Investment thesis

QUALCOMM (NASDAQ:QCOM) is a company that has been consistently demonstrating stellar profitability metrics over the decade. The company has a diverse intellectual property portfolio representing a significant portion of QCOM’s total profits. But recent years’ heavy litigations with the U.S. authorities and other technological giants revealed that legal risks for this revenue stream are massive. Moreover, an unfavorable trend exists when original equipment manufacturers [OEMs] design and produce necessary chipsets in-house. Last, QCOM’s current valuation does not look attractive, especially given the harsh headwinds the company’s end markets are facing. With all factors together, I decided to assign the stock a “Hold” rating.

Company information

Qualcomm is a leading designer and manufacturer of cutting-edge semiconductors for smartphones and commercial wireless applications. The company owns a significant intellectual property portfolio for 3G, 4G, and 5G technologies.

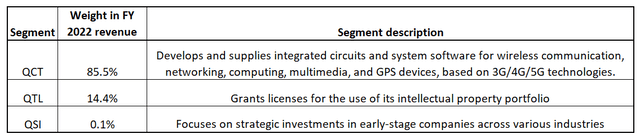

The company’s fiscal year-end on the last Sunday of September. The business is operated under three segments: QCT, QTL, and QSI.

Compiled by the author based on the company’s latest 10-K report

Financials

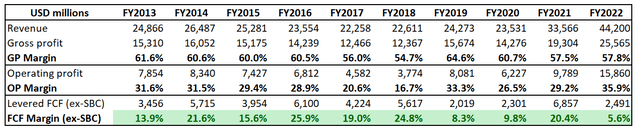

The company’s financial performance over the last decade was solid, with a 5.9% top-line CAGR and wide margins. The red flag for me is the gross margin that shrank slightly over the decade, despite revenue almost doubling. On the other hand, the operating margin in the last full fiscal year was notably wider than ten years ago. The free cash flow [FCF] margin ex-stock-based compensation [ex-SBC] was mostly at solid double digits over the decade, but in FY2022, it significantly shrank due to substantial debt repayments. Over the long term, I expect the FCF margin to sustain double digits.

Author’s calculations

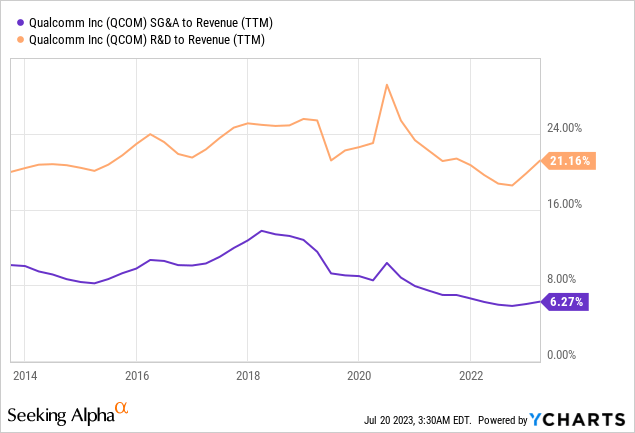

The company is highly efficient from the operating expenses perspective, with the SG&A to revenue ratio consistently below 10% in recent years. This efficiency enables the company to reinvest more than 20% annually in R&D. I like the management’s commitment to innovation, which increases my confidence that the company will be able to protect its competitive advantages over the long-term.

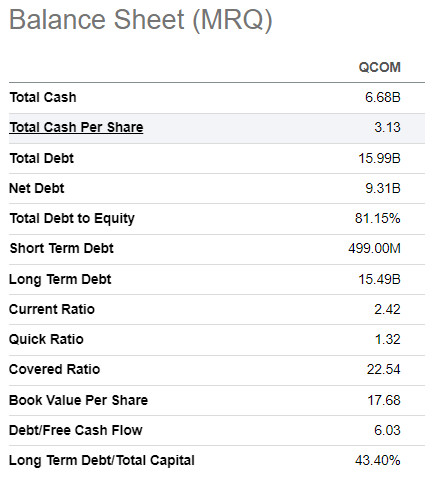

Stellar profitability metrics enabled the company to conduct a very shareholder-friendly capital allocation strategy. The company is generous in share buybacks, returning more than $60 billion to shareholders over the decade. The stock offers a decent 2.6% forward dividend yield, which I consider safe with sustainable growth. The dividend history is stellar, with 19 consecutive years of dividend hikes. The company’s balance sheet is solid. Given the company’s stellar profitability metrics, the 9.3 billion net debt position might look very high, but I am comfortable with the leverage. The covered ratio is above 20, and liquidity metrics are also solid.

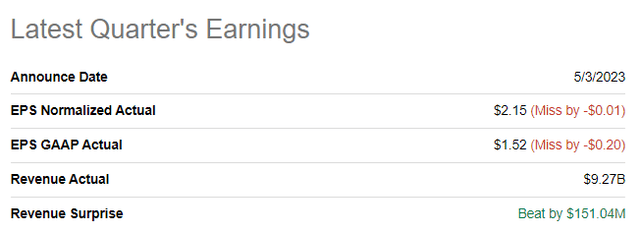

Seeking Alpha

The latest quarterly earnings were released on May 3. Revenue was higher-than-consensus, but the non-GAAP EPS demonstrated a slight miss. Revenue declined YoY for the second consecutive quarter with a 17% decline. The EPS shrank notably from $3.21 to $2.15. The weakness in earnings was mainly due to the softening demand from the end markets, especially handset volumes. QCOM’s profitability metrics deteriorated notably. The gross margin shrank YoY from 58% to 55%, while the operating margin decreased from 35% to 23%. The good sign is that the weakness in operating margin was due to increased R&D expenses rather than the SG&A line.

