I joined Seana Smith and Akiko Fujita on Yahoo! Finance this Tuesday. Thanks to Taylor Clothier for having me on the show and Sydney Fried for the support. We delivered our update on Cooper Standard (which discussed new car and TRUCK demand/incentives), BAC, VNO, Small Caps, Rates, Fed, earnings, outlook and more. There are quite a few surprises throughout, but most importantly is that the real money will not be made chasing the indices in 2H:

Here were a few of my show notes ahead of the segment. The interview covered a lot more:

Thomas Hayes Thomas Hayes Thomas Hayes

Sentiment

This Tuesday, Bank of America published its monthly “Fund Manager Survey.” I posted a summary here:

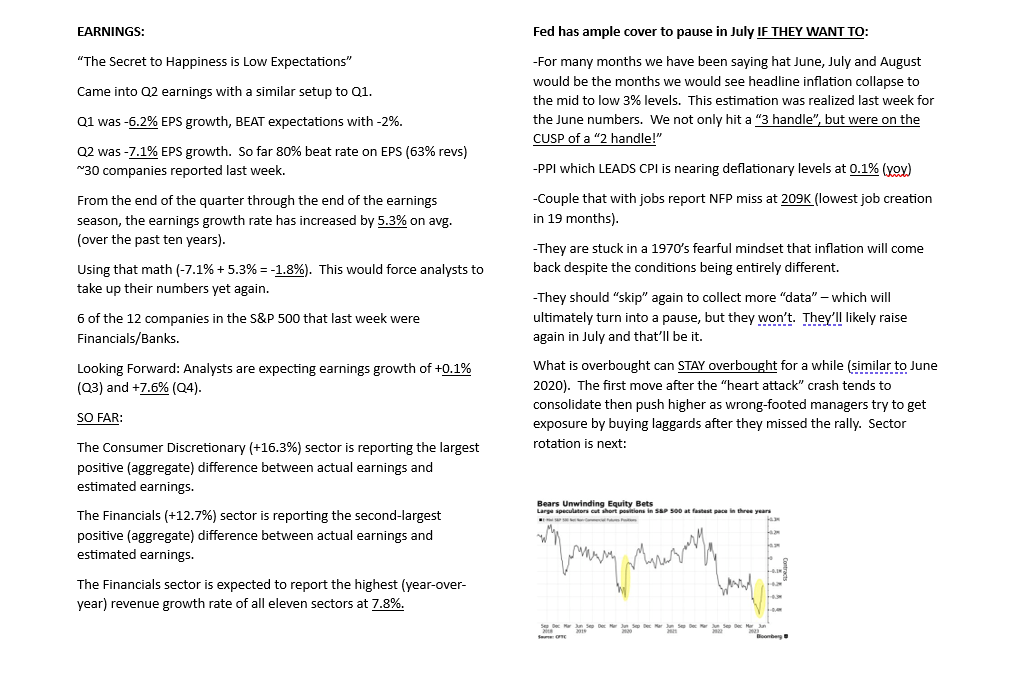

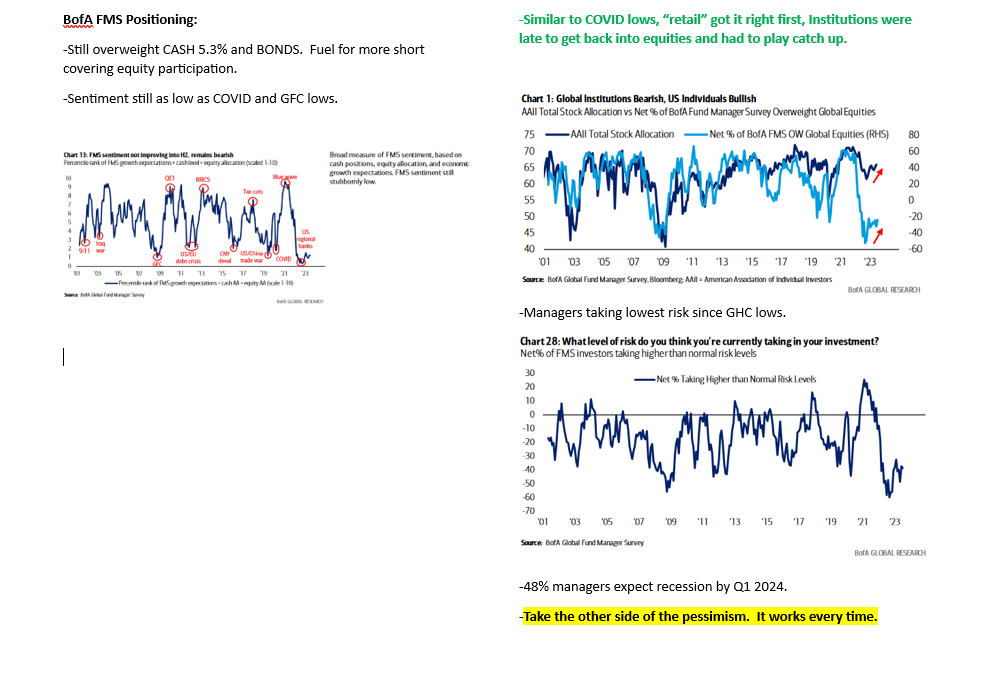

Here were the 5 key points:Similar to COVID lows, “retail” got it right first, Institutions were late to get back into equities and had to play catch up.

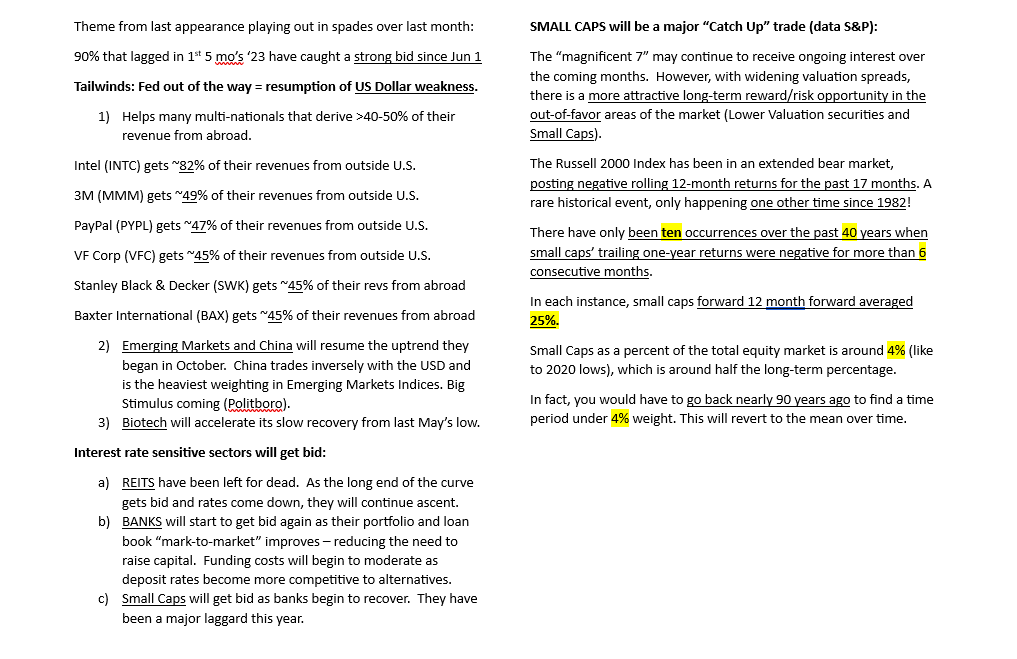

Managers INCREASED their cash positions this month. They will be forced to buy up more and more. We are seeing it already.

