By Brian Nelson, CFA

Artificial intelligence is here. Inflation appears tamed. Unemployment is still near all-time lows. The residential housing market is holding up. The stock market remains resilient supporting household wealth. The Fed has raised rates considerably, translating into tremendous future dry powder to stimulate equities. The banking system was challenged yet again with SVB Financial (OTCPK:SIVBQ) and showed that government agencies were ready to act and in a big way to keep the financial system sound. The regular goings-on and tit-for-tat with China, North Korea and Russia continue, but that’s nothing out of the ordinary. Asset allocators again were burnt by shifting into bonds as big cap tech and large cap growth rallied significantly so far in 2023.

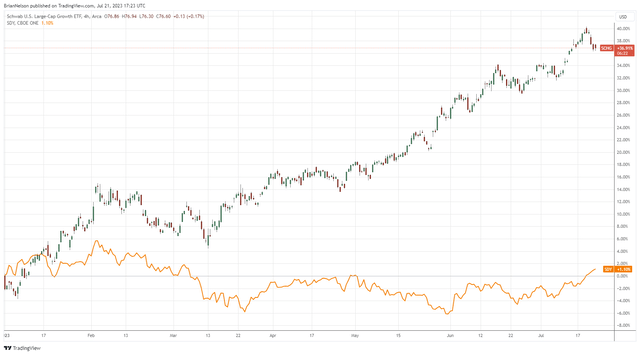

The area of large cap growth is up about 40% so far in 2023 while dividend growth investing is roughly flat. (TradingView)

What does all this mean? Well, we believe it’s a new bull market in equities, and in this article, we highlight five stocks to consider for the good times to come. Many of the stocks below pay a dividend, but it’s important to note that a focus on dividends should not be the primary area of concern for investors. For example, as we note in this article, high yield investing and dividend growth investing may have cost retirees greatly during the past decade or so. When it comes to the dividend, it’s important to think of it this way: If you have a $10 stock, and it pays a dividend, you now have a stock that is $9 and a $1 in dividends. That’s how it works. With that said, let’s dig into five of our favorite ideas for this new bull market!

Microsoft Corp. (MSFT)

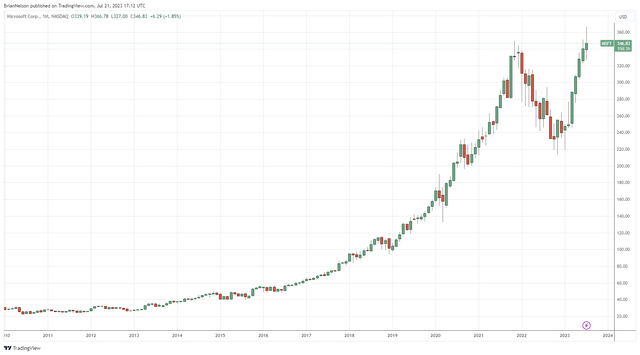

Microsoft’s shares have had a fantastic run. (TradingView)

Microsoft, by far, is one of the best ways to play the proliferation of artificial intelligence. The company has already rolled out AI across some of its products for a nice step-change in price, and we would expect price increases to continue as more and more users see tremendous value in its AI tools. The firm is working to close its proposed acquisition of Activision Blizzard (ATVI), and while we generally don’t like the all-cash deal, we’re starting to think that upside over the next decade for this transaction may turn out to be significantly material as Microsoft post-deal continues to re-build a war chest of net cash on the books as its gaming assets proliferate. We were very cautious on its prior acquisition of LinkedIn, and we were probably wrong about being skeptical on the deal when it turned out to be a great one. We are probably wrong about being cautious on Activision, too, as it could pave the way for significant synergies across the firm’s product suite. We’re huge fans of Microsoft and think the company will remain a leading driver behind the strength in big cap tech and large cap growth.

