Deal Overview

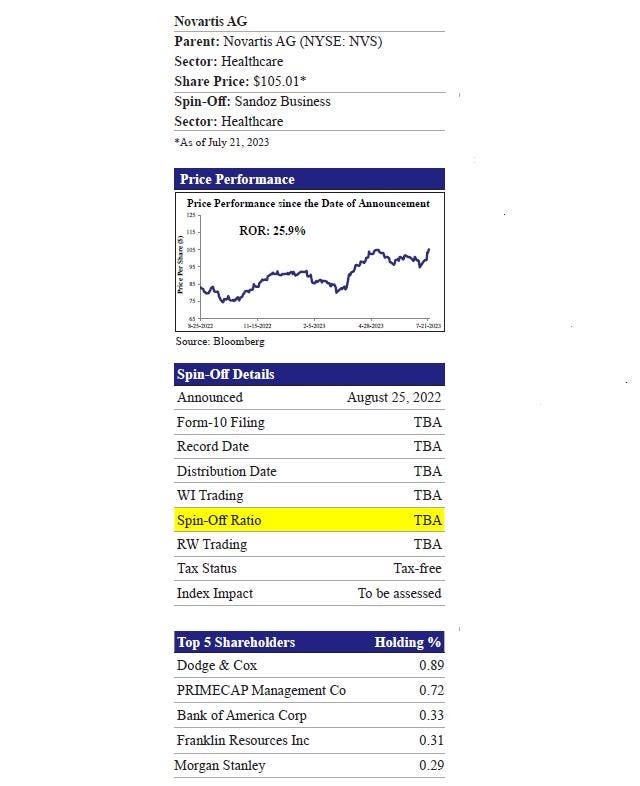

On July 18, 2023, Novartis AG (NYSE: NVS, $105.01, Market Capitalization $239.2 billion), a leading global medicine company, announced that its Board of Directors has unanimously endorsed the proposed separation of Sandoz to create an independent company by way of a 100% spin-off. Earlier on August 25, 2022, Novartis revealed its intention to separate Sandoz, the generics and biosimilars division, into an independent publicly traded company through a 100% spin-off. This decision was a culmination of an extensive strategic review started in October 2021, which considered all options, ranging from retaining the Sandoz business to separation. The review concluded that a spin-off would be in the best interests of Novartis shareholders. The transaction is expected to be tax neutral to Novartis, subject to the receipt of favorable opinions and rulings. Sandoz will be listed on the SIX Swiss Exchange, with an American Depositary Receipt (ADR) program in the US. In the next step, Novartis shareholders will be invited to vote on the proposed spin off and a related reduction of Novartis AG’s share capital during an Extraordinary General Meeting scheduled for Friday, September 15, 2023. The invitation to the EGM, along with a Shareholder Brochure and listing prospectus prepared by Sandoz, is planned to be distributed in August 2023. The planned spinoff is expected to be completed in early 4Q23 if all approvals are secured.

Post-spin-off, Novartis (RemainCo) will focus on its Innovative Medicines business, which is centered on five core therapeutic areas – cardiovascular, immunology, neuroscience, solid tumors, and hematology. On the other hand, Sandoz (Spin-Off) will focus on the key strategic areas of biosimilars, antibiotics and generic medicines. Moreover, Sandoz is set to relocate its headquarters to a prominent office building named ‘Elsässertor’ situated in the heart of Basel. The company anticipates completing the move from the Novartis Campus to its new headquarters by mid 2024. Sandoz has appointed Richard Saynor as a Chief Executive Officer and Gilbert Ghostine as a Chairman of the Board of Directors, while Vas Narasimhan will remain as Chief Executive Officer of Novartis. Novartis intends to continue paying a strong and growing dividend, building on the $3.47 per share paid in March 2023. On the other hand, Sandoz also intends to pay an attractive dividend to its shareholders from 2024 (20-30% of FY23 core net income, which is likely to grow to 30-40% of the company’s core net income in the medium term). Notably, any dividends from Sandoz would be accretive to those of Novartis. On 7/18, Novartis also announced that it will initiate a share buyback of up to $15 billion to be executed by the end of 2025, in line with capital allocation priorities; highlighting confidence in top-line growth and margin expansion.

