A Quick Take On Globant

Globant S.A. (NYSE:GLOB) provides a range of consulting and digital transformation services to companies worldwide.

2023 top line revenue is expected to grow at a much slower rate than 2022’s growth rate.

Until we gain more visibility into client spending patterns amid a broader soft business environment, I’m Neutral [Hold] on GLOB.

Globant Overview

Luxembourg-based Globant was founded in 2003 to provide consulting, digital transformation and related software and services to companies in Europe and internationally.

The firm is headed by co-founder and Chief Executive Officer Martin Migoya, who is also a Director at Endeavor Argentina and co-founder of Vivid Growth.

The company’s primary offerings include a wide range of digital services for companies in various major industry verticals and at different stages of their digital transformation process.

Globant acquires customers through its direct sales and marketing efforts, its various Studios that specialize in particular service areas, and through partner referrals.

Globant’s Market & Competition

According to a 2021 market research report by 360 Market Updates, the global market for digital transformation strategy consulting was an estimated $58.2 billion in 2019 and is forecast to reach $143 billion by 2025.

This represents a forecast CAGR of 16.2% from 2020 to 2025.

The main drivers for this expected growth are a large transition from on-premises, legacy systems to cloud-based environments with complex architectures.

Also, the COVID-19 pandemic has likely pulled forward significant demand to modernize enterprise systems resulting in increased growth prospects for digital transformation consultancies.

Major competitive or other industry participants include:

-

EPAM

-

Slalom

-

Accenture

-

Deloitte Digital

-

McKinsey

-

BCG

-

Ideo

-

Cognizant Technology Solutions

-

Capgemini

-

Company in-house development efforts.

Globant’s Recent Financial Trends

-

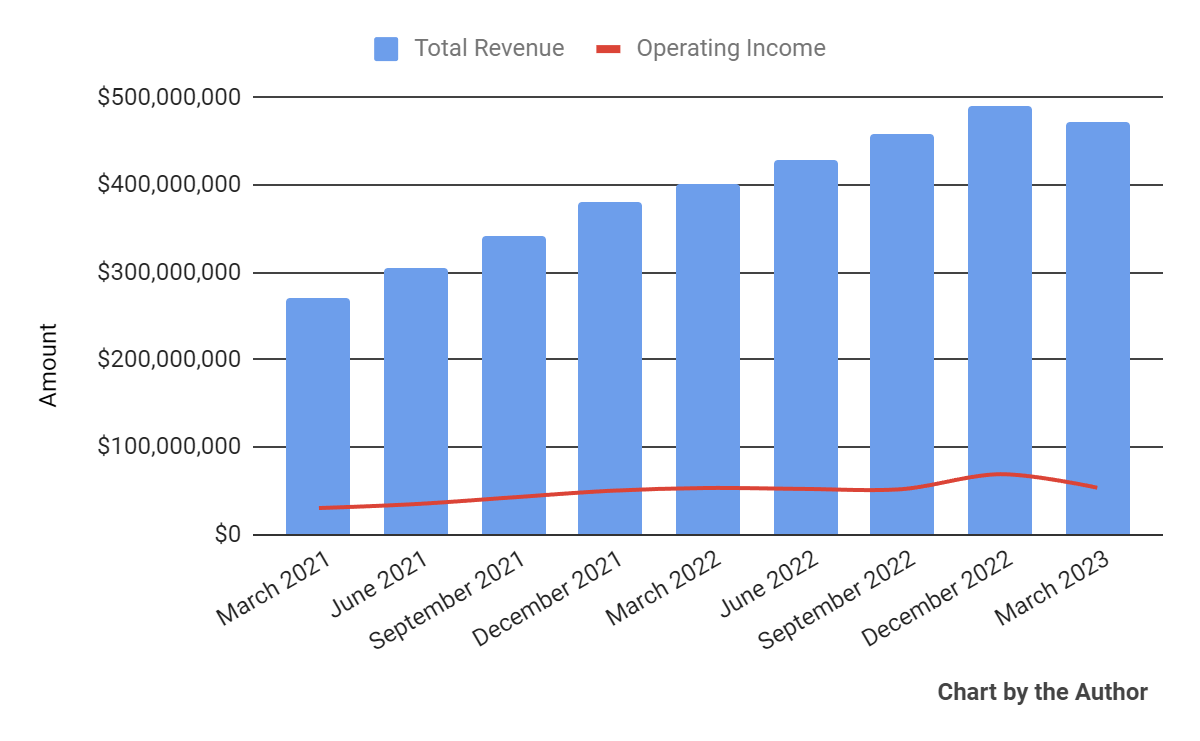

Total revenue by quarter has produced the following growth trajectory; Operating income by quarter fell sequentially in Q1 2023.