BofA

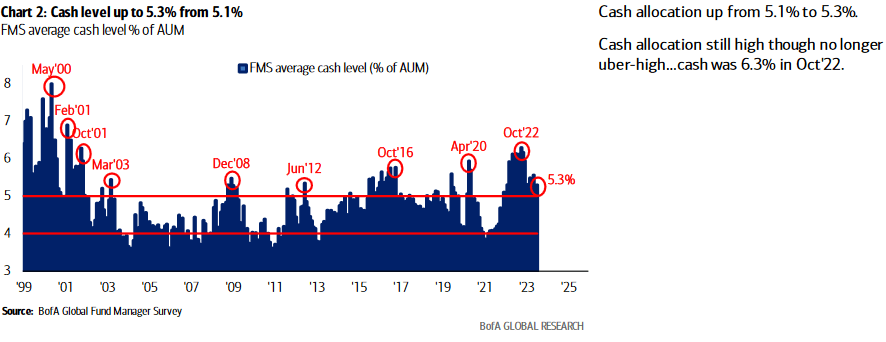

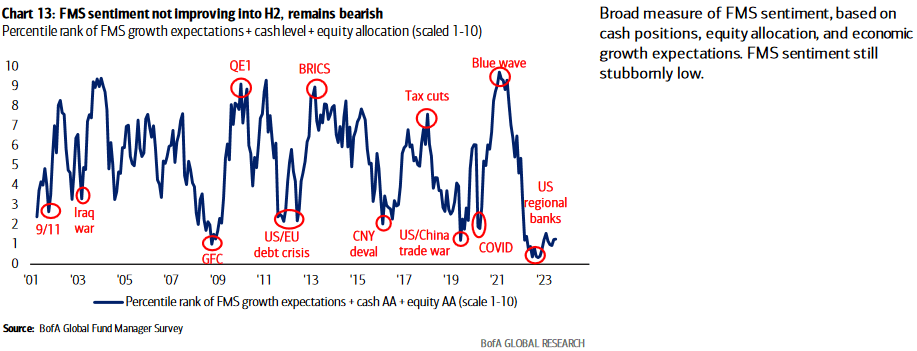

Sentiment is at the same pessimistic level you see at market lows (not highs):

BofA

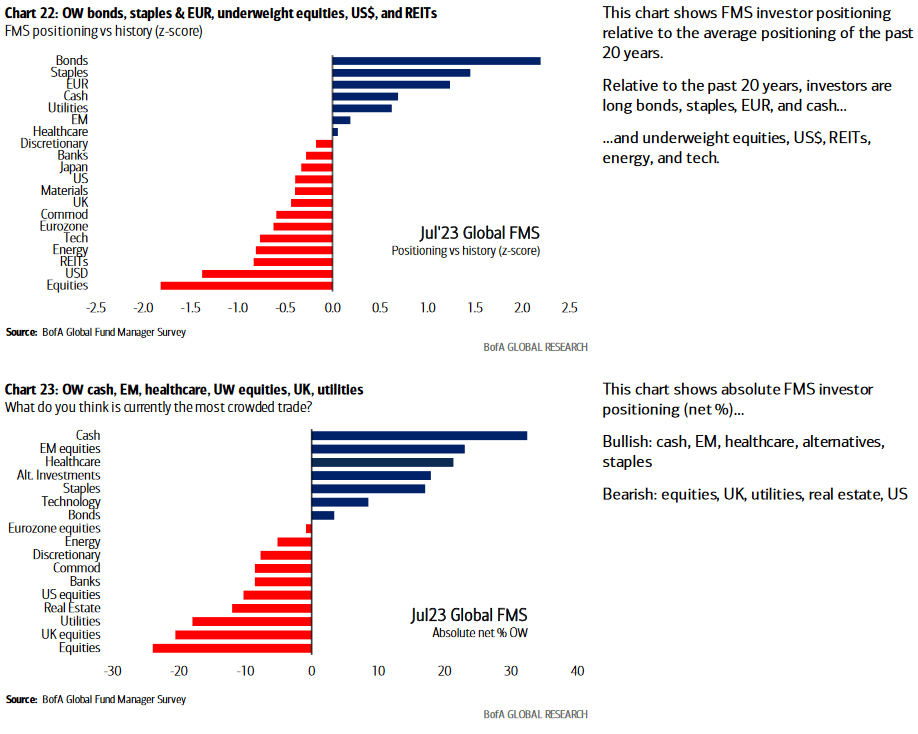

Managers still overweight cash and bonds. Underweight equities. You know what to do!