Deal Rationale

It is worth noting that Novartis initiated a strategic review of the Sandoz division in October 2021 following a protracted period of underperformance driven largely by mounting pricing pressures in the off-patent drug sector, particularly in the United States. Following the completion of the strategic review in August 2022, Novartis revealed its intention to separate Sandoz (the generics and biosimilars division) into an independent publicly traded company through a 100% spin-off. The Sandoz spin off is expected to unlock shareholder value by establishing it as a leading European generics company and a global biosimilar leader. This strategic move allows Novartis shareholders to fully participate in the potential future growth of both Sandoz and Novartis Innovative Medicines. The spin-off of Sandoz enables both the Innovative Medicines and Sandoz businesses to focus more effectively on their individual growth strategies. It should be noted that Sandoz’s growth prospects are based on its current biosimilars pipeline, which comprises more than 15 molecules, a competent management team, and a well-organized structure. On the other hand, Novartis’s ultimate objective is to transform into a specialized innovative medicines company, bolstering its financial position and enhancing return on capital.

Sandoz operates in an attractive and growing off-patent market with an increasing share in Biosimilars. The global off-patent market is expected to grow at a CAGR of ~8%, from $208 billion in FY22 to $420 billion in FY31. The spin-off will likely allow Sandoz to maintain its leading global position by capitalizing on its strong brand and increasing its focus in key strategic areas such as biosimilars, antibiotics, and generic medicines. As an independent entity, Sandoz will be able to focus on its vision to deliver access to patients, leveraging its strengths and harnessing the dedication of its purpose-driven workforce. The company plans to pursue a growth strategy that involves efficient resource deployment, reinforcing essential platforms, and striving for launch excellence. Following the proposed spinoff, Sandoz aims to achieve an investment-grade credit rating (with net debt to core EBITDA ratio in the range of 2.0-2.5x), providing financial flexibility to fulfill its growth plans and explore additional growth opportunities. The company also intends to pay attractive dividend to its shareholders, which will be accretive to those of Novartis.

Post-spin-off, Novartis will continue transforming into a ‘pure-play’ Innovative Medicines business. As a part of this transformation, the company unveiled a new focused strategy in 2022, centered on five core therapeutic areas – cardiovascular, immunology, neuroscience, solid tumors, and hematology. Novartis possesses numerous in-market and pipeline assets within these areas, addressing high disease burdens and showing significant growth potential. The company is investing in two established technology platforms (chemistry and biotherapeutics) and prioritizing three emerging platforms (gene & cell therapy, radioligand therapy, and xRNA) for further R&D capabilities and manufacturing scale.

Other updates

1. Sandoz announces plans to build a Biosimilar Technical Development Center in Slovenia:

On 7/20, Sandoz announced an investment of ~$90 million in Ljubljana, Slovenia, to establish a dedicated Sandoz Biopharma Development Center by 2026. The planned investment complements recently announced Sandoz plans to invest at least ~400 million in a new biologics manufacturing plant in Lendava, Slovenia, and expand its biosimilar development capabilities at its facility in Holzkirchen, Germany. The new site will create ~200 new full-time jobs and further strengthen the company’s capabilities in end-to-end drug substance and drug product development of biosimilars.

2. Entresto patent update:

On 7/18, after receiving an unfavorable ruling from the US District Court for the District of Delaware, Novartis plans to appeal to the US Court of Appeals for the Federal Circuit to defend the validity of its patent covering Entresto and combinations of sacubitril and valsartan. Currently, there are no generics with tentative or final approval in the US for this product. However, any potential launch of a generic version of Entresto before the final decision on Novartis’ patent appeal or ongoing patent litigations could be subject to later legal developments and risks.

3. Acquisition of DTx Pharma Inc:

On 7/14, Novartis acquired DTx Pharma Inc., a biotechnology company based in San Diego. DTx specializes in the pre-clinical stage development of siRNA therapies for neuroscience indications, with its lead program, DTx-1252, targeting the root cause of CMT1A. The acquisition also includes two additional pre-clinical programs for other neuroscience indications. The transaction was finalized for a total cash payment of $0.5 billion, with potential additional milestones of up to $0.5 billion contingent on specific achievements.

