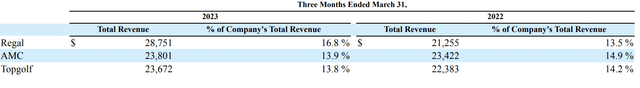

I’m out of EPR Properties (NYSE:EPR) after a more than three-year holding period that was entered at the onset of the pandemic. It’s been a wild ride and total returns since then have been material. My inaugural article; EPR Properties, Wrecked By COVID-19, Is A Strong Buy, set out why the zeitgeist of fear around COVID was overdone and whilst this has proved true, the pandemic would ultimately catalyze the restructuring of Regal Cinemas and now likely stands to derail one of EPR’s largest tenants AMC Entertainment (AMC). The situation is dire with AMC accounting for 13.9% of EPR’s rental revenue as of the end of its fiscal 2023 first quarter.

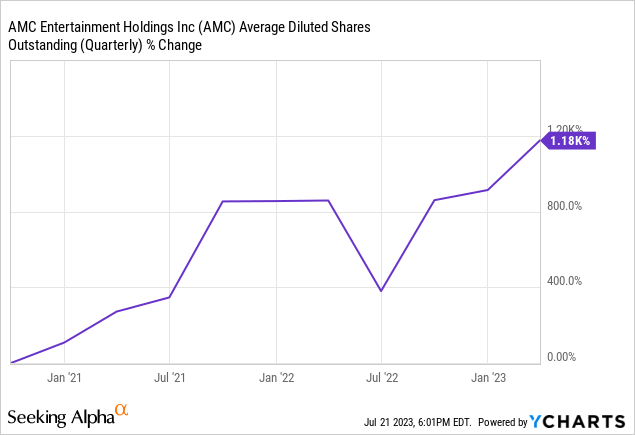

What has changed? AMC has been incredibly dependent on dilution to remain a going concern. The largest cinema chain in the US has increased the number of its weighted shares outstanding by north of 1,000% over the last three years. AMC hit a ceiling with the number of shares it could issue and faced intense opposition from its broad retail shareholder base, self-titled “Apes”, to expanding this ceiling. AMC tried to issue more common shares via the backdoor of a convertible preferred stock not subject to the cap. This was challenged by a shareholder lawsuit whose settlement was just rejected by a Delaware judge in a surprise ruling. It would not be controversial to state that the theatre chain has essentially been helped to meet rent to EPR through the most dramatic dilution of its army of retail investors.

The Ape Dilution Comes To An End To Render Future Rent Payments Uncertain

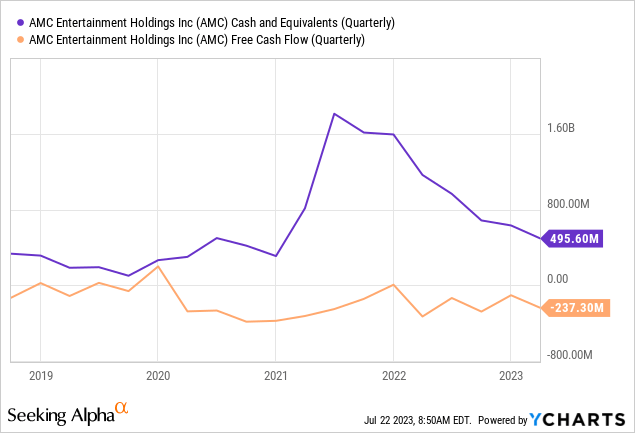

To be clear here, AMC is not going to file Chapter 11 next week. The company held cash and equivalents of $495.6 million as of the end of its fiscal 2023 first quarter. But this was besieged by a long-term debt of $4.86 billion and a free cash outflow of $237.3 million. Further, the first quarter benefited immensely from a movie slate that was boosted by Avatar: The Way Of The Water, a top 3 grossing movie of all time. It also included several big ticket releases including Ant-Man and the Wasp: Quantumania. AMC still lost a marked amount of cash in a quarter when the number of releases in the quarter was up 35% versus the year-ago period.