Seeking Alpha

The upcoming quarter’s earnings are also expected to be substantially weaker on a YoY basis. The top line is expected to accelerate the decline, with about 22% decline. The EPS is expected to deteriorate by more than $1. Headwinds are the same and relate to a weakness for end markets, especially the smartphone market. In Q2 of 2023, global smartphone sales plunged by 11% YoY. The management expects that the weak smartphone demand will likely carry on during the whole calendar 2023. Another warning sign is that recently Samsung warned that its Q2 operating profit might plunge 96% due to the ongoing slump in demand for consumer electronics. Understanding trends in consumer electronics demand is also crucial for QCOM investors because in FY 2022 Internet-of-Things [IoT] end market sales represented 15% of the total. That said, I expect the calendar Q2 earnings of the company to be pressured down not only by the smartphone end market but IoT as well.

Valuation

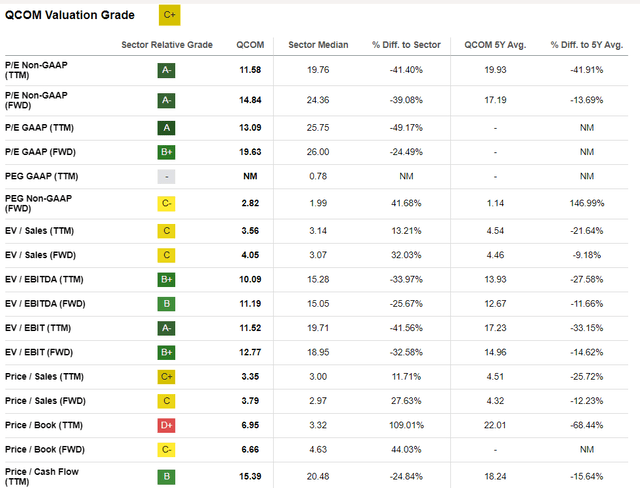

The stock demonstrated a 16% year-to-date rally, about two percentage points below the broader stock market performance. If we compare QCOM’s year-to-date performance to the iShares Semiconductor ETF (SOXX), the stock’s performance significantly lagged. Seeking Alpha Quant assigned the stock an average “C+” valuation grade, meaning the stock is fairly valued. Comparing valuation ratios of QCOM to the sector median and historical averages, discrepancies are mixed and to me, it is difficult to conclude whether the stock is overvalued or undervalued based on the multiples analysis.

Seeking Alpha

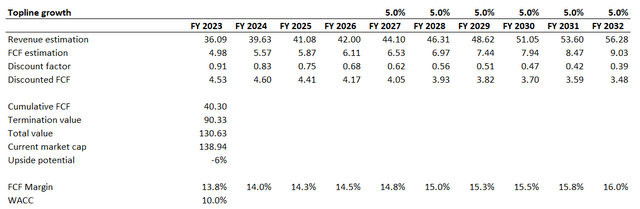

Therefore, let me continue my valuation analysis by exercising the discounted cash flow [DCF] model. I select a 10% WACC, which I usually implement for semiconductor companies. I have consensus earnings estimates available up to FY 2026. For the years beyond, I project a 5% revenue CAGR. For FY 2023 FCF margin, I use the past five-year average, which is 13.8%. I expect it to expand by 25 basis points yearly.

Author’s calculations

As you can see, the current market capitalization is slightly above the business’s fair value. Moreover, let us not forget that the company is in a substantial net debt position of about $9 billion, which makes the valuation less attractive.

Risks to consider

Leaders of the smartphone market, like Apple (AAPL) and Samsung, are developing in-house cutting-edge chips to decrease dependence on external providers. According to Mark Gurman from Bloomberg, Apple plans to replace Qualcomm’s chips with a homegrown alternative by 2024. There also were rumors that Samsung aimed to challenge Apple and Qualcomm in the chipset race. That said, there is a high risk that other second-tier smartphone producers like Huawei or Xiaomi will also design in-house chips. This will significantly hurt Qualcomm’s sales.

Another major risk is the company’s licensing [QTL] segment. Qualcomm had massive litigation with the Federal Trade Commission [FTC] in 2019. The FTC accused Qualcomm of operating a monopoly and forcing its customers to work with it exclusively. The same year, Qualcomm company also had a big legal battle with Apple and Huawei related to patents and intellectual property royalties disputes. While these cases were already settled, it is apparent that Qualcomm’s licensing business faces significant legal risks. This business represents a significant portion of the total sales and is highly profitable. Therefore, litigations with unfavorable outcomes for Qualcomm might substantially hurt the company’s earnings.

Bottom line

To conclude, I assign the stock a “Hold” rating. The company’s financial performance is stellar, and I like the firm commitment to innovation. But the company faces significant risks of losing substantial parts of its smartphone revenue due to unfavorable shifts like plans of giant smartphone manufacturers to design and produce chips in-house. Also, about 15% of the company’s highly profitable revenue is under significant legal risks. Moreover, the valuation does not look attractive at current levels, and near-term headwinds are severe.

Read the full article here