A Quick Take On Docebo

Docebo Inc. (NASDAQ:DCBO) provides a suite of online learning capabilities with AI-enhanced functions to improve learning results for organizations of all sizes.

I previously wrote about Docebo with a Buy outlook.

Management is seeing slow decision-making and longer sales cycles from large enterprise clients.

Assuming a slowdown in Docebo Inc.’s revenue growth rate in 2023 versus 2022’s growth rate, which is currently consistent with other SaaS companies, I’m Neutral [Hold] on DCBO in the near term.

Docebo Overview

Toronto, Canada-based Docebo was founded in 2005 to develop an integrated learning management system [LMS] for organizations of all sizes to provide internal and external training capabilities.

The firm is headed by founder and Chief Executive Officer Claudio Erba, who was previously project leader at MHP Srl and product manager at Selpress.

The company’s primary offerings include:

-

Learn LMS

-

Impact Measurement

-

Analytics

-

Shape

-

Content

-

Flow

The firm acquires customers through its direct sales and marketing efforts, both through inbound and outside sales teams.

Docebo’s average contract value was approximately $47,000 as of March 31, 2023.

Docebo’s Market & Competition

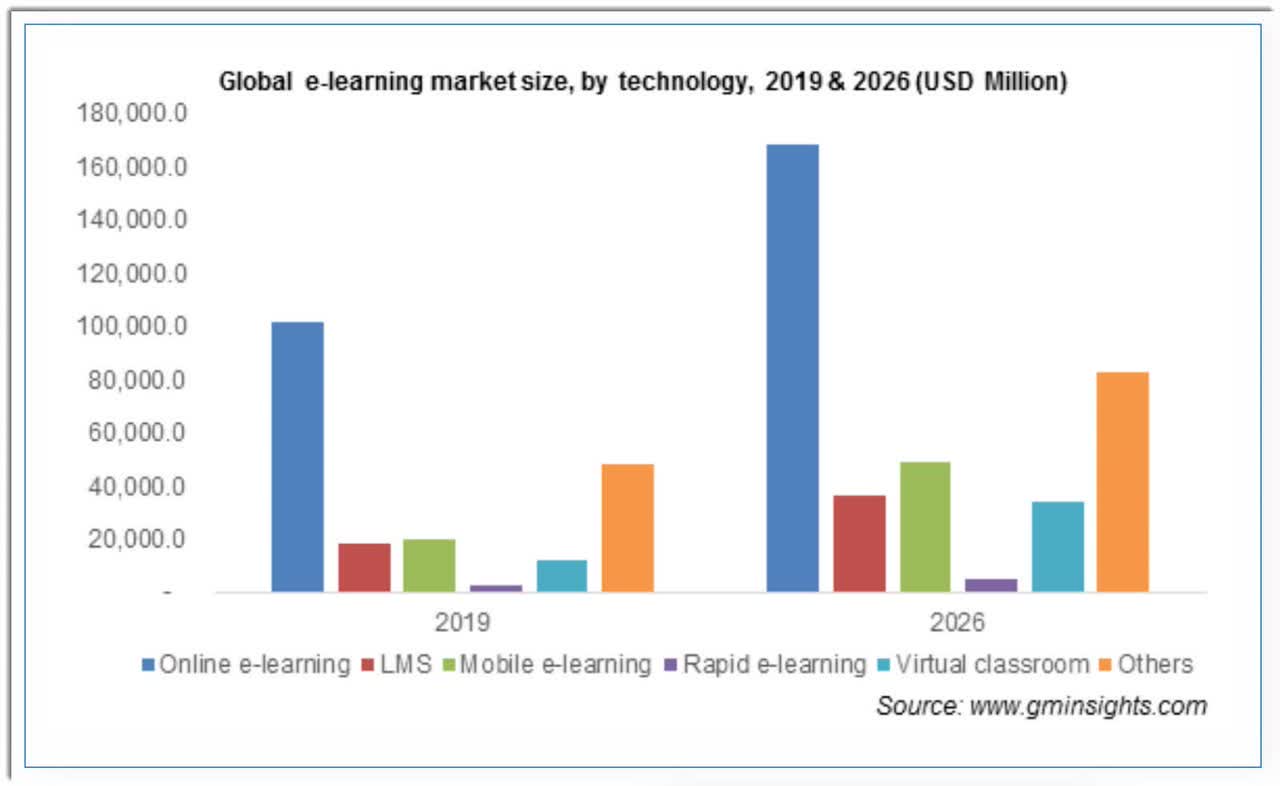

According to a 2020 market research report by Global Market Insights, the global market for e-learning services is expected to reach $375 billion in value by the end of 2026.

