Desktop Metal (NYSE:DM) is a provider of additive manufacturing solutions that is differentiated by its focus on mass production use cases. Desktop Metal is trying to establish its business in a difficult macro environment, and hence its financials currently look poor. The business has potential if the company’s single pass jetting becomes widely adopted in mass production use cases though.

Market

Additive manufacturing is a type of manufacturing where products are made by progressively depositing material in layers. Additive manufacturing enables:

- Design flexibility

- Mass customization

- Greater part complexity

- Low volume parts and faster product cycles

- Assemblies to be consolidated into a single part

- Reduced waste

Additive manufacturing can also support shorter lead times and lower inventory levels.

Because of these properties additive manufacturing has primarily been used for prototyping, but manufacturers are now beginning to fully utilize these advantages to create more complex products and customized products.

Despite its promise, the market has been somewhat held back by size and speed constraints, as well as material properties. Newer additive manufacturing technologies are focused on advancing speed, accuracy, material variety and build volume.

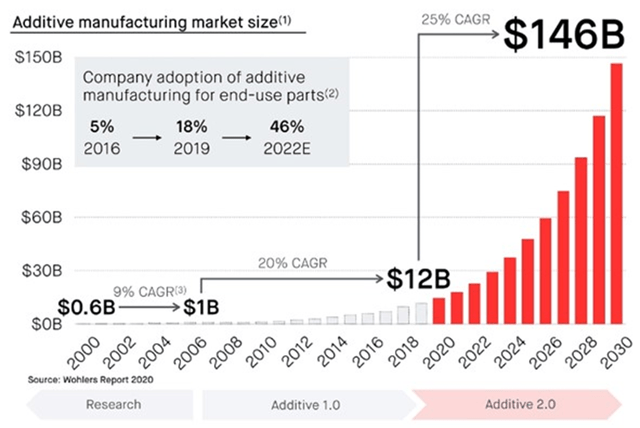

Desktop Metal is a pioneer in the area of printing speed, and hence is focused on mass production applications. The shift from prototyping to mass production of end use parts is expected to drive rapid growth in additive manufacturing. Reshoring of manufacturing and a greater desire for supply chain flexibility could also support growth.

Figure 1: Additive Manufacturing Market Size (source: Desktop Metal)

Desktop Metal believes it has a large market opportunity, but probably still needs to do more to establish the viability of its technology at scale. Its opportunity extends beyond mass production of metal parts though, with Desktop Metal also offering photopolymer solutions.

Dental applications are a particular focus area for Desktop Metal’s DLP technology. Stratasys (SSYS) believes that dental could be a 50 billion USD opportunity for additive manufacturing, with dentures alone providing a 5 billion USD market in the US.

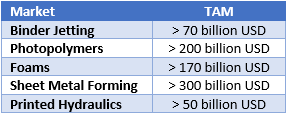

Table 1: Desktop Metal TAM (source: Created by author using data from Desktop Metal)

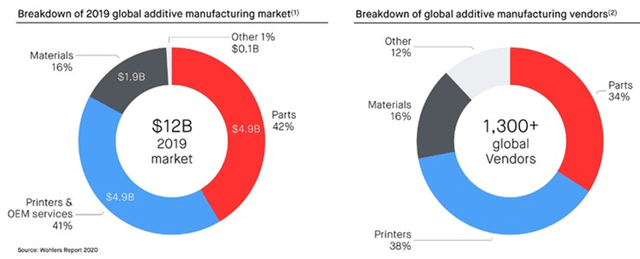

The market is split across printers, services, materials and parts and is currently quite fragmented due in large part to the diversity of technologies. Desktop Metal is primarily exposed to the printer and material segments and hopes to drive consolidation through acquisitions.

Figure 2: Breakdown of Additive Manufacturing Market (source: Desktop Metal)

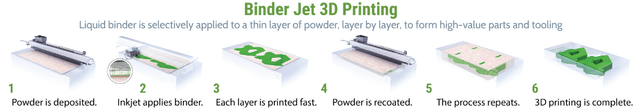

Binder Jet 3D Printing

Binder Jet 3D Printing is a cost-effective and low-energy manufacturing method that supports a wide range of materials. It is generally considered the best suited additive manufacturing method for mass production.

During binder jet printing a liquid binding agent is selectively deposited onto a thin layer of powder particles and the part progressively printed in layers. Parts need to either be cured (if they are plastic) or sintered (if they are metal) at the end of the process to yield a useful part.