EPR Properties Fiscal 2023 First Quarter Form 10-Q

AMC faced a quarterly interest expense of $90.7 million during its first quarter, up 10.6% from its year-ago comp. And whilst AMC bulls would flag the current Barbenheimer hype as the type of viral dynamism that places theatres at the front of the post-pandemic entertainment world, the summer box office has been below expectations. Two tentpole releases Indiana Jones and the Dial of Destiny and The Flash were broad flops. Hence, the current negative viscosity of AMC’s free cash outflow is unlikely to moderate as its largely variable debt balance moves to reflect a Fed funds rate set to be hiked to its highest level in over a decade and set to be increased by another 25 basis points at the upcoming July 26th FOMC meeting.

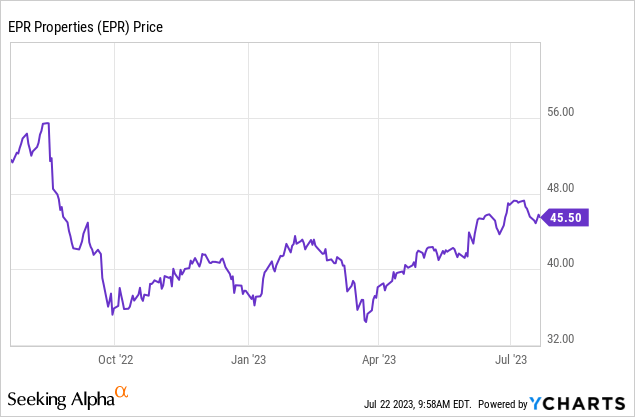

Possibly The Second Of EPR’s Top Three Tenants To File Chapter 11

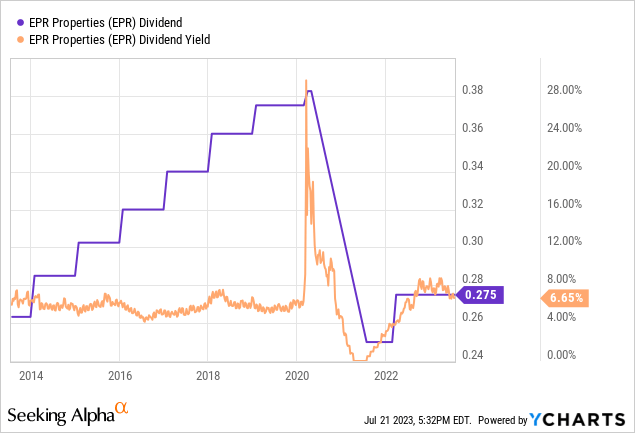

EPR fell markedly, as low as $35 per share, following Regal’s Chapter 11 bankruptcy filing in September last year. It’s possible that the company will retest these lows in the event of AMC having to restructure its debt with the same tool. Critically, AMC has a cash runway of around two quarters against its current cash burn trajectory. This is not a cash runway written in stone and AMC could take more extreme options to reduce its cash burn. Its CEO Adam Aron has proved incredibly adept at navigating the unfortunate position posed to AMC by the pandemic and doing what needed to be done to keep the firm as a going concern. In many ways, EPR has likely been preparing for this. The REIT last declared a monthly cash dividend of $0.275 per share, in line with its prior payment and for a 7.25% annualized forward yield.

This is just under the monthly dividend declared for much of 2014. The outlook for an expansion of the dividend was of course discombobulated by Regal, but the REIT last reported a first-quarter adjusted funds from operations per share of $1.30. This beat consensus estimates by $0.11 and was a growth of $0.14 from AFFO of $1.16 in the year-ago comp. EPR’s payout ratio is around 63.4% against the 3-month aggregate of its monthly payouts. Hence, any loss of rental revenue should not immediately be reflected by a cut to the monthly payout.

Fundamentally, EPR has not been as aggressive as it could have been in diversifying its revenues beyond theatres since the pandemic. Yes, bearish concerns around the death of theatres were overdone, but the concentration in Regal and AMC was always going to be a liability coming out of the pandemic. AMC’s financial health has been precarious since the era of stay-at-home orders and I’d have liked to see EPR be more aggressive in deploying its balance sheet and taking on more fixed rate debt to acquire other experimental properties. I’m out of EPR Properties against this more uncertain future for AMC. However, the preferreds like the Series G (NYSE:EPR.PG) continue to offer a more hedged exposure to the REIT for those looking to retain experiential property exposure. Will this movie have a bad ending? Possibly not. But I’m not sticking around to find out.

Read the full article here