This represents a forecast CAGR of 8.0% from 2020 to 2026

The main drivers for this expected growth are continued technological innovation and growing Internet usage worldwide.

Also, the COVID-19 pandemic has acted as a forcing function for many users to pursue their education in an online environment, likely increasing the industry’s growth prospects in the years ahead.

Below is a chart showing the expected growth in the market by technology:

Global E-Learning Market (Global Market Insights)

Major competitive or other industry participants include:

-

Absorb LMS

-

SAP SuccessFactors Learning

-

Saba Cloud

-

Tovuti LMS

-

Cornerstone Learning

-

Captivate Prime

-

360Learning

-

SumTotal Learning

- Instructure

Docebo’s Recent Financial Trends

-

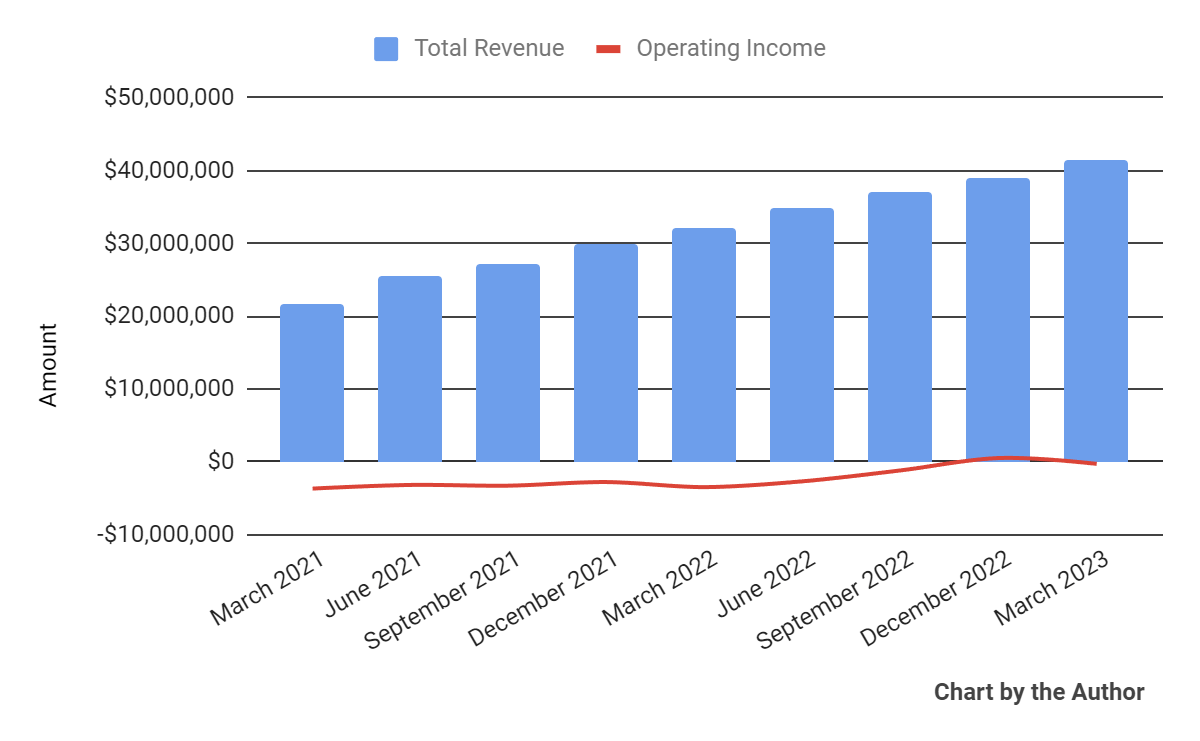

Total revenue by quarter has continued to rise; Operating income by quarter has improved in recent quarters.

