & defense. The fourth quarter is typically the strongest for CEF as well, and the sector is seeing signs of normalcy as growth drivers like heat exchangers continue to be strong in CST, thereby muting the sector’s typical seasonality. Last but not least, Management is optimistic about Maag’s backlog, which is one reason why orders require less recovery than one might think when looking at the anticipated sales progression.

All in, I remain positive on FY24 but would be cautious on sizing up in the near term given the uncertainty in near-term earnings expectations (3Q23 to 4Q23).

Risk & Conclusion

I think the major short-term risk is if DOV did worse than expected in 3Q23, which implies that 4Q23 needs an even steeper ramp than expected if FY23 guidance holds. The fundamentals might be strong, but investors are likely to take a risk-off approach, causing a sell down in the share price. Overall, I remain bullish about DOV for the long term. For FY24, management expressed optimism, driven by growth exposures in key sectors. However, the risk of missing guidance or consensus estimates in the near term remains high, especially in 4Q23, which could result in a potential sell down in the share price.

Read the full article here