Operating Revenue (Seeking Alpha)

-

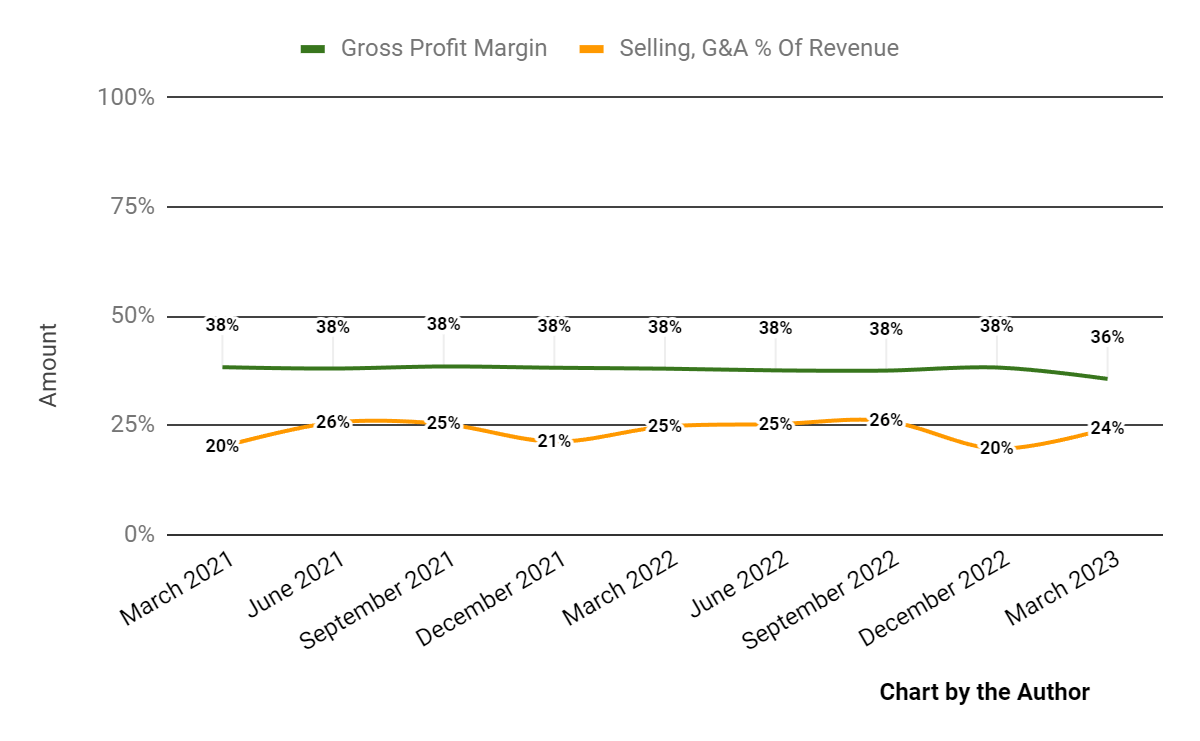

Gross profit margin by quarter has dropped in Q1 2023; Selling, G&A expenses as a percentage of total revenue by quarter have varied in recent quarters.

Gross Profit Margin and Selling, G&A % Of Revenue (Seeking Alpha)