Total Revenue and Operating Income (Seeking Alpha)

-

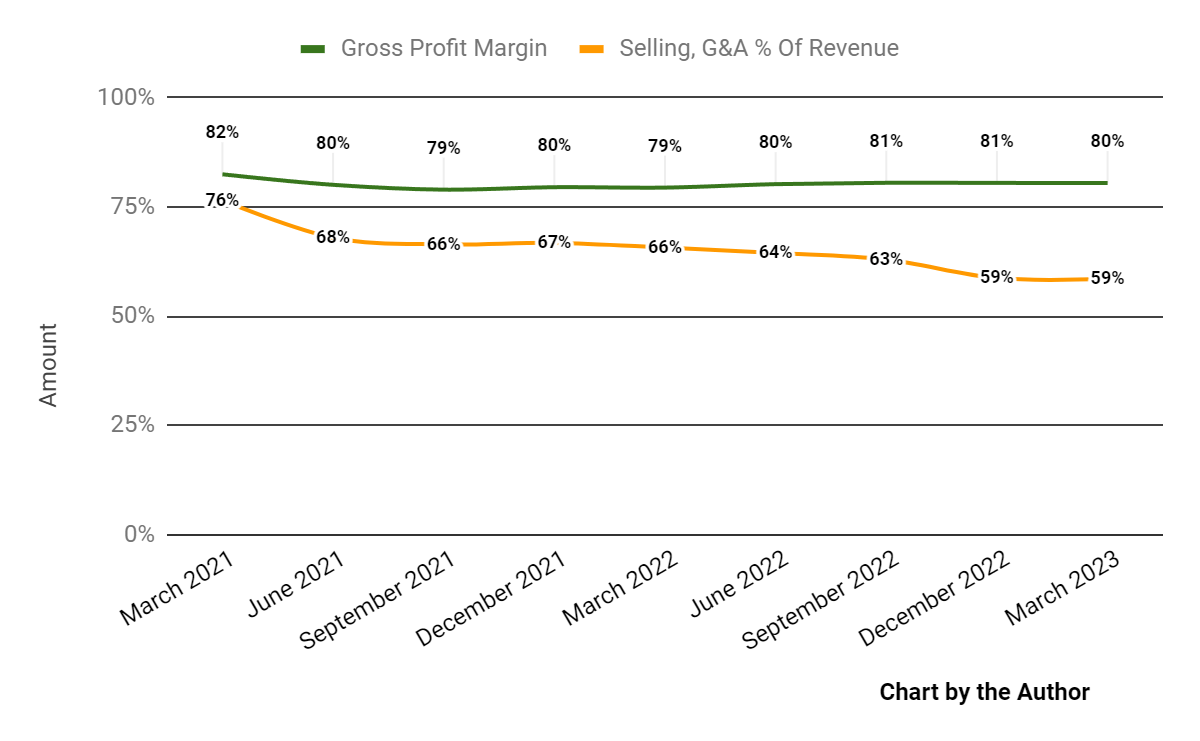

Gross profit margin by quarter has remained flat; Selling, G&A expenses as a percentage of total revenue by quarter have dropped in recent reporting periods.

Gross Profit Margin and Selling, S&A % Of Revenue (Seeking Alpha)

