Thesis

Armstrong World Industries, Inc. (NYSE:AWI) reported Q2 2023 Non-GAAP EPS of $1.38 beating by $0.07, and revenue of $325.4M that missed by $10.18M. In this analysis, I argue that despite challenges such as lower volumes and increased input costs, the company has shown remarkable strength, achieving increases in Average Unit Volume, EBITDA margins, and adjusted free cash flow which all signal potential value for investors and underscores a promising outlook for investors.

Company Profile

Armstrong World Industries, Inc., established in 1860, specializes in the creation, production, and marketing of ceiling and wall solutions. Its operational reach extends to various parts of the U.S., Canada, and Latin America, offering an extensive variety of products such as hanging mineral fiber, plush fiber, fiberglass wool, and metallic ceiling systems, alongside wood, wood fiber, glass-fortified-gypsum, and felt ceiling and wall commodities. Armstrong caters to both the commercial and residential construction sectors, and actively participates in the refurbishment of pre-existing structures. Their merchandise is distributed to a varied clientele consisting of resale distributors, ceiling system contractors, wholesalers, and retail outlets, inclusive of major home improvement centers.

Armstrong World Industries Q2 2023 Earnings Highlights

In the second quarter, Armstrong World Industries exhibited a solid performance that can be traced back largely to their Mineral Fiber and Architectural Specialties (AS) divisions.

On the Mineral Fiber front, despite a dip in volumes, there was a promising 7% rise in Average Unit Volume (AUV). There was also an encouraging expansion in the division’s adjusted EBITDA – a climb of $6 million (or 7%), with the margin widening by 260 basis points relative to the same period last year.

However, not everything went Armstrong’s way. The company grappled with lower volumes and a surge in input costs. While the quarter’s energy and freight costs fell compared to the prior year, the cost of raw materials continues its inflationary trend. Selling, General & Administrative (SG&A) expenses remained relatively stable, with the hikes in digital initiative support being counterbalanced by savings from cost-cutting measures.

Turning to the Architectural Specialties (AS) segment, most product categories saw sales growth, underpinned by strong bidding activity, particularly in metal products. Here, both order intake and backlog figures shot up by over 20% compared to the previous year. This upswing lends support to Armstrong’s $14 million acquisition of BOK Modern. The AS division also saw EBITDA margin improve in Q2, year-on-year and sequentially, a growth of 360 basis points, driven by operating leverage on rising sales.

All told, Armstrong’s second-quarter consolidated metrics show a positive trend, with AUV, WAVE joint venture equity earnings and reduced manufacturing costs all improving. These factors more than compensated for the drop in volumes, the rise in input costs, and an increase in SG&A expenses. Adjusted EBITDA margin increased by 260 basis points while adjusted free cash flow soared 64% year-on-year.

The first half of the year witnessed a 10% increase in adjusted EBITDA and margin expansion of 130 basis points, as adjusted diluted net earnings per share rose 9% year-on-year and adjusted free cash flow increased approximately $40 million (or 60%) relative to last year.

Armstrong purchased $30 million worth of shares back during Q2, bringing their total repurchase since starting their program in 2016 to roughly $908 million. Armstrong added an additional $500 million repurchase program extending through 2026 as they appear confident in their ability to generate adjusted free cash flow and strive to enhance shareholder returns.

To conclude, Armstrong has updated its full-year 2023 guidance for sales, adjusted EBITDA, and adjusted diluted EPS, in light of improved visibility for the remainder of the year and the removal of the most pessimistic market downturn scenario. The company also boosted the midpoint of their adjusted free cash flow guidance, now set at between $240 million and $250 million, implying a midpoint free cash flow margin of around 19%

Performance

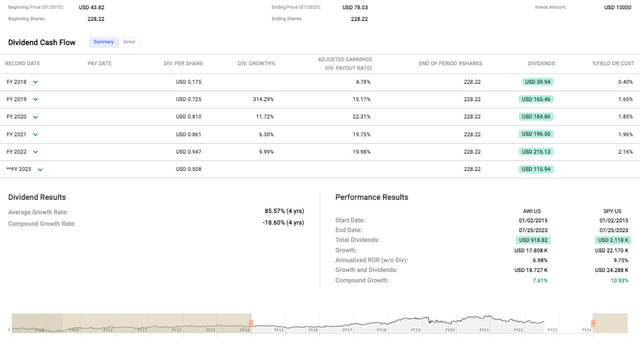

Armstrong’s Compound Growth Rate over the past four years is -18.60%. Negative compound growth is generally a concern, but in this case, it is likely due to the drastic drop in dividends for FY 2023, pulling the average down significantly. If we look past this anomaly, AWI’s track record shows an overall upward trajectory.

