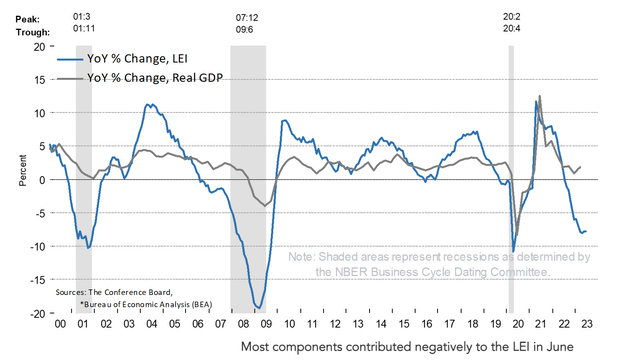

The Leading Index has been in decline for fifteen months-the longest streak of consecutive decreases since 2007-08, during the runup to the Great Recession. Taken together, June’s data suggests economic activity will continue to decelerate in the months ahead. We forecast that the US economy is likely to be in recession from Q3 2023 to Q1 2024. Elevated prices, tighter monetary policy, harder-to-get credit, and reduced government spending are poised to dampen economic growth further.

-Thursday’s statement from the Conference Board.

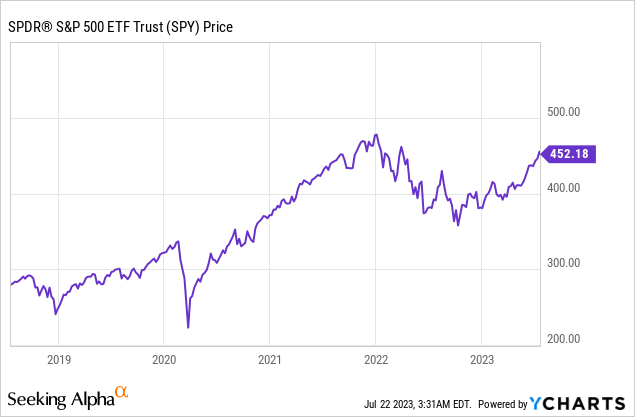

After a brief pause, markets are pricing roughly a 99% chance of a quarter-point interest rate hike at this week’s FOMC meeting. Although progress has been made on inflation, there is still work that needs to be done, and price pressures are still running too hot. The Fed has signaled that they intend to hike rates higher this year to 5.75% and to hold them at levels that are sufficient to rein in the economy and bring inflation down. The tightening is starting to take effect. Recently released leading economic indicators worsened at an accelerating month-over-month pace in June. The picture would be even worse without the impact of stock prices, which are themselves part of the index of leading economic indicators. The S&P 500 (SPY) is on an absolute tear this year, up 18.7% as of my writing this and straight up since a series of high-profile bank failures in March. The NASDAQ (QQQ) is up 42% YTD, actually understating the 100%+ gains for many of the hotter stocks in the index. Traders are partying like it’s 1999. But by tightening yet again, Powell and the Fed are quietly tightening the economic noose.

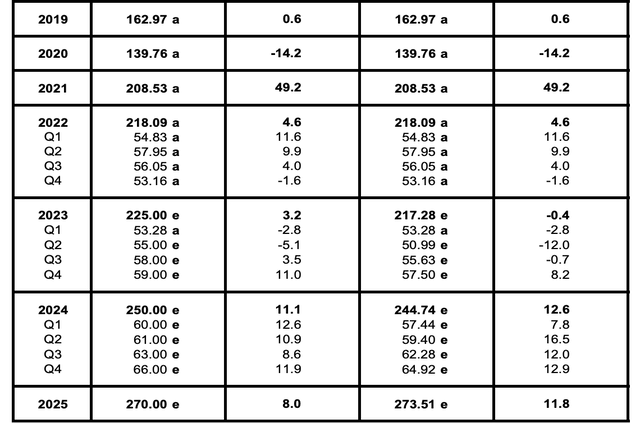

Large-cap equity valuations now trade at levels in history only matched by the dot-com bubble and the 2021 pandemic bubble. Consensus earnings estimates for 2023 are roughly $217 per share, which is a multiple of roughly 21x earnings on already inflated earnings estimates and down from the $218 earned in 2022. Investors are paying more and more for the same dollar of earnings, even while earnings overall are slowly falling. On the other hand, after years of runaway gains, the Fed is offering a golden ticket to 5.75% risk-free returns, which is more than the underlying earnings yield of the S&P 500 index.