-

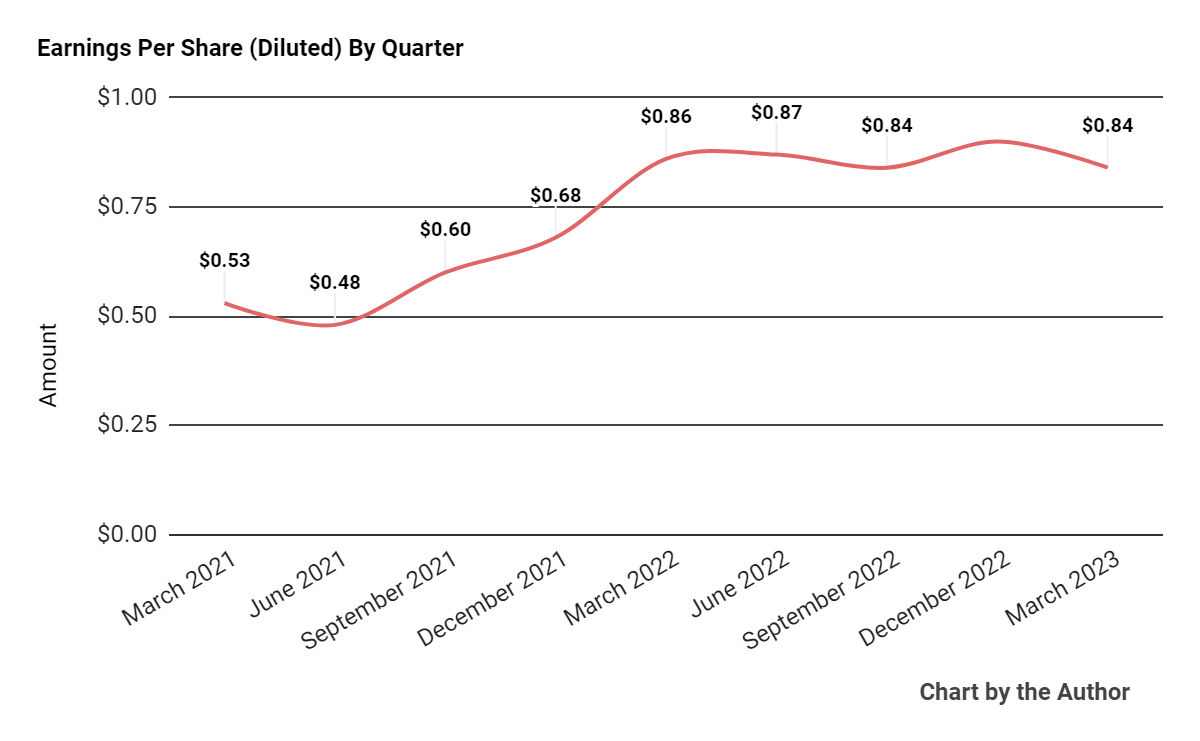

Earnings per share (Diluted) have trended higher in recent quarters.

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP.)

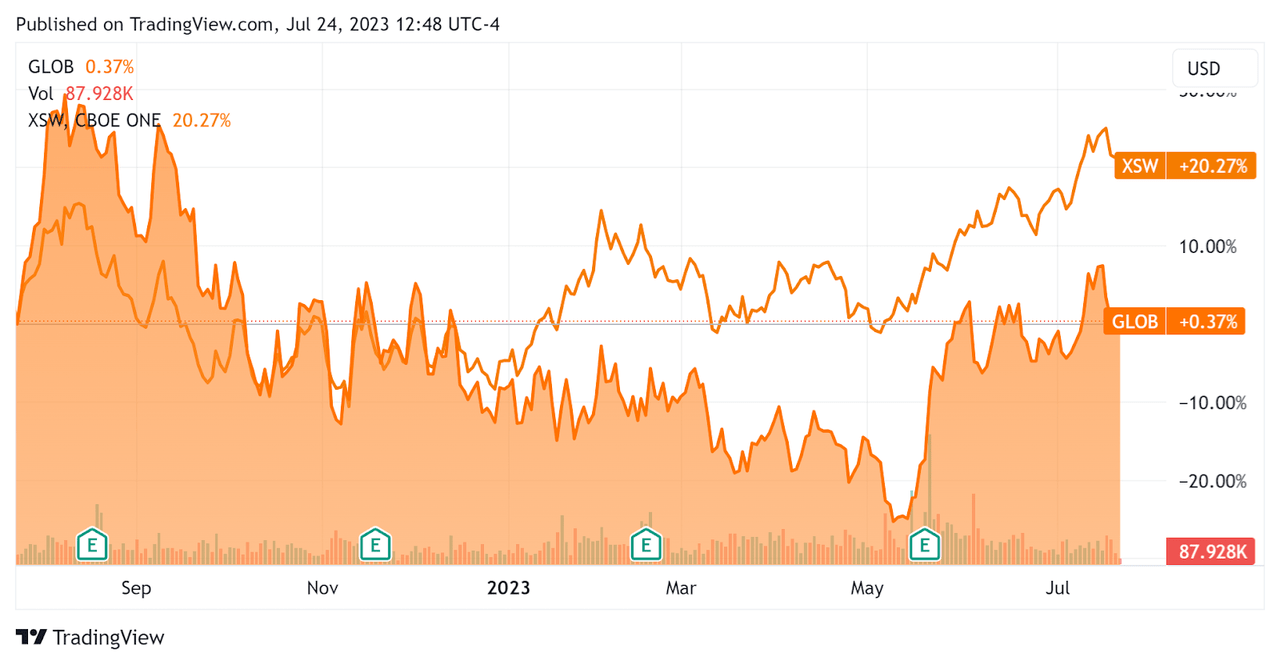

In the past 12 months, GLOB’s stock price has risen only by 0.37% vs. that of the SPDR S&P Software & Services ETF (XSW) growth of 20.27%, as the chart indicates below.