Apple Inc. (AAPL)

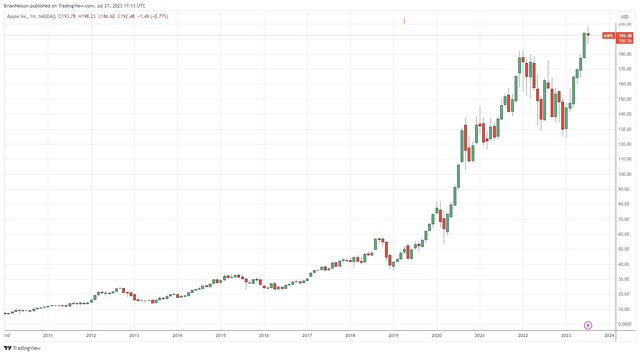

Apple’s shares recently broke out, and we continue to like its strengthening fundamentals. (TradingView)

Apple is simply phenomenal and meets a lot of the criteria we look for in a great investment idea consideration. But seriously, what can we say about Apple that hasn’t already been said? Well, truth be told, we’re not against repeating what Warren Buffett recently said about the company:

“The good thing about Apple is (Berkshire) can go up (in our ownership stake). They keep buying their stock; instead of our owning 5.6%, if they get down to… 15.25 billion of shares outstanding, without our doing anything we got 6%. Our criteria for Apple isn’t different than the other businesses we own; it just happens to be a better business than any we own. And we put a fair amount of money in it… and our railroad business is a very good business, but it is not remotely as good as Apple’s business. Apple has a position with consumers where they are paying $1,500 or whatever it may be for a phone, and these same people pay $35,000 for having a second car, and if they had to give up their second car or give up their iPhone, they’d give up their second car. I mean it’s an extraordinary (product). We don’t have anything like that that we own 100% of… but we’re very, very, very, happy to have 5.6% or whatever it may be percent (of Apple), and we’re delighted every tenth of a percent that it goes up.”

Apple’s products are an extremely valuable part of consumer life, and we love the firm’s tremendous net cash position and significant free cash flow — two of the most important cash-based sources of intrinsic value. We expect the firm’s iPhone to continue to be a fan-favorite, and its Services business and entrenched installed base are ripe for upselling and cross-selling opportunities, whether it be in AI or other areas. We’re excited about the company’s ‘Vision Pro’ and expect some big numbers in fiscal 2024. We don’t think Apple will disappoint.

UnitedHealth Group (UNH)

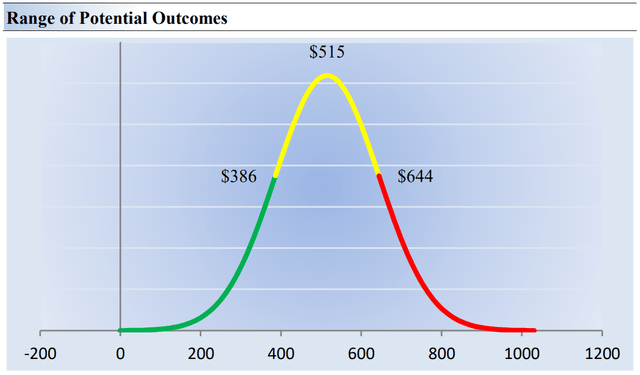

Our fair value estimate range for UnitedHealth Group. (Valuentum)

Big cap tech tends to dominate the headlines these days, but there is a large cap growth entity that is held in the same esteem by us. That company is UnitedHealth Group. Shares of UnitedHealth Group recently came under pressure with concerns over increased healthcare costs as discretionary surgeries pick up following a slowdown during the COVID-19 pandemic, but we think UnitedHealth Group will eventually be able to re-price effectively to recover the increased costs.

UnitedHealth Group is a rare large cap growth idea that is trading at the lower end of our fair value estimate range ($386-$644 per share). In some ways, UnitedHealth Group can be viewed as an undervalued, growth-oriented equity with a nice dividend yield. These characteristics could bring in a lot of buying, as the stock is attractive to a great number of investors. Our point fair value estimate for UNH stands at $515 per share, and the company boasts a ~1.5% forward estimated dividend yield.

Visa Inc. (V)

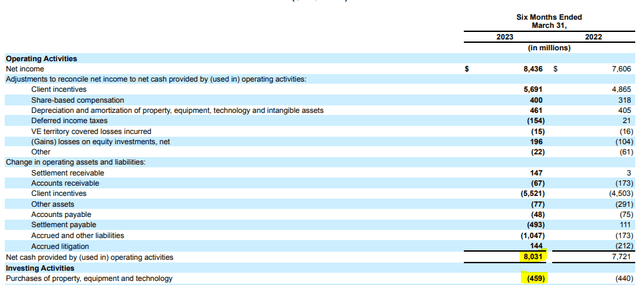

Visa’s operating cash flow of $8 billion, and free cash flow of ~$7.5 billion through the first half of its fiscal 2023 is remarkable. (Visa)

Visa probably has the best business model out there. The credit card giant benefits from a network effect, acts as a toll-road operator as it collects a fee every time one of its cards is swiped. It also puts up massive operating and free cash flow margins. The company is a top consideration in the portfolio of our Best Ideas Newsletter, and we don’t see that changing anytime soon.