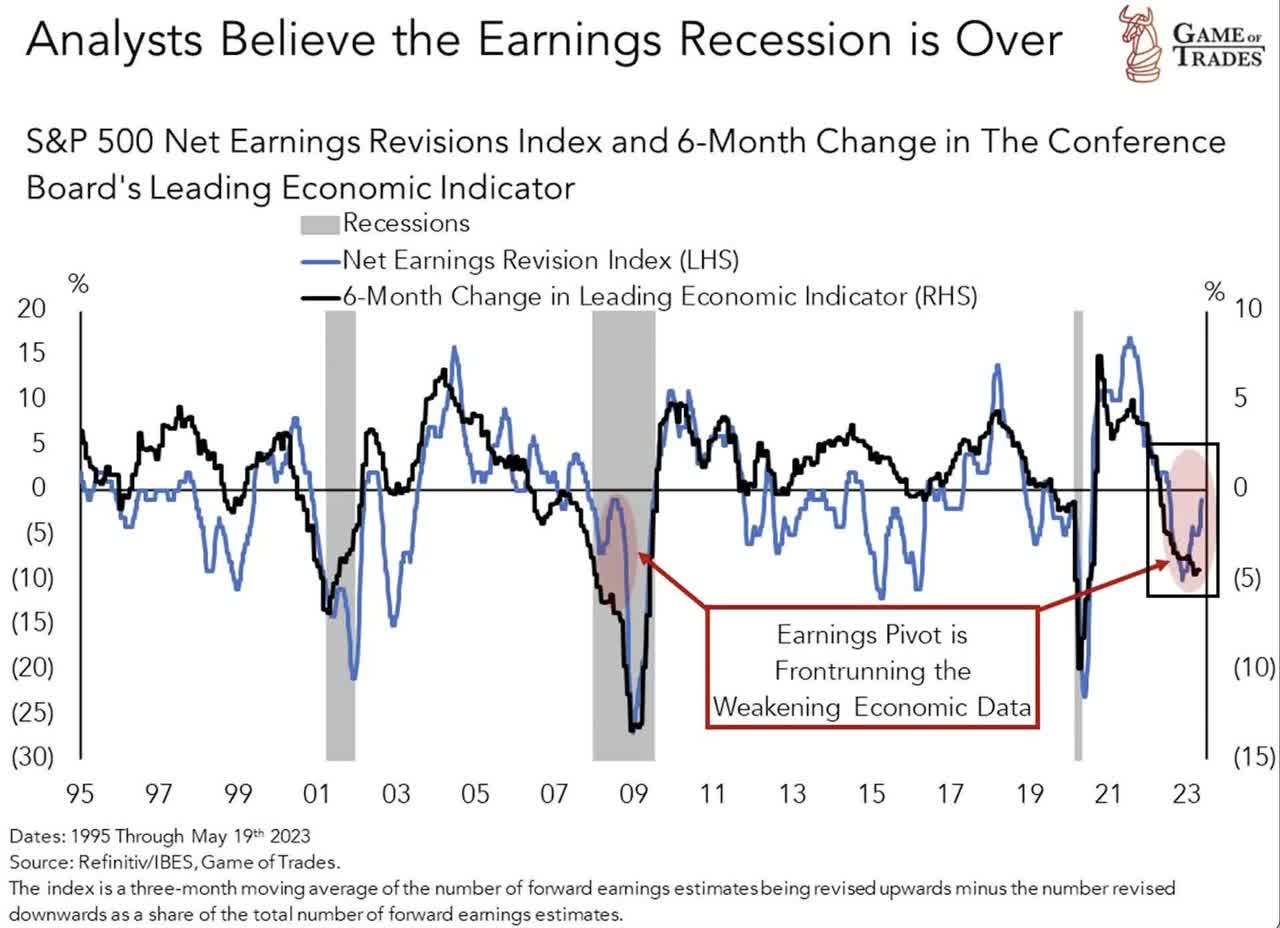

Analysts are pricing a massive earnings pivot from a recession that hasn’t happened yet, while many of the biggest companies in America are proactively reducing their payrolls. It’s not that ChatGPT is suddenly doing all the middle managers’ work, it’s that large corporations hired a ton of people during the pandemic and business is slowing down.

Earnings vs. Leading Economic Indicators (Game of Trades)

This chart dates to a couple of months ago, but the contrast is incredible. On one hand, leading economic indicators and the bond market are approaching warning signals of the magnitude given before the 2008 recession. On the other, the most speculative areas of the stock market are skyrocketing. American consumers still largely refuse to save and reduce borrowing, reducing their resilience to the eventual recession. This forces the Fed to hike yet again, lighting the fuse on an economic time bomb. Dwindling availability of credit is set to collide with market prices of goods (houses, cars, etc.) that are far too high for prevailing wages, at the same time the government is raising taxes and interest rates. As it was in 2008, the situation is largely the same in Europe, which has all of the same economic drivers as the US plus way more variable rate mortgages.

If Leading Economic Indicators Are So Weak, Why Is The Fed Still Hiking?

Good question. A few thoughts.

1. The Fed is already pot committed from getting behind the curve on inflation. One reason that the Fed is likely to continue hiking is the desire to avoid the “stop and go” policy mistakes from the 1970s and early 1980s. This is a valid concern. Then, inflation came in several waves, and after each wave, the Fed would ease up, only for inflation to come roaring back. In other words, the Fed didn’t