Bradesco (NYSE:BBD) is one of Brazil’s largest private banks. It has been working on “getting its house in order” after dealing with the toxic loan provisioning related to the Lojas Americanas retail scandal in the not-so-distant past.

In recent years, I believe the bank has followed a misguided lending strategy, leading to an excessive provision to cover the debts of troubled companies. This has continued to put pressure on its financial results and return indicators.

As the earnings season for Brazilian banks commences, Wall Street expects Bradesco to report weaker numbers, particularly compared to its domestic peers Itaú Unibanco (ITUB) and Banco do Brasil (OTCPK:BDORY). The main reasons for this are the high provisions and a likely increase in delinquencies, mainly due to the challenging macroeconomic situation in Brazil.

While Bradesco is not a bad business, its current position relative to its peers indicates that it has fallen behind. Considering this, having a bullish thesis for Bradesco shares is challenging, and a bearish outlook seems more appropriate.

Lagging behind its peers

Over the past few quarters, Bradesco has been underperforming its main peers, Itaú and Banco do Brasil, as it has struggled to grow its loan portfolio substantially, delivered lower returns, and suffered from defaults.

| Loan Portfolio (R$ bi) | Loan Portfolio Growth (YoY) | Gross Margins (R$ bi) | Delinquency Rate | ALL (R$ bi) | Coverage Ratio | ROAE | Basel | |

| Bradesco | 879.3 | 5.40% | 16.7 | 5.10% | -9.5 | 182% | 18.20% | 12.60% |

| Banco do Brasil | 1032 | 16.80% | 21.1 | 2.62% | -5.8 | 202% | 21% | 16.70% |

| Itaú Unibanco | 1153 | 11.70% | 24.69 | 2.90% | -9.1 | 212% | 20.30% | 15% |

The reason behind Bradesco’s underperformance is straightforward: the bank extended more credit than it should have. Two quarters ago, Bradesco reported an unusual provision of R$4.8 billion to cover 100% of the debt from Lojas Americanas stores, a Brazilian retailer involved in a tax scandal.

As a result, the market was spooked by Bradesco’s recent balance sheet releases, especially in the last quarter of the previous year, when the bank’s net profit plummeted by 76%, totaling R$1.6 billion, and its return on equity (ROE) decreased from 17.5% to 4%.

In the most recent quarter, although Bradesco has already set aside 100% of toxic credits from Lojas Americanas, with the potential to reverse if renegotiated, it seems unlikely that the bank will be able to achieve significant profit growth for the rest of the year, unlike its competitor Itaú. Thus, Bradesco’s primary focus will be organizing its affairs for this year.

One positive aspect in the latest quarter was a significant improvement in the treasury result, alleviating concerns about negative treasury performance, rising credit costs, and efficiency. This suggests that Bradesco expects a positive treasury performance from the second quarter of this year.

While Bradesco’s ROE remains below its peers, it showed a positive highlight in the most recent quarter as profits increased by 10% YoY to R$1.77 billion. Despite the challenges, Bradesco has not altered its guidance for this year.

However, I anticipate Bradesco will continue to face pressure from its credit portfolio mix, mainly due to exposure to low-income retail customers and old loans, leading to substantial credit provision expenses throughout 2023. Bradesco’s loan portfolio is expected to grow by an average of 8%, according to the projection of the Brazilian Federation of Banks (FEBRABAN), in line with the guidance provided by the company of between 6.5% and 9%.

Provisioning is still at high levels

One of the major concerns for Bradesco lies in its provisioning for credit losses (ALL), which remains at high levels, still impacted by the ongoing credit cycle at R$9.5 billion, representing a significant 96% YoY increase. However, it is worth noting that this figure is lower by 36% compared to the end of 2022, with the Lojas Americanas case having a considerable impact on this increase.

The mass segments, comprising retail customers and small businesses, appear to be more sensitive to the challenging economic scenario, and this sensitivity is reflected in the pressure on the provision.

Another aspect that demands attention is the delinquency rate exceeding 90 days, which stands at 5.1%. It increased by 0.8 p.p QoQ and 1.9 p.p YoY, largely influenced by the mass segment. Furthermore, the portfolio contraction experienced during the quarter also contributed to the rise in delinquencies.

Additionally, in the most recent quarter, Bradesco significantly increased its write-offs, totaling R$7.36 billion, a substantial increase compared to the R$4.9 billion reported in 4Q22. It’s noteworthy that Bradesco did not sell any portfolio during this quarter, leading to rapid consumption of its coverage ratio for accounts over 90 days. Consequently, the coverage ratio declined significantly by -22 p.p QoQ and -53 p.p YoY, reaching 182%.

These factors collectively pose challenges for Bradesco as it grapples with credit and asset quality concerns in the face of ongoing economic uncertainty.

The loan portfolio is more cautious

Bradesco’s loan portfolio totaled $642.3 billion, resulting in a 2% decrease compared to Q4 2022 and a 3.8% increase compared to Q1 2022, with the year-on-year evolution being due to products with guarantees that maintained their growth.

In QoQ, the reduction in the first quarter occurred due to the repositioning of the credit policy, opting for lower risk categories due to the moment of the credit cycle. The biggest detractor of the portfolio was the large companies segment that went from R$ 137.8 billion in Q4 2022 to R$ 122.7 billion in Q1 2023, probably with more cautious policies after the events of judicial recoveries started by the Lojas Americanas case.

