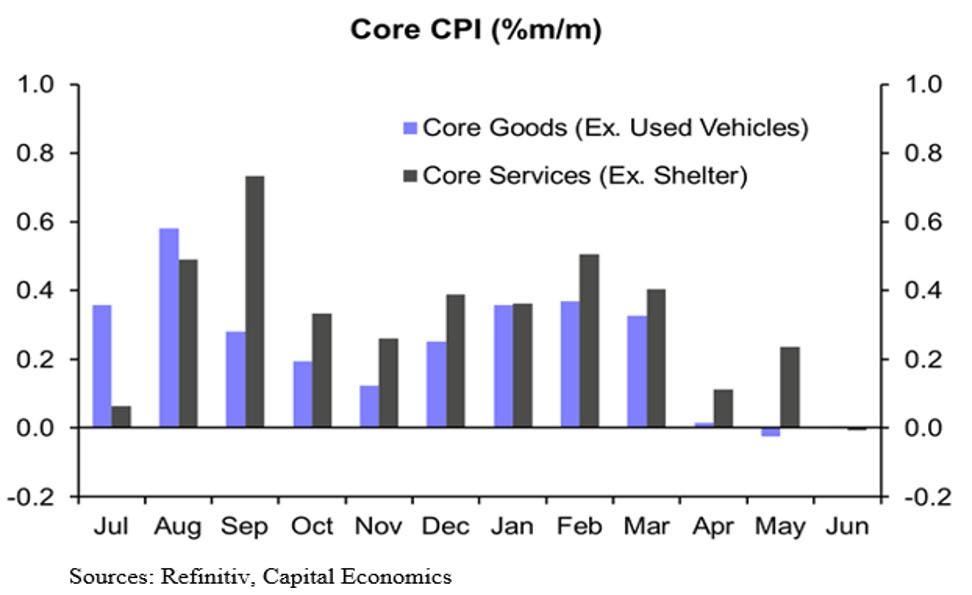

If you look closely at the far-right side of the chart and squint, you can see that Core Goods (ex-used car prices) and Core Services (ex-shelter) were both negative (slightly) in June. In addition, Jay Powell’s “go to” CPI sub-index, Services (ex-energy and shelter), showed up as a big fat “0%” in June. This made Economist David Rosenberg remark: “Memo to Jay Powell: mission accomplished.”

It appears that, Recession or not, inflation has been quelled. Nevertheless, more for credibility reasons than anything else, the Fed is going to raise interest rates another 25 basis points (0.25 pct. points) at this week’s July 25-26 meeting. Chief Fed hawk, James Bullard, is stepping down from his St. Louis Fed President position and says he won’t be participating in the rate setting discussions. We wonder if, as a result, the vote to raise will not be unanimous, given the presence of Austan Goolsbee, the new Chicago Fed President, who also happens to be a prominent economist in his own right.

Inflation’s Future

Shelter’s weight in the CPI is more than 33%. Note in the chart below the close relationship of CoreLogic’s

CLGX

Used Cars

Used cars, too, have been a poster child for the current inflation wave. Note the close relationship between CPI’s Used Vehicle sub-index and the Manheim Auction Price index. From June to July, that index fell -0.9% and is now down -11.1% from year earlier levels.

In June 2022, that index had risen +12.5% on a year over year basis! On the chart, the Manheim index is “advanced” two months, as it takes that long for the auction prices to translate to the consumer market. As a result, we know that, for at least July’s and August’s CPI, used car prices will be exerting a negative bias on the inflation indexes. And we think used car price declines will continue.

Economic Activity

Retail Sales fell -0.2% in June. The “soft landing” markets were expecting +0.5%. After adjusting for inflation, real retail sales (volume) for Q2 fell more than -2.5%. The chart shows Johnson Redbook Same Store Sales (week of July 15) have now turned negative on a year over year basis.

Meanwhile, consumers, feeling inflation’s pinch, have tried to keep up their living standards by buying on credit (yes, despite 20%+ interest rates) as shown on the left side of the next chart. And, of course, that futile attempt results in rising credit card delinquencies (right side).

In response, what do the banks do? They restrict credit! The next chart shows the negative trends in both consumer and business loans. The U.S. economy is credit dependent. Restricted credit means slower growth/Recession.