-

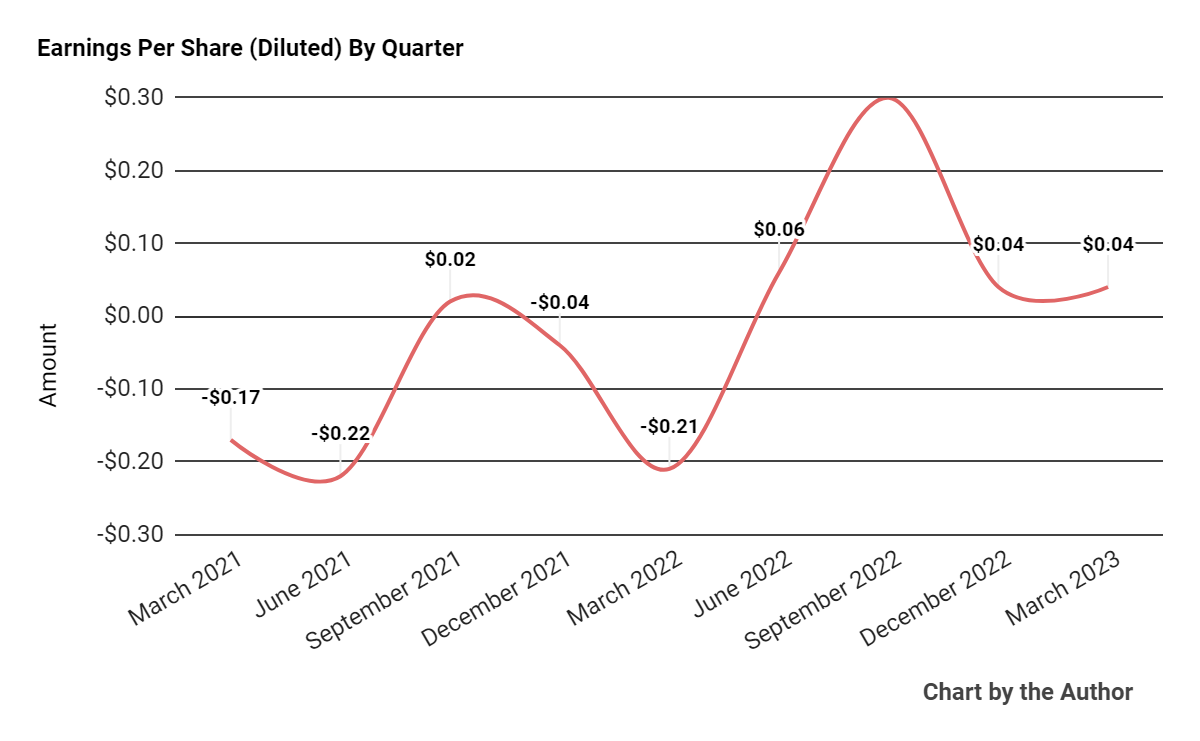

Earnings per share (Diluted) have remained positive in recent quarters.

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP.)