BofA

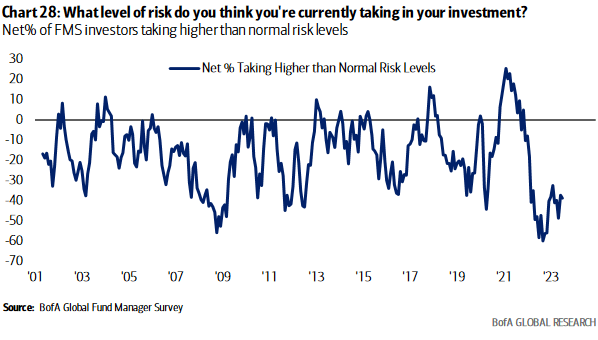

Investors taking the least risk since 2009 lows.

BofA

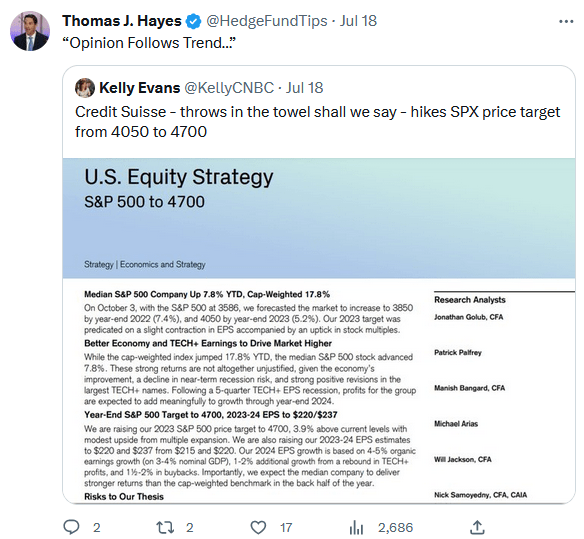

Always remember…

Thomas J. Hayes

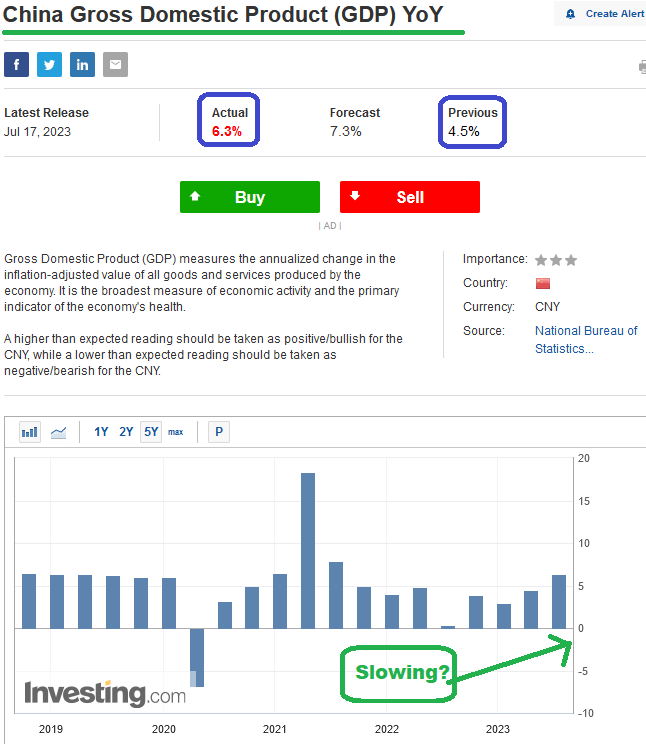

China Updates

Investing.com

Now onto the shorter term view for the General Market:

