Investment Thesis: I do not take a bullish view on Hanover Insurance Group (NYSE:THG) at this time.

In a previous article back in February, I made the argument that The Hanover Insurance Group could see little growth in the short to medium term, owing to a rising combined ratio across the Personal Lines segment due to inflationary pressures – in spite of resilient performance across the Core Commercial segment.

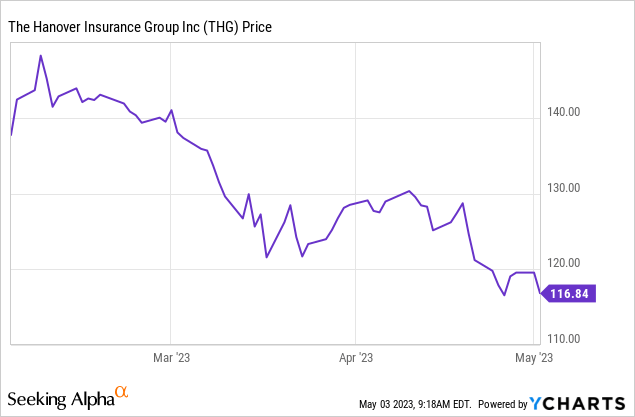

Since my last article, THG stock is down by just over 16%:

ycharts.com

The purpose of this article is to assess whether Hanover Insurance Group has the potential to rebound from here – taking recent financial performance into consideration.

Performance

When looking at Q1 2023 financial results, we can see that the combined ratio (the sum of expenses and losses over the earned premium) for both Core Commercial and Personal Lines has increased from that of last year – while that of Specialty decreased slightly (all ratios excluding the impact of catastrophic losses):

| March 2022 | March 2023 | |

| Core Commercial | 88.9 | 92.1 |

| Specialty | 85 | 83 |

| Personal Lines | 93.5 | 96.2 |

Source: Figures sourced from Hanover Insurance Group Q1 2023 Press Release.

When including catastrophic losses – that of Core Commercial had increased from 93% in March 2022 to 104.7% in March 2023, while that of Personal Lines had increased from 97.1% to 112.2% over the same period.

While I had previously expressed concern over the rising combined ratio across the Personal Lines segment, I had also acknowledged that performance across the Core Commercial segment continued to remain strong. However, we can see that the combined ratio has been rising across both segments over the past year.

According to Hanover Insurance Group, the reason for the rise in the combined ratio across the Personal Lines segment was primarily due to a higher loss frequency across personal auto as well as a relatively low level of claims in the first quarter of 2022. Inflationary pressures on cost of parts and labour had ultimately led to higher losses across personal auto.

In terms of the Core Commercial segment – a higher level of losses across commercial auto had also led to upward pressure on the combined ratio for this segment. With higher costs also affecting the commercial auto segment – the expense of insuring this segment accordingly saw an increase.

In spite of the higher combined ratio for both of these segments – net premium growth continued to see an increase of 7.3% and 10.1% for Core Commercial and Personal Lines respectively from Q1 2022 to Q1 2023.

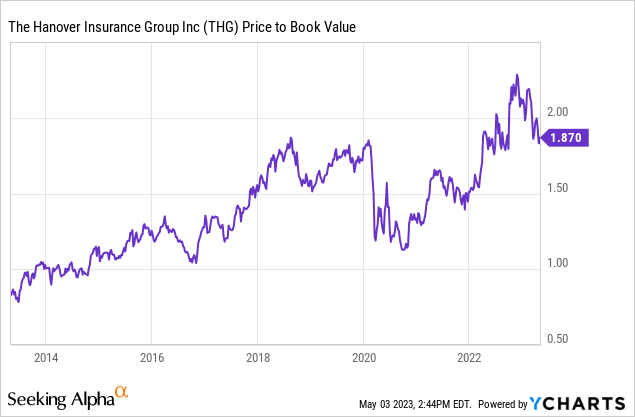

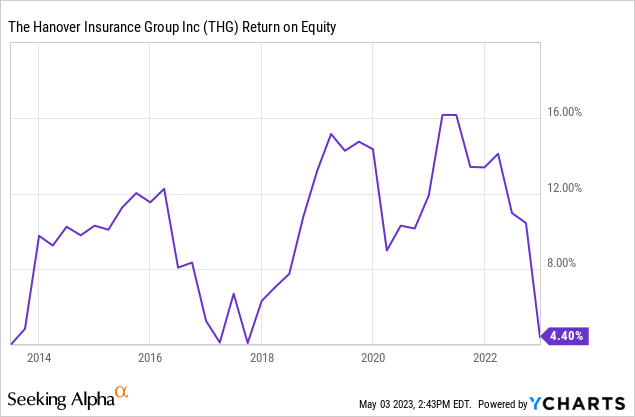

When looking at Hanover Insurance Group’s price to book and return on equity ratios, we can see that the former is trading near a 10-year high, while the latter is trading near a 10-year low:

Price to Book

ycharts.com

Return on Equity

ycharts.com

On the basis of these ratios, I cannot see any evidence to suggest that Hanover Insurance Group is trading at an attractive valuation at this time.

The recent downturn in the stock may have been a combination of market contagion and concerns over rising combined ratios for both Core Commercial and Personal Lines, but it also appears that investors deem the stock too expensive at this time – which could be why we have been seeing a decline in Hanover Insurance Group.

Risks and Looking Forward

Going forward, investors are likely to closely watch fluctuations in the combined ratio across Core Commercial and Personal Lines, and specifically look for evidence of a decreasing ratio in subsequent quarters. Should we see a continued climb in these ratios as a result of continued inflation and rising costs of insuring personal and commercial auto – then further downside in the stock could be a risk factor.

With that being said, we have seen net premium growth continue throughout the course of the year – with double-digit percentage growth for the Personal Lines segment. A side effect of rising costs means that we may see more consumer demand for insurance going forward – growth in property replacement costs may entice a wider range of customers to increase their coverage. The main consideration is whether net premium growth will be sufficient to outweigh the rises in expenses and losses – which does not appear to be the case to date.

Conclusion

To conclude, Hanover Insurance Group has seen downside coinciding with a higher combined ratio from rising insurance costs. While net premium growth could allow the stock to recover going forward, I take the view that Hanover Insurance Group remains too expensive on a price to book basis and rising costs could pose challenges ahead.

Read the full article here