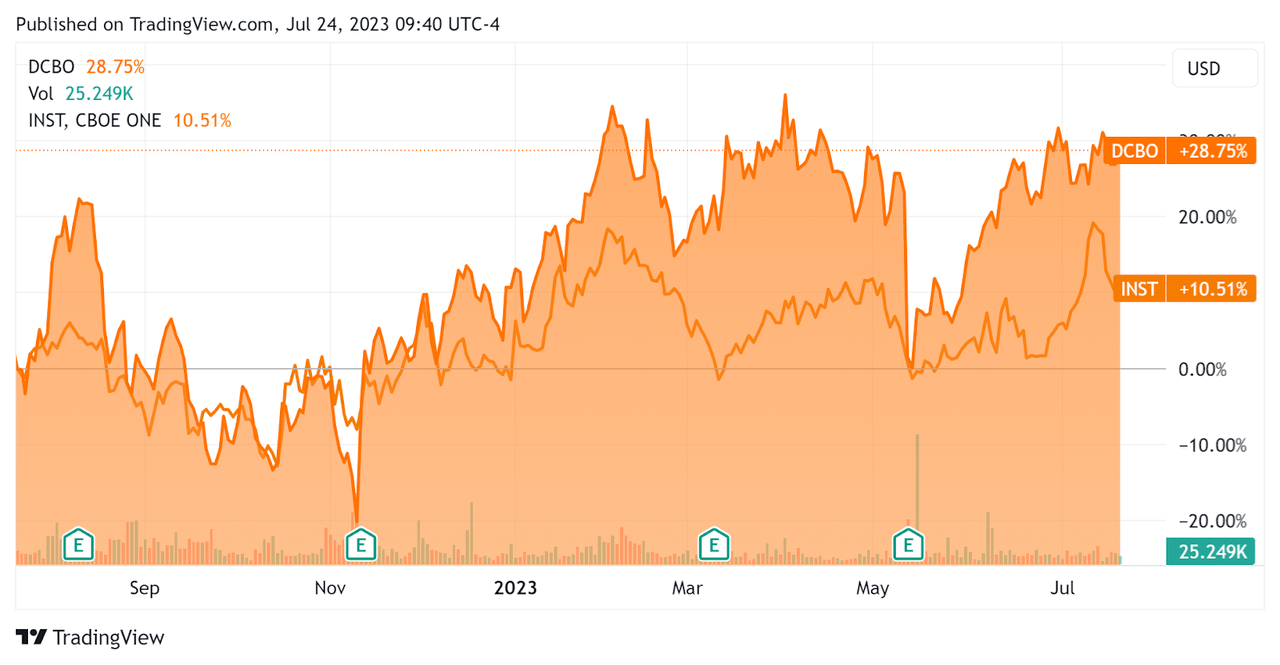

In the past 12 months, DCBO’s stock price has risen 28.75% vs. that of Instructure Holdings, Inc.’s (INST) rise of 10.51%, as the chart indicates below.

52-Week Stock Price Comparison (Seeking Alpha)

For the balance sheet, the firm ended the quarter with $215.8 million in cash and equivalents and no debt.

In the last twelve months, free cash flow was an unimpressive $1.2 million, during which capital expenditures were only $0.9 million. The company paid $4.9 million in stock-based compensation in the last four quarters, the highest trailing twelve-month figure in the past eleven quarters.

Valuation And Other Metrics For Docebo

Below is a table of relevant capitalization and valuation figures for the company.

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

7.0 |

|

Enterprise Value / EBITDA |

NM |

|

Price / Sales |

8.4 |

|

Revenue Growth Rate |

33.0% |

|

Net Income Margin |

10.0% |

|

EBITDA % |

-1.7% |

|

Net Debt To Annual EBITDA |

83.0 |

|

Market Capitalization |

$1,280,000,000 |

|

Enterprise Value |

$1,060,000,000 |

|

Operating Cash Flow |

$2,080,000 |

|

Earnings Per Share (Fully Diluted) |

$0.44 |

(Source – Seeking Alpha.)

As a reference, a relevant partial public comparable would be Instructure; shown below is a comparison of their primary valuation metrics.

|

Metric [TTM] |

Instructure |

Docebo |

Variance |

|

Enterprise Value / Sales |

8.5 |

7.0 |

-18.3% |

|

Enterprise Value / EBITDA |

29.7 |

NM |

–% |

|

Revenue Growth Rate |

15.5% |

33.0% |

113.1% |

|

Net Income Margin |

-8.3% |

10.0% |

–% |

|

Operating Cash Flow |

$125,300,000 |

$2,080,000 |

-98.3% |

(Source – Seeking Alpha.)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

DCBO’s most recent Rule of 40 calculation was 31.3% as of Q1 2023’s results, so the firm’s results for this metric have dropped since Q3 2022, per the table below.

|

Rule of 40 Performance |

Q3 2022 |

Q1 2023 |

|

Revenue Growth % |

43.5% |

33.0% |

|

EBITDA % |

-7.3% |

-1.7% |

|

Total |

36.2% |

31.3% |

(Source – Seeking Alpha.)

Commentary On Docebo

In its last earnings call (Source – Seeking Alpha), covering Q1 2023’s results, management highlighted the momentum it is seeing due to investments in new European markets, resulting in closing large deals in Germany and France.

However, leadership noted longer sales cycles in the enterprise segment.

The firm is also focusing on reducing expenses and recently eliminated middle management positions in order to flatten the organization and speed decision-making.

The company’s gross retention was flat sequentially and net retention rate dropped slightly due to ‘lower fee and module expansion.’

Total revenue for Q1 2023 grew by an impressive 29.3% YoY while gross profit margin increased by one percentage point.

Selling, G&A expenses as a percentage of revenue fell by 7.2% year-over-year, indicating increasing efficiency in this regard and operating losses dropped sharply YoY, to slightly under breakeven.

The company’s financial position is solid, with plenty of liquidity, no debt. Free cash flow has been minimal.