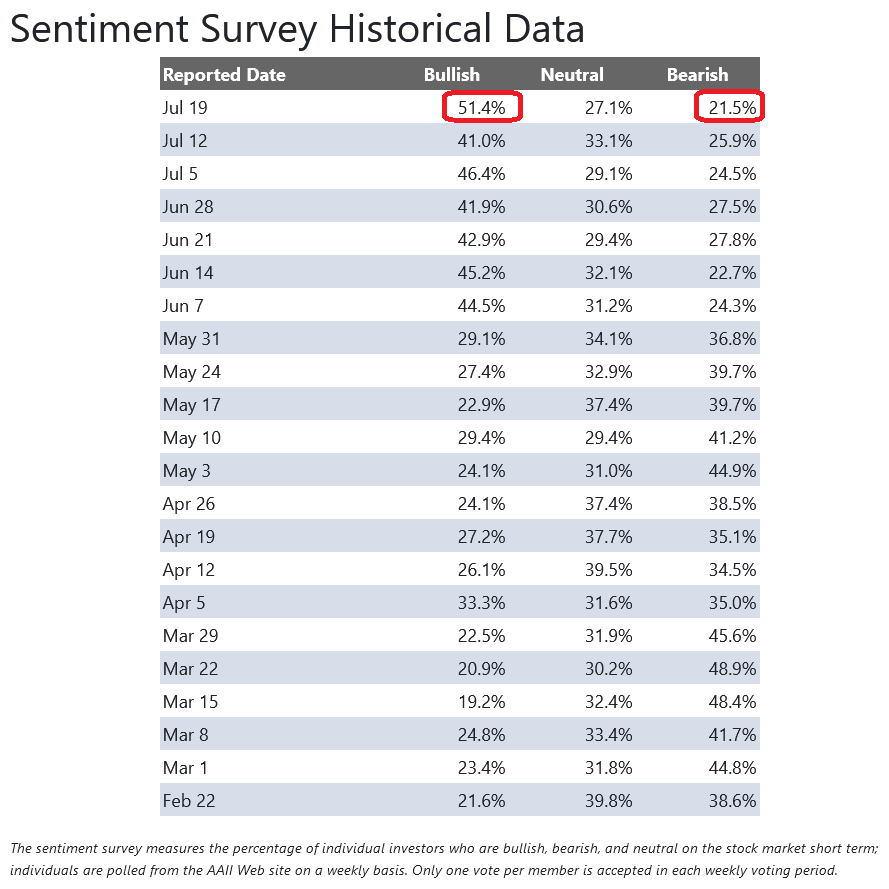

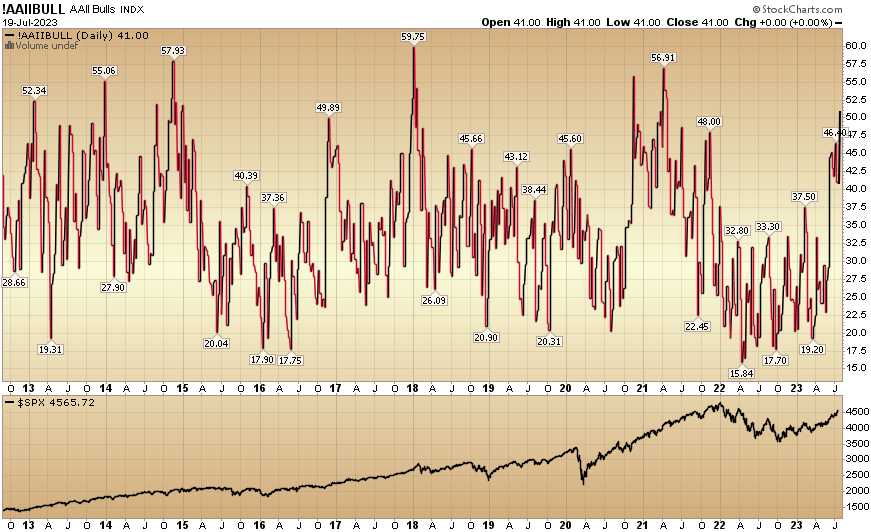

In this week’s AAII Sentiment Survey result, Bullish Percent jumped to 51.4% from 41% the previous week. Bearish Percent dropped to 21.5% from 25.9%. The retail investor is very optimistic. This can stay elevated for some time based on positioning coming into these levels, but it would not surprise us to see a little give-back in coming weeks (even if we were to push a bit higher first). Keep in mind, institutional investors are nowhere near fully invested yet, so there will be a persistent bid on any bumpy pullbacks through year-end.

