Herbalife Ltd. (NYSE:HLF) has been a disputed and controversial choice for investors over the decades, with the sale of nutritional products made through multi-level marketing [MLM] techniques.

Multi-level marketing, also known as direct marketing or network marketing, is the process of selling products directly to consumers using independent sales representatives. The primary appeal to new recruits includes promises of wealth and independence, while being able to work out of your home. Often, illegal pyramid schemes are present in MLM inventions, where the original developers get rich, while the newest sales associates are left with substantial “start-up” fees/losses and no real income.

Company Homepage – July 21st, 2023

My job in this article is not to pass judgement on the business model, but point out after nearly 43 years in business (publicly trading since 1986), with tens of billions in revenue generated over that span, the HLF stock ownership story is perhaps as cheap now as it has ever been on underlying fundamentals. In addition, a monster borrowed and sold-short position could be trapped if sales and earnings reverse into a sizable uptrend going into 2024, like now projected by Wall Street analysts.

The upside argument is better operating results will encourage new investors to buy the stock, while shorts start to experience heavy losses on their bearish trade idea. The extra volume of buy orders, as short sellers reverse course and purchase shares to close positions, could serve to create an unusual imbalance in share supply/demand. If aggressive buyers outnumber sellers by 2 to 1, or 3 to 1 daily for weeks on end, the price could jump +50% to +100% in a classic “short squeeze” scenario.

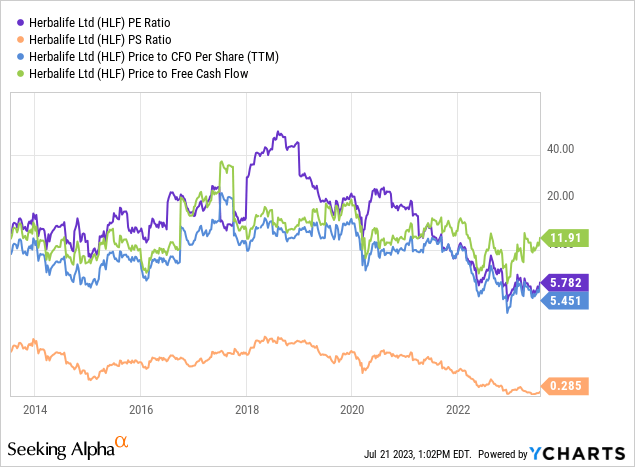

Ultra-Low Valuation

The core bullish story is found in the current valuation of the stock vs. what the business is generating for owners. On price to trailing earnings (5.8x), sales (0.28x), and cash flow (5.5x), HLF is effectively trading around its 10-year low presently. Additionally, despite a “free” cash flow multiple of 11.9x stacking up as comparatively average over the latest decade of history, the projected pickup in income (and elimination of temporary headwinds) should produce a number well under 10x next year.

YCharts – Herbalife, Price to Basic Fundamental Valuations, 10 Years

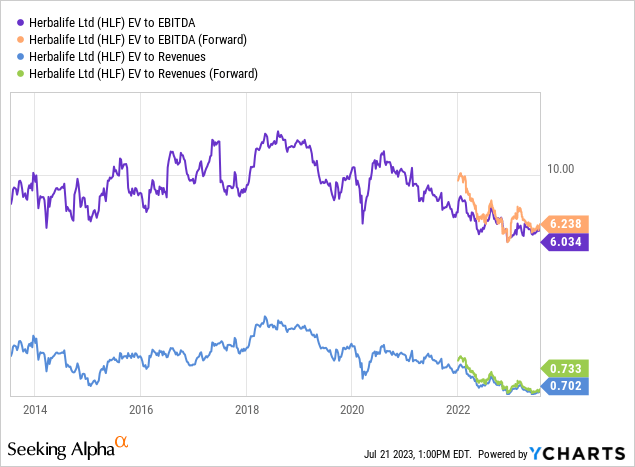

Even more impressive is the enterprise valuation on basic cash EBITDA and revenues. When we add total debt and subtract cash holdings to the equity market capitalization, a relatively complete picture of operating results on zeroed-out debt, theoretical net acquisition cost for a single buyer is created.

YCharts – Herbalife, Enterprise Valuations on EBITDA & Sales, 10 Years

EV to EBITDA around 6x and sales near 0.70x in the summer of 2023 is essentially the least expensive setup for new Herbalife buyers in recent memory. If you like to “shop” company valuations, and are looking ahead to an improved business outlook, there’s plenty to be upbeat about.

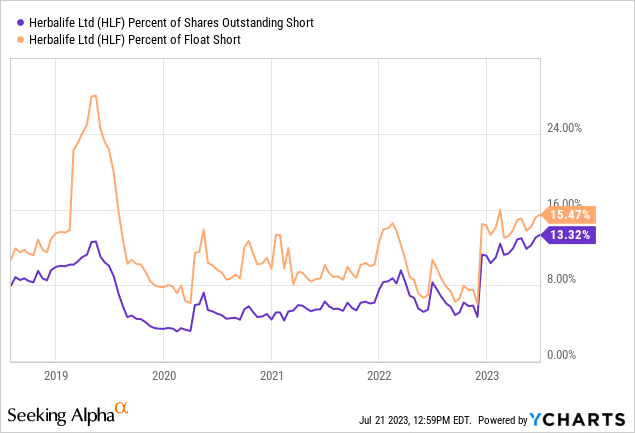

Short Interest Logic and Positioning

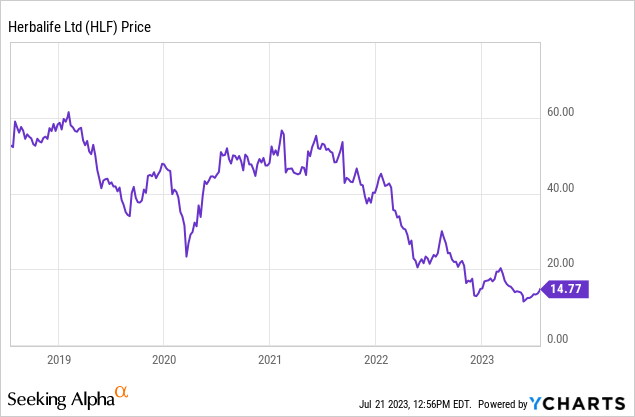

The curious part of the Herbalife investment proposition is investors are taking a very negative view of the company today, all because of PAST events. The #1 reason to shy away from owning HLF is share performance has sucked for years (pardon my French). Below is a 5-year graph of weekly price changes.