Figure 3: Binder Jet 3D Printing (source: ExOne)

While binder jetting offers a number of advantages, it is not a panacea. Metal parts produced using binder jetting generally have inferior mechanical properties to parts produced using SLM.

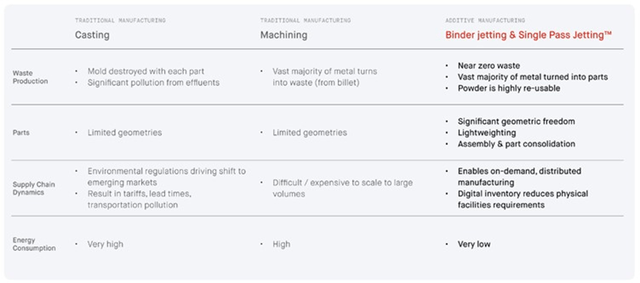

Figure 4: Comparison of Binder Jet Printing with Casting and Machining (source: Desktop Metal)

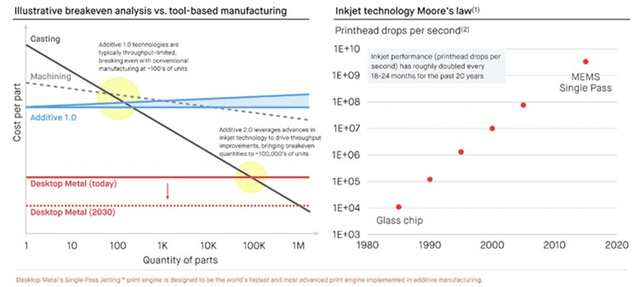

Desktop Metal utilizes a process they refer to as single pass jetting. Normal binder jetting performs the powder deposition, binder deposition and binder drying steps sequentially. This becomes time consuming when a part has many layers.

Single pass jetting performs all binder jetting processes for each layer in a single step. By performing these steps concurrently, each layer is completed in as little as 3 seconds, dramatically accelerating the printing process.

Single-pass jetting is up to 100x faster than laser powder bed fusion and significantly faster than conventional binder jetting. This increases throughput and reduces costs relative to other additive manufacturing methods. The cost can be as low as one twentieth the cost of legacy additive manufacturing technologies.

Figure 5: Illustrative Breakeven Cost Analysis (source: Desktop Metal)

Desktop Metal

Desktop Metal offers a range of additive manufacturing solutions, with the core of its portfolio based around binder jetting and DLP technology. The company’s focus is really on enabling mass production using binder jetting though. In support of this, Desktop Metal has developed advanced sintering and software capabilities, combined with a differentiated materials platform.

Figure 6: Desktop Metal’s Product Portfolio (source: Desktop Metal)

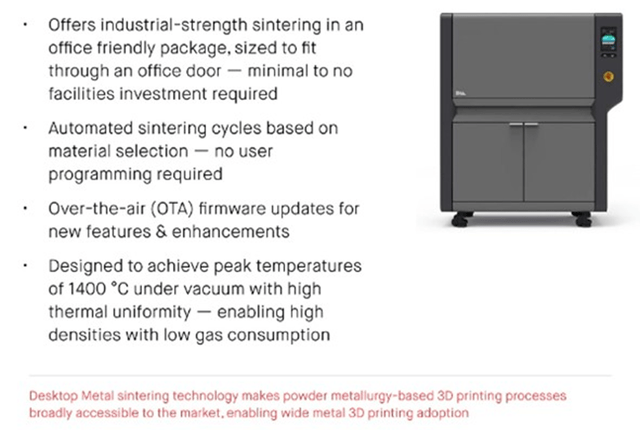

Sintering is an important part of metal additive manufacturing using binder jetting. Desktop Metal offers both hardware and software to easily produce parts with the desired properties. The company has proprietary technology designed to improve part accuracy, reduce costs, and eliminate trial and error for powder metallurgy-based additive manufacturing.

A large part of this is Desktop Metal’s sintering process simulation capabilities. Software dynamically simulates the results of the sintering process by leveraging a GPU-accelerated, multi-physics engine and AI. This software automates the compensation of geometries for distortion and shrinkage during sintering.

Figure 7: Desktop Metal Sintering Technology (source: Desktop Metal)

Desktop Metal has over 250 materials in its library, across metals, polymers, ceramics, biocompatibles, sands, woods, foams and elastomers. Customers are also able to procure materials from third parties.