4. Acquisition of Chinook Therapeutics:

On 6/12, Novartis agreed to acquire Chinook Therapeutics, a Seattle-based clinical stage biopharmaceutical company focused on developing treatments for rare, severe chronic kidney diseases. The purchase price for Chinook Therapeutics amounts to $3.2 billion in cash, with potential additional payments of up to $0.3 billion based on specified milestones. The completion of the Chinook Therapeutics acquisition is expected in 2H23, subject to customary closing conditions, including approval from Chinook Therapeutics shareholders and receipt of regulatory approvals.

5. Sandoz and Just-Evotec Biologics Partnership:

On 5/9, Sandoz and Just-Evotec Biologics announced a multi-year partnership to develop and manufacture multiple biosimilars with an option for expansion. Due to this partnership, Sandoz will gain access to a proprietary AI-driven technology platform that delivers fully integrated drug substance development and continuous manufacturing. The partnership supports Sandoz pipeline expansion to 24 biosimilar assets and provides an opportunity to enhance integrated development and manufacturing network.

2Q23 Results

On 7/18, Novartis reported solid 2Q23 results with revenue and adj. EPS beat vs. consensus. The company reported 2Q23 net sales of $13.6 billion, up 7% YoY (+9% YoY on a constant currency basis) primarily due to volume growth. In 2Q23, adjusted operating income increased to $4.7 billion, up 9% YoY (+17% on a constant currency basis), driven by higher sales. Consequently, the adjusted operating income margin improved to 34.3% in 2Q23. Adjusted net income was $3.8 billion (+11% YoY, +19% on a constant currency basis), mainly due to higher core operating income. Adjusted EPS jumped to $1.83 (+17% YoY, +25% on a constant currency basis), growing faster than adjusted net income, owing to a lower weighted average number of shares outstanding.

2023 outlook update

Given the strong 1H23 momentum, the company has raised its 2023 outlook assuming no US Entresto Gx at risk launch in 2023, no Sandostatin LAR generics entry in the US in 2023, and Sandoz spin-off completion in early 4Q23. Now in the case of Novartis excluding Sandoz, sales are expected to grow high single digit (previously: mid-single-digit), and adjusted operating income is expected to grow low-double digit to mid-teens (previously: high-single to low-double digits).

For Sandoz, sales are expected to grow mid-single digits, and adjusted operating income is expected to decline to low-double-digit, reflecting required stand-up investments to transition Sandoz into a separate company and continued inflationary pressures.

Company Description

Novartis AG (Parent)

Headquartered in Basel, Switzerland, Novartis AG researches, develops, manufactures, and markets healthcare products in Switzerland and internationally. The company operates through two segments: Innovative Medicines and Sandoz. The Innovative Medicines segment offers prescription medicines for patients and physicians. It also provides cardiovascular, ophthalmology, neuroscience, immunology, hematology, and solid tumor products. The Sandoz segment develops, manufactures, and markets finished dosage forms of small molecule pharmaceuticals to third parties. It also provides protein- or other biotechnology-based products, including biosimilars; biotechnology manufacturing services; and ant infectives. Moreover, Novartis AG has a license and collaboration agreement with Alnylam Pharmaceuticals

ALNY

Sandoz Business (Spin-Off)

Post-spin-off, SpinCo will include Sandoz business. Sandoz will be a global leader in the generic pharmaceuticals and biosimilars business serving 100+ markets globally with a #1 position in Europe and a strong presence in the United States and the rest of the world. In 2Q23, Sandoz restructured its global organization into two divisions: Generics and Biosimilars. Under the Generics division, Sandoz focuses on developing, manufacturing, and marketing finished dosage forms of small molecule pharmaceuticals, catering to various therapeutic areas. This includes finished dosage forms of anti-infectives sold to third parties and active pharmaceutical ingredients and intermediates, mainly antibiotics, which are supplied to third-party companies. On the other hand, the Biosimilars division is responsible for developing, manufacturing, and marketing protein- or other biotechnology-based products, including biosimilars. In FY22, Sandoz reported net sales of $9.2 billion.

Read the full article here