YCharts – Herbalife, Weekly Price Changes over 10 Years

Had you purchased a stake at $60 in early 2019, you would not be happy with shares sitting at $15 (a -75% price loss) four years later (receiving no cash dividends over this period).

Then, a dip in operations has occurred as the pandemic has faded. During 2020-21 a robust climb in consumer/distributor sales and income took place as a consequence of unusual work-from-home demand.

Short sellers have confidently jumped on both ideas in 2023 and more than DOUBLED their bets against the company’s stock vs. late 2022. With 15% of share float and 13% of outstanding share counts now pre-sold on borrowed stock from others, shorts are confidently sitting on only negligible gains overall, measured from the December spike in positioning. I am guestimating (having played short squeezes extensively since 2006), HLF’s price would be $5 to $10 higher absent the significant and skewed effect of this extra selling in the open market.

YCharts – Herbalife, Monthly Short Positioning, 5 Years

I would also point out that total company sales have only risen about 10% over the past decade. This appears to be a business fading into the sunset, another solid reason to consider selling or shorting the stock.

But wait! Management has aggressively used nearly all free cash flow over the years to buy back shares, instead of investing capital into growing the business through plant & equipment spending and acquisitions. When you properly account for the better than 50% reduction in outstanding shares over the previous 10 years, revenue growth has actually averaged a stronger than +7% annual increase “per” share, which has outperformed many brand-name blue chips on Wall Street.

This financial engineering effort is also keeping pressure on short sellers as available supply to short is constantly shrinking, while future results are “leveraged” for remaining longs without the use of added debt. Any sizable uptick in operations should increase the worth of shares rather rapidly is my thinking.

Technical Momentum Reversing to Upside?

If the short squeeze setup is ready for ignition, we need some evidence regarding a reversal in selling pressure. To be honest, several hints of trouble for the short position have appeared on the charts since May.

First, many trading-health indicators bottomed on the December skid in price, which you can review on the 18-month chart below. The Accumulation/Distribution Line and On Balance Volume indicators reached new lows at the same time (circled in green). However, the share quote low in May was “not confirmed” by the two momentum creations, and most others I watch closely.

Second, the 20-day Chaikin Money Flow calculation has turned quite bullish since the end of June. A CMF swing from money outflows to inflows happened during July of last year and January of this year, just before price jumped 30% and 20% respectively. We could, at a minimum, experience another rebound to $16 or $17, as a retest of the 200-day moving average. My thinking is a real turnaround in operations could easily support breaking well above the 200-day MA to as high as the next overhead price resistance level from February near $20.

StockCharts.com – Herbalife, 18 Months of Price & Volume Changes, Author Reference Points

Final Thoughts

One potential short squeeze catalyst could be the Q2 earnings report, scheduled for release on August 2nd. If results impress or guidance is raised, the shorts could be stuck in an every-man-for-himself rush to the exits.

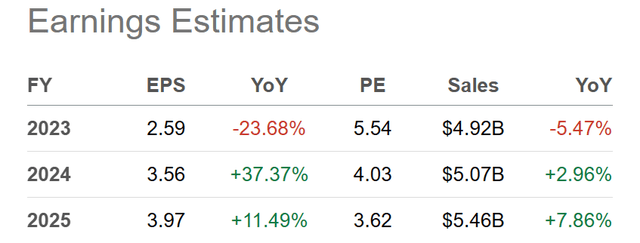

Below is a table of the turnaround forecast in earnings projected for 2024-25 by Wall Street analyst consensus. Yes, Herbalife could be priced at a super-low forward P/E of just 4x today!

Seeking Alpha Table – Analyst Estimates for 2023-25, Made July 20th, 2023

The main risk for the company is a recession with higher interest rates could undercut income generation. Herbalife held over $2.4 billion in debt (down from $2.8 billion in 2021) ending Q1 in March vs. an equity market capitalization of $1.5 billion at $15 per share. So far, total interest expense has stayed around $140 million the last three years (vs. after-tax income of $250 million over the trailing 12 months). Nevertheless, a weaker economy with lower sales and business profitability could lead to bond rating downgrades alongside higher expenses eventually. The majority of its debt will likely have to be refinanced at greater borrowing expense between 2024-26.

How high can Herbalife go? That’s a fair question. I don’t see any reason why it cannot trade back to its 52-week high of $30, given a real turn for the better in operating profitability. Such would put the valuation story closer to 10-year normal levels, while a P/E of 8x “forward” estimates would still be a distance from expensive vs. S&P 500 estimated P/Es in the 15x to 17x range for 2024. Remember, a $30 price from $15 today would equate with a gain of +100% for smart buyers (or lucky ones depending on your point of view).

As a best-case scenario for traders, an exaggerated short squeeze spike on truly positive operating news over the next quarter or two may allow price to overshoot $30 on the upside. Don’t say it cannot happen. This security has a history of wild swings over the decades.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Read the full article here