fully understand the lag with which their monetary policies worked. The story eventually ended with Fed chair Paul Volcker being forced to raise interest rates to 20%, inducing a sharp recession. This is a natural consequence of Fed policy that is reactive rather than proactive. In Jerome Powell’s Jackson Hole speech last year, he alluded to this dynamic, sparking a rapid selloff in stocks. Here, even though the Fed likely had some advance notice that CPI numbers would be tame for June, making a U-turn on a planned hike would likely cause some market chaos. Another reason to not do this is that the Fed doesn’t want to import inflation from Europe- if the Fed decided to backtrack on hiking when the ECB and Bank of England are aggressively raising rates, then the dollar would likely fall 3-5% in a matter of hours, driving up the cost of imports and thereby causing inflation.

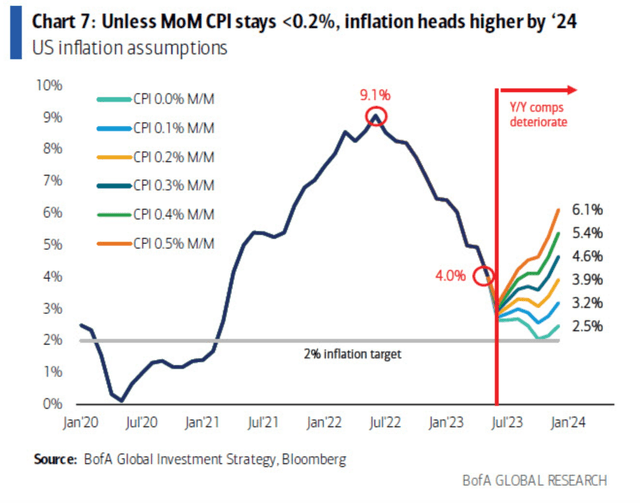

2. Worsening Y/Y comps show the Fed still has some problems controlling core inflation. Headline inflation has fallen largely due to decreases in food and energy after the world adjusted to the Russian invasion of Ukraine. Core inflation is higher than overall inflation, with the Fed’s preferred core PCE gauge still stuck at 4.6%. The calculations for CPI are weirder and have some quirks, but this graph illustrates the potential issue facing the Fed. If inflation rises at 0.3% per month over the next 6 months, that means the 2023 inflation will be 4.6%. That’s not nearly good enough for the Fed’s mandate, hence the need to keep hiking. The Fed already knew that June inflation would be a bit softer than expected when they indicated that they’d take rates to 5.75% or higher, so this is worth paying attention to. Moreover, controlling inflation is polling as the top priority among American voters.