AAII.com Stockcharts

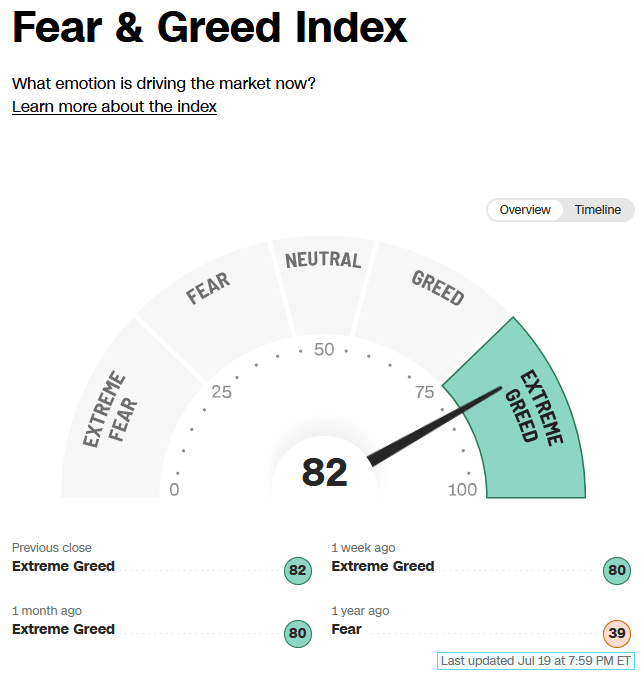

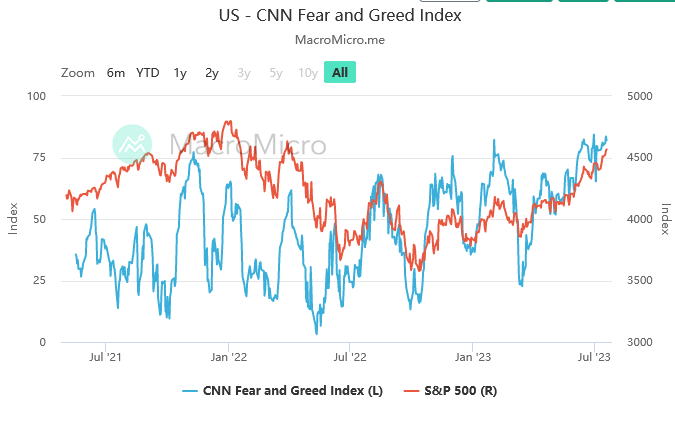

The CNN “Fear and Greed” ticked up from 80 last week to 82 this week. Sentiment is hot and has remained pinned for several weeks.

CNN MacroMicro.me

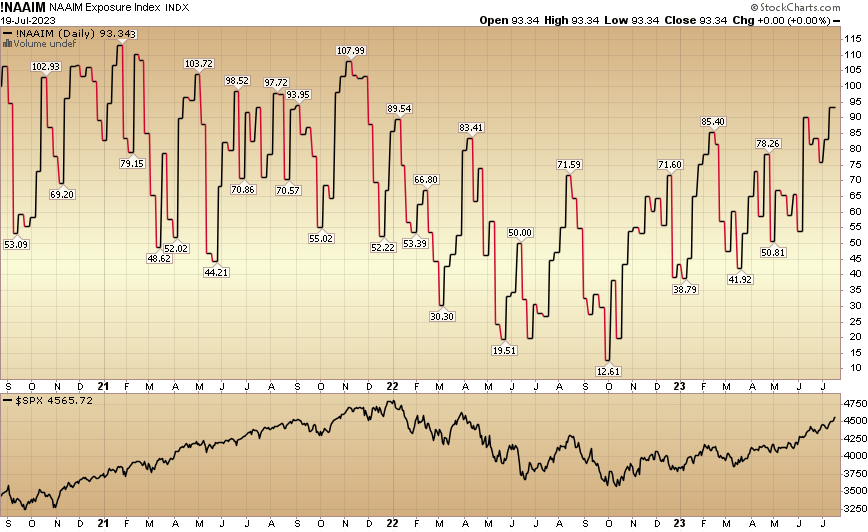

And finally, the NAAIM (National Association of Active Investment Managers Index) moved up to 93.34% this week from 83.11% equity exposure last week. Managers have been chasing the rally.

Stockcharts

*Opinion, not advice. See “terms” at hedgefundtips.com.

Read the full article here