52-Week Stock Price Comparison (Seeking Alpha)

For the balance sheet, the firm ended the quarter with $284.8 million in cash, equivalents, short-term investments and trading asset securities and only $0.9 million in total debt.

Over the trailing twelve months, free cash flow was $194.0 million, during which capital expenditures were $60.0 million. (Source – Seeking Alpha.)

Valuation And Other Metrics For Globant

Below is a table of relevant capitalization and valuation figures for the company.

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

4.2 |

|

Enterprise Value / EBITDA |

25.6 |

|

Price / Sales |

4.2 |

|

Revenue Growth Rate |

29.6% |

|

Net Income Margin |

8.0% |

|

EBITDA % |

16.2% |

|

Net Debt To Annual EBITDA |

-0.9 |

|

Market Capitalization |

$7,780,000,000 |

|

Enterprise Value |

$7,670,000,000 |

|

Operating Cash Flow |

$254,010,000 |

|

Earnings Per Share (Fully Diluted) |

$3.45 |

(Source – Seeking Alpha.)

As a reference, a relevant partial public comparable would be much larger consulting company Capgemini SE (OTCPK:CAPMF); shown below is a comparison of their primary valuation metrics.

|

Metric [TTM] |

Capgemini |

Globant |

Variance |

|

Enterprise Value / Sales |

1.6 |

4.2 |

161.0% |

|

Enterprise Value / EBITDA |

11.8 |

25.6 |

116.5% |

|

Revenue Growth Rate |

21.1% |

29.6% |

40.2% |

|

Net Income Margin |

7.0% |

8.0% |

14.2% |

|

Operating Cash Flow |

$2,700,000,000 |

$254,010,000 |

-90.6% |

(Source – Seeking Alpha.)

Commentary On Globant

In its last earnings call (Source – Seeking Alpha), covering Q1 2023’s results, management highlighted that 11,000 of its employees have gone through a new AI training module as it seeks to infuse the organization with new skills for both internal use and external practice areas.

However, the firm’s company’s wide utilization rate fell to 79% from 82% in the previous quarter, indicating a softening backdrop of client demand.

Leadership cautioned that the current macroeconomic environment may present some challenges to its forward visibility, which is a common refrain recently for many consulting firms.

Management did not provide any company, customer or employee retention rate metrics, but said its annual employee attrition rate was now at 14.5%, the lowest level in two years.

Total revenue for Q1 2023 grew by 17.7% year-over-year, and gross profit margin slid 2.3 percentage points.

Selling, G&A expenses as a percentage of revenue fell 0.4% YoY, and operating income rose 0.6%.

The company’s financial position is very strong, with substantial liquidity, negligible debt and significant free cash flow.

Looking ahead, management guided to full year 2023 topline revenue growth of approximately 16%.

If achieved, this would result in a large drop from 2022’s growth rate of over 37% from 2021.