Year-Ahead Inflation Comps (Bank of America via Bloomberg)

3. Econometric modeling suggests the Fed is still a little behind the curve on inflation, despite leading economic indicators rapidly weakening. This means that the Fed either needs to hike now, or they’re running the risk of being effectively forced to. This also means that the tradeoffs regarding growth and inflation could be worse than bulls think. For example, the Saudis are doing everything they can to successfully restrict the supply of oil. If they’re successful, energy costs could turn from a tailwind to a headwind, pushing inflation back up to 5% or more. This would expose the problem with core inflation that the Fed still has.

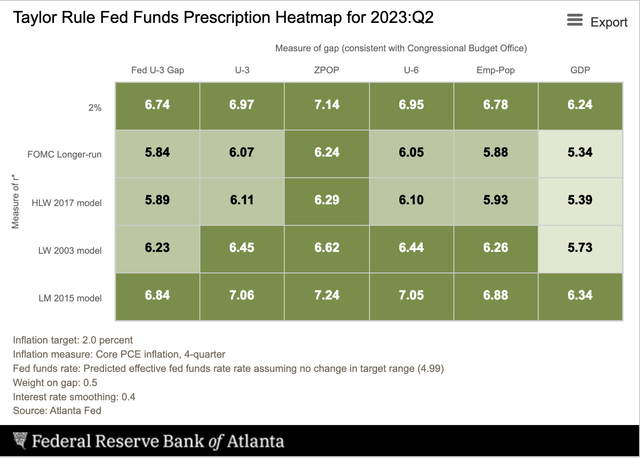

Here’s what my models are saying. I made a tweak to the last time I ran it- this time I’m upping the smoothing feature to adjust for the effect of newly falling rents across the US on overall inflation. The Fed still isn’t quite where they need to be, which is why they’re hiking.

Taylor Rule Utility (Atlanta Fed)

Here, all 30 of the model runs are above the current Fed funds rate of 5.00-5.25%. Most of the models suggest that a Fed funds rate above 6% is appropriate. Taking rates higher from here but below 6% is a decent short-term compromise, and that’s where I think the Fed will be at year-end. Believe them when they say they’re hiking. All bets are off when the eventual recession does start and a rapid rise in unemployment pulls the extra demand out of the economy, but this is where I’d expect rates to reach if the economy holds reasonably steady.

Ignore Economic Indicators At Your Peril

The rally off of the October lows has largely been about what hasn’t happened. Despite a sharp fall in stock prices last fall, earnings have held up so far in 2023, and are only off a few percent off of 2022 levels. Analysts had feared far worse, pricing a 2022 earnings recession and subsequent recovery. Now, the tables have turned. The recession hasn’t hit yet, but analysts still expect a post-recession earnings boom to occur.

I don’t see it. In two months, student loans kick back in, erasing about 1% of consumers’ after-tax income. Everything the Biden administration does to try to stop it on a large scale is likely to suffer the same fate in court as their first attempts at student loan forgiveness. The Fed will hike here in July, and likely again at least once more this year. Leading economic indicators continue to sequentially weaken. Raising taxes and hiking interest rates is not bullish.

The massive earnings pivot that analysts are expecting is not coming.

S&P 500 Earnings Actuals and Estimates (Yardeni Research)

Last year, S&P 500 components earned about $57 per share in Q2. This year, they’re expected to earn about $51, which is off 12%. That’s remarkably consistent with what the leading economic indicators are telling us. What’s not consistent with the leading economic indicators are the valuations of stocks and future expectations for earnings. The huge boom in Q3 and Q4 earnings is simply not coming with the Fed hiking rates and the Treasury raising taxes. Moreover, with the massive run-up in stocks, the burden of proof has shifted from bears betting on earnings to decline to bulls betting on earnings to soar.