Desktop Metal continues to develop new materials for its additive manufacturing portfolio. Recent additions include copper C18150 and titanium Ti64 for its production system and 304 stainless steel for the shop system platform.

Ceramics are also a focus area for Desktop Metal in response to customer demand. Ceramics have applications in diverse end-markets like aerospace, automotive, energy and consumer electronics. Binder jetting simplifies production of ceramics, hard metals and carbides that are challenging to fabricate using traditional manufacturing technologies.

Desktop Metal also appears set on bringing powder supply in house. Vertical integration of powder supply could increase customer lifetime value by 2-6x. The low end of this range represents commodity metals (e.g. stainless steel). The high end of this range represents specialty metals and super alloys (e.g. Inconel, copper, titanium).

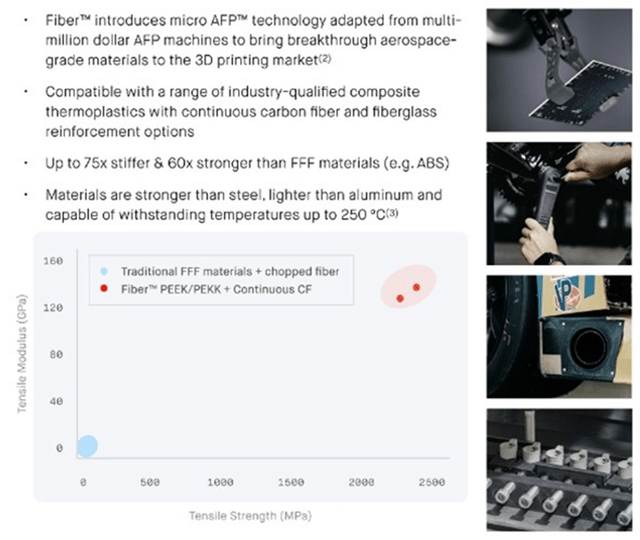

Figure 8: Desktop Metal’s Aerospace-Grade Composite Solutions (source: Desktop Metal)

Desktop Metal recently launched Live Suite, an end-to-end software hub that delivers generative AI solutions. Live Suite is a new package of premium software applications with all new functionality that allows users to seamlessly manage their build preparation, printers, accessories and processes with success in one cloud-based location.

Live Suite includes:

- Live Platform – centralized administration hub for all Live Suite applications

- Live Studio – cloud-based build preparation software

- Live Build – desktop-based build preparation software

- Live Sinter – sintering simulation application

Desktop Metal’s solutions are being adopted across a variety of end markets, including consumer electronics, nuclear, dental and automotive. The company has been making progress in consumer electronics and believes that this could be an important part of the business in the future. A master supply agreement was recently signed with one of the largest consumer electronics companies in the world and this appears to be focused on production applications.

While the company’s focus is on volume production, binder jet systems also provide value in some niche markets like nuclear energy. In the past year, Desktop Metal has sold 5-10 million USD of equipment in this segment. This includes the 3D printing of nuclear fuel, where a ceramic encapsulates micro particles of uranium so that it cannot be reprocessed and weaponized.

Automotive is a key vertical for volume additive manufacturing, with Ford and BMW both having made strategic investments in Desktop Metal. Potential benefits of additive manufacturing in the automotive sector include assembly consolidation, lighter parts, lower costs and advanced materials. Desktop Metal believes it is well positioned to capture an outsized share of this market.

Importantly, there are also signs that Desktop Metal’s printers are being used in higher volume applications. The number of customers using Desktop Metal’s printers in larger numbers is increasing and there is momentum in the repeat customer base. 25% of Desktop Metal’s binder jetting machines are multisystem sites. Similarly, 20% of photopolymer systems are at multisystem sites.

Figure 9: Selection of Desktop Metal’s Customers (source: Desktop Metal)

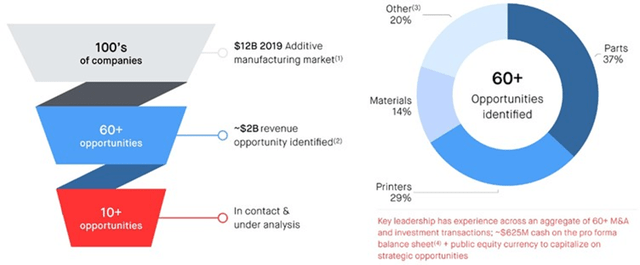

Desktop Metal also hopes to drive growth through M&A and has identified 2 billion USD of inorganic revenue across 60+ potential targets. Consolidation is an important theme within additive manufacturing at the moment as vendors are trying to create scale and reduce competition.