Housing

Existing Home Sales fell -3.3% in June from their May level and are now off -18.9% from a year earlier. This has occurred despite Zillow’s Median Home Price Index (May) showing a -2.4% contraction from May 2022. Note that in May 2022, that index was showing a +14.9% year over year growth. But, despite the fact that New Home Sales have recently shown buoyancy (lack of Existing Home inventory – most existing home owners have a low-rate mortgage), housing starts are still off more than -8% over the year.

World Economies

In the rest of the world, China’s Q2 GDP rose a paltry +0.8% over the prior quarter. That’s less than half the +6% to +8% expectation. Retail sales were up a skimpy +0.2% in June and only +3.1% year over year. And exports, China’s specialty, fell a whopping -8.3%. Taiwan, a leader in chip making, had their exports contract -25% from a year earlier, and as of mid-July, So. Korea’s are down -15.2%. In Europe, France and Italy are already in Recession, and such is inevitable for Germany. This is symptomatic of what is happening to the world’s economies.

Leading Indicators

The immediate future doesn’t look promising, at least that’s what the 15th consecutive negative reading from the Conference Board’s Leading Economic Indicators (LEI) points to. June’s reading was -0.7%.

GDP vs. GDI

When it comes to assessing the health of the economy, GDP (Gross Domestic Product) is the go-to indicator. Econ 101 explains that it is composed of C + I + G + E (Consumption + Investment + Government Spending + Net Exports). But there is another concept called GDI (Gross Domestic Income) which is a view of the economy from the income side. It’s formula: Wages + Profits + Interest Income + Net Taxes. Theoretically, GDP and GDI are equal. If they aren’t, it is due to measurement errors.

Some years ago, a Federal Reserve researcher (J. Nalewalk) showed statistically that early estimates of GDI are more accurate than those of GDP. We bring this up because, as the chart shows, in Q1 and Q2, GDI has declined while GDP was slightly positive. More disconcerting, a close examination of the chart shows that it is quite unusual for there to be a large discrepancy, and almost never for two quarters in a row. Furthermore, the norm for discrepancy is that GDI is higher than GDP. We see negative growth in income as another sign of a weakening economy and Recession.

Employment

The employment numbers are key for the Fed. While they can’t say so, they clearly want to see the unemployment rate in the 4%+ range. No dice. The U3 rate appears to be stuck in the mid-3% area. This problem looks to be demographic – baby boomers retiring with not enough bodies in the younger generations to fill in. However, there does appear to be some emerging good news. The chart on the left shows that job openings peaked in 2022. The right side shows a dramatic fall in the “Quits Rate,” so the Fed’s worry about wage push inflation should soon fade. Note the close (lagged) relationship between the Quits Rate and the year over year increase in the wage index, especially beginning in 2021. If the relationship holds, wage growth will decelerate.

Productivity

Recent declines in productivity is yet another in the long list of Recession indicators. Falling productivity only happens around Recessions. Productivity growth has been negative for more than a year (five quarters). When productivity falls, it is normal for layoffs to occur. But, because of today’s labor shortages, the layoffs we would normally expect have not occurred. This is evident in the relatively low level of Initial Unemployment Claims (although we do note that Continuing Claims have been rising). Without layoffs, the result of falling labor productivity is normally lower profit margins. We note here that the FactSet forecast for Q2 earnings is a fall of -8% vs. Q2 ’22. And we expect Q3’s profits to be negative on a year over year basis.

Some Good News

There is one piece of good economic news. There is a boom in non-residential construction, and this is keeping construction workers employed. The political move toward protectionism (in this case onshoring of critical tech industries) has created a construction boom.

Final Thoughts

It is no surprise to us that key Recession indicators have continued to deteriorate, even while the equity markets have convinced themselves (and apparently some equity-based economics teams) that a Recession has been avoided and a “soft landing” is at hand. The political elites have even coined a name for this economy – “Bidenomics.” We think this will backfire as the Recession unfolds.

We await the Fed’s 25 basis point hike on Wednesday (July 26). The markets have set the odds of such an event at a near certainty (99.8%). The economic data continues to deteriorate, but a rising stock market has convinced many that all is well. After all, how can the stock market be rising if a Recession is at hand?

For us, the GDI data are quite compelling. Besides the non-residential construction phenomenon and the low level of unemployment due to demographics, positive economic data is rare. In fact, we think that, over the long-run, the demographic issues will become the major obstacle to economic growth. But today, negative productivity growth, and rising debt levels are major concerns.

It is our view that when the National Bureau of Economic Research (NBER) gets around to dating the Recession, Q1 or Q2 will be designated as the start.

(Joshua Barone and Eugene Hoover contributed to this blog.)

Read the full article here