The Fed hikes by 25bp then will watch and wait

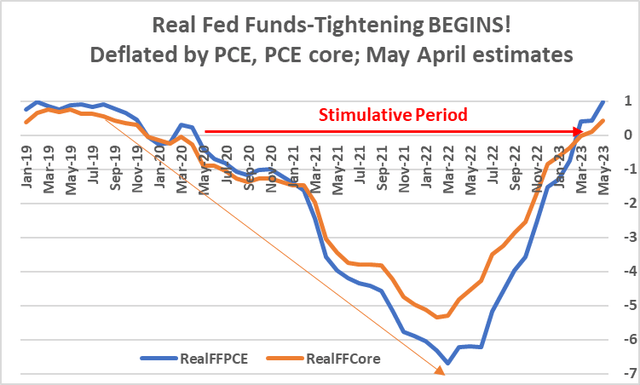

PCE-deflated real Fed funds rates (Haver Analytics & FAO Economics)

PCE View: Policy tightening just begins

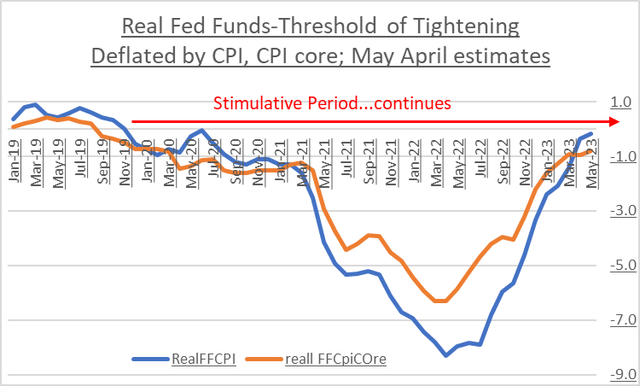

Real Fed funds rate deflated by CPI (Haver Analytics & FAO Economics)

CPI View: Policy tightening has not yet begun

Fed chair spooks markets in the Q&A session by saying he does not think that inflation will not come down all that quickly…anymore.

This meeting…

“The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 5 to 5-1/4 percent. The Committee will closely monitor incoming information and assess the implications for monetary policy. In determining the extent to which additional policy firming may be appropriate to return inflation to 2 percent over time…”

Previous meeting…

“The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 4-3/4 to 5 percent. The Committee will closely monitor incoming information and assess the implications for monetary policy. The Committee anticipates that some additional policy firming may be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time. In determining the extent of future increases in the target range…”

What policy is and what it does…

The Fed is no longer planning (anticipating) it will have to hike rates. Instead, the Fed is going to watch the economy, the data, and inflation, and DECIDE the best course of action. The Fed is not on a ‘determined pause’ but it is ‘on hold’ as it assesses policy to decide the right policy course. Policy is flexible not fixed.

The charts above are meant to convey as succinctly as possible that the Fed policy has been stimulative until very recently and in the view of the CPI policy is STILL stimulative. These charts explain why the economy is doing so well. It’s because policy has been stimulative, and this is either just changing or about to change.

What does policy plan or want ahead?

A number of onlookers are saying the Fed will cut rates before year end. Of course, no Fed officials – NONE OF THEM- have been forecasting any rate cuts in 2023.

Why this disconnect? We get some insight today as Chair Powell says it does not look like inflation will be falling very quickly anymore. If the Fed is serious about hitting its 2% target, it will need to keep rates at current levels for some time to let interest rates grind inflation lower. Look at the charts…as things stand real rates (PCE) are just barely positive or not even positive (CPI). So cutting rates at the first sign of weakness does not seem like a good way to make sure inflation will fall to 2%. The banking ‘crisis’ likely will keep the Fed from hiking rates much or even any further. But the inability to hike rates more will place more emphasis on keeping rates at current levels longer to subdue inflation.

Those looking for rate cuts do not see this and not think this way. Market onlookers seem to think that the emergence of economic weakness or recession will lead to quick Fed reaction and instant rate cuts. But I think the Fed is focused on reducing inflation not on maintaining growth. The Fed spent its pre-tightening effort on getting the unemployment rate low. Now if that rate begins to rise, I think the Fed is going to show more tolerance for that unless there is a quick impact from rising unemployment on reducing inflation- something Powell said he did not expect. To handicap the Fed properly you need to know the Fed’s true policy objective. Let me add one more reason for this… it’s that when covid struck and the unemployment rate ballooned that rate subsequently fell rapidly. Also, because the unemployment rate has stayed so low in the face of Fed rate hikes, I think the Fed is prepared to let the job market show its resilience. It will expect jobs to rebound smartly if the unemployment rate is temporarily driven higher… shall I say that an unemployment rise would be viewed as …transitory?

The Fed keeps saying… “The Committee is strongly committed to returning inflation to its 2 percent objective.” Of course, the Fed does not give us a timeline on this. Powell does confuse the issue by going out of this way to say the Board forecast (for a mild recession) is not his best-case scenario. Powell is trying to keep the door open for controlling inflation without a recession and this is confusing to markets- as it must be. This attitude gives us no idea if Powell is willing to pay the prices to reduce inflation or not. Is he only willing to pay the price to reduce inflation if it is a low enough price? This remains a part of Powell’s communication that is confusing. He will not tell you where he stands.

Markets…

Markets do not always get what they want. In this cycle markets have been quite unrealistic in what they have expected in the way of policy from the Fed. Markets seem to think (as the Fed once did) that inflation is going to 2% on its own, and that interest rates need to fall commensurately. Markets have been looking for the Fed to pivot to a rate cut almost from the very start of rate hiking! That no longer looks like reality. It has taken the Fed a while to wise up and to realize it needed to make significant policy moves to control inflation. The market, on the other hand, seems to be still have the bit in its teeth on this issue.

Read the full article here