Novo Nordisk (NVO), a world leader in diabetes and obesity care, has over the past five years been remarkably successful from a commercial standpoint. The Danish company’s revenues reached $25.47 billion in 2022 compared with $17.15 billion in 2018. This fast pace of growth is commendable given the sheer scale of the company’s operations, which includes more than 50,000 employees in 80 countries and a reach of approximately 170 countries for its marketed products.

Thanks to its high margins and strategic capital allocation by the management team, NVO has been able to translate its explosive topline growth in the past five years into record profits and enhanced shareholder value. NVO enjoys industry-leading margins, with a 5 year average gross profit of 83.78%, EBITDA margin of 46.11% and net income margin of 33.1%. These high margins have allowed it to grow earnings per share at a healthy clip and given the management the flexibility to aggressively grow dividend payouts and step up share repurchases. NVO’s Annual Report 2022 shows that total dividend payouts –denominated in Danish Krone (DKK)– reached DKK 27.95 billion in 2022 vs DKK 19.54 billion in 2018, while share repurchases reached DKK24.08 billion in 2022 vs DKK 15.56 billion in 2018. For further context, the company’s net profit was DKK 55.52 billion against revenues of DKK 176.95 billion in 2022. In 2018, net profit was DKK 38.62 against revenues of DKK 111.83 billion.

The combination of hefty dividends, consistent buybacks and strong commercial execution has worked wonders for NVO’s share price, with the stock’s 157% return in the past 3 years being almost triple the S&P 500’s 48% return over this same period. However, at the current share price, investors should be concerned about the valuation, which has increased dramatically to unprecedented levels.

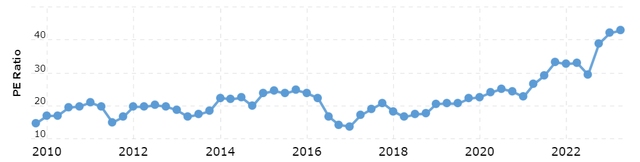

NVO P/E at unprecedented highs (macrotrends)

NVO’s trailing P/E of 41.9x and forward P/E of 32.13x are both higher than the 5 year average P/E of 28.5x and sector median of 20x. In my estimation, NVO would be trading at a fair valuation at a P/E of around 30x. This is on the higher end of the historical P/E range presented in the chart as it reflects the improved earnings prospects that come with obesity care. Given consensus estimate for annual EPS of 5.19 in 2023, the fair value would work to around $155.7 per share, suggesting slight overvaluation at the current stock price of $162 (as of writing).

Making sense of the steep valuation

The downside risks that come with establishing a position in a stock when valuations are stretched are significant. An earnings miss, lower guidance or any other negative news that dampens the prospect of continued profitable growth can lead to panic selling by investors. On the other hand, if valuations are stretched but the share price meets no resistance on its way up (as has been the case with NVO lately), it could be an indicator that investors are pricing in future growth opportunities that are yet to be fully understood by the market. In the case of NVO, the latter scenario is more plausible.

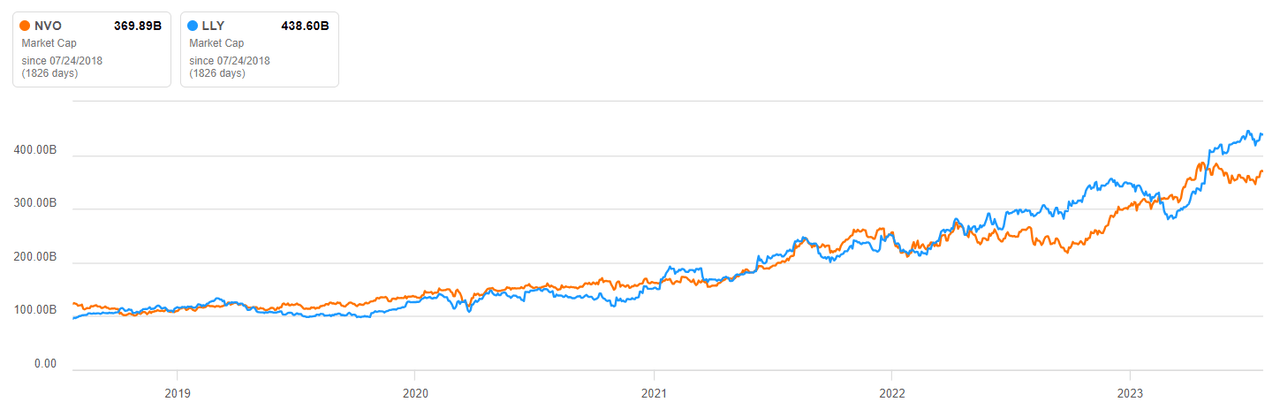

The reason why NVO’s valuation has reached such levels is likely linked to the emerging opportunities in obesity care It is telling that Eli Lilly and Company (LLY), which together with NVO form a formidable duopoly in diabetes and obesity care, also has a high valuation – a scary P/E of 66.58x and EV/EBITDA of 49.52x. Both NVO and LLY have seen their market caps increase in tandem in the past five years, indicating that investors see a huge opportunity in the underlying industries that both companies operate in.

