Welcome to another installment of our BDC Market Weekly Review, where we discuss market activity in the Business Development Company (“BDC”) sector from both the bottom-up – highlighting individual news and events – as well as the top-down – providing an overview of the broader market.

We also try to add some historical context as well as relevant themes that look to be driving the market or that investors ought to be mindful of. This update covers the period through the second week of July.

Market Action

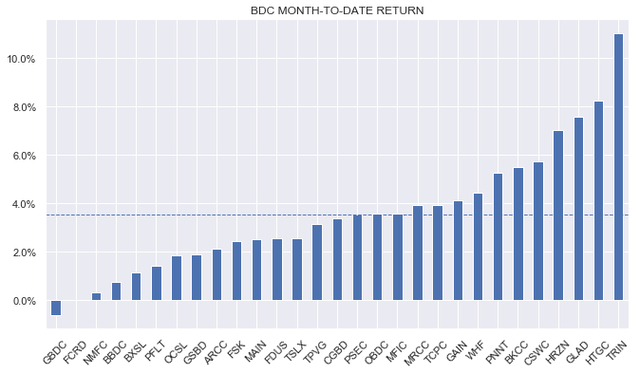

BDCs had a big week with a 2% total return, extending their recent rally. Month-to-date the sector is up nearly 4%, with venture-debt focused lenders like TRIN, HTGC and HRZN in the lead.

Systematic Income

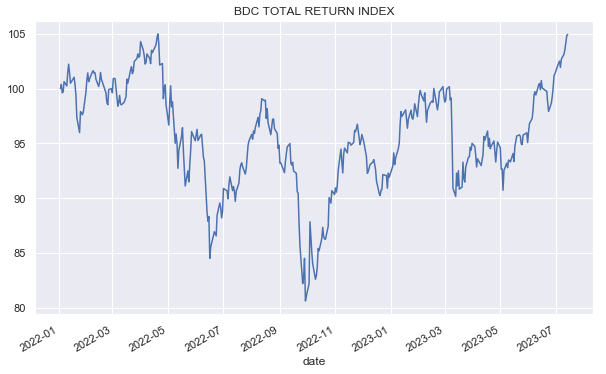

The sector is up by double-digit figures this year and is now at its highest point since the start of 2022 in total return terms.

Systematic Income

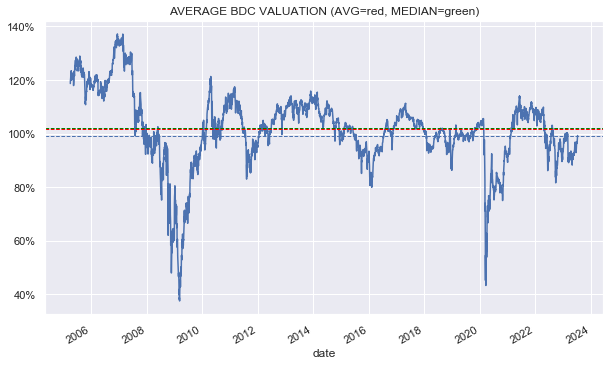

The valuation of the sector is now right around 100%, just shy of its long-term average.

Systematic Income

Market Themes

We recently discussed a closed-end fund, Barings Corporate Investors (MCI) in one of our CEF weeklies. MCI is a kind of BDC-lite as much of its portfolio is in private credit. One commenter said – why not buy a real BDC like MAIN and get double the return. In this section, we take a look at the mechanics of BDC returns in the context of their valuation.

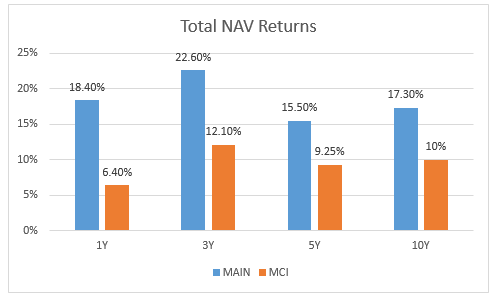

First, the double return figure is questionable. In order to get anywhere close to a double total NAV return, we have to use a 1Y period, which is the only period where MAIN has double or stronger returns than MCI. Over a more sensible longer-term period like 5 years, MAIN has a 15.5% return while MCI has a 9.25% return. So yes, MAIN has done a lot better in total NAV terms.

Systematic Income

But here is the important bit – investors don’t buy BDCs (or CEFs for that matter) at the NAV. They buy them at the market price which, in the case of MAIN, is 50% above the NAV and in the case of MCI 6% below the NAV.

Let’s assume that MAIN absolutely kills it again over the next 5 years just as it did over the last 5 with a 15.5% total NAV return while MCI delivers the same respectable 9.25% total NAV return. What we really need to do is to calculate the total NAV return adjusted by the valuation, which we can by just dividing the return by the valuation.

The intuition here is simple: $1 spent by a MAIN investor only entitles them to 67 cents of the NAV, meaning that invested dollar wouldn’t earn a 15.5% return but 67% of that return or 10.3% over the next 5 years if the total NAV return is 15.5%

If we do the same exercise with MCI, we get 9.9%. In other words, the two are not far from each other from a return on invested capital perspective assuming unchanged valuations.

Investors who prefer MAIN over MCI at current levels implicitly either think that performance of MAIN will improve significantly relative to the sector, or its valuation will outperform relative to the sector. All certainly possible, but from where we sit, MAIN is priced for perfection.

Market Commentary

We are starting to get an early preview of BDC Q2 results. Saratoga (SAR) always reports early as it has a different calendar period. The NAV fell 3% primarily due to unrealized depreciation. Despite the drop during the quarter, the NAV has held up well since the start of 2022 with an increase of about 5%.

Net income increased by 10%. Portfolio quality looks to be doing well, with no assets expected to result in a loss of principal according to the company and 3.5% of assets in the Underperforming bucket. There was one non-accrual at 0.9% of the portfolio on fair-value. Overall a good result which bodes well for the sector.

Stance and Takeaways

With the recent run-up in BDCs, we just trimmed our allocation to the sector in favor of more resilient securities. While the recent set of benign inflation readings suggest the Fed could be done very soon, it doesn’t mean it is ready to take rates down. In the meantime, a lot of the tightening to date is yet to make itself felt while the recent rise in loan defaults is clear that many borrowers are struggling with servicing the debt. While BDC yields remain attractive, the valuation on offer leaves too little margin of safety in our view. We expect to see lower valuations across the sector in the coming months, which would offer more attractive entry points.

Read the full article here