Fast Graphs

Comparing AWI’s performance to the S&P Index, we see that AWI lagged behind in terms of Annualized ROR and Compound Growth. And in terms of investment results based on a hypothetical USD 10k initial investment for this medium-term time period, the return for AWI was USD 18.727 K, including dividends, compared to the S&P’s USD 24.288 K, signifying a lesser performance. However, this does not necessarily mean AWI was a bad investment. The company has shown consistent dividend growth (excluding 2023) and a healthy appreciation in share price.

Valuation

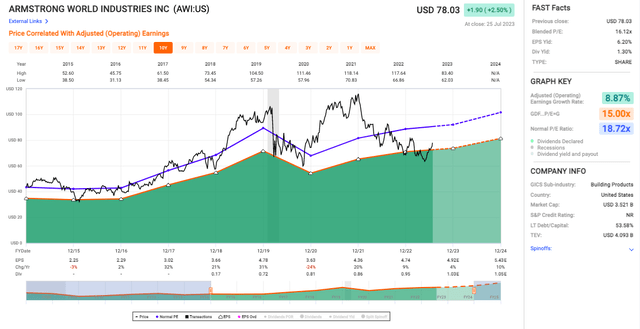

AWI’s blended Price-to-Earnings (P/E) ratio is 16.12x, which is below its normal P/E ratio of 18.72x indicating that AWI is currently undervalued compared to its historical pricing patterns (see chart below). That said, AWI’s Adjusted (Operating) Earnings Growth Rate stands at 8.87%, which is respectable. The solid earnings growth signifies a healthy profitability trend, and it could support a bullish case for the stock if the trend continues.

Fast Graphs

Risks & Headwinds

Starting with the drop in volume, the principal culprits here are a softening in market demand and ill-timed price increases. CEO Vic Grizzled noted:

Overall, we believe that sequentially underlying market demand was modestly soft than the — softer than the first quarter. Relevant indicators for our primary sectors were mixed overall in the quarter. Dodge bidding activity softened, ABI declined but remained in positive territory, office vacancies continue to rise but at a slower pace and commercial leasing activity improved in the quarter for the first time in four quarters

The demand-side issues could raise some eyebrows with investors and trigger questions about whether this is a temporary blip or a signal of a longer-term trend. If the latter is true, we might be staring at a more pervasive issue that could gradually erode future sales and, in turn, depress profits.

Management also highlighted the inflationary pressures that formed another significant part of the Q2 narrative. The persistent inflationary environment in raw materials could eat into the company’s margins, and while the company has demonstrated resilience so far, the mounting pressures could potentially have an impact on profitability if it intensifies.

Input costs, too, have been on an upward trajectory, and the concern is justified. Even though the improved Average Unit Volume (AUV) and lowered manufacturing costs have offset this rise, a continued increase in input costs could become a headwind.

Finally, the company’s full-year guidance hinges on a variety of factors, including the rollover of a period of lower SG&A from the previous year and continued investments in digital initiatives and any deviation from these assumptions can have a negative impact on the company’s ability to meet its guidance.

Final Takeaway

Based on Armstrong World Industries’ Q2 2023 earnings performance, consistent dividend growth, solid average unit volume and EBITDA margin expansion, I would rate the stock a “buy.” Despite facing challenges such as lower volumes and rising input costs, the company demonstrated strength with its strategic acquisitions, reinvestment for high returns, and dedication to returning surplus cash to shareholders. And overall, another major factor supporting the “buy” thesis was Armstrong’s updated full-year 2023 guidance that reflected optimism even as the company acknowledged potential market headwinds.

Read the full article here