Desktop Metal was active in 2021, acquiring companies like ExOne, Aerosint, AIDRO and EnvisionTEC. The company doesn’t really have the capital to make acquisitions at the moment though, and this, coupled with slow growth and ongoing losses, may have spurred the decision to combine with Stratasys.

Given 3D Systems’ (DDD) attempt to acquire Stratasys, the deal with Desktop Metal is now uncertain. Stratasys had made an all-stock offer which placed little premium on Desktop Metal. As a result, it is not clear that Desktop Metal’s stock will suffer significantly if the deal falls through.

Figure 10: M&A Opportunities (source: Desktop Metal)

Financial Analysis

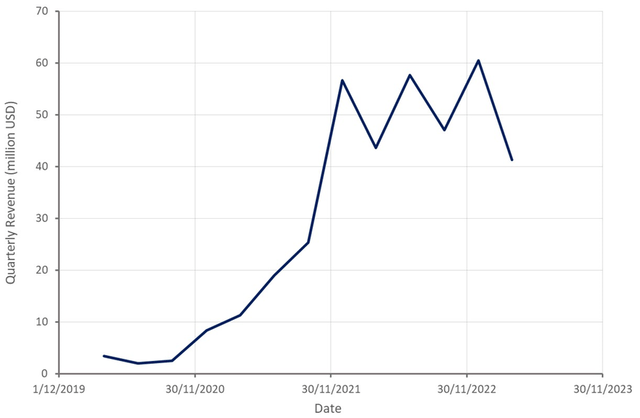

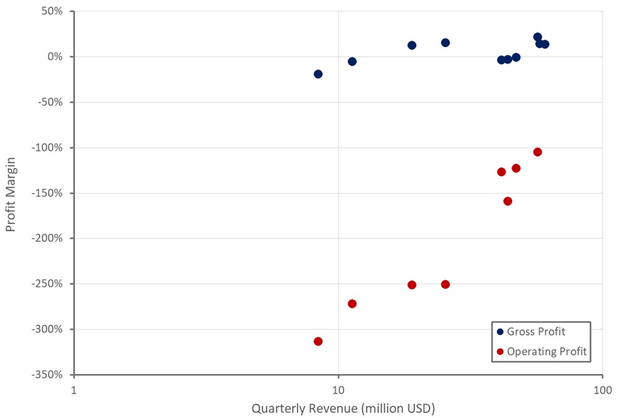

Desktop Metal’s revenue was down by 5.5% YoY in the first quarter of 2023. Desktop Metal indicated that something like 5-8 million USD of business slipped from the first quarter into the second quarter as a result of the macro environment. While the business is currently being negatively impacted by macro headwinds, digital casting solutions, consumables services and subscriptions have been growing. Outside of difficult market conditions, demand reportedly remains healthy, as indicated by metrics like projects and bookings. Desktop Metal is guiding for FY2023 revenue to be 210-260 million USD, which would represent roughly 12% growth YoY.

Figure 11: Desktop Metal Revenue (source: Created by author using data from Desktop Metal)

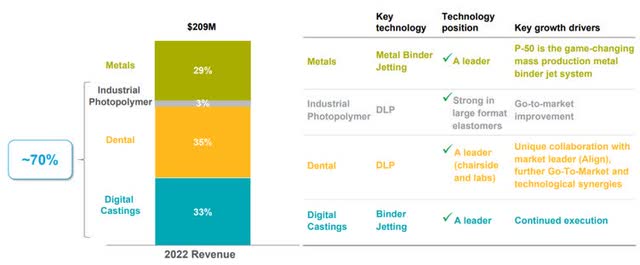

While Desktop Metal heavily promotes the strength of its binder jetting technology, revenue is also heavily dependent on DLP solutions. Dental is an area of strength of Desktop Metal though and this business is expected to increase significantly in coming years.