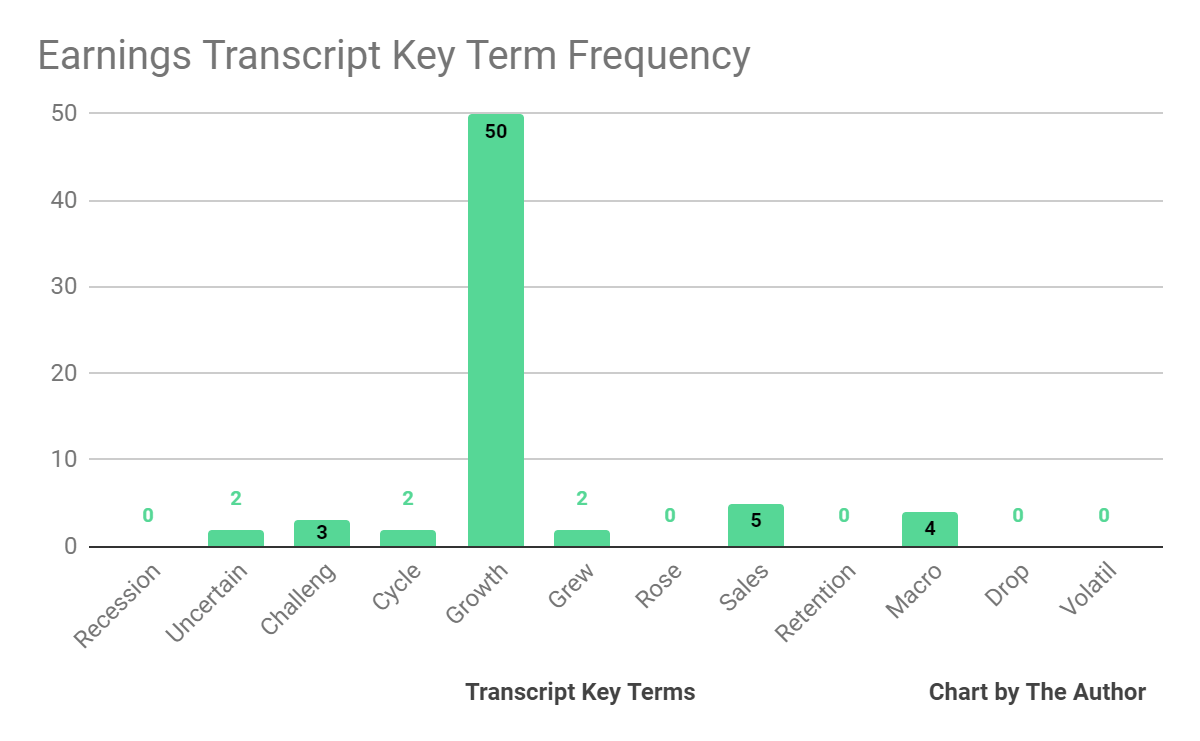

From management’s most recent earnings call, I prepared a chart showing the frequency of key terms mentioned (or not) in the call, as shown below.

Earnings Transcript Key Terms Frequency (Seeking Alpha)

I’m most interested in the frequency of potentially negative terms, so management or analyst questions cited “Uncertain” two times, “Challeng[es][ing]” three times, and “Macro” four times.

Analysts questioned company leadership about how its approach differs from that of its peers, and management said its heavy specialization (studio) focus enables decisions to be made by practice leaders who are much closer to the work and can deliver value faster.

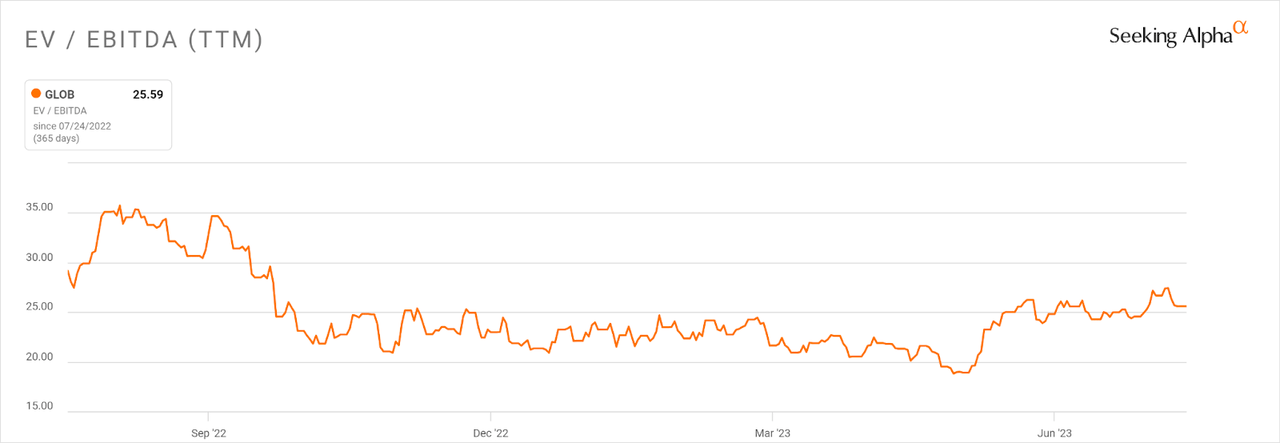

Regarding valuation, in the past twelve months, the firm’s EV/EBITDA valuation multiple has dropped 12.3%, as the chart from Seeking Alpha shows below.

EV/EBITDA Multiple History (Seeking Alpha)

The primary business risk to the company’s outlook is the slowing macroeconomic environment, causing clients to defer and delay discretionary projects, reducing revenue growth for the company and leading to decreased utilization.

Since it appears 2023 revenue growth will be slower than 2022’s growth rate, I’m generally cautious on consulting firms this late in the business cycle.

Globant, however, appears to have a solid balance sheet, which may give it a competitive advantage in tackling M&A opportunities during a further downturn period.

Until we gain more visibility into client spending patterns amid a broader soft business environment, I’m Neutral [Hold] on Globant S.A.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here