Visa’s pace of expansion continues to turn heads, too, and its free cash flow generation remains remarkable. Operating cash flow has come in at ~$8 billion during the first six months of the year, while the company shelled out ~$460 million in capital spending, good for free cash flow generation of ~$7.5 billion and a free cash flow margin of 47.5%. Very few other companies have this kind of free cash flow margin, and we look forward to a strong back half to Visa’s fiscal 2023. Visa is definitely one for consideration during this new bull market.

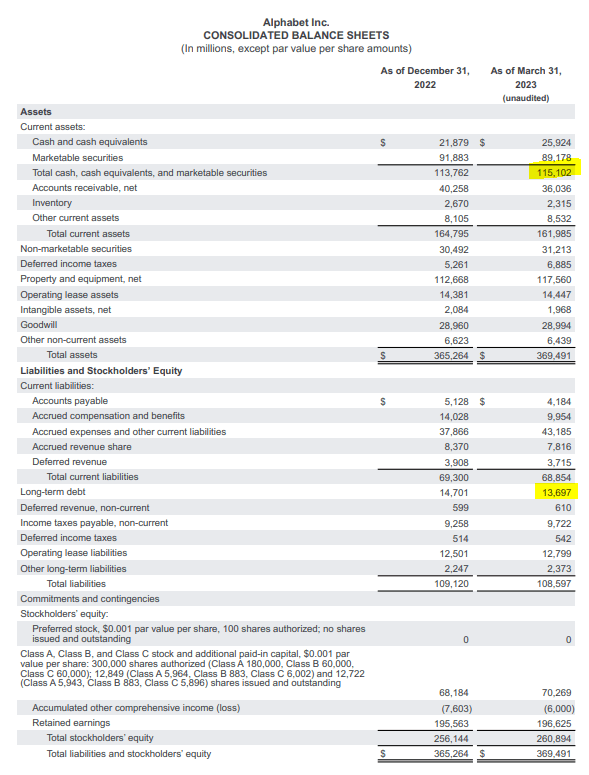

Alphabet’s balance sheet is fantastic! (Alphabet)

In one of our recent notes, we noted the following:

“Alphabet remains one of our favorite companies… thanks to its tremendous net-cash-rich balance sheet and future expectations of free cash flow… Alphabet has upside in AI, and the global search market is large and growing fast enough that we don’t expect competition to eat Alphabet’s lunch. But even if Alphabet does eventually lose share in search, it would likely be Microsoft’s Bing that would take it, and that’s actually a good thing for large cap growth (given Microsoft’s weighting in this area, too). Even if Alphabet falters, large cap growth may not.”

We wanted to include an image of Alphabet’s most recent balance sheet as well. When we say that a company has a tremendous net cash position, we mean that its cash on the balance sheet is significantly greater than its debt position.

As shown in the image above, Alphabet has ~$115.1 billion in total cash, cash equivalents, and marketable securities, while it has just ~$13.7 billion in long-term debt, good for a net cash position of $101.4 billion in net cash, which is greater than many of the market capitalizations of companies in the S&P 500.

We love this characteristic of Alphabet as it gives the firm tremendous financial flexibility, and if the company were to ever put this war chest of excess cash to work, it would likely be a positive catalyst, in our view. If Alphabet were to get even more aggressive with buybacks or scoop up undervalued assets, we’d expect the stock to pop considerably.

Concluding Thoughts

We’re loving what we think is a new bull market, and it seems like all the pieces of the puzzle have fallen in place for another great decade of equity returns. We believe the leaders of this new bull market will continue to be in the areas of big cap tech and large cap growth, and this article highlights five of our favorites for consideration. Investors may be wise to steer clear of high yield equities such as those found in mortgage REITs, master limited partnerships, REITs and instead consider the net-cash-rich and strong free cash flow generators within the areas of big cap tech and large cap growth. Let the good times roll!

This article and any links within are for informational and educational purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of this article and accepts no liability for how readers may choose to utilize the content. Assumptions, opinions, and estimates are based on our judgment as of the date of the article and are subject to change without notice.

Read the full article here