Investment Thesis

Microsoft’s (NASDAQ:MSFT) share price is down slightly premarket. However, I don’t believe its share price will remain down for long.

After all, throughout the call, we heard that demand for generative AI solutions remains strong, and the company is focused on executing against this demand to drive revenue growth.

What happened after the earnings print is that investors were not amazed with new information. And indeed this reaction makes sense. After all, Microsoft had already been on a tear headed into this earnings result, so a lot of the news was already priced in.

In sum, this continues to be a rewarding long-term investment.

Microsoft’s Near-Term Prospects

Earlier in June the world discovered just how big Azure is relative to AWS (AMZN). Half the size. With the proverbial pandora box now open, Microsoft had little choice but to open up its earnings call with this factoid once again.

Azure generated about $55 billion of annualized revenues in fiscal Q4 2023. But while Microsoft spent a lot of time on its earnings call discussing its AI prospects, Microsoft didn’t wish to over-stress the AI side of its operations to the detriment of everything else the IT conglomerate offers.

That being said, as you can imagine, the analysts’ Q&A section of the call was dominated by questions seeking to figure out how much capex AI will require to figure out how to best model Microsoft’s next couple of quarters’ outlook.

One interesting insight that percolated from the call included this,

We continue to build momentum in Microsoft Teams across collaboration, chat, meetings and calling.

[…] Teams Phone is the market leader in cloud calling with more than 17 million PSTN users, up 45% year-over-year. Teams Room is used by more than 70% of the Fortune 500, including L’Oreal, United Airlines and U.S. Bank, and revenue more than doubled year-over-year this quarter. (emphasis added)

This shows that we are way past the pandemic and still the use of Teams Phone is still clearly rising. This is quite astounding. Particularly when we compare that insight with Zoom’s (ZM) recent prospect.

Reiterating that Microsoft is still the preferred platform for IT infrastructure. Particularly at the current moment, when firms are aggressively moving towards platform consolidation and reducing unnecessary IT expenses.

Let’s move press ahead and discuss Microsoft’s outlook.

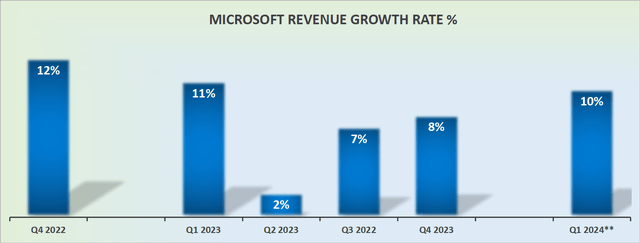

Revenue Growth Rates At Double Digits

MSFT revenue growth rates

Microsoft’s fiscal Q1 2024 guidance points towards about 10% topline growth. Needless to say that Intelligent Cloud segment remains the crown jewel at present, and is expected to increase by approximately 15% y/y. While More Personal Computing could end up being down 1% y/y.

Meanwhile, Productivity and Business Processes are expected to deliver about 11% y/y revenue growth rates.

And even though Microsoft’s revenue growth rates find themselves in a digestion period, I suspect in the coming few days we’ll be seeing analysts busily upwards revising their outlook as they gush over CFO Amy Wood’s comments below,

And we do expect, as you asked and Satya talked about, the pace of this [AI] adoption curve, we do expect to be faster [than the cloud’s]. So you’re seeing the CapEx spend accelerate in Q4 and then again in Q1 […]

So I think the real focus here is being able to be aggressive in meeting the demand curve and focusing on the transition and growth in gross margins and delivering the operating leverage.

MSFT Stock Valuation — Not Cheap

Microsoft is priced at approximately 28x forward EPS. For a business that is growing its EPS line at about 12% to 14% CAGR, this is not a cheap valuation, as you know.

That being said, the bull case for MSFT has never been about its valuation, but rather a place where capital can hide out while knowing that no negative surprises are likely to emerge.

It’s a bit like an ”insurance trade”, knowing that Microsoft is a toll bridge on the IT world.

The Bottom Line

In my opinion, Microsoft’s share price may have dipped slightly premarket, but I believe it won’t remain down for long.

The demand for generative AI solutions is strong, and the company is focused on capitalizing on this demand to drive revenue growth.

While investors may not have been overly amazed by new information during the earnings call, it’s important to consider that Microsoft was already performing well before the results were released, so much of the news was already priced in.

Looking ahead, Microsoft’s outlook remains promising, with revenue growth rates expected to be at double digits, particularly driven by its Intelligent Cloud segment.

While the stock may not be cheaply valued, it has been considered a safe haven for capital, as Microsoft is a leading player in the IT world. Overall, I see Microsoft as a rewarding long-term investment with bright prospects.

Read the full article here