Figure 12: Desktop Metal Revenue by Segment (source: Stratasys)

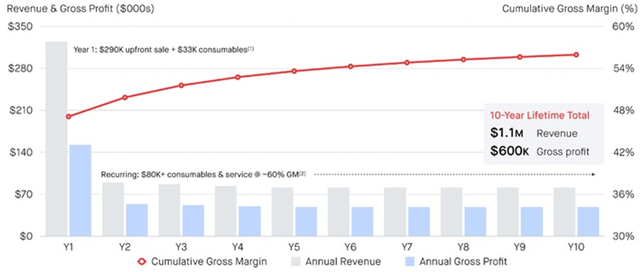

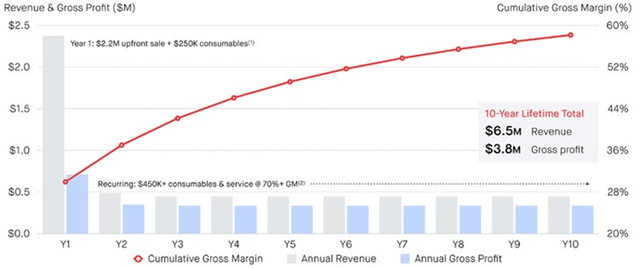

While Desktop Metal’s business is scaling, it is still struggling with relatively poor gross profit margins. Product sales appear to be viewed as something of a loss leader, with downstream revenue expected to lift margins over time. High-margin consumables, services and subscriptions contributed 24% of revenue in 2022.

The margin profile of the business also varies considerably across product types. The Shop System appears to have better margins on the product and lower margins on consumables relative to the Production System. Adoption of Desktop Metal’s products in mass manufacturing may therefore temporarily depress gross profit margins.

Figure 13: Shop System Illustrative Economics (source: Desktop Metal) Figure 14: Production System Illustrative Economics (source: Desktop Metal)

Desktop Metal successfully executed 50 million USD of cost reduction initiatives in 2022. A further round of cost cutting was undertaken in the first quarter of 2023, with an expected impact of 50 million USD annually. This is expected to begin showing up in the financials in the second quarter, with the full impact occurring later in the year. In particular, these measures are expected to reduce fixed costs in the COGS line item, resulting in higher gross profit margins. For example, Desktop Metal is in the process of closing 6 production sites, which should improve facility utilization.

Desktop Metal is now targeting adjusted EBITDA breakeven before the end of the year. The company is also planning on using working capital to temporarily reduce cash burn.

Desktop Metal currently has around 150 million USD of cash, cash equivalents and short-term investments on the balance sheet and operating cash burn was 37.3 million USD in the first quarter of 2023. This is a fairly weak position to be in when macro conditions are soft and financing difficult to come by. Desktop Metal’s management team is confident that they are in solid position based on internal cash use forecasts though.

Figure 15: Desktop Metal Profit Margins (source: Created by author using data from Desktop Metals)

Conclusion

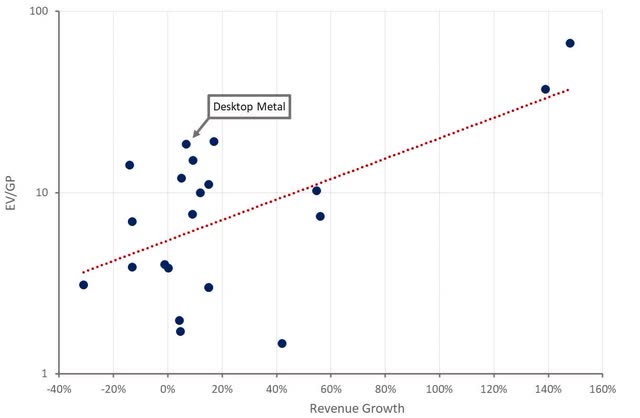

Desktop Metal’s future is currently highly uncertain, due to a combination of:

- Competing additive manufacturing technologies

- Low customer adoption

- Poor margins

- Weak balance sheet

- Unknown outcome of Stratasys takeover

These factors make trying to value Desktop Metal a near impossible task.

At this stage, investors should probably consider the combination with Stratasys a low probability outcome. While Desktop Metal will not need to raise capital in the immediate future, this is a downside risk if an extended manufacturing downturn occurs.

On the other hand, if Desktop Metal can get costs under control and the demand environment improves there is significant upside. Desktop Metal is targeting a double-digit share of the 100 billion USD additive manufacturing market by the end of the decade. If the company can achieve anything like this level of success, it will result in strong returns for shareholders.

Figure 16: Desktop Metal Relative Valuation (source: Created by author using data from Seeking Alpha)

Read the full article here