DCBO’s Rule of 40 performance has dropped in comparison to Q3 2022’s results, a negative trend.

Looking ahead, management only provided revenue guidance for Q2 2023. Based on actual and expected revenue growth through Q2, my 2023 topline revenue growth estimate is 24% versus 2022’s growth rate of 37%.

If achieved, this would represent a drop in year-over-year growth rate, which is consistent with what I’m seeing from other enterprise SaaS providers.

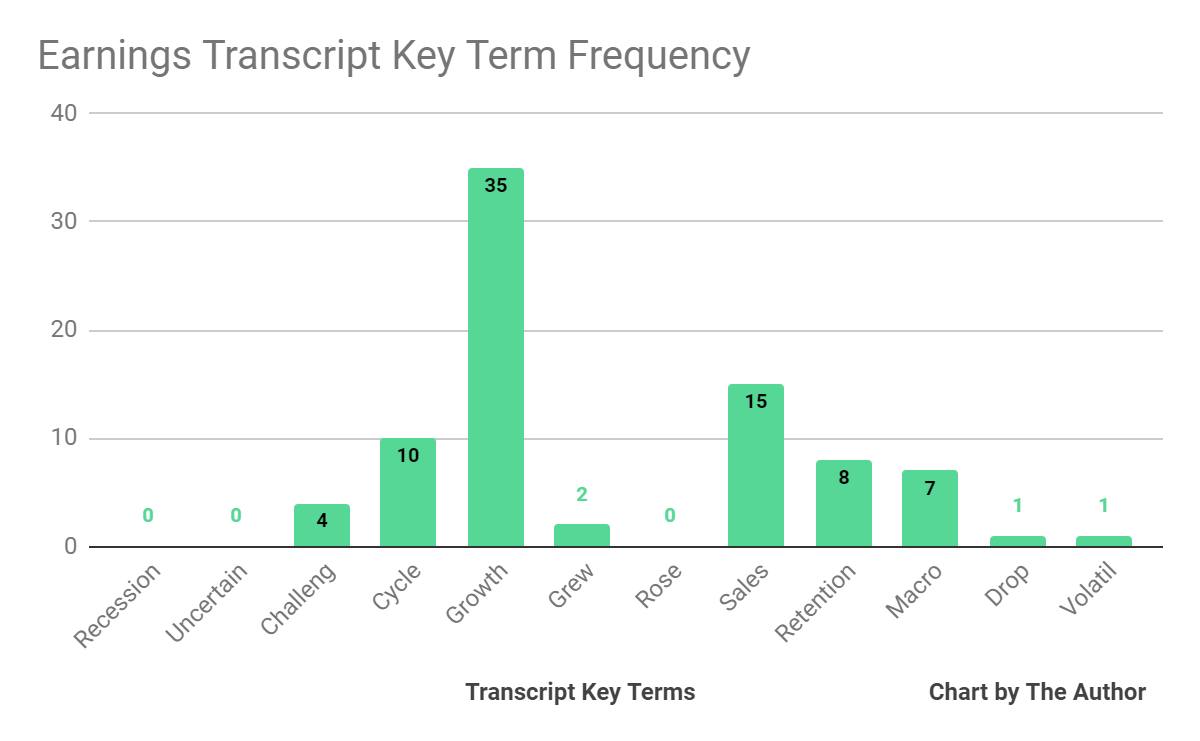

From management’s most recent earnings call, I prepared a chart showing the frequency of key terms mentioned (or not) in the call, as shown below.

Earnings Transcript Key Term Frequency (Seeking Alpha)

I’m most interested in the frequency of potentially negative terms, so management or analyst questions cited “Challeng[es][ing]” four times, “Macro” seven times, “Drop” once, and “Volatil[e][ity]” once.

Analysts questioned company leadership about the impact of AI technologies on e-learning.

Management responded that e-learning content companies may have problems due to the rise of AI and machine learning, but that Docebo is a distribution company and its Shape system is becoming a competitor to e-learning content companies via its own content to which management is adding AI capabilities.