Interestingly, its other peer Santander Brasil (BSBR), adopted the opposite strategy in the first quarter of this year, growing its corporate portfolio by 7% QoQ and 19% YoY, while Bradesco contracted this portfolio by -11% QoQ and -11% YoY.

Valuation

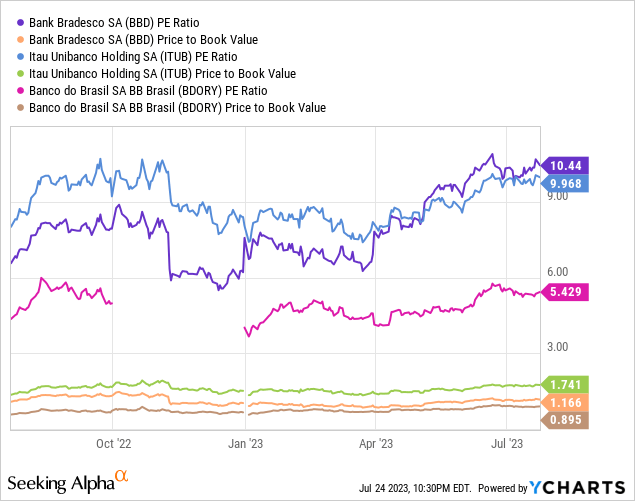

Although Bradesco has shown an improvement in profitability and has a forward price-to-earnings (P/E) multiples of 10.8x for this year and 10.1x for 2024, making it the most expensive among its main peers, such as Itaú and Banco do Brasil (the latter due to being a state-owned bank).

While Bradesco appears more discounted than Itau when considering its book value, it is deemed attractive with a 2023 price-to-book value (P/B) of 1.17.

However, despite being valued as an opportunity due to the discounted book value, resembling a value play, the high P/E ratio raises concerns about the potential disappointment in the stock’s performance, as it suggests that there are high expectations for earnings growth that might not materialize.

In my opinion, Bradesco’s valuation does not seem attractive to me, considering that the bank’s credit cycle performance is clearly lagging well behind that of Itau and Banco do Brasil, both of which are other alternative banks capable of delivering an ROE above 20% and are also trading at a more attractive valuation.

How the second quarter should look

As the Brazilian banking sector’s second-quarter earnings season approaches, Bradesco is expected to report mixed results amid a less-than-ideal macroeconomic scenario. Analysts anticipate that Bradesco’s EPS will be 0.09, implying a 28% YoY decline. The bank will likely face a challenging quarter, still affected by higher provisions and lower profit margins.

In contrast, Banco do Brasil and Itaú are expected to maintain their recent positive trajectory of loan portfolio growth, despite facing tough comparisons. They may also experience only a marginal increase in delinquencies.

Delinquency figures are expected to impact Bradesco’s second-quarter results significantly. An increase to 6% would not be surprising, considering the troubled delinquency scenario in Brazil. Disturbing data reveals that 80% of Brazilian households are in debt, with 30% defaulting. Furthermore, household debts account for about 33% of the national GDP.

If defaults reach 6%, Bradesco’s coverage ratio is likely to close to 180%, leading the bank to report another quarter of declining recurring results.

The bottom line

Bradesco, a major Brazilian bank, has historically been seen as positioned between growth and value strategies. However, in recent quarters, the bank has underperformed compared to its peers, Itaú and Banco do Brasil, due to an inferior loan portfolio strategy.

I am maintaining a bearish stance on Bradesco for the second half of the year. Despite already dealing with significant impacts related to the issue with the retailer Lojas Americanas, the bank is expected to face ongoing challenges from the unfavorable macroeconomic scenario. This is likely to lead to lower efficiency and higher defaults compared to its main peers, making its valuation less attractive when considering other superior options in the market.

Bradesco’s shares have appreciated about 35% over the year due to its recovery, while Itaú, with more consistent earnings results and loan portfolio growth, has seen a 38% increase and is still trading at a more discounted P/E multiple compared to Bradesco.

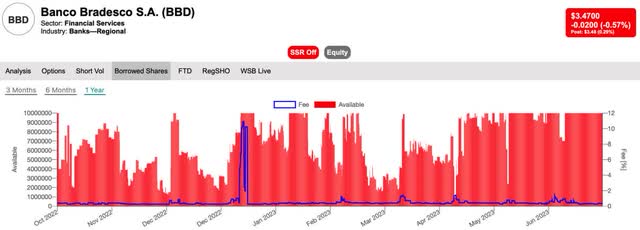

Unlike Banco do Brasil, which has experienced borrowing costs exceeding 100% in recent months, likely due to political risk, Bradesco’s cost-to-borrow has remained inexpensive, making it a less risky option for betting against the stock. In recent months, Bradesco’s borrowing rates have ranged from 1% to 0.3%. However, in the last quarter of 2022, rates jumped to 10% due to the provisioning of Lojas Americanas.

Stocksera, data from Interactive Brokers

Considering these factors, I believe that Bradesco presents a favorable choice for hedging in long-short positions, especially when compared to Itaú and Banco do Brasil. I would consider taking a short position on Bradesco with a price target of $3 per share, implying a 14% downside from current levels. This would put Bradesco’s minimum forward P/E multiple below 10 times.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here