Leading Economic Indicators (Conference Board)

Amidst the backdrop of a slow-motion commercial real estate train wreck and high-profile bank failures, the Fed has no choice but to hike yet again and guide for more. If you’re paying attention, credit is rapidly tightening.

- Mortgage News Daily is showing that US jumbo mortgages hit a 52-week high at ~7%, and this week were a bit more expensive than conventional mortgages for the first time in years. This time last year, jumbo mortgages were at ~4.8%, close to 100 bps cheaper than conventional mortgages. Once the credit train gets rolling, it tends to have a lot of momentum, and if the current trend holds, it’s possible and even likely that jumbo mortgages could hit 8%. This happened last in 2008. The Fed is using its regulatory powers to tighten real estate credit as well, for example with new rules penalizing banks that fail to require larger down payments on home loans.

- New York Fed data shows that loan rejections are soaring, particularly for auto loans and for consumers with FICO scores below 680.

- Other surveys show that business credit is tightening and that businesses are borrowing less, in some part due to higher rates. Bankruptcies of distressed firms continue to rise.

When you put all of this together, it’s hard to see how stocks continue to rise into a weakening economic environment, let alone continue to rise at a rapid pace.

When Will The Market Correct?

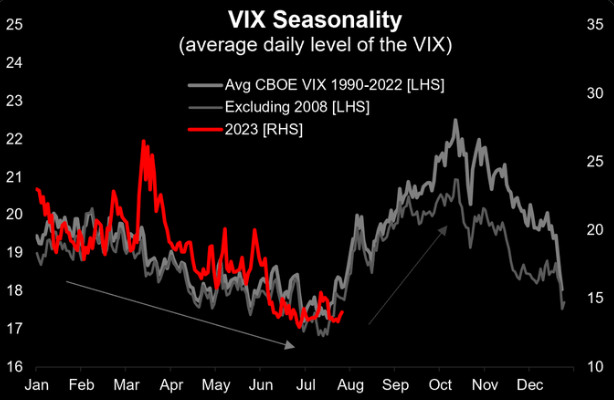

Summer trading is notorious for low volume, even complacency. Much of the market is currently at the lake, at the beach, or somewhere in the Western Mediterranean. But as July turns to August, volatility tends to rise, and it doesn’t stop there. Volatility continues to rise on average in September and October. I’d expect the low volatility regime to end and for some real price discovery to begin. For centuries, this same pattern has been repeated with corrections/market panics tending to occur in the autumn. Historically this was due to banks making loans to farmers that were repaid (or not) after the harvest. Even today, late summer and autumn seem to be when financial delusions are crushed.

Historical VIX Seasonality (Chartstorm)

There are a lot of junk theories being tossed around by traders about how the Fed’s tightening and QT don’t matter (or even that they boost the economy- they don’t), how stocks will never be cheap again, or that a recession would be bullish for stocks. The truth is less complicated. Higher interest rates incentivize saving and paying down debt over borrowing and spending. This slows the economy, and the effect is particularly pronounced on small businesses. The best you could say about higher rates helping the economy is that it discourages unproductive investment, perhaps leading to higher growth in the long run (5+ years). But first, all the nonsense malinvestment from the ZIRP has to be washed out. Monetary policy works with a long and variable lag, with the full effect of tightening being felt generally about 12 months or so after the Fed hikes. Traders piling on risk here aren’t too different from tourists in Amsterdam eating their third edible because the first two didn’t kick in. After the lag, it’s going to hit.

Bottom Line

Faced with the choice between earning a bit less than 6% in interest or paying 21x earnings for stocks, I’m going to stick to my guns here. While you may lose out to traders making speculative gains of 20%, 50%, or more in a matter of months, you’re not losing any purchasing power by being largely in cash or short-term bonds. And when the pendulum inevitably swings the other way, it’s quite likely that low-conviction traders who have piled into the market will exit en masse, giving you the option to buy stocks cheaply.

Read the full article here