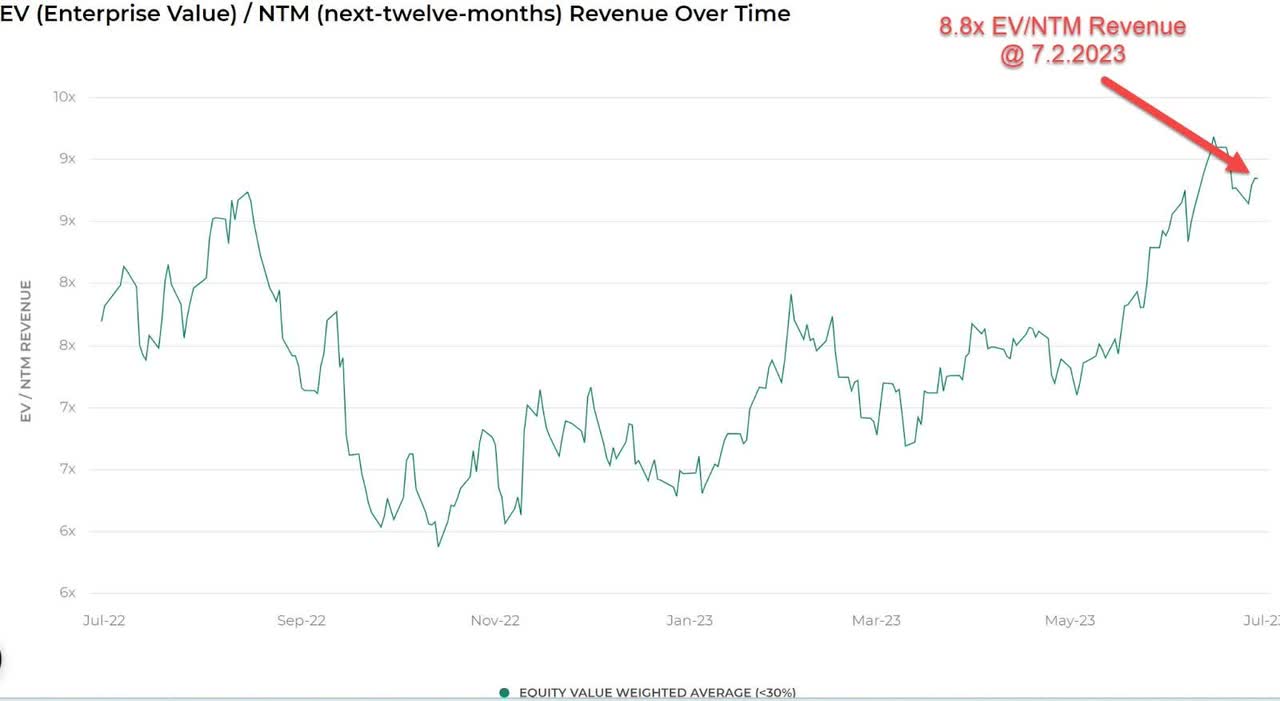

Regarding valuation, the market is valuing DCBO at an EV/Sales multiple of around 7x on a TTM revenue growth rate of 37% against a median Meritech SaaS Index implied ARR growth rate of 21% (Source).

The Meritech Capital Index of publicly held SaaS application software companies showed an average forward EV/Revenue multiple of around 8.8x on July 2, 2023, as the chart shows here:

EV/Next 12 Months Revenue Multiple Index (Meritech Capital)

So, by comparison, DCBO is currently valued by the market at a discount to the broader Meritech Capital SaaS Index, at least as of July 2, 2023 and assuming a higher-than-average growth rate.

Risks to the company’s outlook include an economic slowdown that may be underway, reduced credit availability which may affect customer/prospect spending plans and lengthening sales cycles which may reduce its revenue growth potential in the near term.

Docebo’s stock has performed well in recent quarters in line with the general “re-rating” of technology stocks.

A question is how DCBO will perform in the near term as management notes continued slowness in enterprise decision-making.

Assuming a slowdown in DCBO’s revenue growth rate in 2023 versus 2022’s growth rate, which is currently consistent with other SaaS companies, I’m Neutral [Hold] on Docebo Inc. in the near term.

Read the full article here