LLY’s and NVO’s market cap growing in tandem (Seeking Alpha)

The big opportunity that NVO and LLY represent for investors is a chance to profit from emerging weight loss therapies that are already wildly successful going by patient demand and recent regulatory action by the FDA. Obesity is a problem of growing proportions not only in the US, where more than 40% of adults and about 20% of children are obese, but also globally. The worldwide prevalence of obesity nearly tripled between 1975 and 2016, according to the World Health Organization. Due to the close relationship between diabetes and obesity, NVO and LLY have in recent years been able to leverage on their existing diabetes therapies to develop medication for obesity. This effectively represents an opportunity to move into a large and growing adjacent market without much investment in terms of product innovation, marketing, and distribution. Low production costs, high margins, and high sales volume are a powerful combination when it comes to driving business growth and creating value for shareholders.

NVO’s flagship Type 2 diabetes drug, Ozempic, has skyrocketed in use since 2018 due to its reported benefits in weight loss. NVO capitalized on this opportunity to develop Wegovy, a higher dose version of the same medication. Wegovy was approved for weight loss in adults in 2021 and for weight loss in children aged 12 and older in 2022.

When it comes to competition for Wegovy, LLY is in the process of rolling out tirzepatide as a weight loss drug. This new drug is already approved under the brand name Mounjaro to treat Type 2 diabetes. LLY is essentially following the same playbook as NVO (which rebranded Ozempic to Wegovy for weight loss) to capture the opportunity in weight loss therapies.

What has investors excited, particularly when looking at NVO, is the speed at which the company has been able to tap into the weight loss opportunity and the fact that it has a unique selling point of a once-weekly dosage with Wegovy. NVO launched Ozempic in 2018 in the US and Canada. Its key selling point was that it was a once-weekly GLP-1 product (a drug that induces the pancreas to produce more insulin). Most type 2 diabetes therapies require more frequent dosage. Since then, Ozempic has become a market leading product and NVO’s best performing product by sales, with global sales of DKK 59.8 billion in 2022 (around 33% of total sales). With Wegovy, NVO is pushing the same unique selling point as Ozempic – once-weekly dosage. The fact that the drug is also available to adolescents is bullish since their demographic profile means that they are likely to remain customers over longer periods of time.

In my opinion, NVO is an expensive stock because of the immense opportunity in weight loss. This opportunity is largely untapped considering that Wegovy is less than 5 years in the market. Obesity care is a highly promising space, given the growing prevalence of obesity as a health problem, the chronic nature of the health problem (patients can regain weight after losing it and constantly need to maintain their ideal weight range), and the psychological factors that may push patients to seek treatment not only for medical reasons but for aesthetic reasons as well. The fact that Wegovy is also a once-weekly therapy and that there is limited business investment in terms of new product development or innovation (it’s essentially Ozempic in a higher dose) means that this will likely be highly profitable product. Given NVO’s track record of buybacks and dividends and the prospects of enhanced profitability through Wegovy, it’s not surprising that investors are willing to pay premium prices to own the stock.

Weight loss drugs gaining mainstream acceptance

Given the current high valuations, investors bullish on NVO will want to be strategic about when and how they buy. While it’s difficult to time the market, investors can take advantage of short-term share price declines to build a position. One of the likely catalysts for a downward move in NVO will be when (and if) LLY gets approval to market tirzepatide, which is poised to become the most potent obesity drug on the market. In April, LLY posted its second late-stage trial win for tirzepatide, with patients on the drug losing an average of 15.7% of their body weight. An FDA approval for use of the drug to treat obesity is expected imminently, possibly before the end of the year. When this happens, analysts from Global Data expect LLY to surpass NVO in the obesity care space thanks to its drug’s potency.

Whether or not LLY surpasses NVO in the obesity market is not material in the short-term. For investors, the focus should be on the fact that weight loss drugs are gaining mainstream acceptance as a category. In the past, most weight loss drugs and therapies were viewed with suspicion but NVO and LLY are changing this. I believe the pie is big enough for both companies, so any competition from LLY’s tirzepatide that leads to a sell-off in NVO should be viewed as a buying opportunity instead of a reason to abandon ship. Because of its focus on obesity care, NVO will in my opinion continue delivering strong returns. The current high valuation simply reflects these prospects, which are immense when you consider how complex and persistent of a problem obesity and being overweight is shaping up to be in the US and elsewhere around the world. According to WHO global estimates, 39% of adults aged 18 years and over were overweight in 2016, and 13% were obese.

Risks to the bull case

One of the main risks facing NVO is the persistent shortages of Wegovy and Ozempic (though not indicated for weight loss, it has been prescribed off-label for that reason). As of July 20, the FDA says that three of five dosage strengths of NVO’s weight loss treatment Wegovy have limited availability through September. NVO’s management noted in the Q1 earnings call that the shortage “is driven by higher-than-expected volume growth for GLP-1-based products, such as Ozempic and Wegovy and temporary capacity limitations at some manufacturing sites.”

While these shortages are also affecting LLY’s Mounjaro (tirzepatide) — which is also prescribed off-label for weight loss — there is a risk that the prevailing shortages could lead to loss of market share for NVO if LLY is able to resolve its supply issues faster and capitalize on the huge demand in the market. Its therefore critically important that investors monitor this situation closely to ensure that it doesn’t end up putting NVO at a competitive disadvantage to LLY.

The other risk worth mentioning is the possibility of regulatory action to control the price of obesity drugs. We have already seen this kind of action with diabetes drugs, including insulin. As obesity gains more recognition as a public health crisis, pressure from the government to make drugs more affordable for lower income groups could lead to margin pressure for NVO and its competitors. Lower margins could lead to slower growth in earnings and thus impact the share price.

Read the full article here